Abstract:IG Securities adds an all‑stock information view to its web platform, letting traders see prices and charts across accounts in one place while trading stays account-specific.

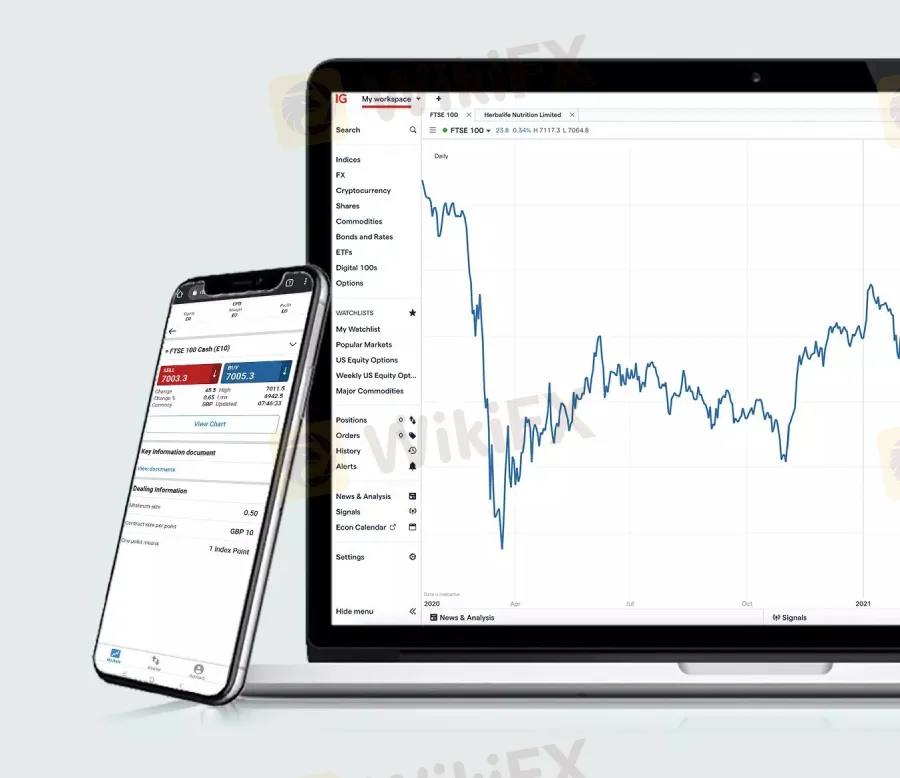

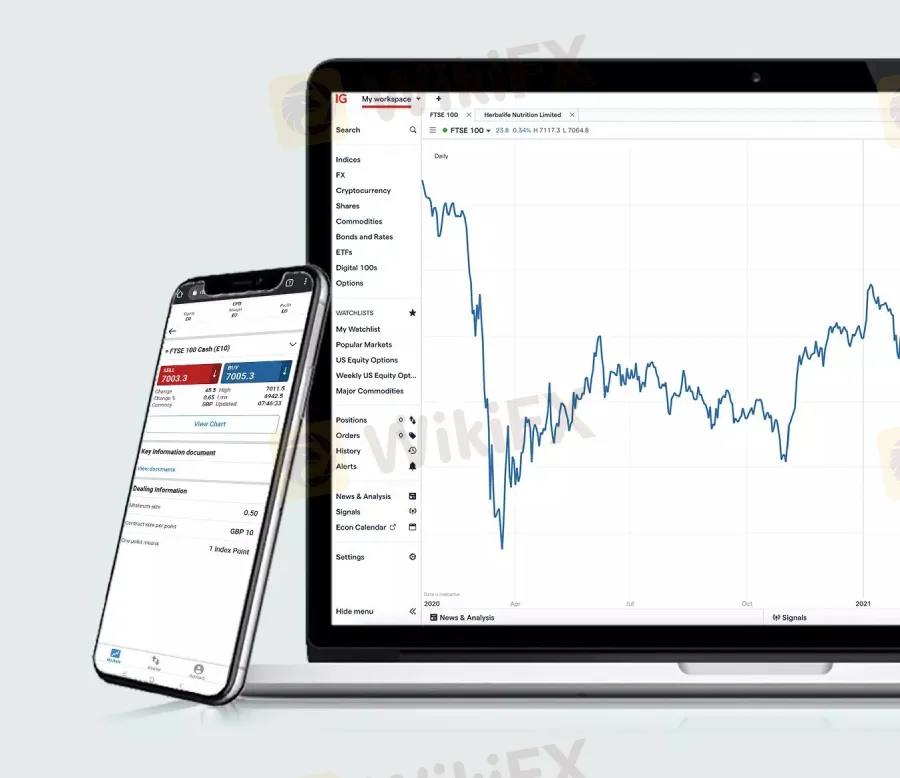

IG Securities has rolled out an All Stock Information Viewing feature on its web trading platform in Japan, enabling market prices and charts from all supported markets to be viewed without switching accounts. The web release follows the same capability introduced on the mobile app in June 2025, bringing cross‑account market visibility to desktop users. While traders can now monitor FX, indices, commodities, shares, bond futures, and a variety of markets side by side, order placement still requires switching into the appropriate account as before.

What Changed

The previous web interface only showed data for the currently selected trading account, forcing manual toggles to compare instruments across FX, indices, commodities, shares, bond futures, and variety. With the update, charts and prices from every supported account type can be displayed together, helping traders assess broad market moves at a glance and reduce context switching during active sessions. The company notes that certain instruments, including knockout options, binary options, and ETFs, are excluded from this viewing feature at launch.

Why It Matters

Cross‑account visibility streamlines situational awareness, particularly for strategies that hinge on intermarket signals, such as tracking equity indices while managing FX exposure. By mirroring the mobile apps June 2025 upgrade on the web, IG Securities aligns desktop workflows with on‑the‑go monitoring, aiming to minimize friction across devices. Maintaining the requirement to switch accounts for execution preserves existing risk controls and account‑level governance, even as market intelligence becomes unified on screen.

How To Use It

From any trading account on the web platform, enable the All Stock Information Viewing feature to surface charts and prices from all supported markets in a single interface. Use the consolidated view to compare FX pairs, stock indices, commodities, and individual shares without leaving the current account, then switch to the relevant account when ready to place a trade. Keep in mind that excluded instruments—such as knockout options, binary options, and ETFs—will not populate in this view until eligibility changes in a future update.

About IG Securities

IG Securities is the Japanese subsidiary of IG Group, offering multi‑asset trading across FX, indices, commodities, shares, and listed derivatives via mobile and web platforms in Japan. The new All Stock Information Viewing feature reflects the firm‘s ongoing platform enhancements to support cross‑market analysis while upholding account‑specific execution policies. Further details on coverage, exclusions, and activation steps are provided within the platform’s announcement and help materials.