Company Summary

| Information | Details |

| Company Name | SBI FXTRADE |

| Registered Country/Area | Japan |

| Regulation | Financial Services Agency, Japan |

| Minimum Deposit | 1,000 yen for Quick Deposits |

| Spreads | Narrow Spreads |

| Trading Platforms | Desktop and Mobile |

| Tradable Assets | Forex (34 currency pairs) |

| Demo Account | Available |

| Deposit & Withdrawal | Quick Deposits, Normal Deposits, Deposits to SBI Shinsei Bank |

| Educational Resources | Official YouTube channel |

Overview of SBI FXTRADE

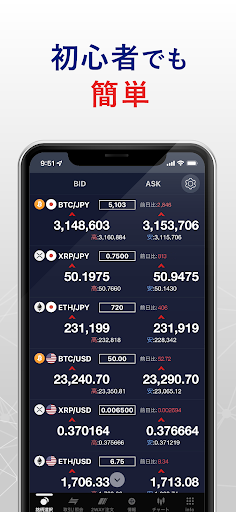

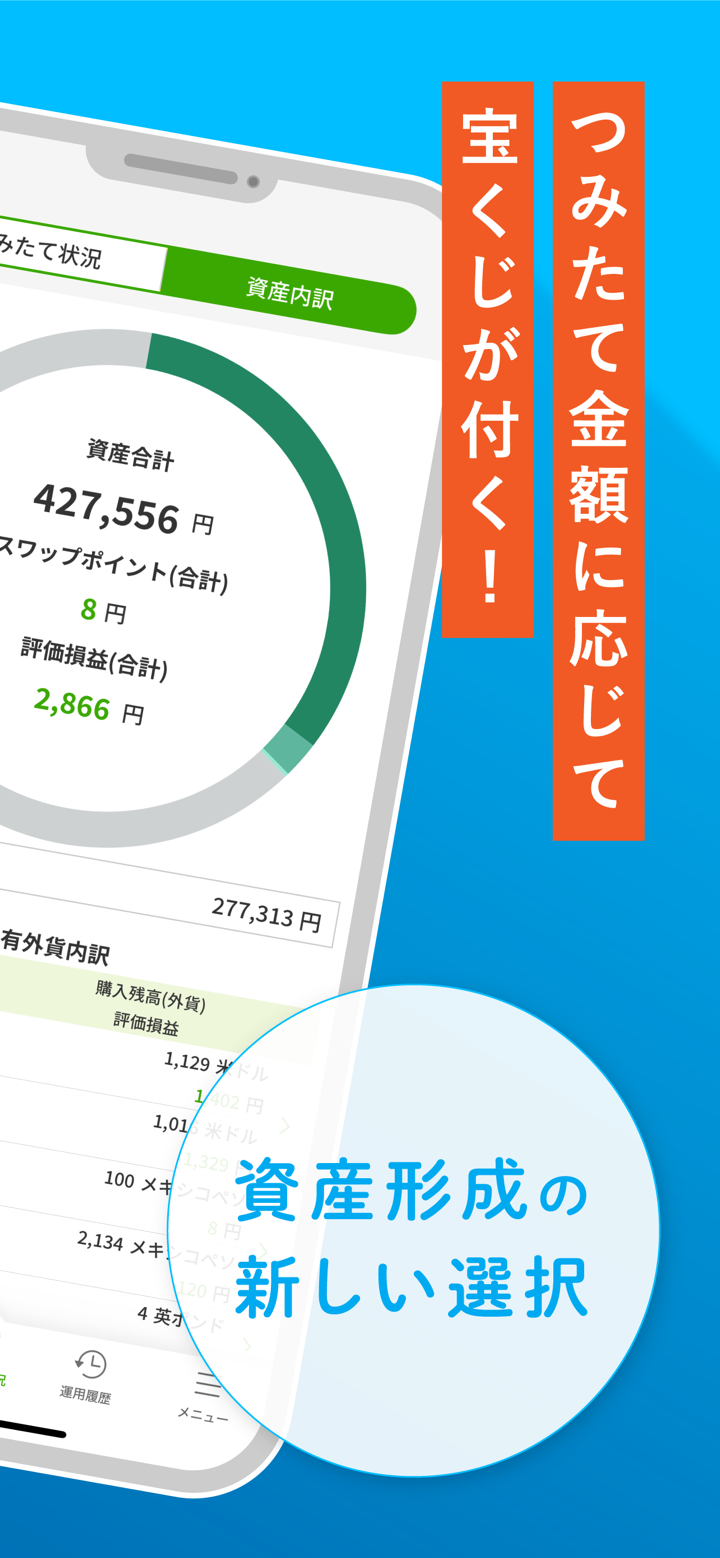

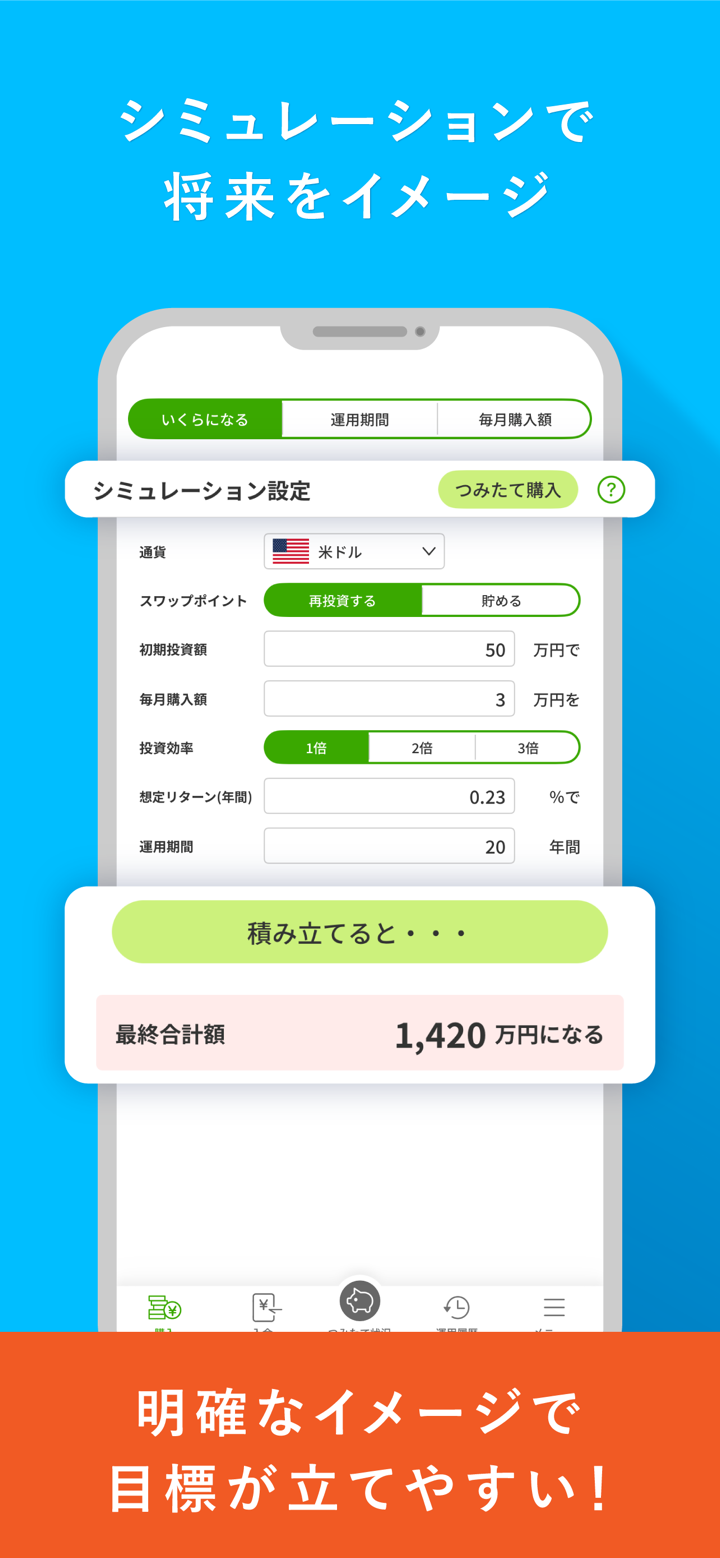

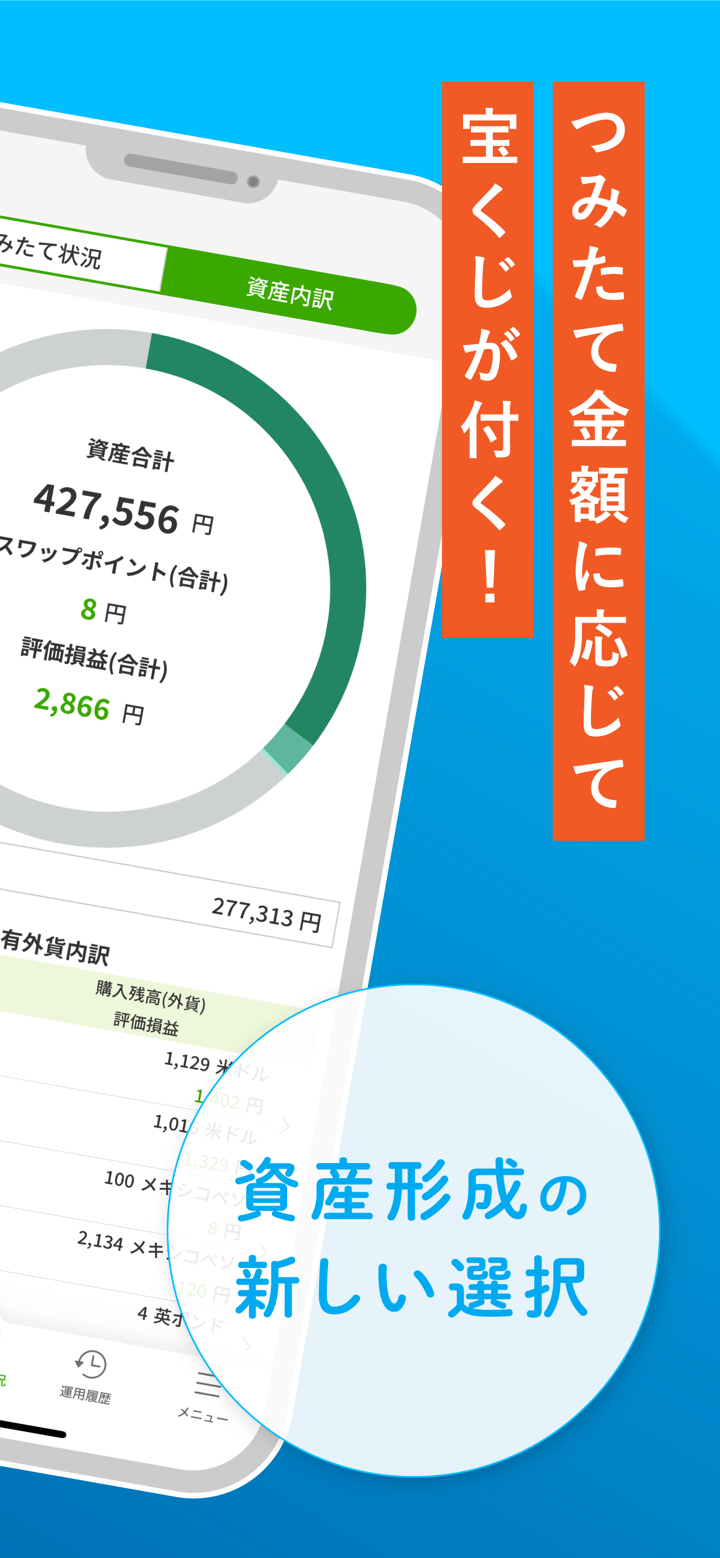

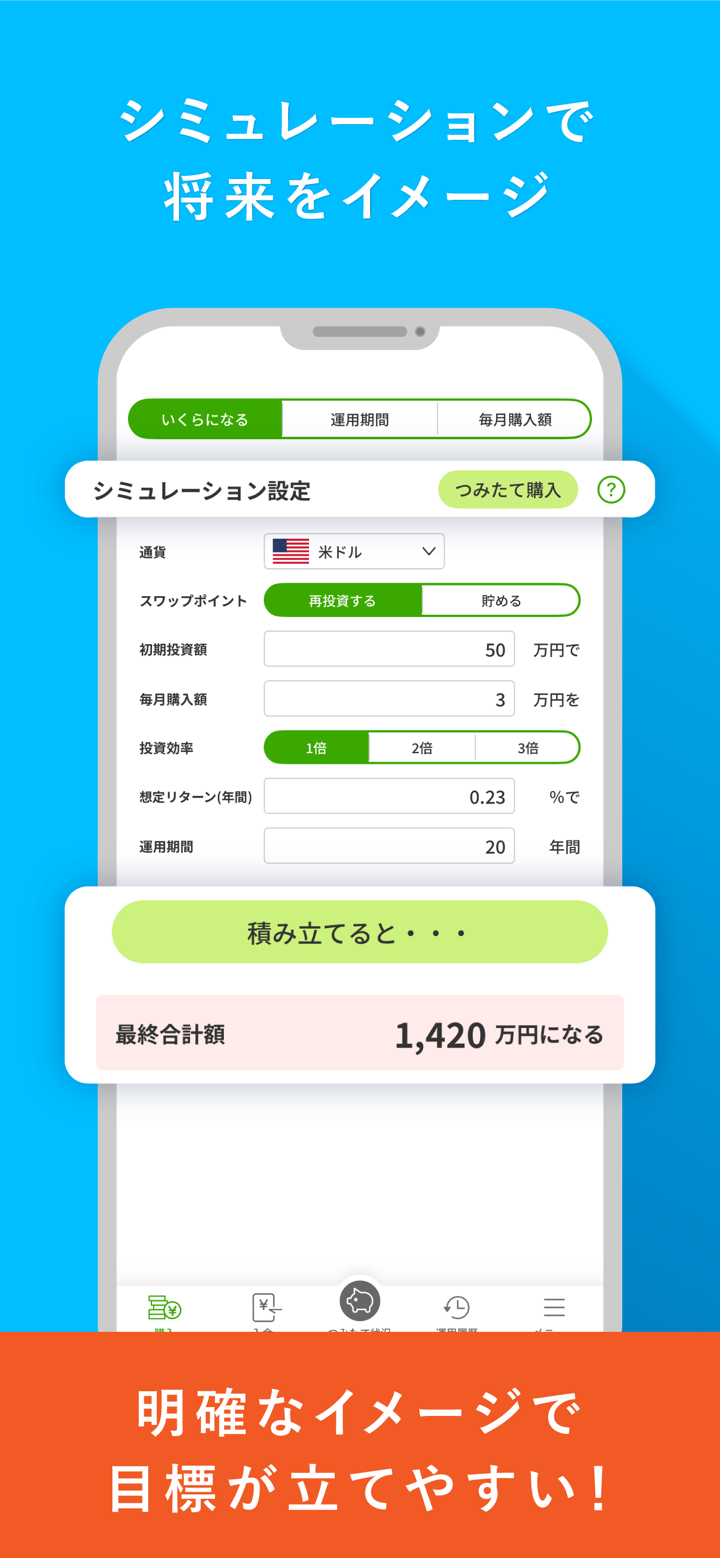

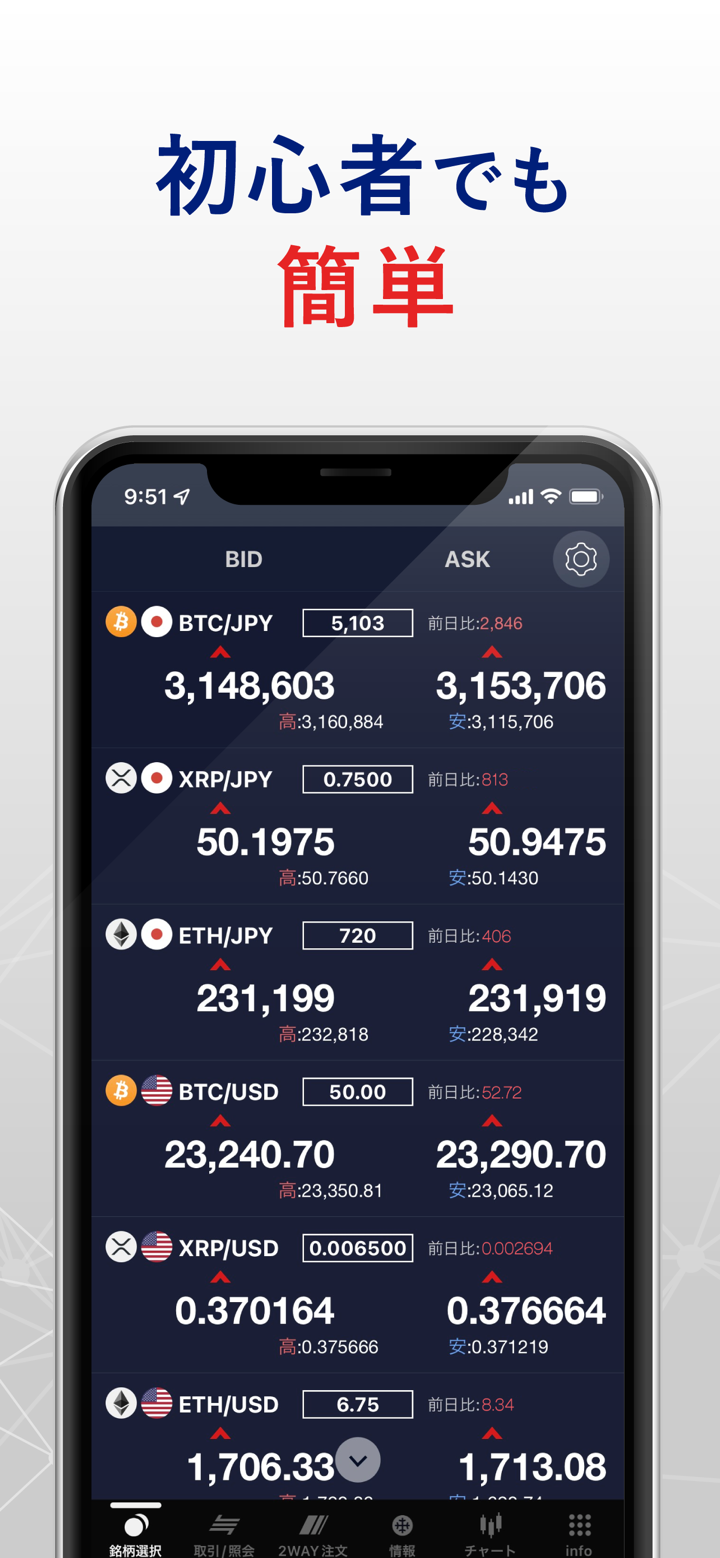

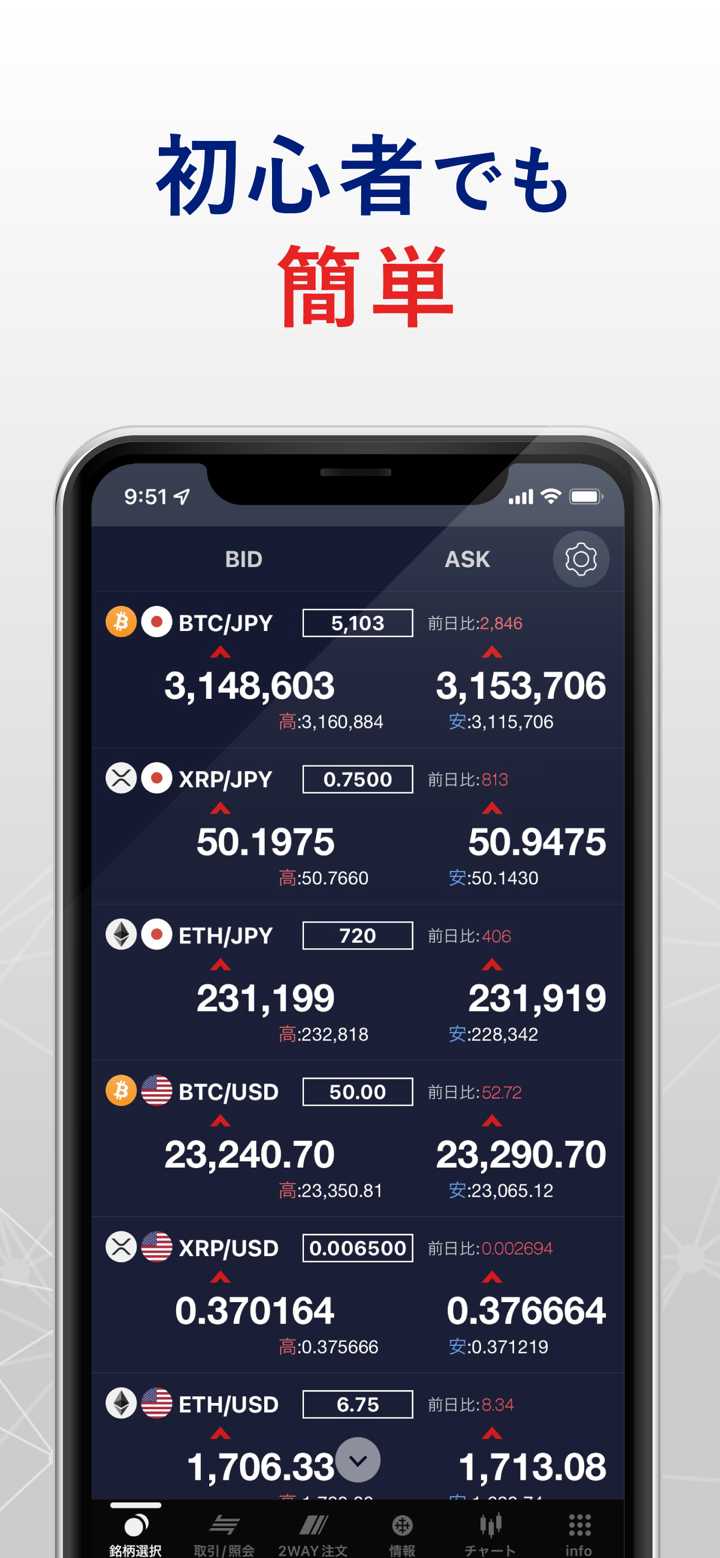

SBI FXTRADE is a Forex broker and a part of the SBI Group, a leading online financial services company in Japan. Its service allows users to engage in foreign exchange (FX) margin trading. The platform offers real-time market information and various analysis tools, which can assist both novices and experienced traders in their decision-making process.

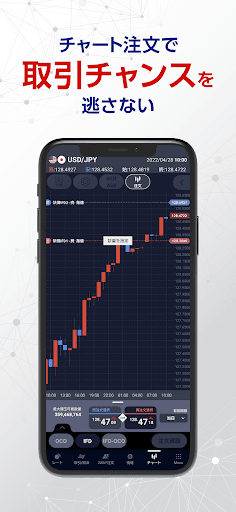

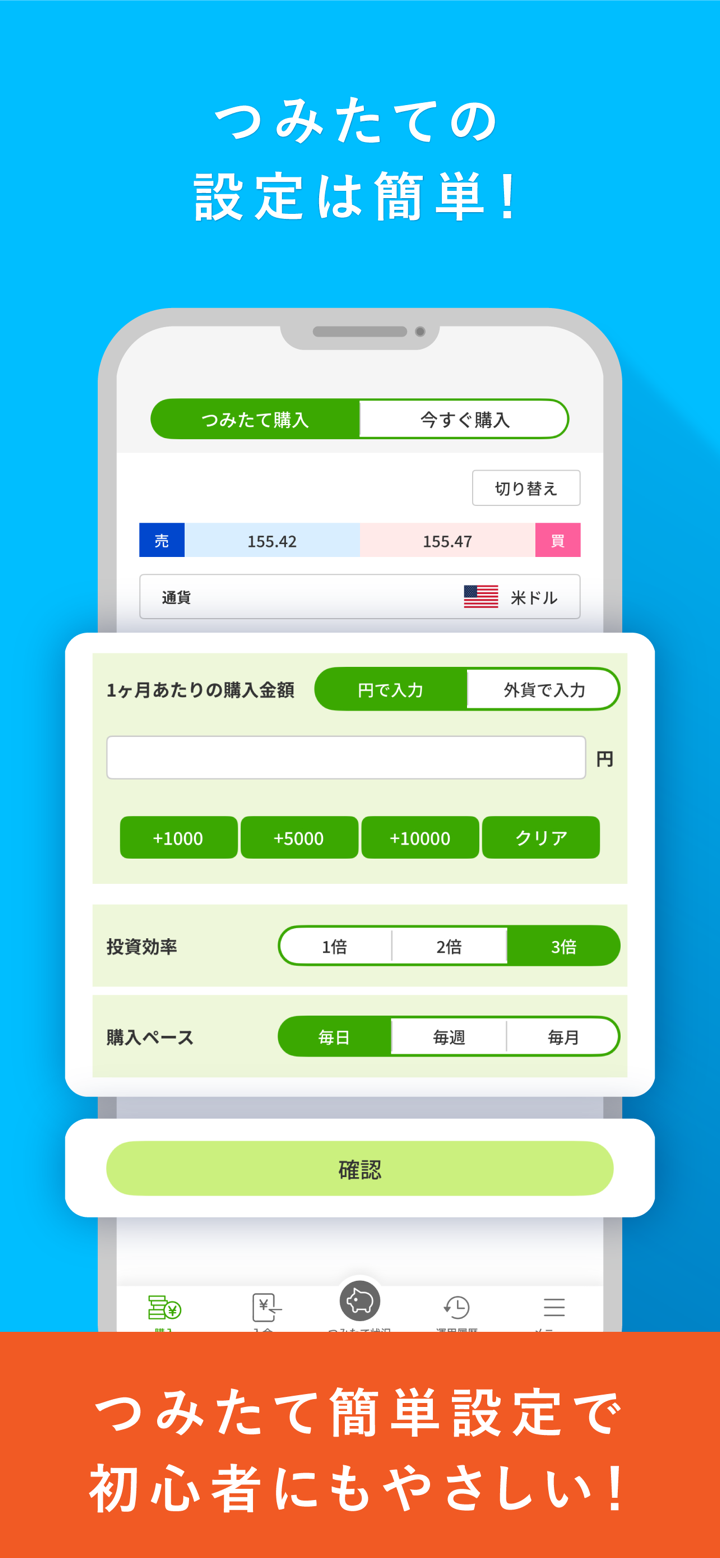

The SBI FXTRADE platform boasts of features such as narrow spreads and 24-hour trading. It also offers a demo account option for practice. Additionally, there is a user-friendly interface which simplifies the process of FX trading and a mobile application for trading on the go. It is essential to remember that just like any other type of trading and investment, forex trading involves certain risks which should be thoroughly understood before participating.

Regulation

SBI FXTRADE is a regulated broker under the jurisdiction of Japan. The platform is licensed as a Retail Forex License holder and is overseen by the Financial Services Agency of Japan. The license number is 関東財務局長(金商)第2635号 and the official licensed institution is SBI FX トレード株式会社. The license was effectively granted on 13th April 2012. However, there is no shared email address of the licensed institution. It's crucial to trade with a regulated broker as it provides a certain level of security and oversight.

Pros and Cons

Pros:

1. Wide Range of Trading Instruments: SBI FXTRADE offers an extensive range of 34 currency pairs for trading, making it an attractive platform for those who wish to diversify their trading portfolio.

2. Quick Deposits: The platform provides a quick deposit feature that starts from 1,000 yen with no associated fees.

3. Regulation: SBI FXTRADE is regulated by the Financial Services Agency of Japan, adding a higher level of security and trustworthiness.

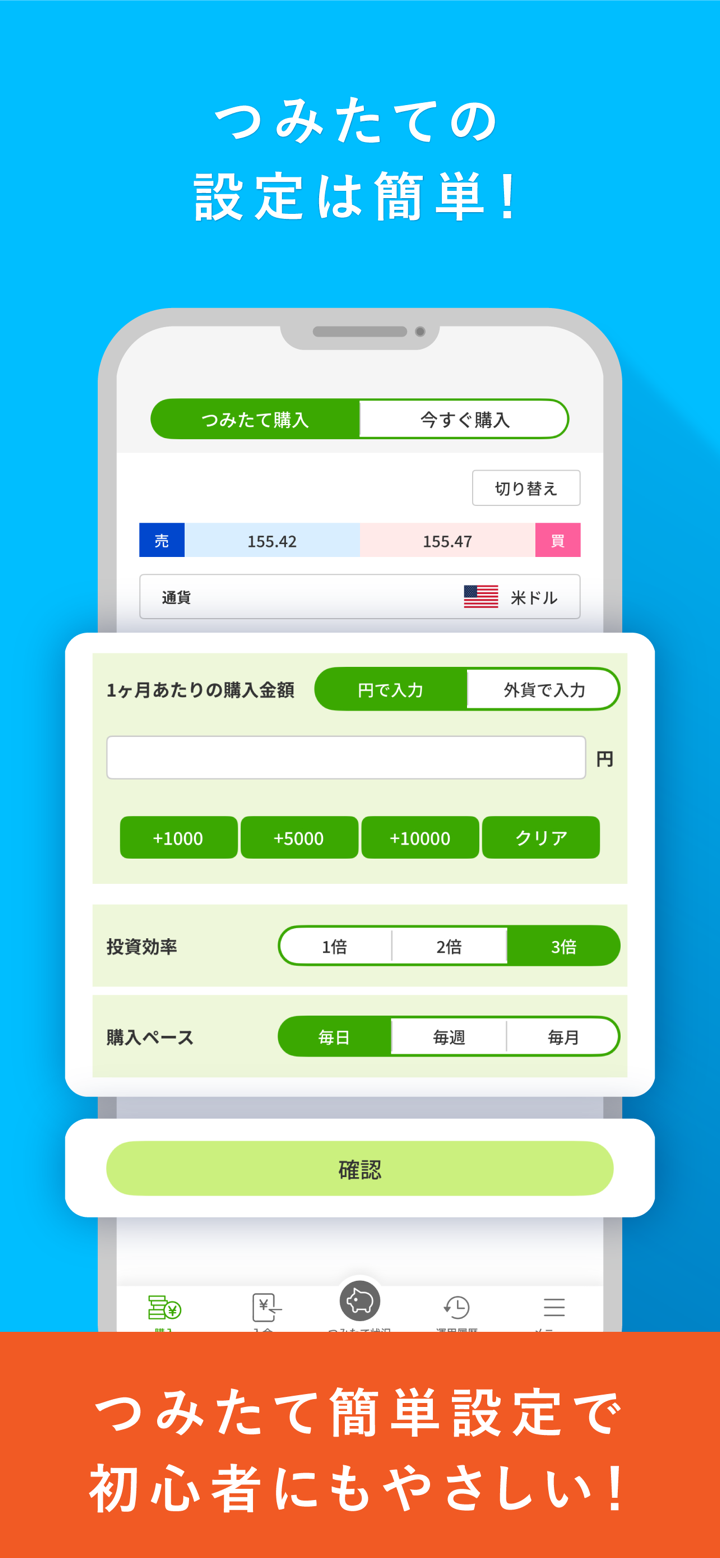

5. User-Friendly Interface: The platform has a user-friendly interface that simplifies the process of FX trading, making it easier for beginner traders to navigate.

6. Demo Account: SBI FXTRADE provides a demo account which allows users to practice trading strategies before investing real money.

7. 24-Hour Service: The platform facilitates 24-hour trading, enabling traders to take advantage of global forex market hours.

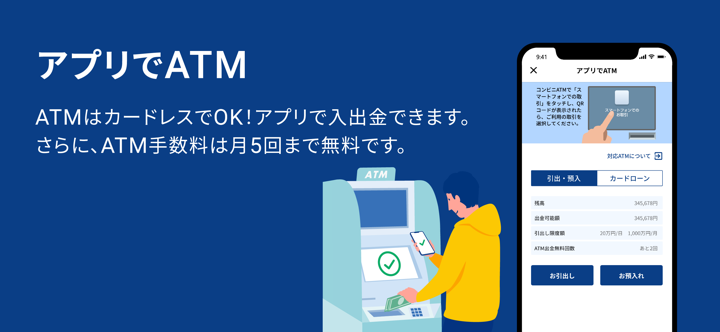

8. Mobile Trading: SBI FXTRADE offers mobile trading platforms for users to trade on the go.

Cons:

1. Deposit Fees: While quick deposits are free, other deposit methods such as the “normal deposit” method have associated transfer fees that will be borne by the customer.

2. Delay in Reflection of Deposits: Certain deposit methods may not immediately reflect the deposited amount in the trading account. If any error occurs, the reflection of deposit will have to wait till the confirmation of payment receipt.

3. Fees on Some Services: For certain services, such as normal deposits, transfer fees will be borne by the customer.

Market Instruments

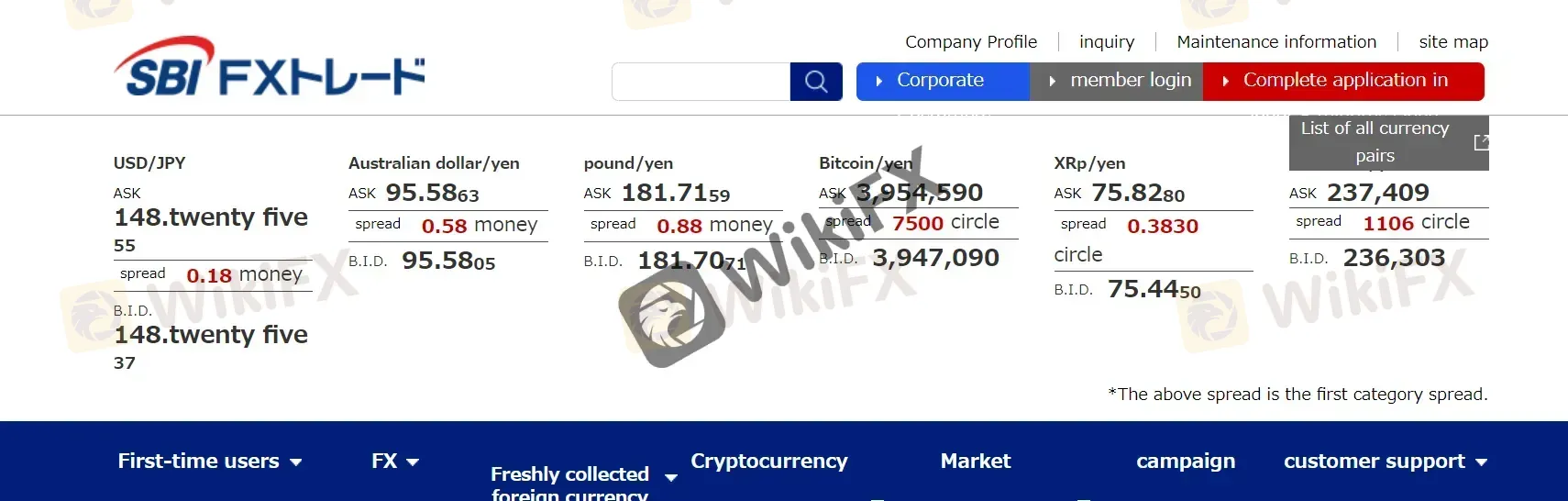

SBI FXTRADE provides its users with the opportunity to trade in a total of 34 currency pairs. This offering is considered to be one of the highest in the industry, giving traders a wide range of options when it comes to choosing their trading instruments.

It signifies that traders have the opportunity to capitalize on the movements of various currencies ranging from major currency pairs to minor and exotic ones. However, it's always important for traders to understand the risks associated with each trading instrument before investing.

How to open an account?

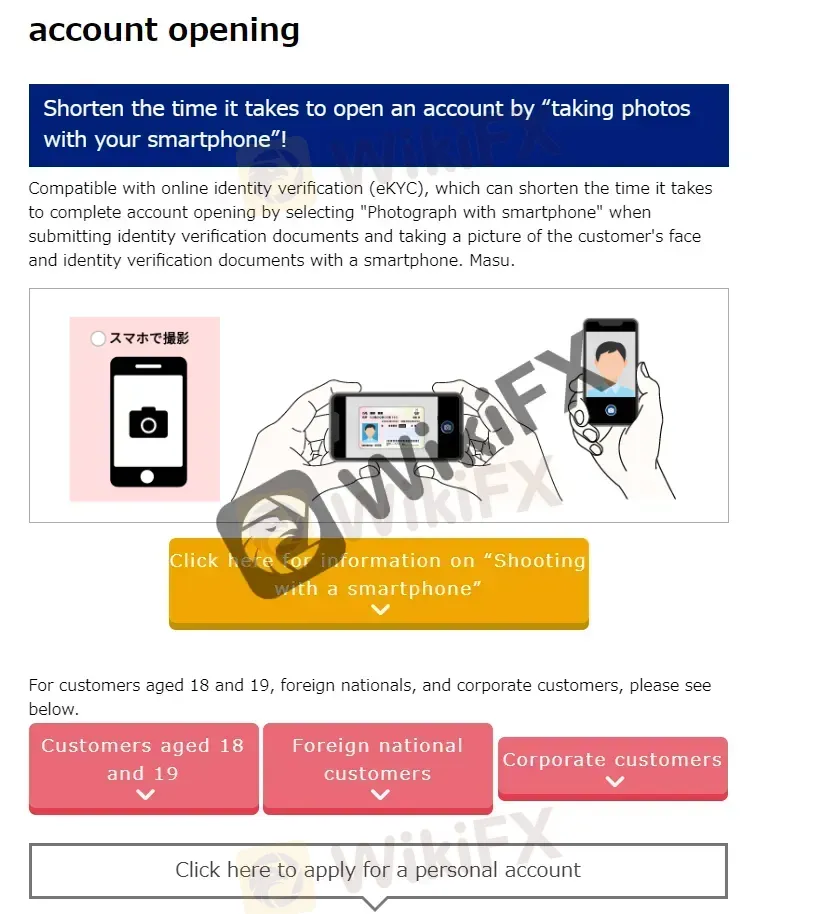

- The first step would be to navigate to the “Complete application in” button at the top right side of the page.

- Please enter your email address using the submit button that is below the “apply for a personal account” sign. An account opening application URL will be sent to the email address you entered.

- Enter your name, date of birth, and current address as in the identity verification document. The user is required to have a Japanese “MyNumber” identification in order to continue to after this step.

- After the information has been examined, SBI FXTRADE will determine if the account creation process will be completed.

Minimum Deposit

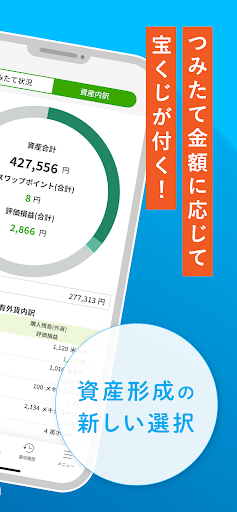

SBI FXTRADE offers two different methods of depositing funds: quick deposits and normal deposits.

Quick deposits start from 1,000 yen, with no associated fees. It's important to note that applications cannot be accepted during maintenance times performed by the broker or financial institutions.

Deposit & Withdrawal

SBI FXTRADE provides several methods for depositing and withdrawing funds.

For making deposits, there are three methods available:

- Quick deposits: This method allows clients to deposit funds starting from 1,000 yen with no associated fees. However, deposition isn't guaranteed to reflect immediately - errors might delay the reflection of the deposit.

- Normal deposits: This involves a money transfer to a created “Customer Dedicated Deposit Account”. Note that transfer fees are borne by the customer unless they are an SBI Shinsei Bank account holder depositing into the “SBI Shinsei Bank account exclusively for SBI FX Trade”.

- Deposit to SBI Shinsei Bank: This method involves a money transfer to the dedicated SBI Shinsei Bank account for SBI FX Trade. There are no transfer fees and the customer has to specify their login ID and first and last name in kana in the remittance name.

The following provides more details on deposit confirmation and conditions:

- Payments can be confirmed on the transaction screen.

- Payments may not reflect immediately as they need to be received and confirmed by the bank. This process can take some time during busy periods.

- Deposit processing is done three times a day at 9:00, 13:00, and 15:30.

- Shinsei Bank deposits will be reflected in the FX account and need to be transferred to the savings FX account or the crypto asset CFD account by the user.

Customer Support

SBI FXTRADE offers an array of contact channels enabling seamless and efficient communication:

- Direct Phone Line: Enabling immediate assistance, the firm can be directly contacted via their dedicated line at +81 0120-982-417.

- Official Web Portal: An exhaustive array of resources could be found on their official website, SBI FXTRADE.

- Social Media Presence: Connect with them on Twitter for real-time updates and interactions. They also maintain an active online presence on Facebook and exclusive content on their dedicated YouTube channel.

Educational Resources

SBI FXTRADE provides several educational resources for its traders:

- Official YouTube Channel: SBI FXTRADE maintains an official YouTube channel where they share informative video content. This includes market news, tutorials, trading strategies, and explanations on various aspects of Forex trading.

- Today's Exchange News: This is presumably a feature where recent news and events affecting the exchange market are discussed, providing insights to help traders make informed decisions.

- Crypto Asset Market Information: This channel is maintained by SBI VC Trade, which is also a part of the SBI Group. It provides information related to the crypto asset market.

Please note that Forex trading and trading in general can be risky, so it's essential to fully understand these risk factors and strategies before investing. Educational resources are a starting point, but should not be the only source of knowledge or strategy formulation. Real-time experience, trading practice, and individual research are also critical components of trading education.

Conclusion

SBI FXTRADE, a premium trading firm, offers multiple features tailored towards assisting traders succeed. Key offerings include diverse deposit methods (featuring Quick Deposits), a wide array of trading instruments, a user-friendly platform, and well-developed educational resources. However, potential users should be aware of potential deposit fees and delays, and inherent trading risks.

FAQs

Q: What are some educational resources that SBI FXTRADE provides for traders?

A: SBI FXTRADE offers a variety of educational resources, including a YouTube channel filled with market news, trading strategies, and other trading-related insights, a feature for recent market news, programs providing insights into alternative currencies to USD/JPY.

Q: How can users contact SBI FXTRADE?

A: SBI FXTRADE can be reached through their phone number (+81 0120-982-417), their official website, or their social media accounts on Twitter, Facebook, and YouTube.

Q: What are the unique features of SBI FXTRADE?

A: SBI FXTRADE offers quick deposits without any fees starting from 1,000 yen and is regulated by the Financial Services Agency of Japan for enhanced security.