Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

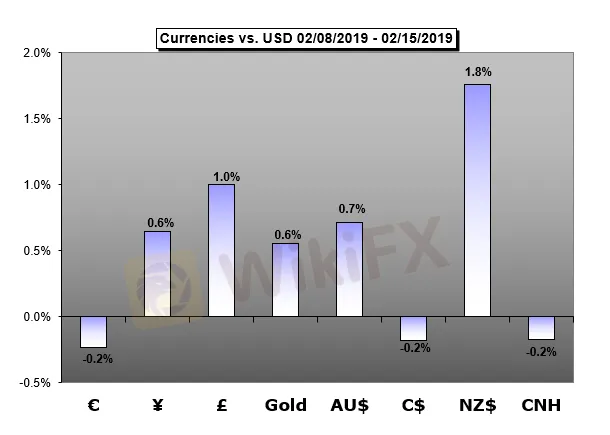

Abstract:Two of the most systemic fundamental threats facing the financial system have eased this past week in the avoidance of a second US government shutdown

Australian Dollar Forecast –May Head Lower If RBA Jawboning Starts Anew

The Australian Dollar has just come through a rather more peaceful week than the preceding one but could fall once more if the RBA continues to highlight the benefits of a weaker currency.

Oil Forecast – Price Tied to Non-OPEC Supply Concerns, Lower Demand

Crude oil will take its price cues from the ongoing concerns on increased supply from non-OPEC sources.

British Pound Forecast – Sterling Struggles as the Brexit Clock Tick

The British Pound is just about keeping its poise against a range of currencies, especially a strong US dollar, with less than two weeks until PM May presents her Brexit deal to Parliament again.

US Dollar Forecast –Needs Sentiment Consistency to Set Lasting Trend

The US Dollar seesawed last week, reflecting the competing influence of fundamental cross-currents. Risk sentiment consistency may be needed for a lasting trend.

Gold Forecast – Gold Bull-Flag Formation Continues to Unfold Ahead of FOMC Minute

Developments coming out of the U.S. economy may continue to heighten the appeal of gold as the Federal Reserve further adjuststhe forward-guidance for monetary policy.

Equities Forecast – Dow Jones and DAX Hinged to Trade Wars, Potential Auto Tariff

The Dow Jones Industrial Average and the German DAX will look to progress from the US-China trade talks and potential auto tariffs.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

USD/JPY just broke through 1-year highs earlier than expected.

A Good Week For the US Dollar As It Gains Strongly Against Other Major Pairs.

Performance like this hasn't been seen since 2021

The EUR/USD pair ended the week in the red last week as many investors remained in a holiday mood. It was trading at 1.1720, down slightly from last year’s high of 1.1910 ahead of key events this week.