Company Summary

| NORDEAReview Summary | |

| Founded | 2000 |

| Registered Country/Region | Denmark |

| Regulation | No Regulation |

| Services | Loans and credits, savings and investments, insurance, private banking, digital services, financing, foreign trade, corporate banking, cash management, investment banking, international business |

| Customer Support | Phone: +45 7033 3333; +45 7033 4444 |

| Social Media: LinkedIn, Facebook, Threads, YouTube | |

| Address: Denmark, Finland, Norway, Sweden | |

NORDEA Information

Founded in 2000 and registered in Denmark, NORDEA provides diversified financial services for individuals, businesses, and large institutions, including daily banking, digital services, investment banking, and capital market products. Although the company has multiple customer service channels such as telephone and social media, it is not regulated and lacks detailed information on deposit and withdrawal processes and fee structures. Customers need to exercise caution when using their funds.

Pros & Cons

| Pros | Cons |

| Multiple banking services | No regulation |

| Various customer support channels | Unclear fee structure |

| Long operation history |

Is NORDEA Legit?

NORDEA is not regulated, and customers should exercise caution when trading.

Services

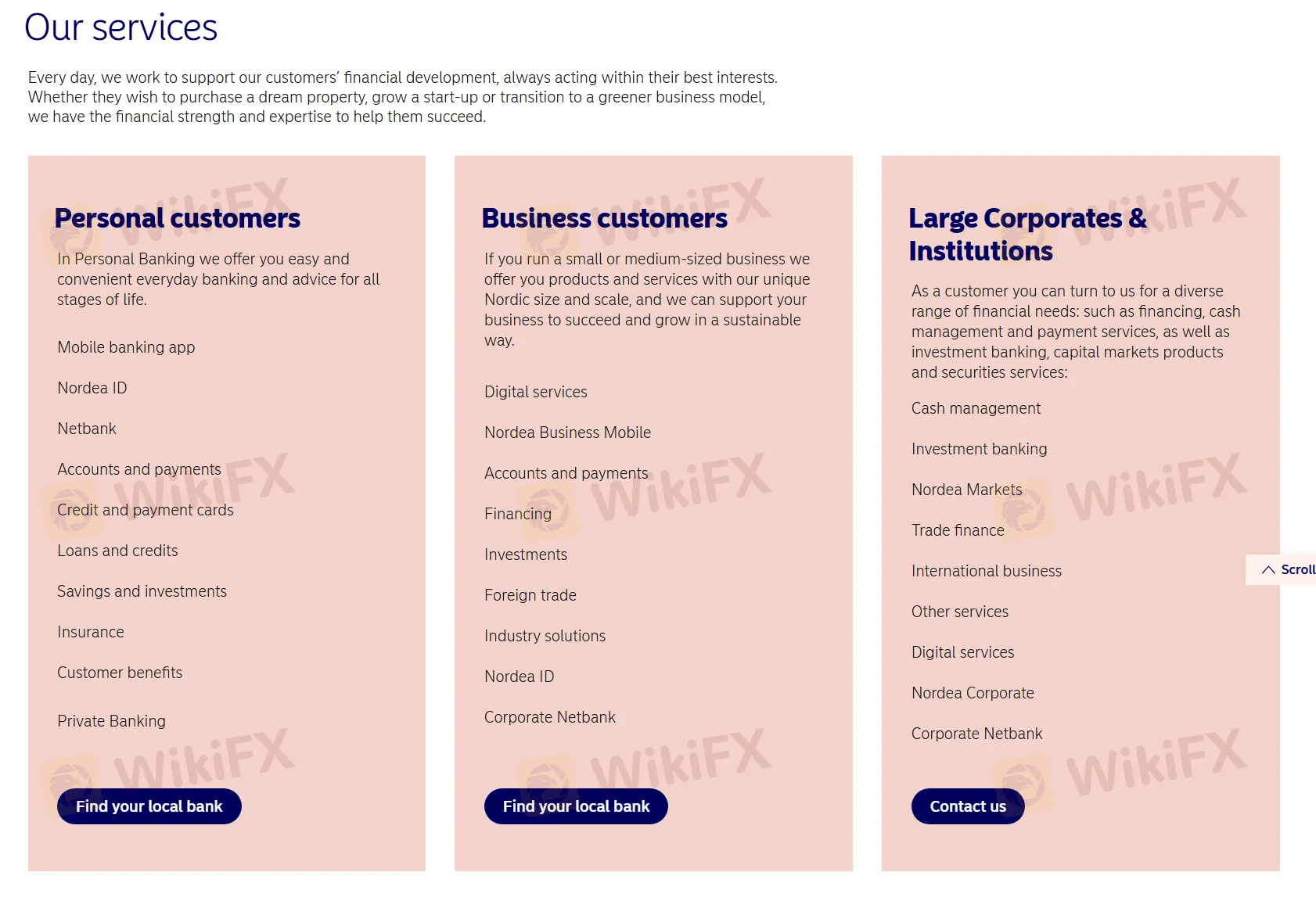

NORDEA provides services to personal customers, business customers, and large corporations and institutions, including:

Personal Customers: For individual customers, it offers convenient daily banking and financial services, including mobile banking apps, account management, payment services, credit cards, loans, savings and investment, insurance, customer benefits, and private banking services.

Business Customers: For small and medium-sized enterprises, it offers digital services, mobile banking, account management, financing, investment, international trade, industry solutions, and other services to support sustainable business development.

Large Corporates & Institutions: For large corporations and institutions, it offers comprehensive financial services including cash management, investment banking, capital market products, securities services, international trade, other services, and digital services.

| Customer Type | Services Offered |

| Personal Customers | Mobile banking app |

| Nordea ID | |

| Netbank | |

| Accounts and payments | |

| Credit and payment cards | |

| Loans and credits | |

| Savings and investments | |

| Insurance | |

| Customer benefits | |

| Private Banking | |

| Business Customers | Digital services |

| Nordea Business Mobile | |

| Accounts and payments | |

| Financing | |

| Nordea Business Mobile | |

| Foreign trade | |

| Industry solutions | |

| Nordea ID | |

| Corporate Netbank | |

| Large Corporates & Institutions | Cash management |

| Investment banking | |

| Nordea Markets | |

| Trade finance | |

| International business | |

| Other services | |

| Digital services | |

| Nordea Corporate | |

| Corporate Netbank |