Abstract:Discover OANDA’s business impact, regulatory approvals, and verified offices worldwide. Get trusted, expert insights for secure forex trading.

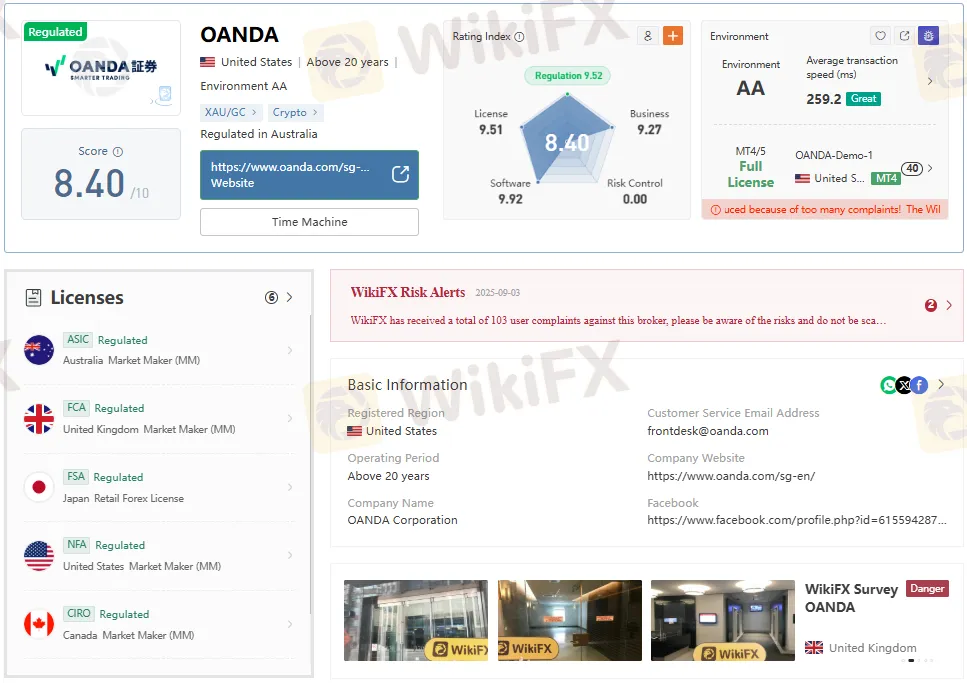

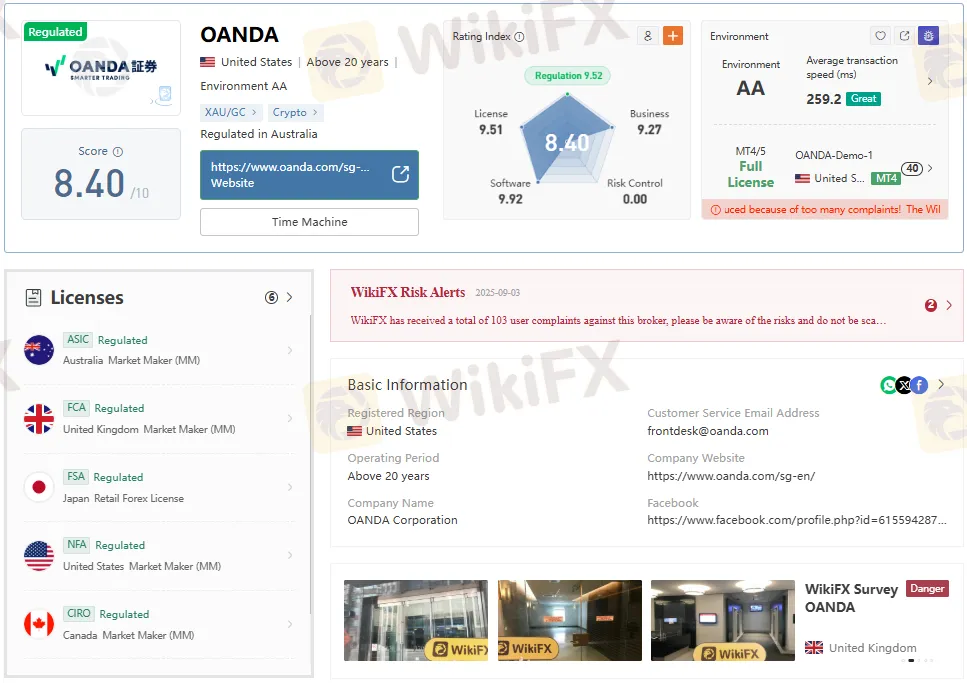

OANDA stands out as a highly influential and trusted forex broker, demonstrating strong regulatory compliance and a broad international presence. As of September 2025, OANDA secures an impressive 8.40/10 score according to comprehensive industry analysis, reflecting its robust operational standards, regulatory licensing, and business reputation.

Global Influence and Market Ranking

OANDA‘s reach is evident in the worldwide business area analysis, with the United States, Japan, and Germany ranking as top regions for forex broker influence (scores above 8). OANDA is regulated in key financial markets, including the United States (NFA), the United Kingdom (FCA), Singapore (MAS), Japan (FSA), and Canada (CIRO). This wide regulatory footprint affirms OANDA’s credibility and commitment to international trading standards.

Regulatory Compliance and Licenses

OANDAs authoritative status is underpinned by its licenses from globally recognized regulators:

- FCA (UK): Market Maker (MM)

- NFA (US): Market Maker (MM)

- FSA (Japan): Retail Forex License

- MAS (Singapore): Retail Forex License

- CIRO (Canada): Market Maker (MM)

These license verifications, documented by certificates and regulated status, are critical for traders assessing broker security and reliability. OANDA also meets high marks for software quality (9.92/10) and business operations (9.27/10), although users should note flagged concerns for complaints, as reported on platforms like WikiFX.

Office Verification and Transparency

OANDA has successfully established and verified offices at multiple global financial centers:

- 1 Raffles Place, Central, Singapore — Office Found

- 335 King Street West, Toronto, Ontario, Canada — Office Found

- Pitt Street, Sydney, South Australia, Australia — Office Found

- 4-5, Shinjuku, Tokyo, Japan — Office Existed

However, no active office was found at 6 Store Street, London, England, highlighting the importance of confirming the broker's physical presence before engaging.

Expert Perspective and Practical Insights

OANDAs extensive history of over 20 years, stringent regulation, and high business index position it among the leading forex brokers for international traders. Speed metrics (average transaction speed: 259.2ms) also support a seamless trading experience. For optimal safety and risk management, always review recent broker complaints and negative cases on the WikiFX app before trading.

Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone.