Abstract:It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

1. Lack of Regulation from Top-Tier Authorities

DB Investing is licensed by several regulators, including the FSA in Seychelles, the SCA in the UAE, and FINTRAC in Canada. However, these are considered mid- or low-tier regulators, and don't offer the same level of investor protection as top financial authorities.

The main concern is that DB Investing is not licensed by any top-tier regulators like the FCA (UK), ASIC (Australia), or SEBI (India). These top regulators are known for their strict rules, strong investor been protection, and high transparency. Without oversight from such trusted bodies, there is a higher risk of fraud, poor fund security, and lack of accountability.

2.. Complex fee structure

DB investing broker's complex fee structure has raised concerns among investors. Understanding these fees is crucial to avoiding unexpected costs. Fees can significantly impact investment returns, reducing overall performance.

3. Regional Restrictions

A major red flag is that DB Investing does not offer its services in key financial markets, including the EU, USA, Canada, UK, and several other jurisdictions such as Iran, Iraq, Armenia, and Azerbaijan. Additionally, it does not operate in countries listed under FATF (Financial Action Task Force) restrictions.

4. Leverage Risk

The broker offers high leverage—sometimes up to 1:500—especially for forex and CFD trading. While this allows traders to amplify profits, it also increases the risk of significant losses, especially in volatile markets.

5. Limited Payment Methods

Reliable brokers typically offer a wide range of secure, regulated payment options such as bank transfers, credit/debit cards, e-wallets, and local payment systems. In contrast, DB Investing provides limited information about its accepted payment methods.

Conclusion

DB Investing is suitable for traders who are comfortable with a moderate level of risk and understand the nature of leveraged trading. It's important for users to practice proper risk management and be aware of the regulatory landscape before investing.

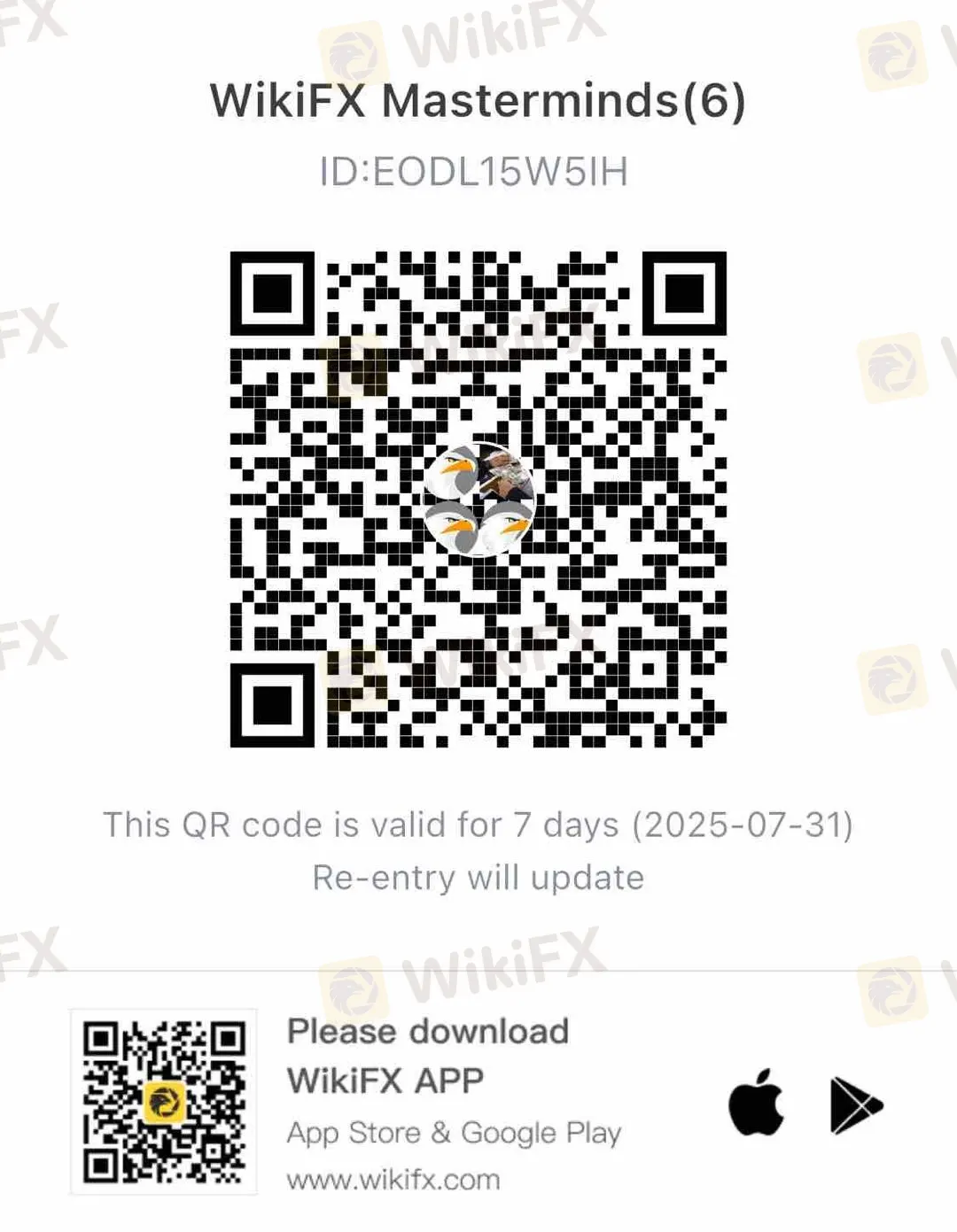

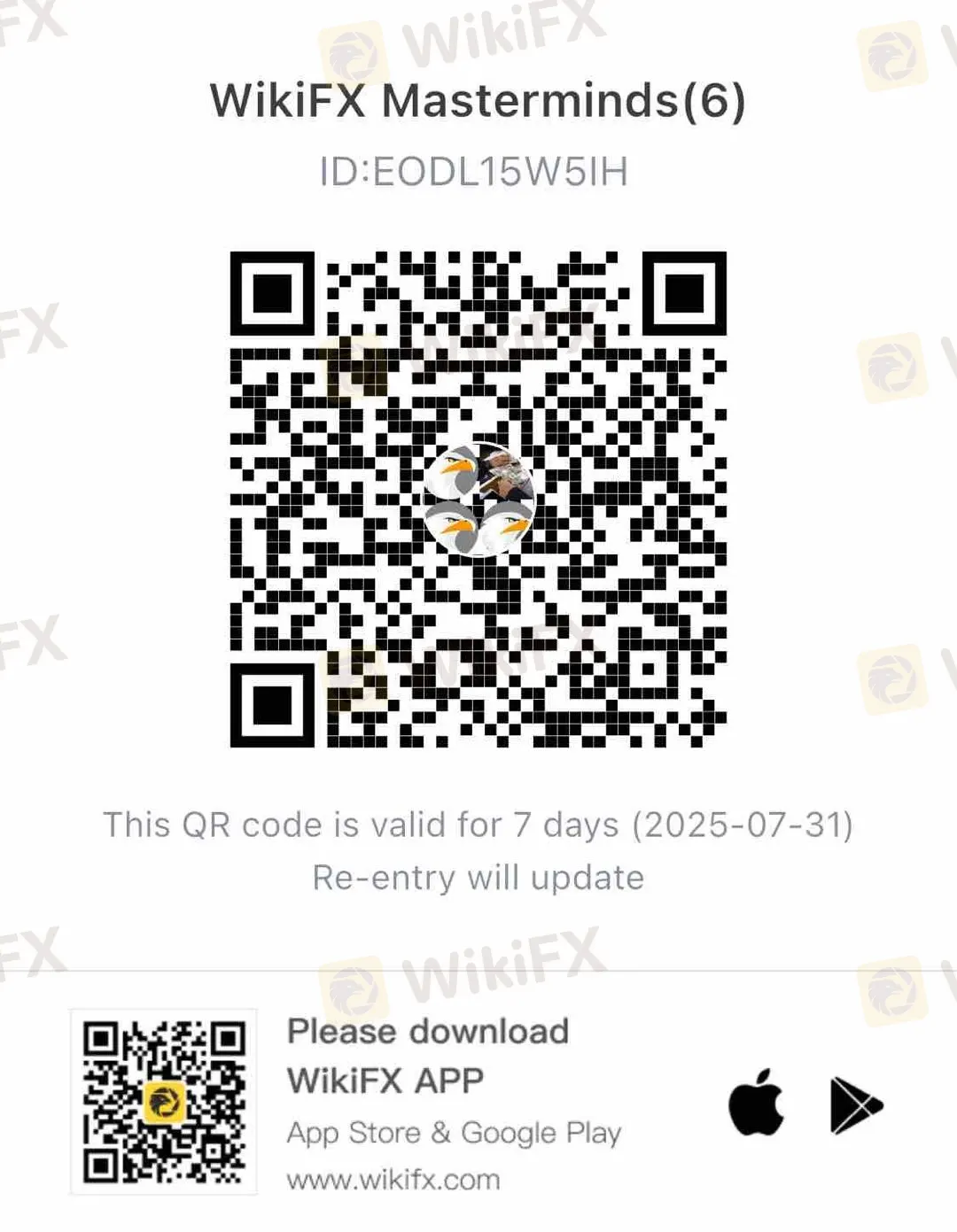

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!