Company Summary

| SHENGDA FUTURES Review Summary | |

| Founded | 2010 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Market Instrument | Futures |

| Demo Account | ✅ |

| Trading Platform | Shengda Futures CTP Express Client v2, Shengda Futures CTP Express Client v3, Shengda Futures CTP Infinite Easy Production System, Pyramid Decision Trading System (CTP), etc. |

| Customer Support | |

| Tel: 400-826-3131 | |

| Email: sdqh@sdfutures.com.cn | |

| Zip code: 311201 | |

| Fax: 0571-28289393 | |

| Address: Room 2201, Unit 2, and Room 801, Unit 1, Guojin Center, No. 259, Pinglan Road, Ningwei Street, Xiaoshan District, Hangzhou, Zhejiang | |

SHENGDA FUTURES Information

SHENGDA FUTURES is a regulated service provider of premier brokerage and financial services, which was founded in China in 2010. It offers products and services for gold, silver, and platinum, Share Price Index Futures (SPIF), Natural rubber (RU), fuel oil (FU), linear low-density polyethylene LLDPE (L), polyvinyl chloride PVC (V), coke (J), purified terephthalic acid PTA (TA), methanol (MA), etc.

Pros and Cons

| Pros | Cons |

| Demo accounts | Various fees charged |

| Long operation time | |

| Various contact channels | |

| Regulated well | |

| Multiple trading platforms |

Is SHENGDA FUTURES Legit?

Yes. SHENGDA FUTURES is licensed by China Financial Futures Exchange (CFFEX) to offer services. Its license number is 0256. CFFEX, established with the approval of the State Council of the Peoples Republic of China and the China Securities Regulatory Commission (CSRC), is an incorporated exchange specializing in providing trading and clearing services for financial futures, options and other derivatives.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| China Financial Futures Exchange (CFFEX) | Regulated | 盛达期货有限公司 | Futures License | 0256 |

What Can I Trade on SHENGDA FUTURES?

| Trading Instruments | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

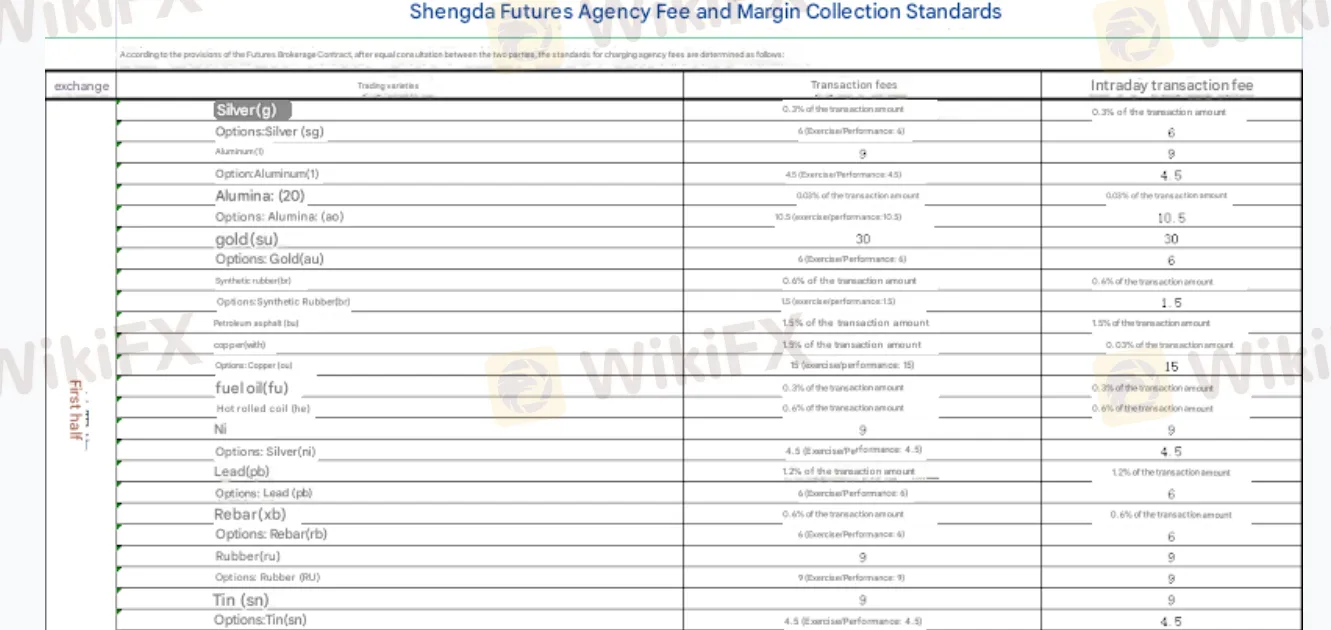

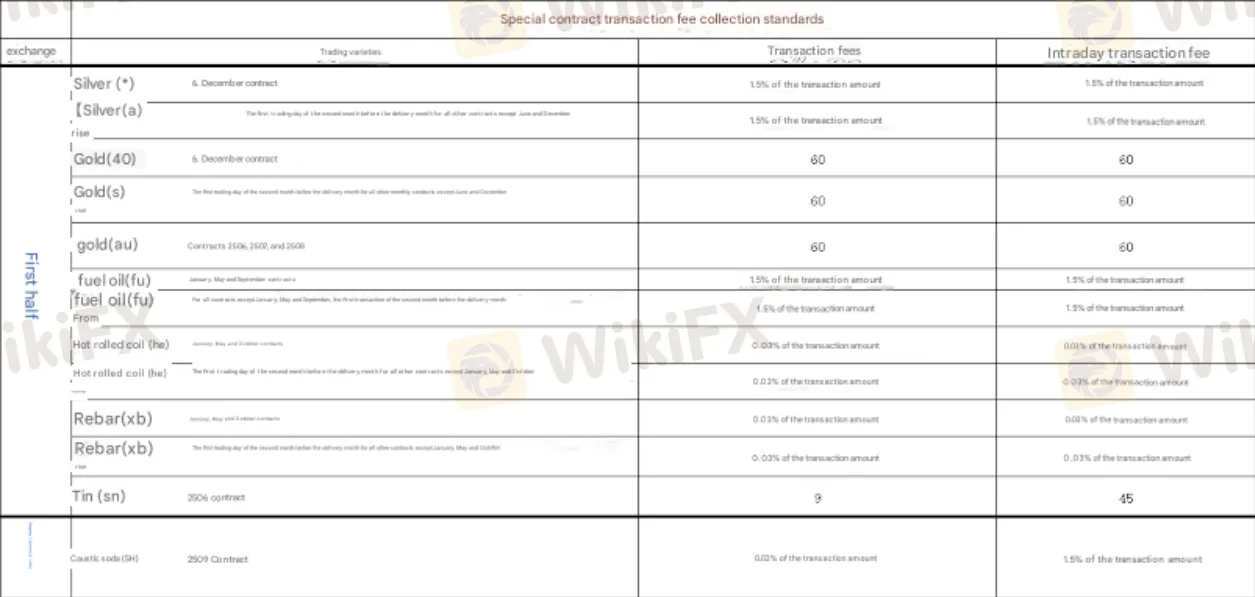

SHENGDA FUTURES Fees

The commission charged by different branches for different commodities and different contract forms are different, please visit the official website for details (the picture is translated by Google, not very clear, please visit the official website for details).

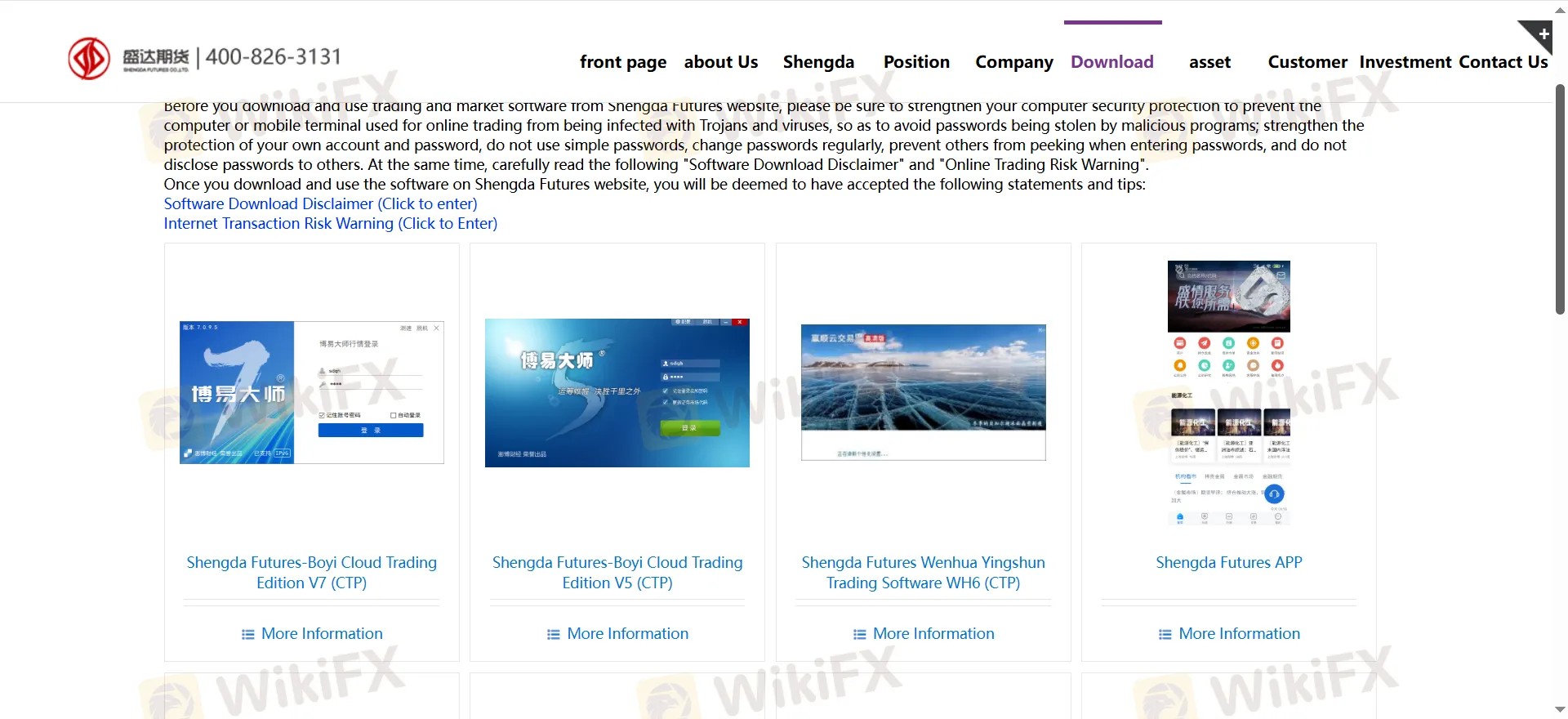

Trading Platform

| Trading Platform | Supported | Available Devices |

| Shengda Futures CTP Express Client v2 | ✔ | PC, laptop, tablet |

| Shengda Futures CTP Express Client v3 | ✔ | PC, laptop, tablet |

| Shengda Futures CTP Infinite Easy Production System | ✔ | PC, laptop, tablet |

| Pyramid Decision Trading System (CTP) | ✔ | PC, laptop, tablet |

| Shengda Futures-Boyi Cloud Trading Edition V7 (CTP) | ✔ | PC, laptop, tablet |

| Shengda Futures-Boyi Cloud Trading Edition V5 (CTP) | ✔ | PC, laptop, tablet |

| Shengda Futures Wenhua Yingshun Trading Software WH6 (CTP) | ✔ | PC, laptop, tablet |

| Trading Pioneer Ultimate (CTP) | ✔ | PC, laptop, tablet |

| Shengda Futures Boyi Master 5CTP Demo Version | ✔ | PC, laptop, tablet |

| Shengda Futures CTP Option Simulation System | ✔ | PC, laptop, tablet |

| Shengda Futures CTP Infinite Options Simulation System | ✔ | PC, laptop, tablet |

| Shengda Futures APP | ✔ | Mobile |

Deposit and Withdrawal

SHENGDA FUTURES accepts payments done via credit, debit cards and bank wire.

Deposit : There are no restrictions on the number of deposits, minimum deposit amount , and maximum deposit amount.

Withdrawal: For withdrawal requirements such as single withdrawal and total withdrawal limit for the day, number of withdrawals per day, and guaranteed funds, please refer to the broker's official website.

Counter deposit and withdrawal time: Monday to Friday: 8:30-16:00.

The funds will generally arrive within 24 hours.