Company Summary

| GRANDIS SECURITIESReview Summary | |

| Registered On | 5-10 years |

| Registered Country/Region | Cyprus |

| Regulation | Unregulated |

| Services | Basic Assets, Derivatives |

| Customer Support | Tel: +357 22 350 854 |

| Email: info@grandissecurities.com.cy | |

| Address: 7 Stasandrou Street, Eleniko Building, 2nd floor, office 203CY-1060, Nicosia, Cyprus | |

GRANDIS SECURITIES Information

Grandis Securities (now EXENICO (CY) LTD) has EU regulatory qualifications. Its service scope includes investment services, ancillary services, and coverage areas. It is suitable for investors who value compliance and need diverse financial instruments. However, the current information transparency is low, and verifying details such as leverage, fees, and trading platforms through official channels is recommended before actual account opening.

Pros and Cons

| Pros | Cons |

| Regulated | No 24/7 support |

| Multiple trading instruments | Missing information (e.g., leverage, trading platform) |

| Unclear fees |

Is GRANDIS SECURITIES Legit?

The company holds an Investment Firm license (CIF 343/17) issued by CySEC, and the regulator has approved its business changes, making it a legitimate financial institution in the EU. However, no domain registration information was found in Whois.

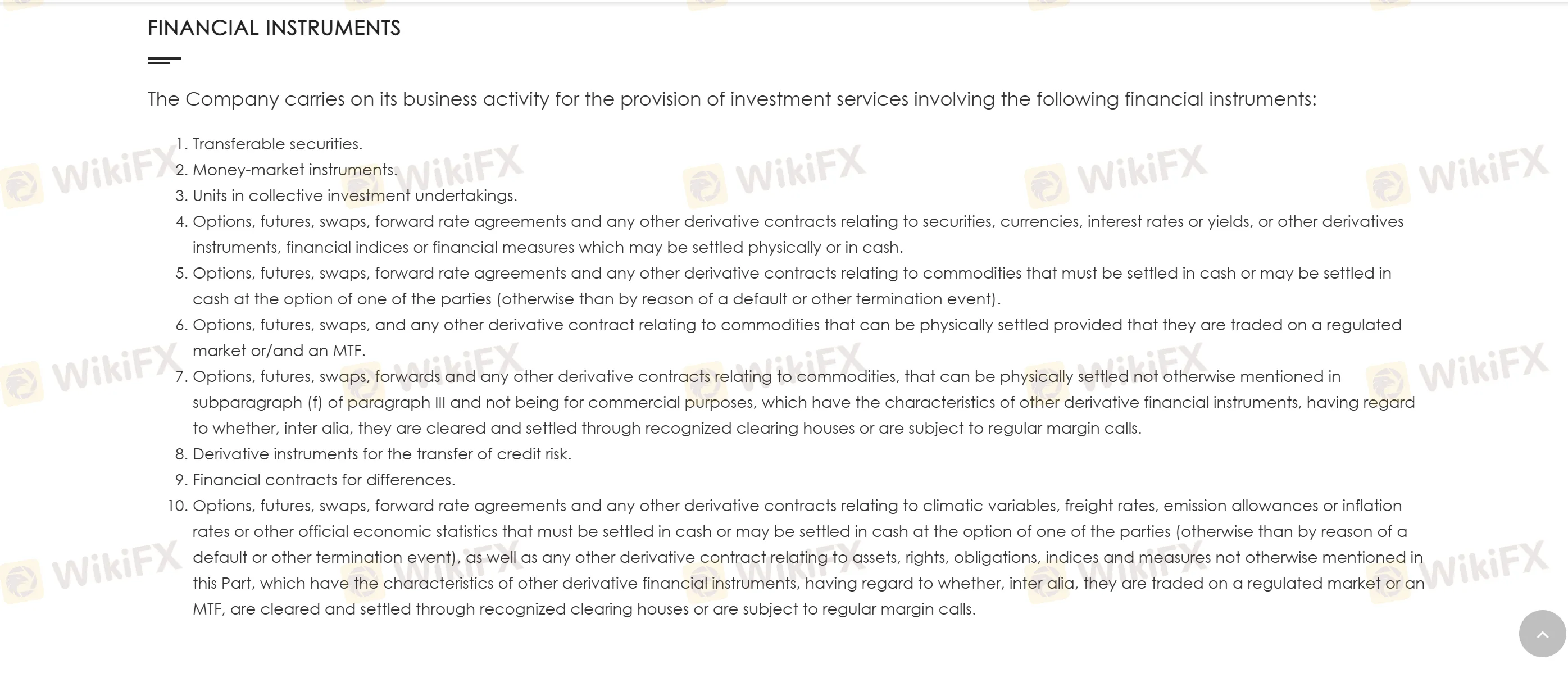

What Can I Trade on GRANDIS SECURITIES?

The tradable financial instruments of GRANDIS SECURITIES are classified into underlying assets and derivatives.

| Category | Trading Instruments | Specific Examples |

| Basic Assets | Transferable Securities | Stocks, bonds |

| Money Market Instruments | Short-term notes, deposit certificates | |

| Collective Investment Products | Fund units | |

| Derivatives | Financial Derivatives | Futures, options, swaps (e.g., interest rate swaps) |

| Commodity Derivatives | Crude oil futures, agricultural product options | |

| Other Derivatives | Weather derivatives, credit derivatives (CDS) |