Abstract:Forex trading has become a critical game now because of advancements in technology. Due to this Unfortunately, scam brokers have also entered in the Forex market. Therefore, you need to stay alert. This article aims to warn all traders and investors. Read carefully and stay aware.

Forex trading has become a critical game now because of advancements in technology. Due to this Unfortunately, scam brokers have also entered in the Forex market. Therefore, you need to stay alert. This article aims to warn all traders and investors. Read carefully and stay aware.

1. Lack of Reputed Regulation - AssetsFX states that it operates under regulation in Mauritius, through the Financial Services Commission (FSC). While Mauritius is technically a regulated environment, But it is often considered a less stringent regulatory body compared to well-established authorities like the UKs Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC). This means that while the broker may have a license, the level of investor protection, regulatory enforcement, and transparency may not be as robust.

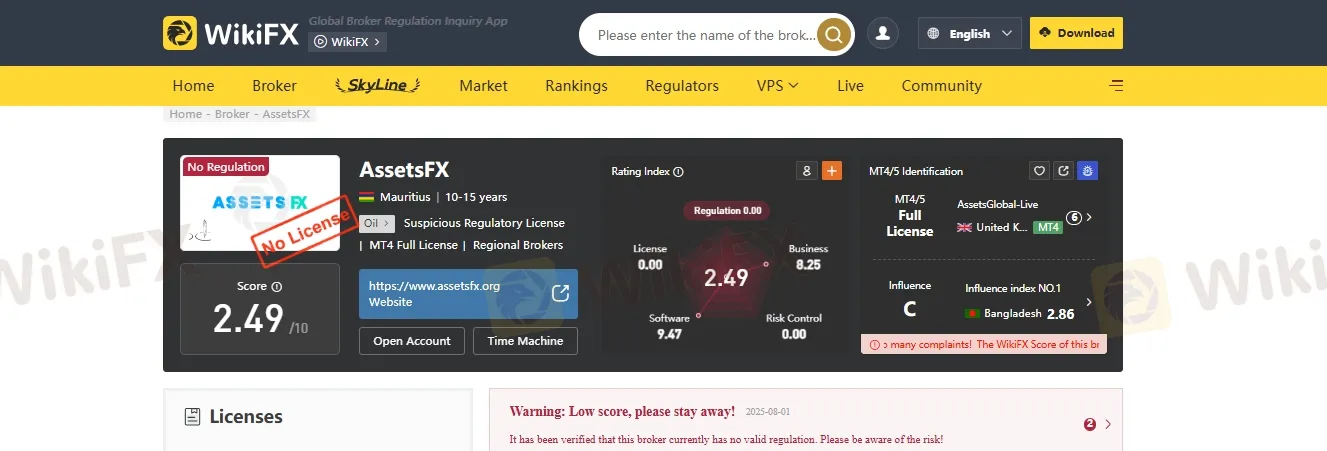

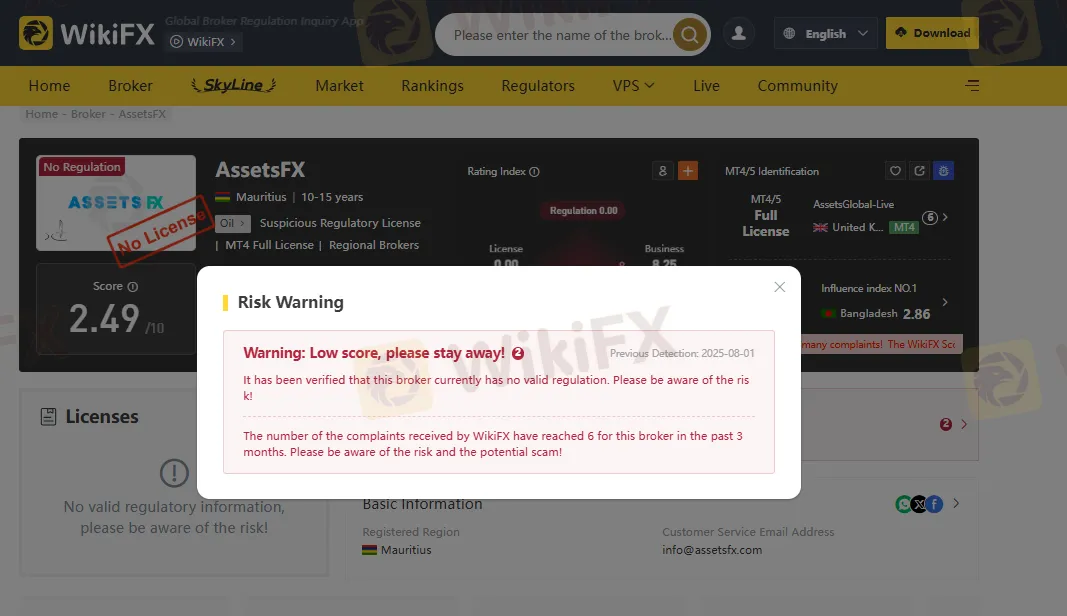

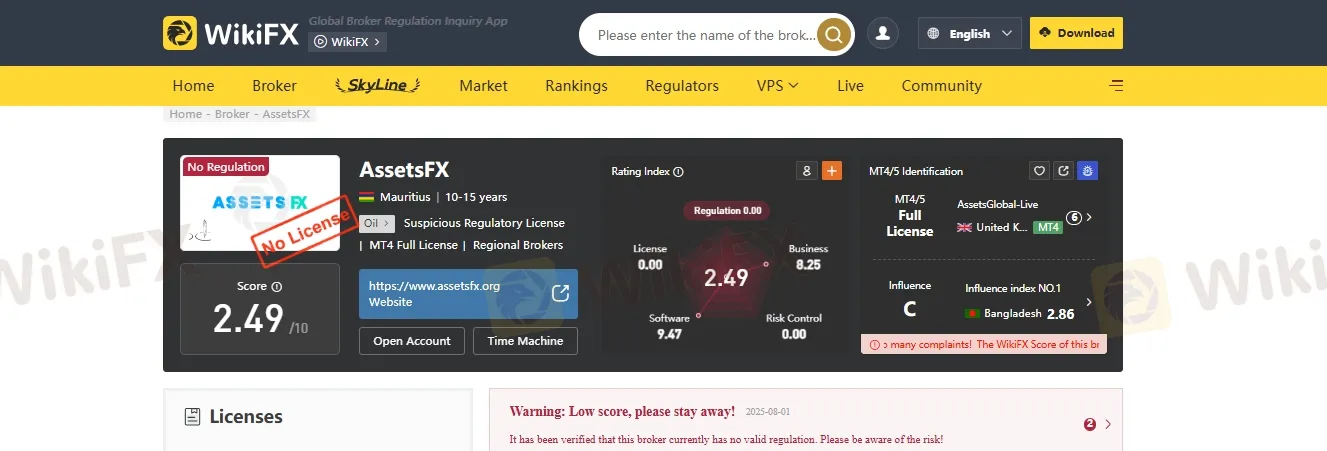

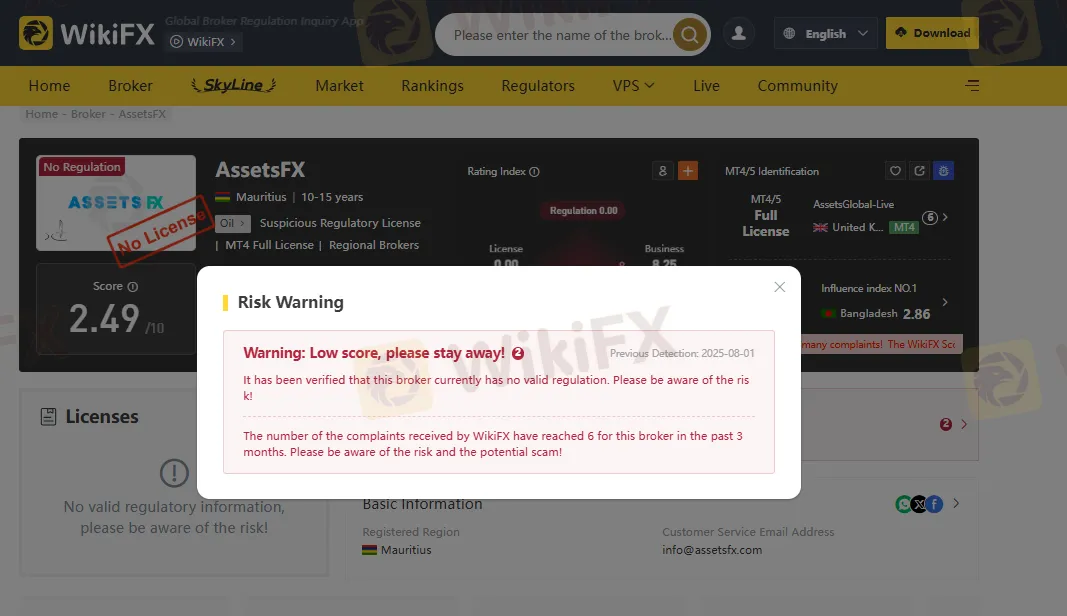

2. Low Score- A Low score for any broker immediately raises concerns about its credibility. When we checked AssetsFX 's score on WikiFX. It shows 2.49 out of 10 which is extremely low. This is one of the topmost red flags weve identified, and it's something you must not ignore.

3. Lack of Multilingual support - AssetsFX currently offers customer support only in English, which can be a significant drawback for many global traders. In todays international trading environment, investors and users come from diverse linguistic backgrounds. The lack of multilingual support may lead to misunderstandings, delays in issue resolution, and overall frustration for non-English-speaking clients.

4. WikiFX Report- According to WikiFX , this broker is a scam broker and having low score. WikiFX has issued a clear and direct alert urging users to avoid Neuron Markets. They highlight the brokers low rating and confirm it lacks valid regulatory approval—stating simply: “Warning: Low score, please stay away!... no valid regulation… be aware of the risk.”

5. Absence of Trader Education- AssetFx has drawn attention for a significant gap in its service offerings: the complete lack of trader education resources. While the broker may provide access to various financial instruments, its failure to equip traders—especially beginners—with foundational knowledge, strategic insights, or risk management tools raises serious concerns about its commitment to client success and ethical trading practices.

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!