Abstract:Multibank Group is making headlines in South Asia but not for good reasons. Users are raising serious complaints about withdrawal delays, frozen accounts, poor customer support, and more. Therefore, you need to stay alert and recognize the risks associated with this broker to protect your hard earned money.

Multibank Group is making headlines in South Asia but not for good reasons. Users are raising serious complaints about withdrawal delays, frozen accounts, poor customer support, and more. Many controversies have come out against it. Therefore, you need to stay alert and recognize the risks associated with this broker to protect your hard earned money.

7 Risks Associated with Multibank Group

If you're thinking about trading with MultiBank Group, you need to read this first. While the platform looks impressive on the surface, but there are hidden drawbacks too.

Limited Market Research Tools

MultiBank Group offers very basic research tools, and what‘s available often lacks depth and insight. Unlike other top brokers that provide detailed market analysis, real-time news, and strategy breakdowns, MultiBank’s research section feels like an afterthought. If you're serious about trading based on strong market data, this can be a major letdown.

Lack of Effective Educational Content

While MultiBank offers some educational content such as introductory videos and downloadable eBooks, it does not provide structured learning paths like webinars, in-depth courses, or mentorship programs commonly found at more established brokers. New traders looking for progressive skill development or expert-led education may find the available resources inadequate to build a solid trading foundation.

High Spreads on Standard Accounts

Standard trading accounts come with above-average spreads, which means youre paying more to open and close trades. Over time, these costs add up especially for active traders. If you're not on one of their premium accounts, you're at a clear disadvantage.. Traders should compare spreads carefully before committing.

Limited Market Access by Default

Although MultiBank offers access to the MetaTrader 5 platform, only a fraction of the brokers total tradable instruments—1,042 out of over 14,000 markets are available by default. That means you're missing out on over 90% of the potential trading opportunities unless you manually request access. Access to additional markets requires a formal request for customer support, creating an extra step and potential delays for traders interested in broader asset exposure. This setup may pose a barrier for beginners unfamiliar with the process and limits immediate access to diverse markets.

High Minimum Deposit for Best Features

To unlock MultiBank‘s most competitive trading conditions, you’ll need to deposit a large amount of money upfront. This entry threshold may be prohibitive for smaller or beginner traders and is less attractive compared to brokers offering competitive conditions at lower deposit levels. .

Delays in Customer Support

While MultiBank provides multilingual customer support via phone, email, and live chat, user reports indicate occasional delays during peak trading hours or periods of high inquiry volume. Timely support is critical in fast-moving markets, and delays may increase trader frustration, especially in urgent situations requiring account or trade assistance.

Scalping Not Fully Supported

MultiBank imposes certain limitations on scalping activities, including minimum holding times on some instruments and restricted use of automated trading strategies (Expert Advisors). These rules can constrain traders who rely on rapid trade execution and frequent position turnover, limiting the flexibility and potential profitability of scalping strategies. Traders with high-frequency trading needs should carefully review MultiBanks policies before opening accounts.

Is MultiBank Group Legally Allowed to Operate in India?

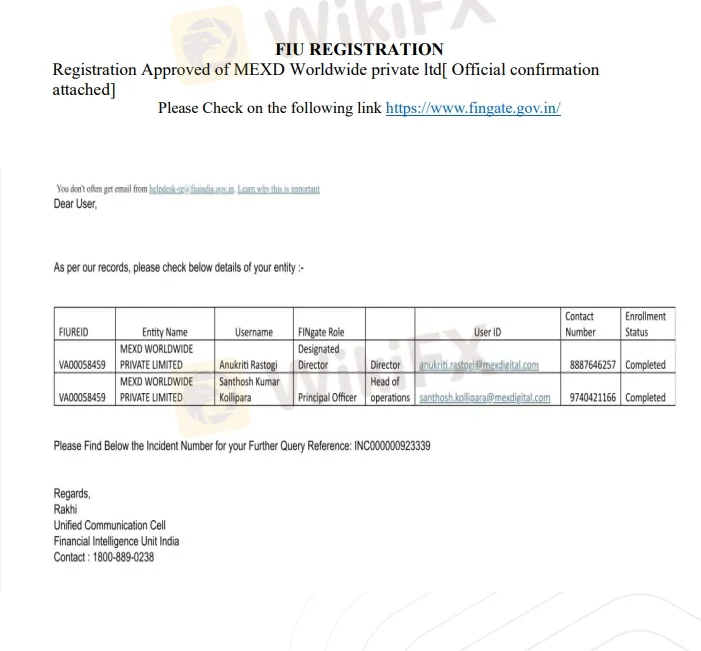

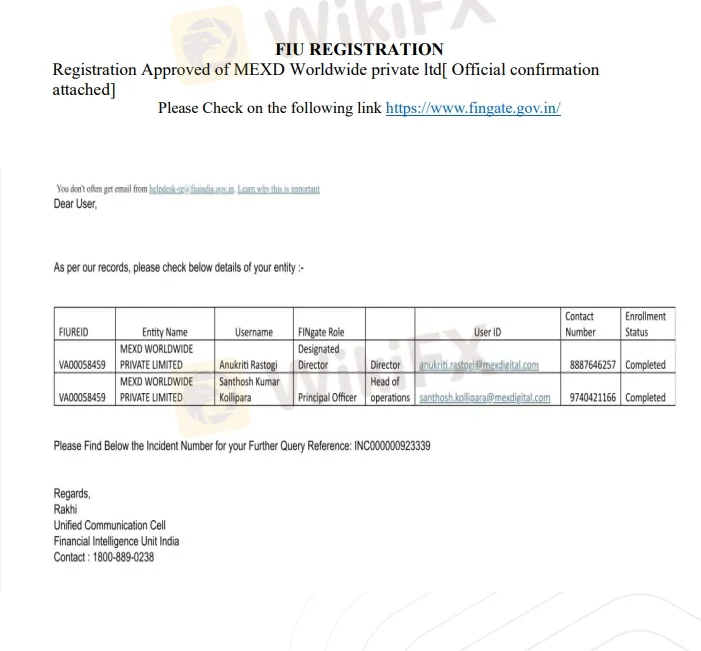

MultiBank Group claims on its official website that it operates in India through a company called MEXD Worldwide Private Ltd, registered with the Financial Intelligence Unit-India (FIU-IND) under Registration Number U62099UP2024FTC208582.

However, it's important to note that in India, the Securities and Exchange Board of India (SEBI) is the primary regulatory authority for all financial and trading services, including forex and currency derivatives. According to SEBI regulations, only SEBI-registered brokers are legally allowed to offer trading services to Indian residents.

As of now, MultiBank Group is not licensed or regulated by SEBI. Therefore, despite its registration with the FIU-IND, it is not authorized to provide trading services to Indian investors under SEBI rules.

Conclusion

While MultiBank Group presents itself as a global broker with an impressive range of services, a closer look reveals significant red flags that traders simply cant ignore. From shallow research tools and limited educational content to high trading costs, restricted market access, and poor customer support, the overall experience falls far short of what many other reputable brokers provide. If you're based in India—or anywhere else—exercise extreme caution before opening an account with MultiBank Group. The combination of regulatory concerns, unfavorable trading conditions, and negative user experiences make it a high-risk choice.