Abstract:This article delves into three distinct methodologies that can be harnessed as effective conduits for generating revenue within the Forex landscape without involving trading.

Navigating the volatile terrain of the Foreign Exchange (Forex) market often entails encountering both profitable gains and unforeseen losses. For many, the prospect of substantial losses has deterred inexperienced individuals from committing to long-term Forex trading endeavours. As the question of “how to generate income from Forex without direct trading” gains traction, alternative strategies emerge to cater to such queries.

This article delves into three distinct methodologies that can be harnessed as effective conduits for generating revenue within the Forex landscape. These methodologies, commonly recognized by multiple appellations, encompass copy trading, embarking on a Forex brokerage venture, and engaging in affiliate programs alongside contributing comments, reviews, and posts across diverse information portals.

Copy trading, interchangeably referred to as social trading, presents an advantageous avenue for novice individuals to navigate the intricate Forex realm. This method involves mirroring the trading practices of seasoned traders, enabling less-experienced traders to potentially profit from their expertise. The appeal of copy trading lies in its potential to mitigate risks associated with a lack of experience. Nevertheless, it's imperative to acquaint oneself thoroughly with these methods, as insufficient understanding could expose one to financial losses. Effective practice and diligent study of a chosen trader's trading system remain pivotal to achieving success.

Strategies for Selecting an Appropriate Trader to Follow:

Identify the most followed professional traders.

Scrutinize the profitability of their followers.

Prioritize traders with consistent monthly performance.

Becoming a Forex broker entails orchestrating transactions between buyers and sellers, engendering income regardless of market fluctuations. In an era characterized by technological leaps, a competitive landscape prevails due to burgeoning technological advancements employed by contemporary brokers. A robust technology infrastructure and substantial capital are essential prerequisites to thrive in this domain. This endeavour holds the potential for significant revenue generation driven by brokerage fees. Moreover, offering educational resources, customer support, insightful analyses, and diverse account options can augment the broker's profitability.

Thriving within an affiliate program necessitates a commitment to studying and mastering the nuances of Forex trading. Individuals can position themselves as sought-after consultants for Forex transactions by accumulating expertise. Trust and recognition hinge upon diligent interaction with clients, answering queries, and providing value-driven advice. Reputation-building is the cornerstone of success in this endeavour, enabling the consultant to attract a broader clientele. Charging consultation fees or providing affiliate links for registration, upfront or post-advice, can bolster revenue streams. Earning a reputable stature is the principal challenge within the affiliate program methodology. This endeavour demands dedication, exemplified by promptly addressing queries, sharing relevant Forex insights, and contributing informative articles. Persistence and proactive engagement are the bedrock for cultivating a profitable consultancy endeavour.

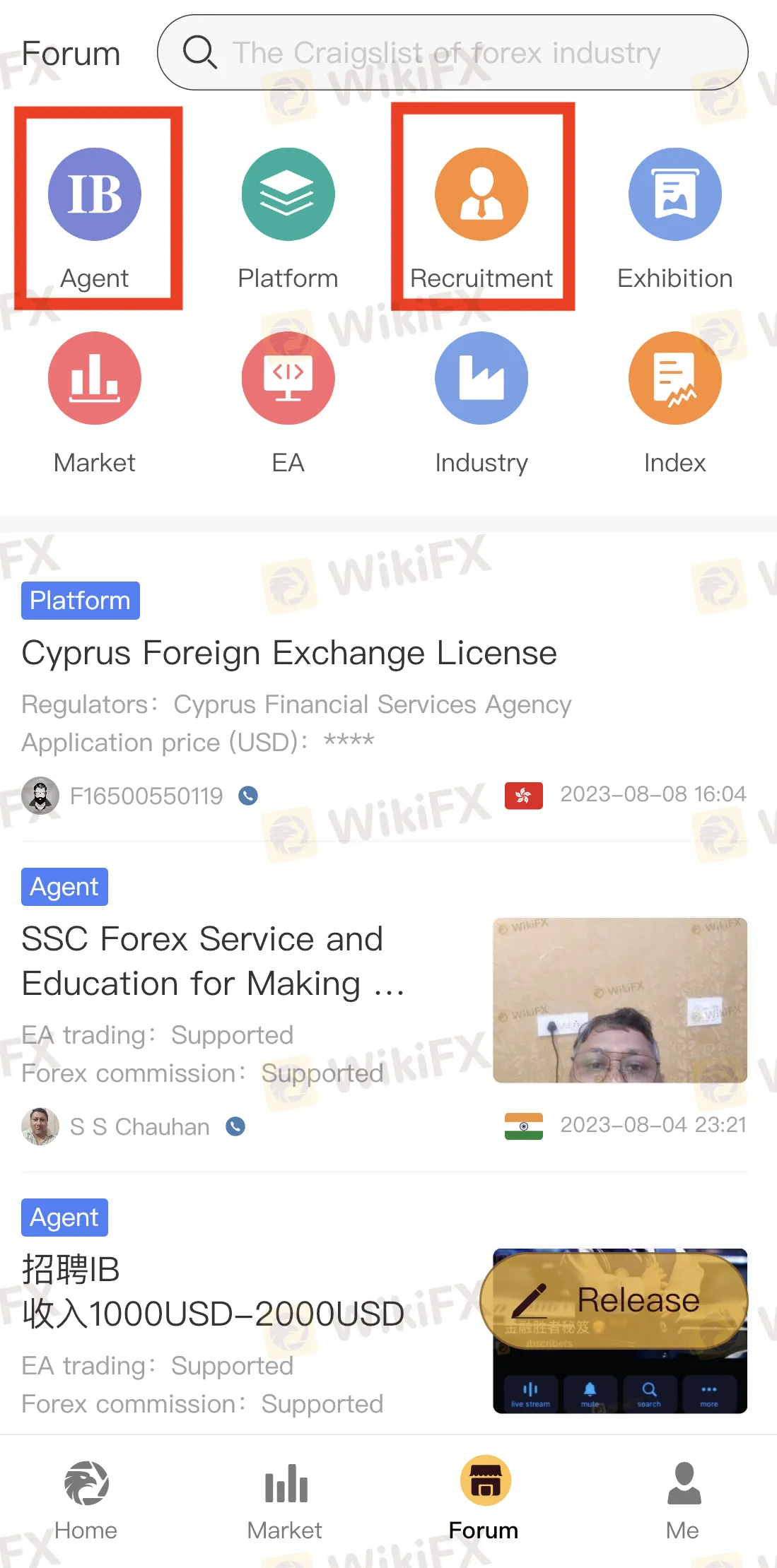

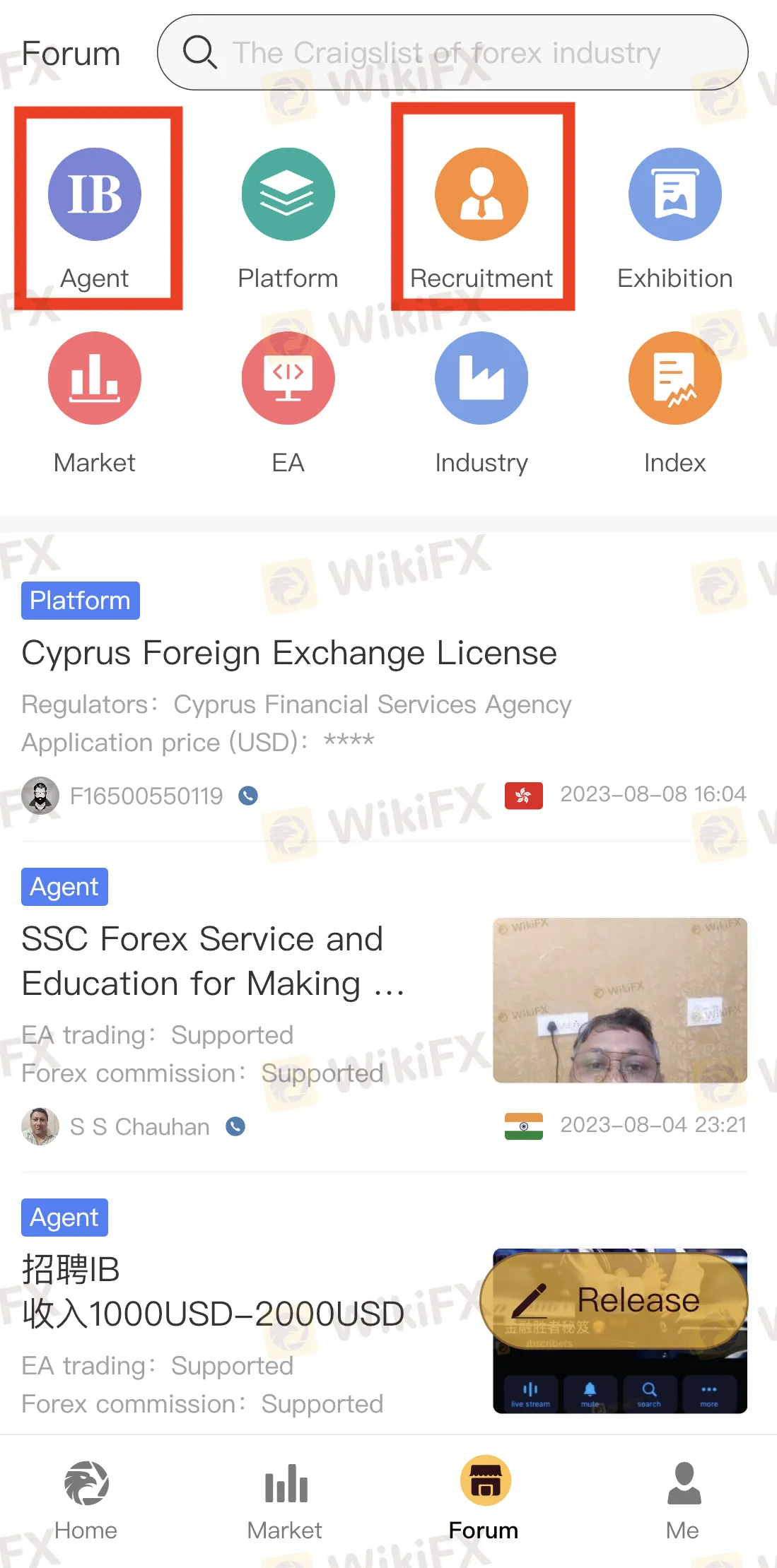

Download the free WikiFX mobile application to find more opportunities at our Forum!

In conclusion, the journey to profit in the Forex realm need not be limited to active trading. Embracing alternative strategies such as copy trading, venturing into brokerage, and participating in affiliate programs presents a diversified approach to financial gain. Each pathway necessitates a unique skill set and diligent efforts, underpinned by an unwavering commitment to mastering the intricate dynamics of the Forex landscape. By harnessing these methodologies, individuals can achieve their financial aspirations without directly engaging in traditional trading practices.