公司简介

| GRANDIS SECURITIES评论摘要 | |

| 注册时间 | 5-10年 |

| 注册国家/地区 | 塞浦路斯 |

| 监管 | 未受监管 |

| 服务 | 基础资产,衍生品 |

| 客户支持 | 电话:+357 22 350 854 |

| 电子邮件:info@grandissecurities.com.cy | |

| 地址:7 Stasandrou Street, Eleniko Building, 2nd floor, office 203CY-1060, Nicosia, Cyprus | |

GRANDIS SECURITIES 信息

Grandis Securities(现为EXEN首次代币发行(CY)LTD)具有欧盟监管资格。其服务范围包括投资服务、附属服务和覆盖范围。适合重视合规性并需要多样化金融工具的投资者。然而,当前信息透明度较低,建议在实际开户之前通过官方渠道验证杠杆、手续费和交易平台等细节。

优点和缺点

| 优点 | 缺点 |

| 受监管 | 无24/7支持 |

| 多种交易工具 | 缺少信息(例如,杠杆、交易平台) |

| 不明确的手续费 |

GRANDIS SECURITIES 是否合法?

该公司持有CySEC颁发的投资公司许可证(CIF 343/17),监管机构已批准其业务变更,使其成为欧盟内合法的金融机构。然而,在Whois中未找到域名注册信息。

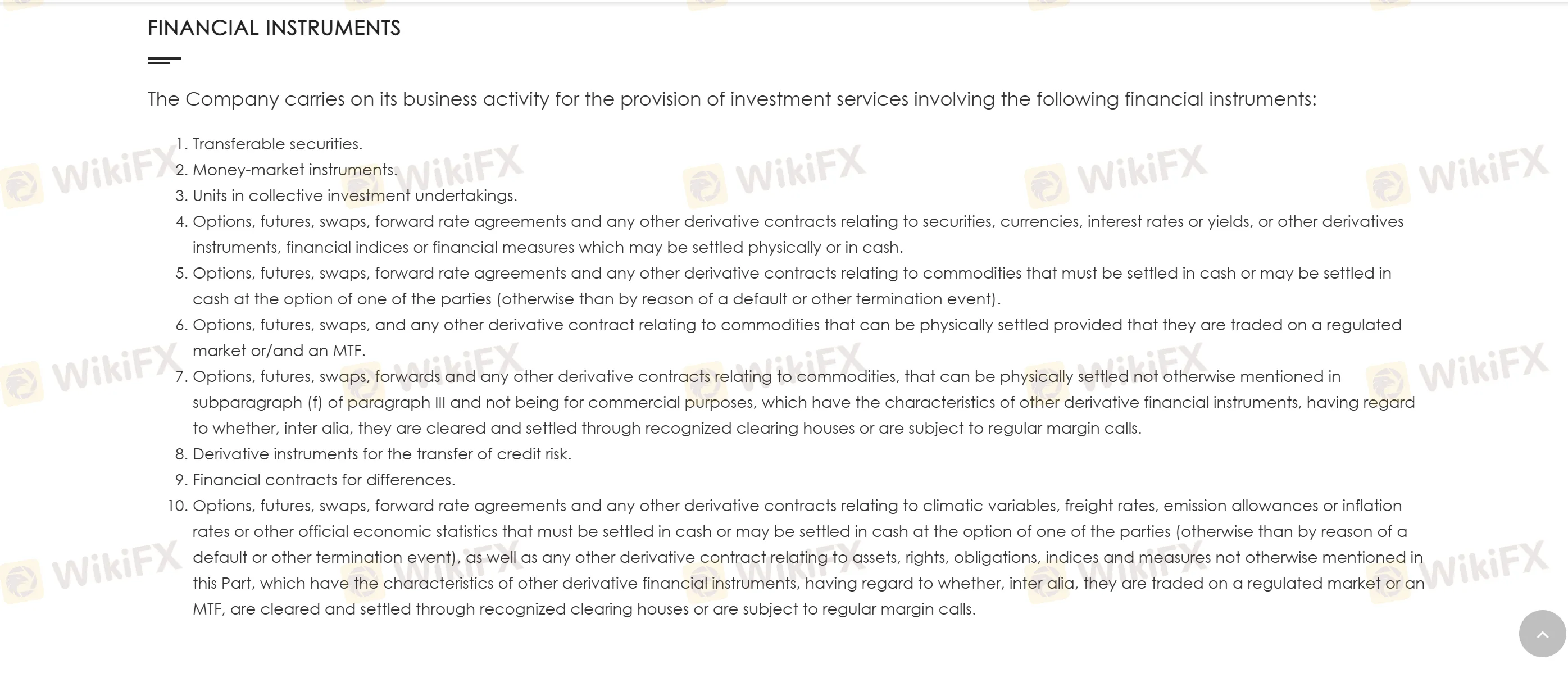

GRANDIS SECURITIES 可以交易什么?

GRANDIS SECURITIES 的可交易金融工具分为基础资产和衍生品。

| 类别 | 交易工具 | 具体示例 |

| 基础资产 | 可转让证券 | 股票、债券 |

| 货币市场工具 | 短期票据、存款证书 | |

| 集体投资产品 | 基金单位 | |

| 衍生品 | 金融衍生品 | 期货、期权、互换(例如,利率互换) |

| 大宗商品衍生品 | 原油期货、农产品期权 | |

| 其他衍生品 | 天气衍生品、信用衍生品(CDS) |