Company Summary

| GFX Securities Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | Forex, Metals, Indices, Energies, Shares CFDs, Cryptos |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 2.5 pips (Standard account) |

| Trading Platform | GFX APP |

| Minimum Deposit | / |

| Customer Support | Phone: (+973) 17260190 |

| Email: info@gfxsecurities.com | |

| Facebook, YouTube, X, Instagram | |

| Address: 3rd Floor, Ebene Skies, Rue de I Institut, Ebene, Republic of Mauritius | |

| Regional Restrictions | US, Cuba, Myanmar, North Korea |

| Bonus | 20% deposit bonus |

GFX Securities Information

GFX Securities is an online broker founded in 2022 that offers a variety of trading products like Forex, Metals, Indices, Energies, Shares CFDs and Cryptos. It provides three kinds of live accounts and the leverage can be up to 1:500.

Pros and Cons

| Pros | Cons |

| Various trading instruments | No regulation |

| Multiple account types | Regional restrictions |

| No commissions | No MT4 or MT5 |

| 20% bonus for deposit |

Is GFX Securities Legit?

No. GFX Securities has no regulations currently. Please be aware of the risk!

What Can I Trade on GFX Securities?

GFX Securities offers trading instruments on Forex, Metals, Indices, Energies, Shares CFDs, and Cryptos.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Shares CFDs | ✔ |

| Energies | ✔ |

| Cryptos | ✔ |

| Metals | ✔ |

| Options | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Account Type & Fees

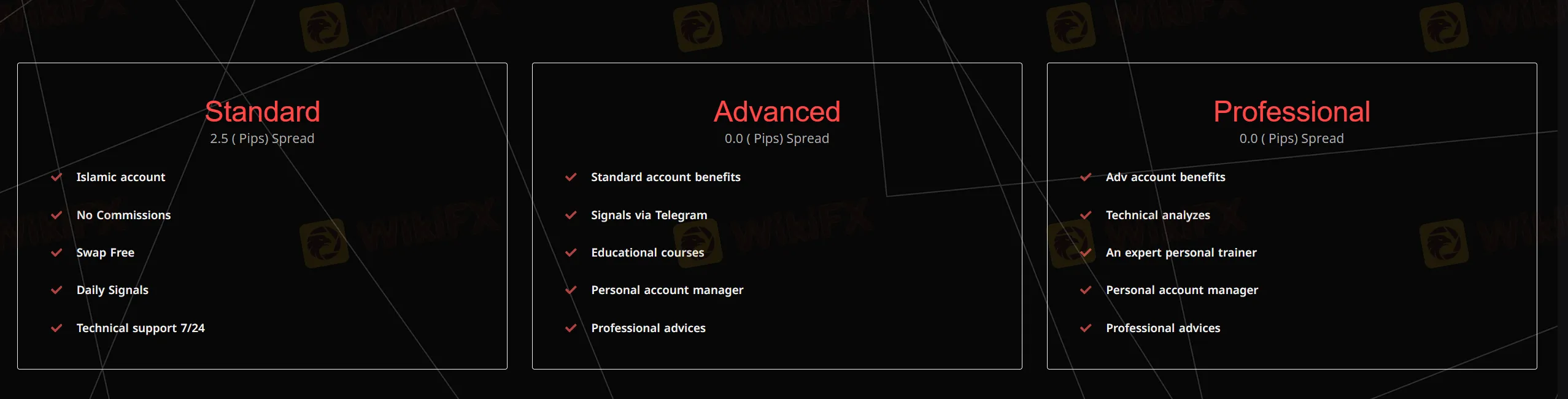

There are three account types on GFX Securities's website.

| Account Type | Minimum Deposit | Spread | Commission |

| Standard | / | From 2.5 pips | 0 |

| Advanced | From 0 pips | ||

| Professional |

Leverage

The leverage can be up to 1:500. Investors need to consider carefully before trading, since high leverage can bring high potential risks.

Trading Platform

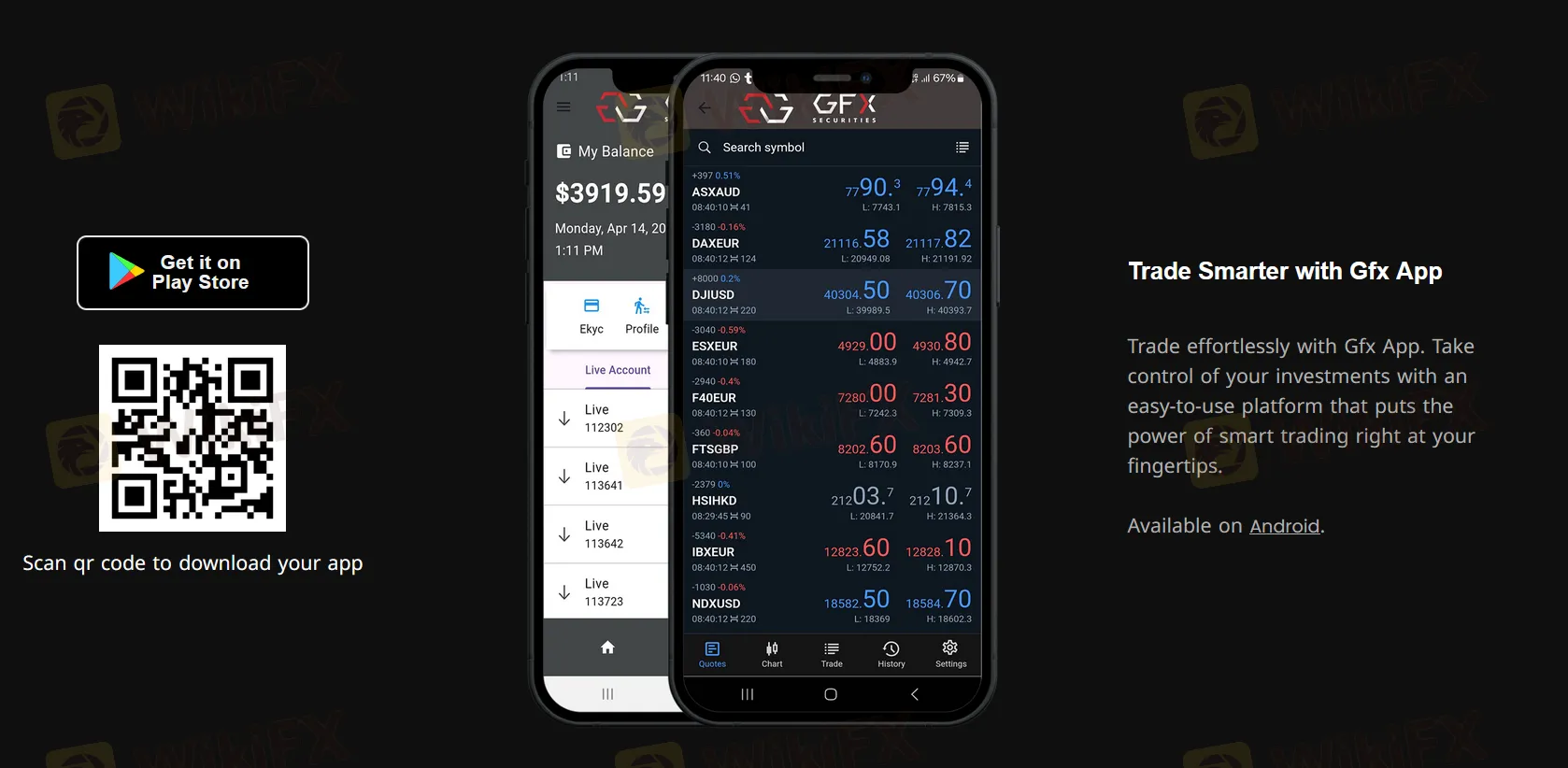

GFX Securities offers their own mobile APP and does not support the commonly used MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| GFX APP | ✔ | Mobile | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Traders can deposit and withdraw funds via Mastercard, MoneyGram, Bank transfer and VISA.