Basic Information

Australia

AustraliaScore

Australia

|

Above 20 years

|

Australia

|

Above 20 years

| https://www.boq.com.au/

Website

Rating Index

Influence

A

Influence index NO.1

Australia 8.71

Australia 8.71 Licenses

LicensesLicensed Entity:Bank of Queensland Limited

License No. 244616

Single Core

1G

40G

1M*ADSL

Australia

Australia boq.com.au

boq.com.au United States

United States

| BOQ Review Summary | |

| Founded | 1874 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Financial Services | Bank accounts, home loans, credit cards, personal loans, insurance, business loans, business accounts, foreign exchange and trade services, merchant and payment products |

| Minimum Deposit | 0 |

| Customer Support | Tel: 1300 55 72 72 |

BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

| Pros | Cons |

| Regulated by ASIC | Age restrictions on high-yield savings |

| Diverse account types | Limited channels for customer support |

| Zero minimum deposit | |

| Long operation time |

BOQ has a Market Maker (MM) license regulated by the Australian Securities and Investments Commission (ASIC) in Australia with a license number of 000244616.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Bank of Queensland Limited | Australia | Market Maker (MM) | 000244616 |

Business bank account: BOQ offers various business bank accounts, including Business Transaction Accounts for daily operations and Savings and Investment Accounts to earn interest on business funds. They also provide Industry Specialist Accounts tailored for sectors like Solicitors, Real Estate Agents, and Not-for-Profits.

Personal account: BOQ offers two types of personal accounts, which are the Transaction Account and Savings Accounts.

Transaction account: BOQ's transaction accounts generally feature no monthly account-keeping fees, no withdrawal fees at BOQ ATMs within Australia, and no transaction fees within Australia. They also state no overdrawn fees if you happen to overdraw your account.

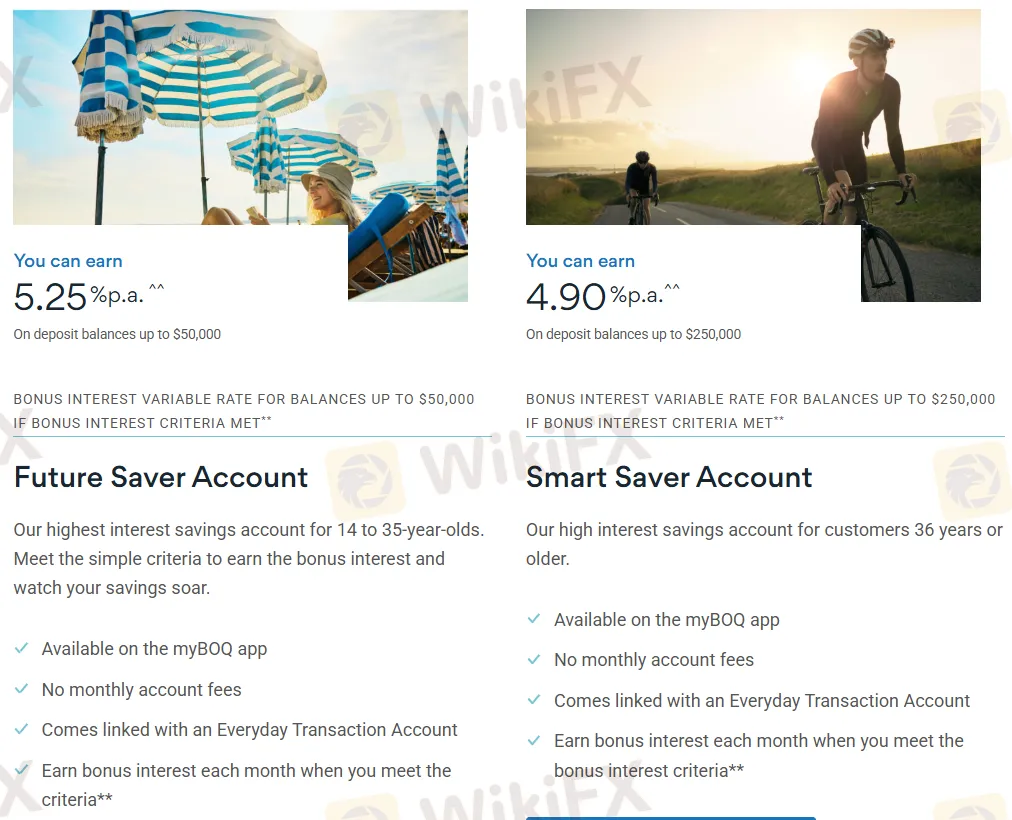

Savings accounts:

| Feature | Future Saver Account (14-35 years old) | Smart Saver Account (36 years or older) | Simple Saver Account | Term Deposits (Balances $5,000 - $249,999, Term 12-24 months) |

| Interest Rate | 5.25% p.a. on balances up to $50,000 | 4.90% p.a. on balances up to $250,000 | 4.55% p.a. on balances up to $5M | 4.00% P.A. |

| Bonus Interest | Variable rate up to $50,000 if criteria met | Variable rate up to $250,000 if criteria met | Get a great, ongoing interest rate | Fixed term interest rates and no account fees |

| Availability | Available on the myBOQ app | - | ||

| Monthly Account Fees | ❌ | ❌ | ❌ | ❌ |

| Minimum Deposit | - | - | 0 | $1,000 |

| Other Features | Earn bonus interest each month when criteria met | Simply sit back and watch your savings grow | Flexible terms from just 1 month, choose interest payment frequency | |

2025 SkyLine Malaysia

2025 SkyLine Malaysia

Yes, ASIC’s regulation of BOQ broker covers all of its services, including the bank’s financial products like loans, credit cards, and investment accounts. ASIC’s oversight ensures that BOQ broker follows Australian financial regulations, offering products that are secure and transparent for customers. The regulation ensures that the bank provides clear terms and conditions, maintains adequate financial reserves, and operates in a way that protects consumer interests. As a consumer, I feel confident that BOQ broker’s broad range of financial services, from personal loans to business banking products, are under the watchful eye of a reputable regulator. This regulatory protection extends to the bank’s operations, meaning that customers have recourse if they encounter any issues or disputes. For me, knowing that BOQ broker operates within the boundaries of ASIC’s strict rules adds a level of security to my dealings with them.

BOQ broker, also known as Bank of Queensland, is a fully regulated financial institution in Australia, overseen by the Australian Securities and Investments Commission (ASIC). This regulation ensures that BOQ broker adheres to strict financial guidelines, providing a secure environment for investors and consumers. ASIC’s role is to ensure that all licensed financial services providers, including BOQ broker, follow the rules that protect investors' rights and funds. Being regulated by ASIC means that BOQ broker must maintain high standards in areas like capital adequacy, financial transparency, and customer service. Personally, I find that the ASIC regulation adds a lot of value to BOQ broker's credibility, especially as it shows their commitment to customer protection and fairness. It also ensures that the bank operates with integrity, which is essential for anyone looking to invest or deposit funds. However, as with any regulated financial institution, it’s important to understand the terms and conditions of the services offered. In my case, I would feel more secure working with a regulated entity like BOQ broker due to the added level of oversight and compliance it ensures.

BOQ broker supports a variety of payment methods for both deposits and withdrawals, including direct bank transfers, card payments (Visa and Mastercard), and electronic funds transfers. These payment methods make it easy for customers to access their funds or deposit money into their accounts. For business accounts, BOQ broker also offers merchant services for businesses needing to process payments. I find the flexibility of payment methods offered by BOQ broker to be very helpful for both personal and business banking needs. The inclusion of card payments and bank transfers makes it easy to manage finances, but for international transactions, it’s always good to verify any additional fees or processing times.

BOQ broker supports a range of payment methods, including direct bank transfers, card payments (Visa and Mastercard), and electronic funds transfers. These payment options make it easy to transfer funds to and from your BOQ broker account. For business accounts, BOQ broker also supports merchant services, which is convenient for companies that need to process payments from clients. Personally, I appreciate the variety of payment options available through BOQ broker, especially for personal accounts where I need easy access to funds.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

jun26

Zimbabwe

Fake platform. If you encounter a BOQ that requires you to deposit money, be careful. You can only deposit money but not withdraw money. They will find various reasons to prevent you from withdrawing money and ask you to continue to pay a margin.

Exposure

gerry400

Jersey

i have made a withdawal of 112,775 USD and its under review. i follow up thru customer service and they advice me that the amount that i have withdrawn cannOT be release due to ID Account Abnormality and needS to recharge to the last amount 3,035 USDT which is being deposited thru OKX via merchants. they explained to me the problem so i was encourage to pay the recharge fee. after a while customer service sent me a message that the are ready to release including the too up payment. however since i agree to release the money i need to pay from my own pocket the amount if 5,017USD as a handling fee and after receiving the payment they will release the money within 10 to 30 minutes. i didnt pay because i realizes ive been scammed already. the last picture on the bottom is their BOQ forex platform and the second one is the log in. this is different from legit BOQ platform which is yellow in color as shown on the last photo

Exposure

David Wilson

United Kingdom

Queensland Bank,a big bank, great service.👍👍👍 They are first-class.

Positive

王苏彬

United Kingdom

ASIC is one of the best regulators in the world and BOQ is my current forex broker. It's able to provide a series of satisfactory services and my money is safe.

Neutral

Aung Myohlaing

Spain

I love the experience of trading with BOQ so far! It is an honest and caring company. They can always answer my questions in time and solve them as soon as possible.

Positive

想當年

Hong Kong

BOQ’s customer support service leaves me a very good impression! Their stuff can always answer my questions patiently and gently, and give me some useful suggestions. So they have become one of my favorite brokers.haha..they did a really good job! Respect!!

Positive

卡布奇诺80913

Hong Kong

I never use this bank before, but it is quite influential in Australia… Its customer support seems quite excellent, their staff would answer your questions politely.

Neutral

漫步咖啡

China

I do not know what to say, bank transfers sometimes need longer time... I once used its services, then it disappointed me. I suggest that you should go to find other companies...

Neutral