Abstract:Global multi-asset broker PU Prime has expanded its product lineup with the launch of Gold Trading by the Gram (GAUUSD), offering traders a more accessible way to invest in gold. This new instrument reflects regional trading preferences and positions PU Prime as a forward-looking broker in the competitive forex and CFD industry.

Global multi-asset broker PU Prime has expanded its product lineup with the launch of Gold Trading by the Gram (GAUUSD), offering traders a more accessible way to invest in gold. This new instrument reflects regional trading preferences and positions PU Prime as a forward-looking broker in the competitive forex and CFD industry.

What is GAUUSD?

GAUUSD (Gold Gram vs US Dollar) is designed for traders who prefer to value gold in grams rather than ounces. While traditional gold trading pairs like XAUUSD (Gold Ounce vs US Dollar) remain popular worldwide, GAUUSD caters to markets such as the Middle East and Turkey, where gold is commonly priced per gram.

By eliminating the need for ounce-to-gram conversions, GAUUSD makes gold trading by the gram more straightforward and convenient, especially for retail traders who want exposure to smaller quantities of gold.

Benefits of GAUUSD Trading with PU Prime

- Accessibility – Investors can trade gold in grams, making entry more affordable and practical.

- Regional Relevance – Tailored to markets where gold is traditionally measured in grams.

- Diversity in Trading Options – Complements XAUUSD and broadens PU Primes gold trading products.

- Ease of Use – No manual conversions between ounces and grams required.

For traders looking to diversify their strategies, GAUUSD trading offers an innovative and flexible approach.

About PU Prime

Founded in 2015, PU Prime has grown into a leading global fintech broker, providing online trading solutions across multiple asset classes. Its offerings include forex, commodities, indices, and shares, all delivered through advanced trading platforms.

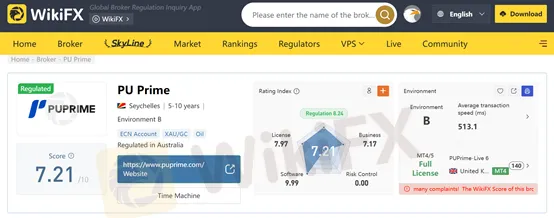

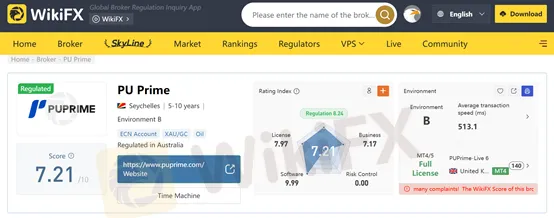

According to WikiFX, PU Prime review scores 7.21/10, demonstrating reliability and a strong reputation among global traders. The broker continues to enhance its services by introducing new products like GAUUSD to meet the demands of its international client base.

Conclusion

The launch of Gold Trading by the Gram (GAUUSD) underscores PU Primes commitment to innovation and trader-focused solutions. By bridging global trading standards with local market practices, PU Prime enhances accessibility and solidifies its standing as a trusted broker in the forex and CFD industry.

For traders seeking a broker that adapts to diverse trading needs, PU Prime remains a strong contender with its expanding product range and client-centric approach.