Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A controversial new rule being implemented by Donald Trump will pave the way for the US to impose punitive tarrifs on the goods from countries with undervalued exchange rate, said the US department of commerce.

A controversial new rule being implemented by Donald Trump will pave the way for the US to impose punitive tarrifs on the goods from countries with undervalued exchange rate, said the US department of commerce.

The action brings more complaints about exchange rate manipulation in Japan and other economies, make the US‘ global forex market with over US$6 trillion of daily trading volumes become Trump’s new battlefield of trade friction.

The rule marks the US another step toward the weaponization of the USD, following the verbal intervention to devalue the dollar and accusation that the Fed has led to a stronger dollar that has harmed US manufacturers and other exporters. This appears to be intended to send a signal to all the trading partners of the US, which is that a significant weakening of their currencies relative to the dollar may lead to the retaliation from Trump.

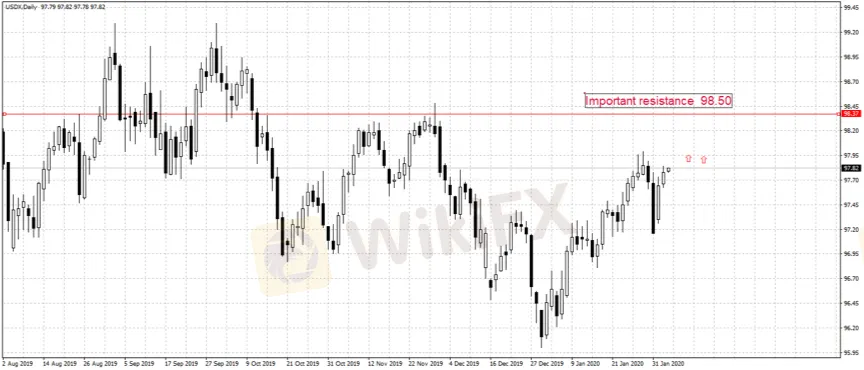

USDX Daily Pivot Points 97.89-97.93

S1: 97.81 R1: 97.81

S2: 97.68 R2: 98.14

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

USD/JPY just broke through 1-year highs earlier than expected.

A Good Week For the US Dollar As It Gains Strongly Against Other Major Pairs.

Performance like this hasn't been seen since 2021

The EUR/USD pair ended the week in the red last week as many investors remained in a holiday mood. It was trading at 1.1720, down slightly from last year’s high of 1.1910 ahead of key events this week.