Company Summary

| Tachibana Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Japan |

| Regulation | FSA (Regulated) |

| Market Instruments | Stocks, Derivatives, and Funds |

| Trading Platform | Tachibana Trade Rich and Tachibana Stock Trading App |

| Customer Support | Tel: 0120-66-3303, 03-5652-6221 |

| Email: info@t-stockhouse.jp | |

| Bonus | ✔ |

Tachibana Information

Tachibana is an institution in Japan that provides diversified financial services. The platform offers a rich variety of investment products, covering physical stocks, margin trading, investment trusts, exchange FX (such as “Tachibana Kurikku 365”), Nikkei 225 futures and options, etc. At the same time, Tachibana Securities is equipped with a series of investment information tools, such as Tachibana Trade Rich, AI Settlement Calendar, etc. In addition, the platform also has a customer service and Q&A section to answer investors' questions promptly.

Pros and Cons

| Pros | Cons |

| Regulated | Language limitation (Japanese) |

| Rich variety of investment products | Complex rules (handling fees calculation) |

| Diverse ways of depositing funds | |

| Long operation time | |

| Bonus offered |

Is Tachibana Legit?

Tachibana is a formal and legal financial institution. The Financial Services Agency (FSA) supervises the trading operations of this securities company, and its license number is “関東財務局長(金商)第110号”.

What Can I Trade in Tachibana?

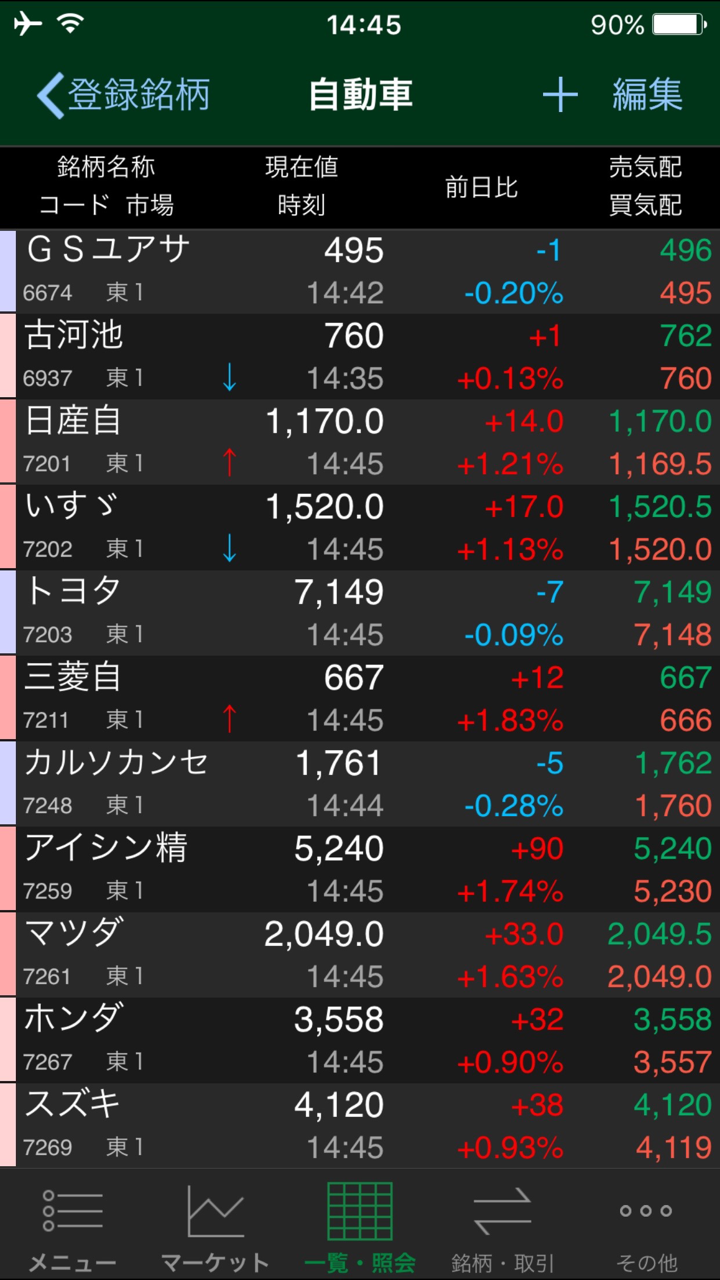

At Tachibana, investors can conduct transactions of various products, such as stocks, financial derivatives (Nikkei 225 futures, Nikkei 225 mini futures, etc.), and fund products.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Derivatives | ✔ |

| Funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Tachibana mainly provides securities trading accounts. After opening a securities account, investors can apply to open a margin trading account, an FX trading account, etc., according to their own needs.

Tachibana Fees

The fees of Tachibana vary greatly depending on the products.

For example, the handling fees for physical stock trading can be calculated on a per-order basis (individual course) or based on the total transaction amount per day (fixed quota course), starting from a minimum of 55 yen (including tax); the handling fees for margin trading are free (except for some specific transactions); there is no purchase fee for investment trusts, but other fees such as trust remuneration exist; the handling fees for Kurikku 365 are determined according to the number of monthly transactions; the handling fees for Nikkei 225 futures start from 247 yen (including tax), the handling fees for Nikkei 225 mini start from 27 yen (including tax), and the handling fees for Nikkei 225 options are approximately 0.11% of the agreed amount, starting from a minimum of 165 yen (including tax).

The charging standards for different businesses are different. For example, the “Online Deposit Service” for depositing funds is free, and there is no fee for withdrawing funds; the fee for the withdrawal of investment trusts is 1,100 yen (including tax) per security.

Trading Platform

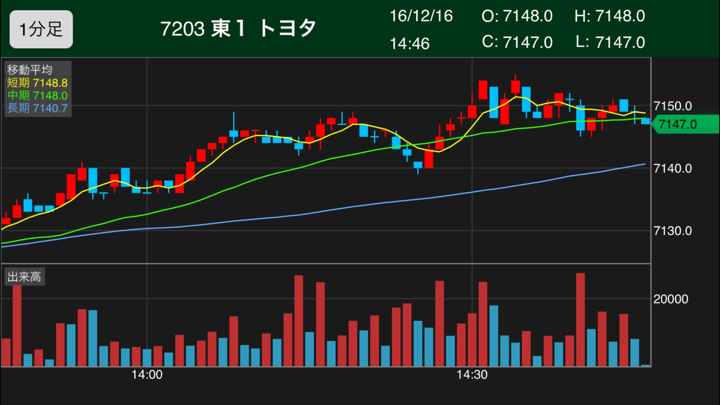

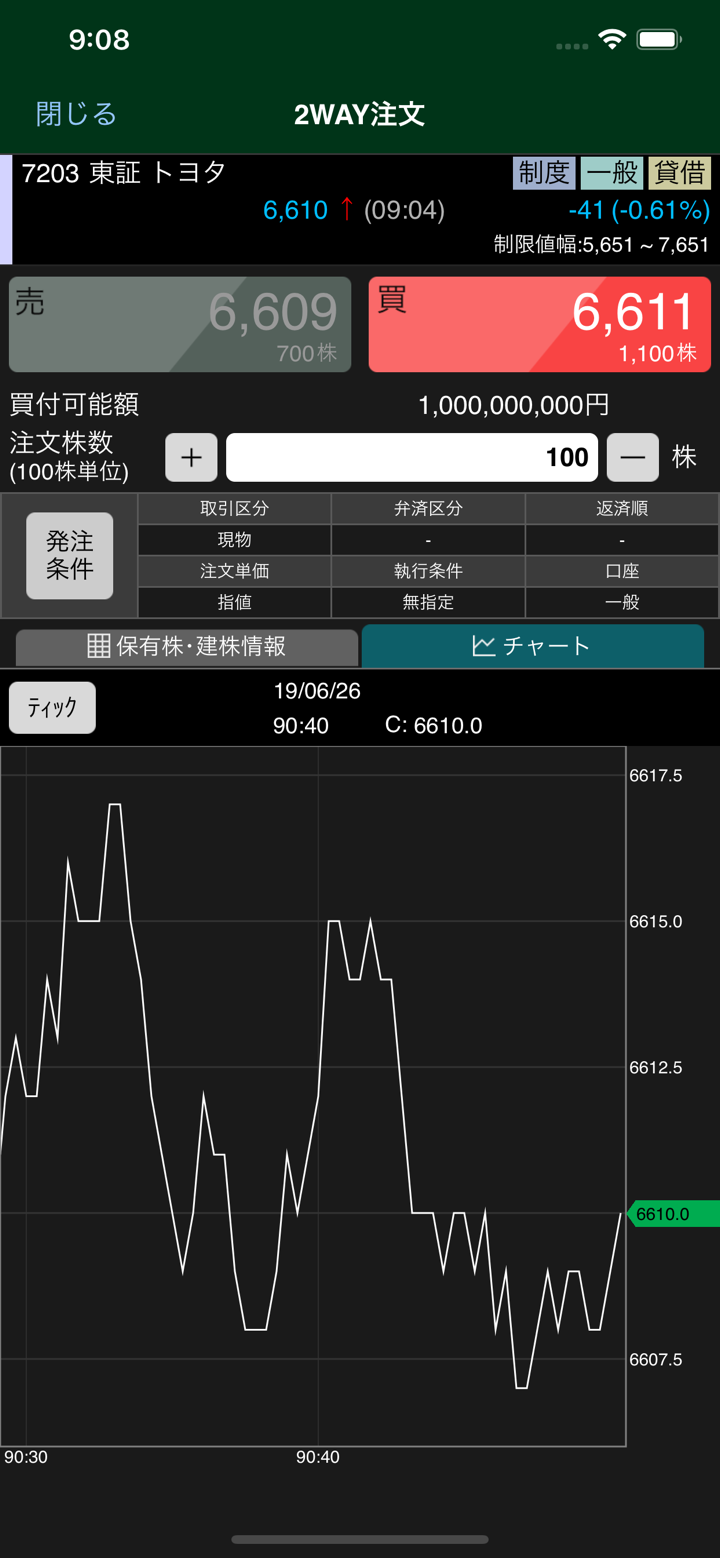

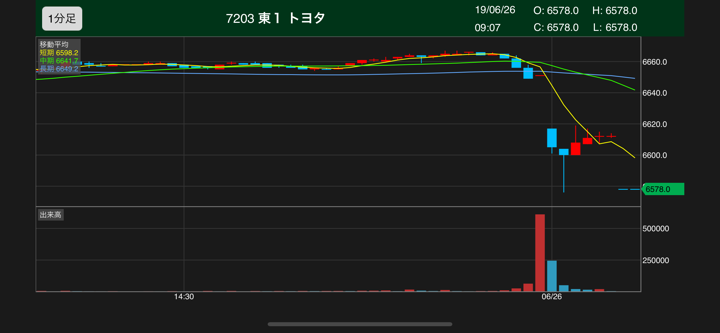

Tachibana provides diverse trading platforms, including Tachibana Trade Rich and Tachibana Stock Trading App. Tachibana Trade Rich has rich functions, and the Tachibana Stock Trading App supports operations on mobile phones and tablets. In addition, there is also a web-based trading platform that caters to the usage habits of different investors.

| Trading Platform | Supported | Available Devices |

| Tachibana Trade Rich | ✔ | Web |

| Tachibana Stock Trading App | ✔ | Mobile |

Deposit and Withdrawal

There are three ways of depositing funds: “Online Deposit Service”, depositing funds into a dedicated transfer account, and the fixed-amount transfer service for savings accounts (for regular investment needs).

In terms of withdrawal, the fees are borne by the company.

Bonus

Tachibana Securities has launched a preferential activity where the transaction handling fee for physical stock trading for newly opened accounts can be 0 yen for a maximum of half a year (120 business days), aiming to attract investors to open accounts and experience the platform's services.

In addition, some products on the platform also offer fee reductions and other preferential policies under specific conditions. For example, for “Kurikku 365”, if the monthly transaction volume is over 1,000 units, the handling fee for some periods of the following month can be waived.