Company Summary

| BPF Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Indonesia |

| Regulation | BAPPEBTI, JFX |

| Trading Products | Multilateral & Bilateral Futures Contracts (Gold, Olein, FX pairs, Indices) |

| Demo Account | ✅ |

| Trading Platform | Pro Trader App (iOS & Android) |

| Customer Support | Phone: +62 21 2903 5005 |

| Fax: +62 21 2903 5132 | |

| Email: corporate@bestprofit-futures.co.id | |

BPF Information

PT. Bestprofit Futures (BPF) is an Indonesian company that has been in business since 2004 and is regulated by BAPPEBTI and JFX. It offers a wide range of futures trading products. It has the Pro Trader app for mobile trading and demo accounts for practice. The company's services are aimed at both retail and professional futures investors, and they offer competitive rates and support for local markets.

Pros and Cons

| Pros | Cons |

| Regulated by BAPPEBTI and JFX | No Islamic accounts |

| Supports demo accounts | Limited information about deposit and withdrawal |

| Low fixed transaction fees (3 points + VAT) |

Is BPF Legit?

Yes, PT. Bestprofit Futures (BPF) is a regulated broker in Indonesia, holding a Retail Forex License from BAPPEBTI (License No. 499/BAPPEBTI/SI/X/2004) and the Jakarta Futures Exchange (JFX) (License No. SPAB-071/BBJ/05/04).

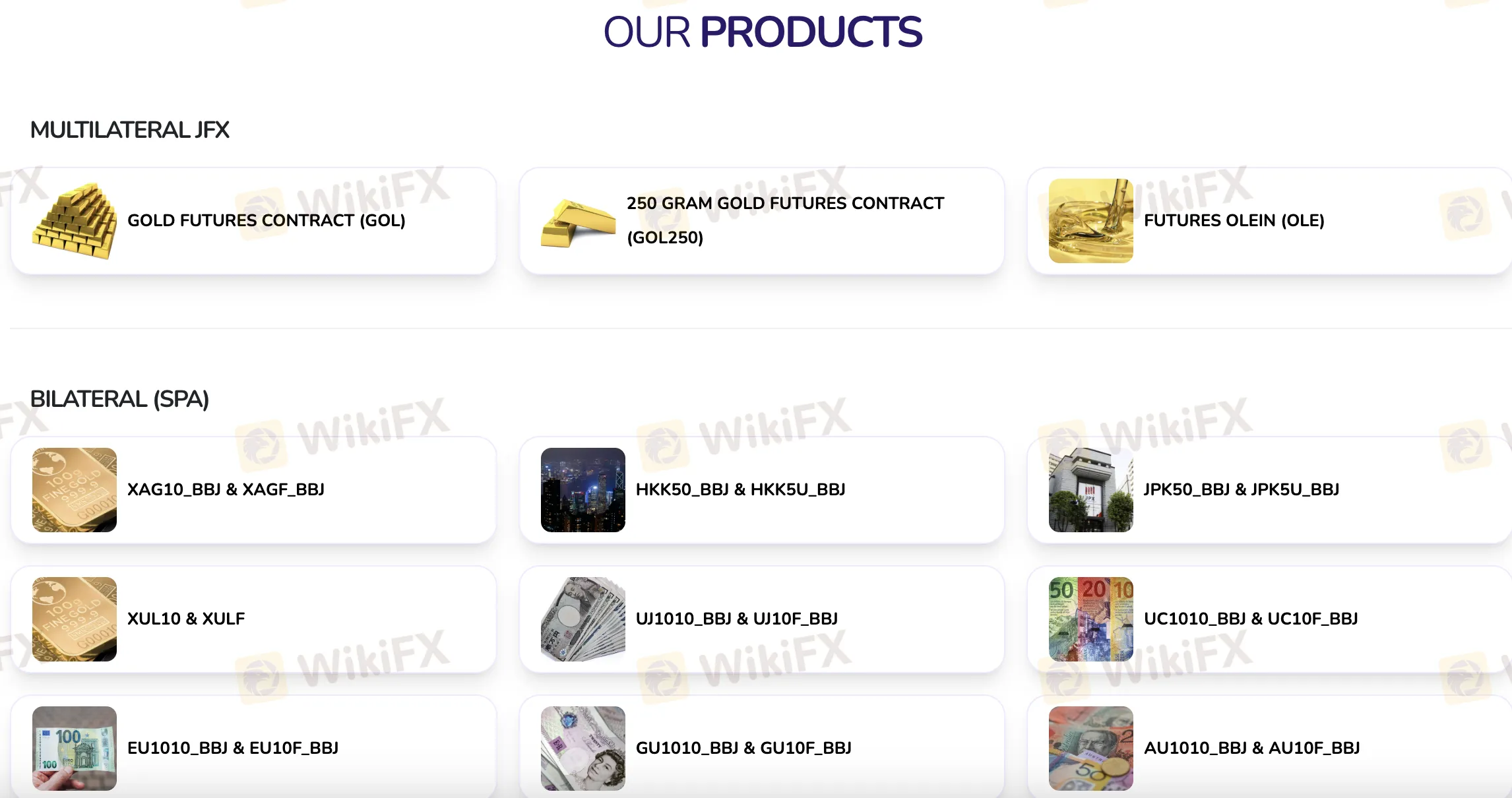

Trading Products

PT. Bestprofit Futures (BPF) has a lot of different futures trading products, such as multilateral contracts on the Jakarta Futures Exchange (JFX) and bilateral (SPA) contracts on different commodities, currencies, and indices.

| Category | Trading Product |

| Multilateral (JFX) | GOLD FUTURES CONTRACT (GOL) |

| 250 GRAM GOLD FUTURES (GOL250) | |

| FUTURES OLEIN (OLE) | |

| Bilateral (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Account

PT. Bestprofit Futures (BPF) offers two main types of accounts: a real/live trading account and a demo account. There's no information confirming the availability of Islamic (swap-free) accounts.

BPF Fees

The transaction costs at PT. Bestprofit Futures (BPF) are in line with what other companies in the Indonesian futures market charge. The fees are simple and fair, with a flat transaction price of 3 points plus 11% VAT. Compared to other regulated brokers in Indonesia that provide similar index futures products, this is seen as modest.

Trading Platform

PT. Bestprofit Futures (BPF) supports trading through the Pro Trader mobile app, available on both iOS and Android.