简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Grand Capital Review 2026: Is this Broker Safe?

Abstract:Grand Capital holds a concerning safety score of 2.34 due to multiple regulatory warnings and confirmed unauthorized status in Seychelles. This analysis highlights critical withdrawal complaints and the risks associated with this unregulated broker.

Executive Summary

In this in-depth review, we analyze the key metrics and safety protocols of Grand Capital, a financial entity headquartered in Seychelles. The broker was established in 2018, attempting to position itself as a global service provider. However, its trajectory has been marred by significant regulatory challenges and client dissatisfaction.

As a broker entity operating since 2018, Grand Capital currently holds a WikiFX score of just 2.34, placing it in a high-risk category. Despite offering popular trading software, the firm has been flagged with a “C” influence rank and faces severe allegations regarding its legitimacy. The primary concern for potential clients in this review is the revocation and lack of valid licensing, which we will examine in detail.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation Grand Capital operates under. According to official disclosures, the broker is currently unauthorized and has been the subject of specific scam alerts. The Seychelles Financial Services Authority (FSA) issued a notice stating that “Grand Capital Ltd” is not authorized to conduct securities dealer business, explicitly labeling it a fraudulent company in past alerts.

Further compounding the risk, European regulators such as the French AMF and the Portuguese CMVM have placed the broker on their blacklists for operating without authorization. This lack of valid regulation means that client funds are not protected by segregated accounts or compensation schemes typically enforced by top-tier authorities. Consequently, traders possess no legal recourse in the event of insolvency or malpractice.

2. Forex Trading Conditions

For traders focusing on Forex instruments, Grand Capital provides access strictly through MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside a proprietary web platform. While these platforms are industry standards known for robust charting and automated trading capabilities, the trading environment itself is questionable due to the firm's regulatory status.

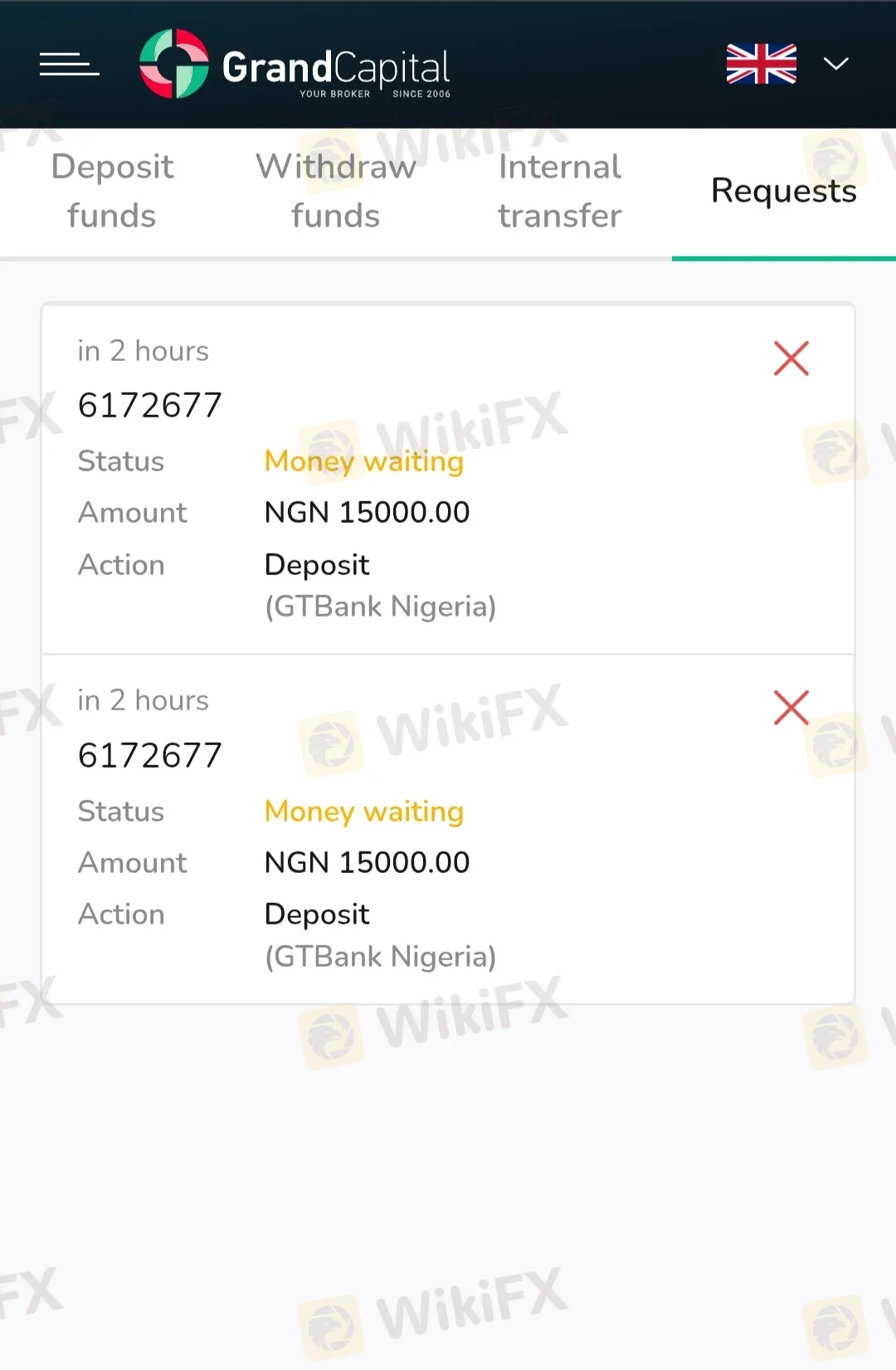

The broker supports various payment methods, including cryptocurrencies like Tether and Bitcoin, which are often favored by offshore entities to bypass traditional banking scrutiny. While the platform claims to offer a “Perfect” software rating, the underlying risk remains high. Investors questioning, “Does Forex pricing compete with top-tier providers?” must weigh the technological availability against the severe safety warnings attached to the brand.

3. User Feedback & Complaints

An analysis of user feedback reveals a disturbing pattern of withdrawal failures and service denials. Recent data from 2024 and 2025 highlights numerous complaints from regions including India and Turkey.

Notable grievances include:

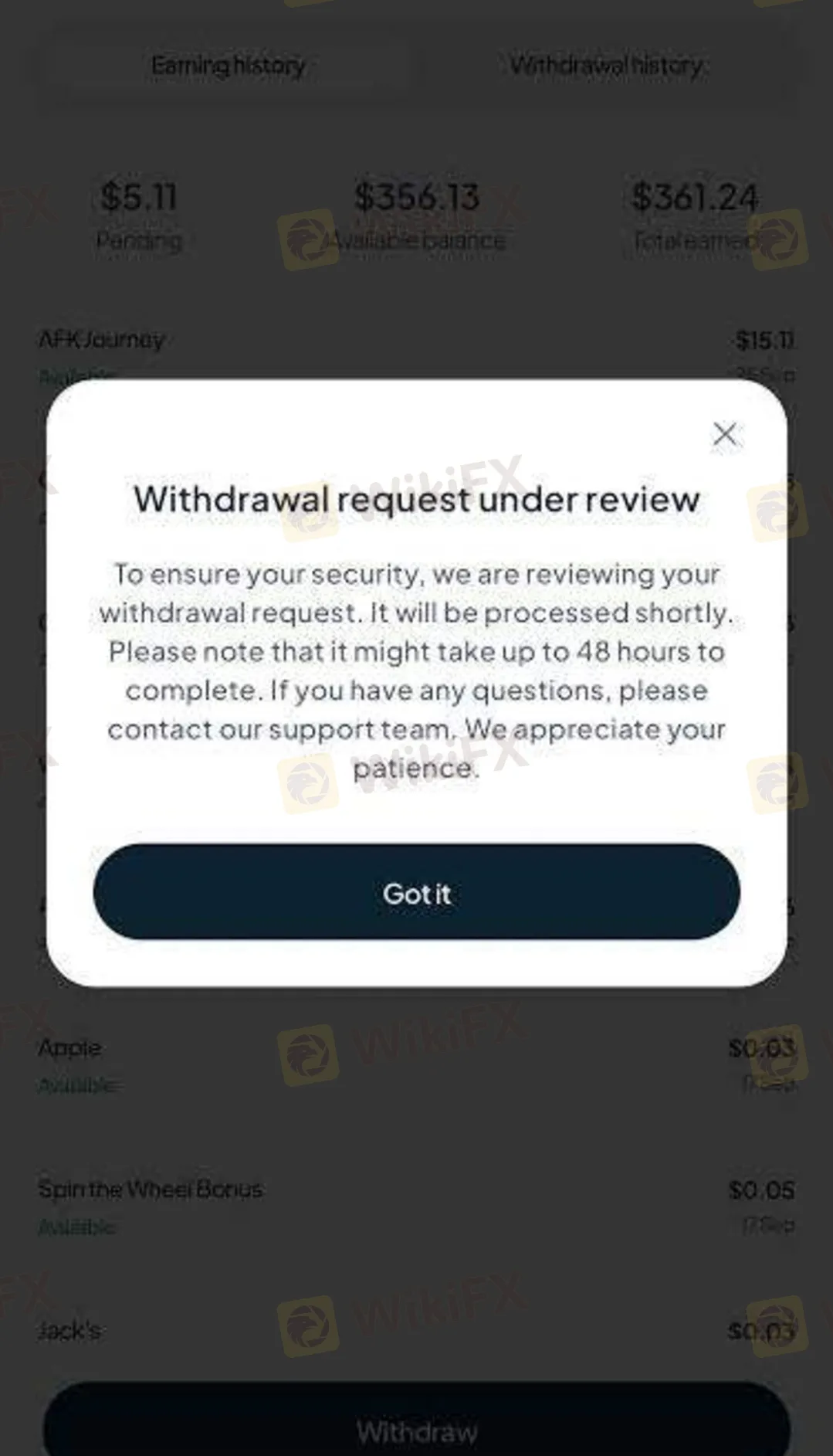

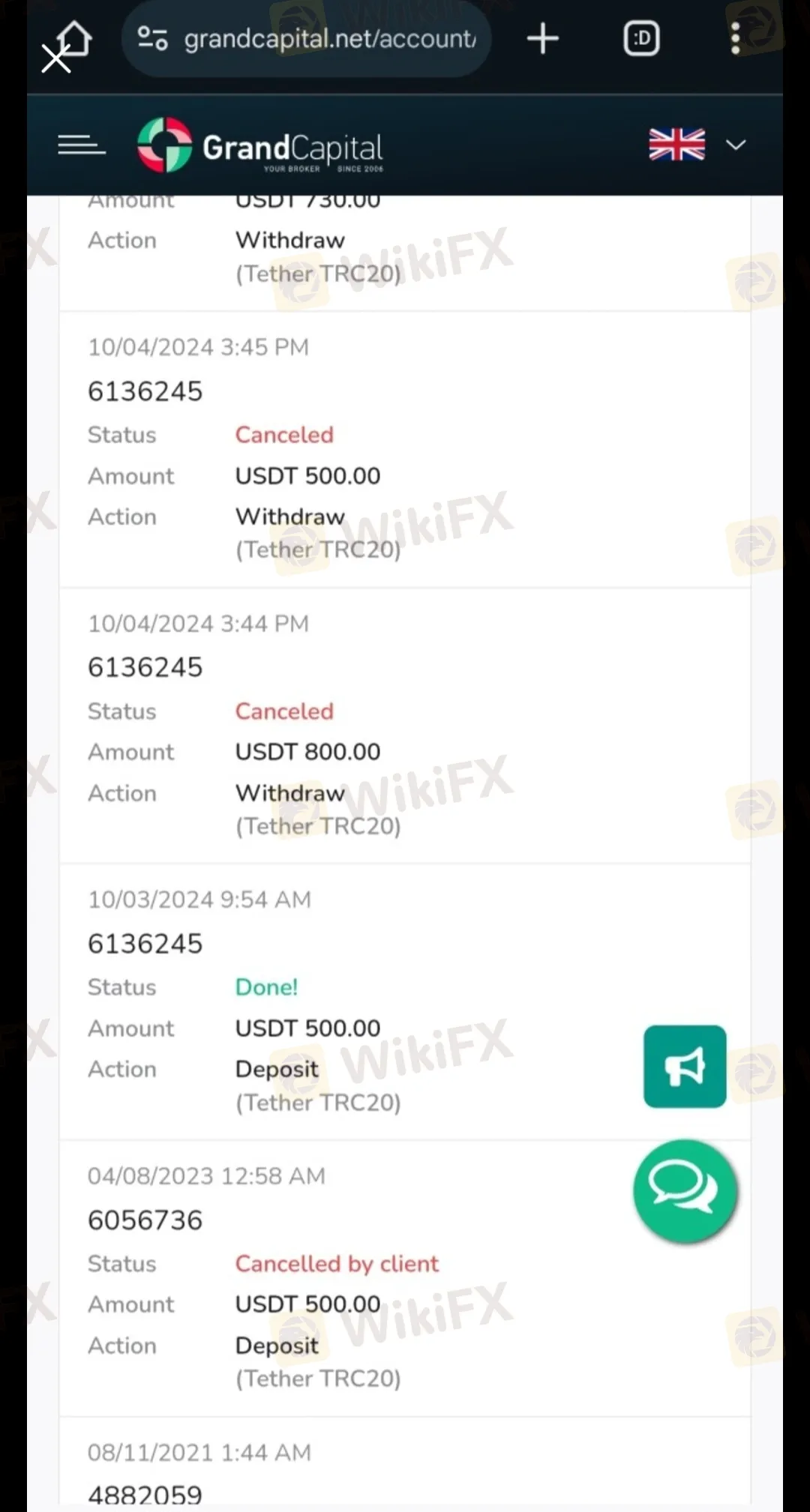

- Withdrawal Delays: Multiple users report that withdrawal requests remain “in review” indefinitely. One user from India stated, “Grand Capital feels impossible for me to withdraw... they have been unresponsive.”

- Rule Manipulation: A case translated from Thailand describes a scenario where the broker refused a withdrawal, alleging the client violated promotional rules despite the client adhering to the terms provided by the IB.

- Deductions: Another user reported that their deposit was deducted without being credited to the trading account.

Technological friction also appears in the complaints. Users have reported difficulties with their login stability, noting that the application interface often takes too long to load or freezes entirely, preventing timely access to funds and trade management.

4. Software & Access

Grand Capital utilizes the widely recognized MT4 and MT5 platforms, which are generally reliable. To access the platform, traders must complete the login security steps, though the broker currently lacks advanced two-factor authentication (2FA) or biometric verification features found in more secure environments.

While the software itself supports sophisticated trading strategies, the ease of access is overshadowed by the operational risks. The login process is straightforward, but as noted in user feedback, interface lags can disrupt the trading experience. Furthermore, the reliance on an offshore infrastructure raises concerns about data privacy and the security of credentials entered into the client portal.

Final Verdict

Grand Capital presents a dangerous profile for retail investors. The combination of a low safety score, confirmed regulatory warnings from the FSA and AMF, and a high volume of unresolved withdrawal complaints makes it a hazardous choice.

Pros:

- Access to MT4/MT5 platforms.

Cons:

- Unauthorized and blacklisted by major regulators.

- Consistent reports of withdrawal blocks.

- Low WikiFX score (2.34).

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App. We strongly advise traders to seek licensed alternatives with proven track records.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

Grand Capital Review 2026: Is this Broker Safe?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

As Ramadan Approaches, Reason and Care Go Hand in Hand: WikiFX Wishes You Peace and Well-Being

Zero Markets Forex Scam Alert News

IUX Review: The Digital Mirage Where Capital Goes to Die

TenX Prime Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator