简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:While ONE ROYAL holds top-tier licenses from ASIC and CySEC, a recent surge in user complaints regarding withdrawals and severe slippage raises significant caution. The broker currently holds a WikiFX score of 6.26, though regional regulatory warnings advise specific risks for traders in Southeast Asia.

Executive Summary: ONE ROYAL (also known as Royal Financial Trading) presents a complex picture with a decent WikiFX Score of 6.26 and strong regulation in Australia and Cyprus. However, recent data from 2025 reveals a worrying trend of withdrawal delays and slippage complaints, particularly from Malaysian traders.

Before you find a broker to trust with your life savings, you need to look past the shiny advertisements. In this review, we are analyzing ONE ROYAL to see if their operational reality matches their regulatory status. While their score suggests a standard level of reliability, the recent influx of user feedback tells a different story that you need to hear before opening an account.

Question 1: Regulation & Safety: Is my money safe?

When assessing safety, we look at who gave the broker permission to operate. ONE ROYAL holds three distinct licenses:

1. Australia (ASIC): Regulated (License No. 420268) – This is a Tier-1 license, generally considered very safe.

2. Cyprus (CySEC): Regulated (License No. 312/16) – Passports to Europe.

3. Vanuatu (VFSC): Offshore Regulation (License No. 700284).

However, a crucial regulation warning was issued in 2023. The Securities Commission Malaysia (SC) placed ONE ROYAL on its “Investor Alert” list for carrying out unlicensed capital market activities. This is a red flag if you are trading from that region.

Education: Why does the entity matter?

If you reside outside of Australia or Europe, you are likely being onboarded to the Vanuatu (VFSC) entity. While legal, offshore regulation often lacks Segregated Accounts protection in the same strict way Tier-1 regulators enforce it. Segregated accounts ensure your deposits are kept in a separate bank account from the broker's operating funds, meaning they can't use your money to pay their electric bill or debts.

Question 2: Are the trading fees and leverage fair?

ONE ROYAL offers varying conditions depending on which account type you choose (Prime, ECN, or CLASSIC). The standout feature here is the leverage, which hits a massive 1:1000.

The Double-Edged Sword of Leverage

While 1:1000 leverage sounds exciting because it allows you to control large positions with only $5, essentially magnifying your buying power, it is dangerous. If the market moves just 0.1% against you, your entire account could be wiped out instantly. This is why strict regulators like ASIC usually cap leverage at 1:30 for retail clients. If you have access to 1:1000, you are likely trading under the offshore entity where protections are lower.

In terms of Forex trading costs, the “Prime” and “ECN” accounts offer spreads as low as 0.0 pips, while the “Classic” account starts around 1.4 pips. For traders looking to scalp, the raw spread accounts are mathimatically superior, provided the commissions are low.

Question 3: What are real traders complaining about?

Despite the decent overall score, our database has flagged 23 complaints within just 3 months. Analyzing the `casesText` reveals disturbing patterns:

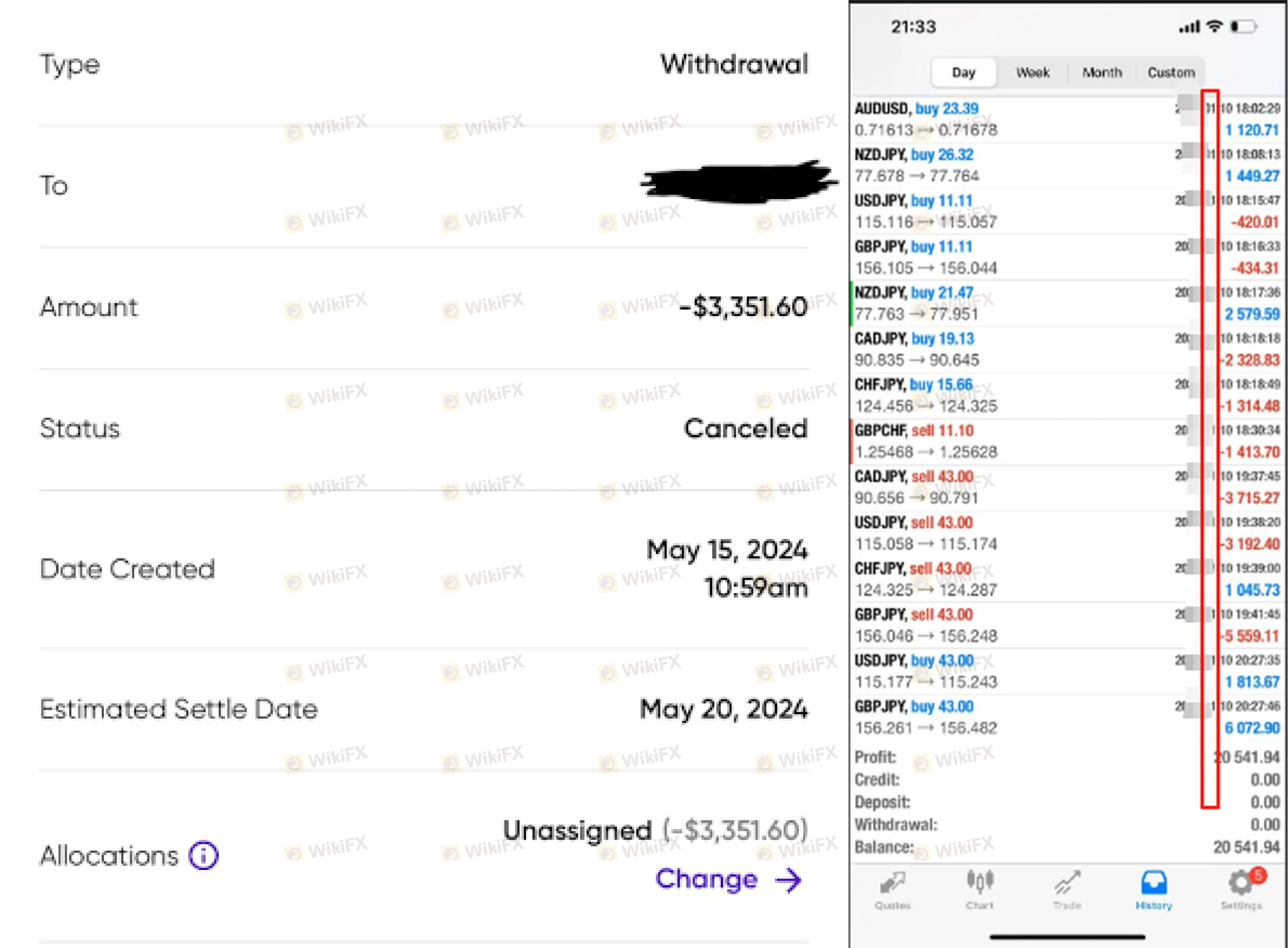

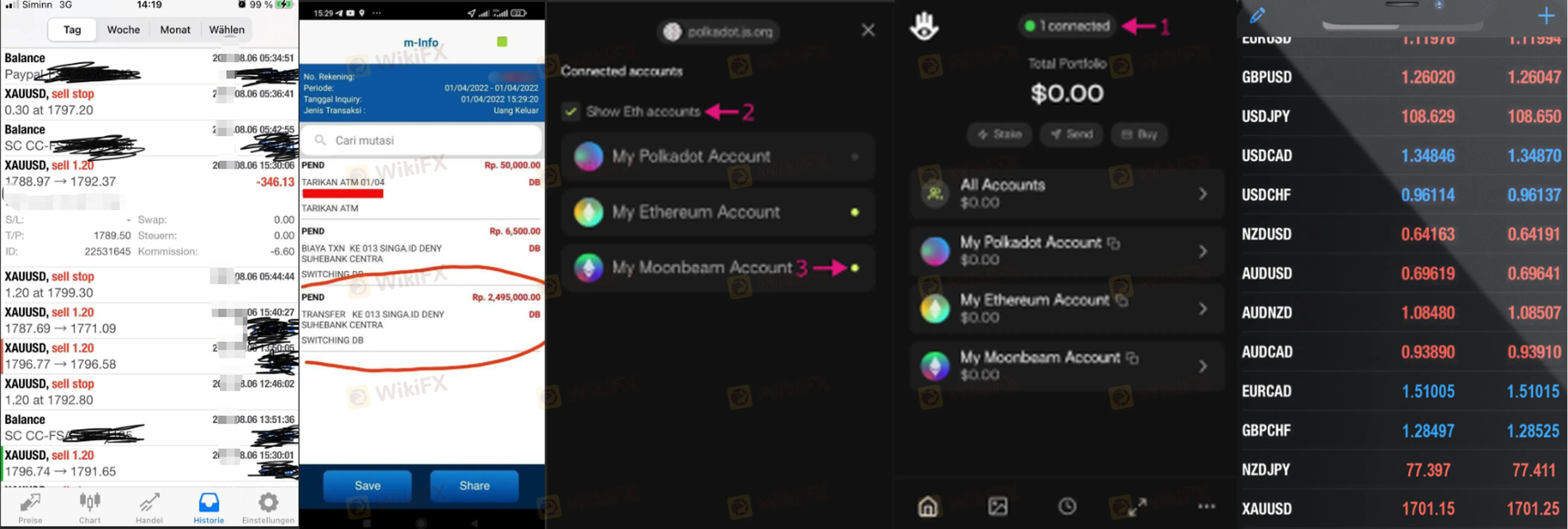

1. Blocks on Withdrawals

Numerous traders from Malaysia and the US reported rejected or delayed withdrawals in late 2025. For example, one user noted their withdrawal was canceled without explanation (Case 1), while another stated their RM 30,000 withdrawal went missing for 15 days (Case 8).

When a broker delays payments, it is often the single biggest warning sign of liquidity trouble.

2. Severe Slippage and “Fake” Data

A recurring complaint involves “slippage”—where the price your order executes at is worse than the price you clicked. One trader reported a massive 160-point slippage on GBP/USD that wiped out their principal (Case 8). Another claimed the platform's price feed differed significantly from international benchmarks, forcing losses (Case 6).

3. The “AI Trading” Trap

Several users mentioned losing money after being sold an “AI Intelligent Trading System” that guaranteed returns (Case 4, Case 5).

> Pro Tip: Legitimate brokers never guarantee returns (e.g., “20% monthly profit”). If you see a sales pitch for an automated AI system that “cannot lose,” it is almost certainly a marketing gimmick or a scam scheme often used by third-party affiliates.

Question 4: What software will I use?

ONE ROYAL provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with a proprietary app.

Security Warning: The Login Process

Because ONE ROYAL supports popular platforms like MT4/MT5, you must be vigilant about phishing. Scammers often create fake websites that look exactly like the real broker. Always verify you are on the official URL (e.g., `oneroyal.com`) before entering your login credentials. Never download a “trading signal app” from a stranger on social media that requires your trading account password; this is a common way hackers steal access.

While they offer a custom app (“orTrader”), most professional traders stick to MT4/MT5 because these platforms are audited by third parties, making it slightly harder for a broker to manipulate backend pricing compared to a purely proprietary app.

Final Verdict: Should I open an account?

ONE ROYAL is a “Dr. Jekyll and Mr. Hyde” case. On paper, they are a legitimate broker with high-level ASIC and CySEC licenses and a decent WikiFX score of 6.26. However, the operational reality reported by traders in 2025—specifically the severe withdrawal delays and slippage allegations—cannot be ignored.

If you are in Australia or Europe under the regulated entities, you have strong protections. However, if you are an international client (especially in Southeast Asia) falling under the offshore regulations, the recent flood of complaints suggests high risk.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and to see if the withdrawal complaints have been resolved.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Dollar Under Siege: Fiscal Gridlock and Foreign Divestment Weigh on Greenback

Commodities Brief: Gold Pierces $5,000 as 'Debasement Trade' Accelerates

Currency Calculator