Abstract:Gold prices consolidates after hitting a record high ($2,075) in August, but the macroeconomic environment may keep gold afloat.

WikiFX News (24 Aug)- Gold prices consolidates after hitting a record high ($2,075) in August, but the macroeconomic environment may keep gold afloat.

The rebound in gold prices from the monthly low ($1,863) struggles to retain the momentum as the Federal Open Market Committee (FOMC) in its meeting minutes revealed a looming change in the monetary policy outlook: the FOMC has voted unanimously to push back “the expiration of the temporary U.S. Dollar liquidity swap lines through March 31, 2021” after extending its lending programs till the end of the year.

In addition, the Feds chairman Jerome Powell is expected to reveal something new at the Jackson Hole Economic Symposium scheduled for August 27-28, with the information further supporting gold prices.

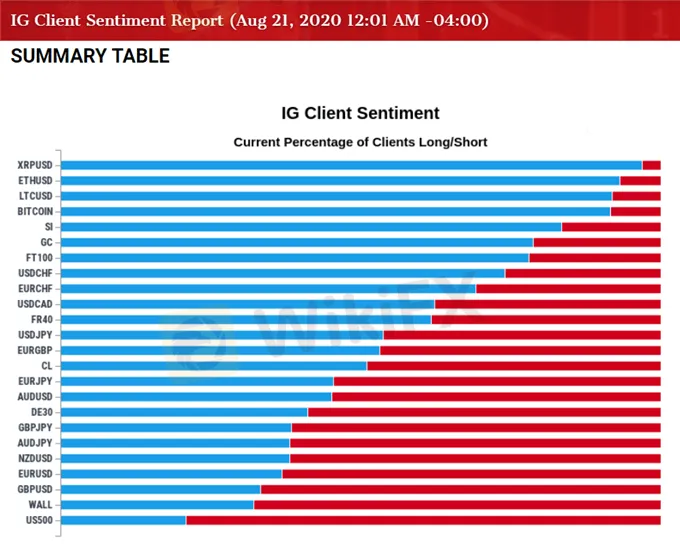

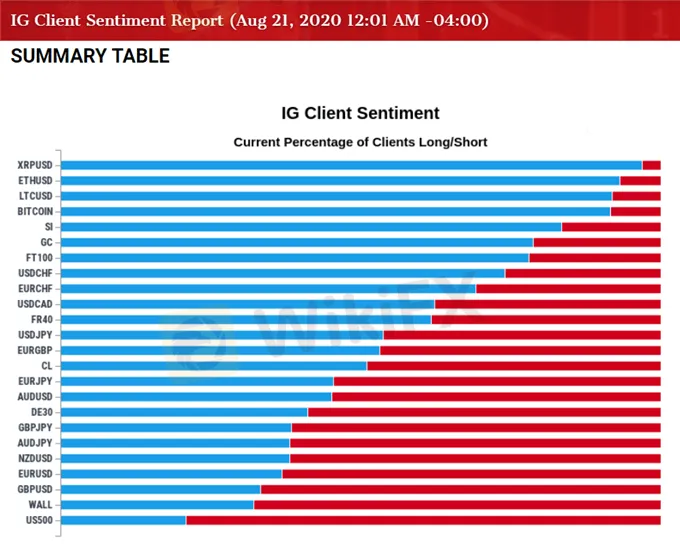

The IG Client Sentiment report implies that the continuous crowding behavior may raise gold prices, heightening the appeal of gold as an alternative to fiat currencies. Technically speaking, it is expected to see bullish gold enduring as it has been trading to fresh yearly highs for every single month so far in 2020.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.