PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Investment scams tied to fake forex brokers and crypto exchanges are rising in Asia, exploiting weak KYC rules and targeting cross-border investors.

Fraudulent investment platforms posing as legitimate forex brokers and cryptocurrency exchanges have become the most pressing financial threat across Asia. Investigators warn that these scams are no longer isolated incidents but part of a coordinated, transnational enterprise.

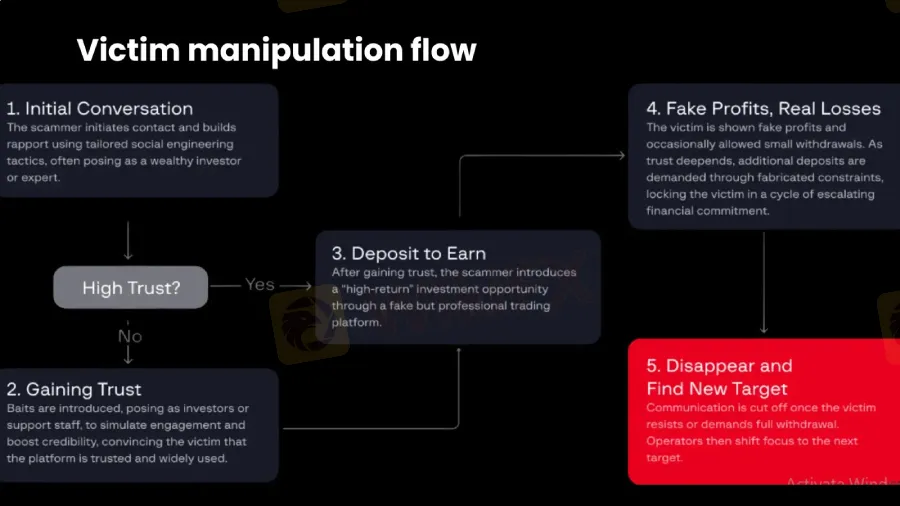

The schemes rely on advanced social engineering, luring victims through social media and encrypted messaging apps. Once contact is made, scammers present themselves as seasoned traders or financial mentors, offering “exclusive” access to high-yield opportunities.

Recent reports from Vietnam highlight the scale of the problem. In August 2025, authorities dismantled a billion-dollar crypto fraud tied to the Paynet Coin platform. Twenty individuals were arrested on charges ranging from asset misappropriation to multi-level marketing violations. Analysts say this case is only the tip of the iceberg, with dozens of similar operations still active across the region.

Unlike traditional cybercrime, these forex scam brokers operate with corporate-style hierarchies. Researchers describe a distributed model where each actor has a defined role:

As deposits grow, withdrawal requests are delayed with excuses ranging from “system upgrades” to “compliance checks.” When victims demand full payouts, communication abruptly ends, and the fraudsters move on to new targets.

Technical analysis shows these scams are not isolated websites but interconnected networks sharing backend infrastructure. Invitation-only access codes tie each victim to a specific promoter, ensuring accountability within the fraud ecosystem.

Governments are tightening controls, but scam brokers are adapting just as quickly. Vietnams Circular 17/2024, effective July 2025, introduced stricter corporate account requirements, including biometric verification. While this has disrupted some operations, it has also fueled underground markets for forged documents, stolen IDs, and even AI-powered face-swap technology.

Archived scans of dismantled domains reveal recurring code structures and admin panels, suggesting a centralized backend supporting multiple scam brands. Analysts warn that generative AI is increasingly being integrated into fraud infrastructure, from automated chatbots to deepfake onboarding videos.

The sophistication of these operations underscores the urgent need for coordinated international enforcement. Financial regulators across Asia and beyond are calling for stronger KYC standards, cross-border intelligence sharing, and public awareness campaigns to blunt the impact of these scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

Malaysian authorities have carried out a sudden, large-scale crackdown in Kuala Lumpur, detaining hundreds of undocumented foreigners and suspected online scam workers. The operation signals a tougher enforcement stance, with frontline operators targeted amid a broader regional push against scam networks.

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.