简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is MultiBank Group Legit or Scam? A 2025 Regulation Review

Abstract:When you're thinking about choosing a broker, the first question is always the most important: is my money safe? You've probably heard of MultiBank Group and are now wondering, is multibank group legit, or is it a scam? The simple answer is that MultiBank Group, started in 2005, is a real, globally regulated brokerage and not a scam. In this review, we will break down the complex network of multibank group regulation, look at how it keeps your money secure, and study its worldwide reputation. Our goal is to give you a clear, expert-backed answer so you can make a smart and safe choice.

When you're thinking about choosing a broker, the first question is always the most important: is my money safe? You've probably heard of MultiBank Group and are now wondering, is multibank group legit, or is it a scam? The simple answer is that MultiBank Group, started in 2005, is a real, globally regulated brokerage and not a scam.

However, the real question is more complicated. How safe and legitimate your experience will be depends completely on which of its many regulated companies your account is set up with. This is the key detail that decides how well your money is protected.

In this review, we will break down the complex network of multibank group regulation, look at how it keeps your money secure, and study its worldwide reputation. Our goal is to give you a clear, expert-backed answer so you can make a smart and safe choice.

Verdict at a Glance

For those who need a quick check, this scorecard shows what we found about MultiBank Group's legitimacy. It gives you a high-level view of the key things that make a broker trustworthy.

| Legitimacy Factor | Rating | Brief Summary |

| Regulatory Strength | Strong | Has multiple licenses, including from top regulators like ASIC & BaFin. How much protection you get depends on which specific company handles your account. |

| Company History & Size | Established | Started in 2005, giving it almost 20 years of experience. A large worldwide presence adds to its credibility. |

| Financial Security | Good | Offers separated accounts and claims to have an Excess of Loss insurance policy. These are strong signs of MultiBank Group financial security. |

| User Reputation | Mixed | Generally positive, but some common complaints about withdrawals and customer service exist, requiring careful thought. |

Breaking Down the Regulation Framework

Understanding how a global broker like MultiBank Group is regulated is the key to checking if it's legitimate. The company works through many smaller companies around the world, each licensed by a different local authority. This is a normal practice that lets brokers offer services designed for different regions.

To make this complexity simpler, we've organized our analysis by regulatory level. This framework helps you understand the real differences in protection offered by each license. The key point is that not all regulation is the same, and where your account is held matters a lot.

Tier-1 Gold Standard Regulation

Tier-1 regulators are the world's most respected financial authorities. They have strict enforcement, careful oversight, and strong investor protection systems, including compensation programs. Signing up with a broker company under a Tier-1 license gives you the highest level of security.

MultiBank Group holds several of these valuable MultiBank Group licenses:

· The Australian Securities and Investments Commission (ASIC) is one of the strictest regulators worldwide. It governs the company MEX Australia Pty Ltd (AFSL 416279). ASIC enforces strict rules on how client money is handled, leverage limits for regular clients, and demands complete transparency from brokers.

· Germany's Federal Financial Supervisory Authority (BaFin) is another top-level regulator. The company MultiBank FX International Corporation is registered with BaFin (ID: 137742). Operating within the European Union, it follows the comprehensive MiFID II directive, which ensures negative balance protection and access to investor compensation funds if the broker fails.

Choosing a company under ASIC or BaFin means your money is protected by some of the best financial safeguards available in the retail trading industry.

Tier-2 and Tier-3 Regulation

Beyond the top level, MultiBank Group also operates companies in places with less strict regulatory oversight. These are often called “offshore” regulators. While perfectly legal, they present a different set of trade-offs for traders.

Key companies in this category include:

· MEX Atlantic Corporation, regulated by the Cayman Islands Monetary Authority (CIMA).

· MultiBank FX International, regulated by the British Virgin Islands Financial Services Commission (FSC).

The main attraction of these offshore companies is the ability to access much higher leverage than what is allowed in Australia or the EU. For experienced traders who understand the risks, this can be a big advantage. However, this flexibility comes at a cost. These places typically offer weaker investor protection frameworks. Getting help if there's a dispute can be more difficult, and required compensation programs are often missing.

The safety of your money is directly connected to which regulatory company your account is registered with. Always check this in your client agreement before putting money in your account. This single step is the most important part of your research process.

How Secure Is Your Money?

Regulation is the legal framework, but a broker's internal security measures are what protect your money every day. Here, we look at the concrete steps MultiBank Group takes to ensure MultiBank Group financial security, going beyond licenses to practical safeguards. These measures are important indicators of a broker's commitment to protecting client assets.

Separated Client Funds

A must-have standard for any legitimate broker is the use of separated accounts. MultiBank Group follows this practice, which is required by all its major regulators.

In simple terms, this means that client deposits are held in bank accounts that are completely separate from the company's own operational funds. The firm cannot use your money to pay for its expenses, salaries, or marketing. This separation is critical. In the unlikely event that the broker faces financial difficulty or bankruptcy, your funds are protected and cannot be claimed by the company's creditors. This is a fundamental pillar of financial security.

Excess of Loss Insurance

This is a key feature that sets MultiBank Group apart and serves as a powerful trust signal. The company states it has secured an Excess of Loss insurance policy, underwritten by the prestigious Lloyd's of London.

This policy provides an extra layer of protection on top of separated accounts. It is designed to protect clients in the extreme and highly unlikely event of broker bankruptcy where there is a shortfall in the separated client funds. The policy claims to protect client funds up to $1 million per account. Think of it as extra deposit insurance for your trading account.

It is important to understand what this insurance does not cover. It is not protection against your personal trading losses. If a trade moves against you, that loss is your own. The insurance is specifically designed to protect your deposited money from the broker's own financial failure. This honest distinction is a mark of a transparent operator.

A Nearly 20-Year Track Record

Does longevity equal trust? In the volatile world of online brokerage, it is a very strong indicator. MultiBank Group was founded in 2005, giving it a history that spans nearly two decades.

This means the company has successfully navigated multiple major financial crises, including the 2008 global financial meltdown and the extreme market volatility of recent years. A broker that can survive and thrive through such events demonstrates a high degree of operational stability and sound risk management. Scam operations are typically short-lived, designed to make a quick profit before disappearing. A nearly 20-year track record is a powerful argument against any such concerns and speaks to the firm's resilience and legitimacy.

The Voice of the Trader

Regulatory licenses and security policies tell one part of the story. The other part comes from the real-world experiences of traders who use the platform every day. We've analyzed user reviews from various sources to provide a balanced look at what it's actually like to trade with MultiBank Group. Instead of just saying reviews are mixed, we've identified the common themes that emerge.

Click and Read “Your Complete MultiBank Group Crypto Trading Guide (2025)”-www.wikifx.com/en/newsdetail/202510306304997894.html

What Traders Commonly Praise

Across the board, users highlight several positive aspects of their experience with the broker. These praises often center on the core trading environment.

· Platform Stability and Execution: Many experienced traders report that the MetaTrader 4 and MetaTrader 5 platforms offered by MultiBank Group are stable, with reliable and fast trade execution. This is a critical factor for active traders.

· Wide Range of Instruments: The sheer breadth of available assets is frequently cited as a major advantage. Traders appreciate the access to a vast selection of forex pairs, indices, commodities, shares, and cryptocurrencies.

· Competitive Trading Costs: For certain account types, particularly the ECN accounts, users often praise the competitive spreads and low commissions, which can significantly reduce the cost of trading.

Common Complaints and Red Flags

No broker is perfect, and it is important to address the negative feedback honestly. Being aware of potential issues allows you to navigate them effectively.

· Withdrawal Process Delays: This is the most frequent complaint, not just for MultiBank Group but across the industry. Some users report that withdrawals take longer than expected. This can be frustrating, though it is often linked to verification issues.

· Aggressive Account Managers: A number of traders have mentioned feeling pressured by account managers. These reports describe encouragement to deposit more funds or take on higher-risk trades, which can be uncomfortable for many clients.

· Bonus Term Confusion: Issues sometimes arise from bonus offerings. Traders may not fully understand the complex terms and conditions attached, such as the trading volume required before a bonus can be withdrawn, leading to disputes.

Our Expert Interpretation

It's important to place these complaints in context. Withdrawal delays, while a valid concern, are often caused by incomplete Know Your Customer (KYC) verification. Our advice is to ensure your account is fully verified with all necessary documents before you even put money in. This single proactive step can prevent most withdrawal-related headaches.

Regarding account managers, it is a standard practice for brokers to maintain contact with clients. However, you should never feel pressured to trade beyond your means or risk appetite. A professional broker will respect your decisions. If you feel uncomfortable, you have the right to request less frequent contact.

Final Verdict: Is It for YOU?

After a thorough analysis of its regulation, financial security measures, and user reputation, we can state our conclusion clearly. MultiBank Group is a legitimate and heavily regulated global broker, not a scam. It has the history, licenses, and security protocols of a major financial institution.

The key factor is not whether MultiBank Group is legit, but whether it is the right fit for you. This depends on your trading experience, risk tolerance, and priorities. To help you decide, we have outlined the profiles of traders who would likely do well with this broker and those who might want to be more careful.

MultiBank Group Is a Good Fit For:

· Traders seeking a broker with a long history and a significant global presence.

· Traders who want the option of high leverage and understand the associated risks of offshore regulation.

· Traders who value the extra protection offered by an Excess of Loss insurance policy.

· Traders who need access to a very wide range of financial instruments on a single platform.

You Might Be Cautious If:

· You are a complete beginner who might be overwhelmed by the multi-company regulatory structure.

· You prioritize fast, guaranteed-same-day withdrawals above all else, as this is a noted area of complaint.

· You are easily swayed by sales pressure and may be uncomfortable with proactive account managers.

Your Final Checklist

Before you commit your money, empower yourself by running through this final checklist. It's a simple process based on our expert experience that will ensure you are starting on the most secure footing possible.

1. Verify the Regulator: Before depositing, ask the support team or check your client agreement to confirm exactly which regulatory body will oversee your account (e.g., ASIC, BaFin, CIMA).

2. Read the Fine Print: Take the time to understand the key terms of your client agreement, especially regarding leverage, fees, and withdrawals.

3. Complete Your KYC: Upload all your identity and address verification documents as soon as you open your account. Do not wait until you want to withdraw.

4. Start Small: There is no better test than your own experience. Consider starting with a smaller deposit to test the platform, execution, and, most importantly, the withdrawal process for yourself

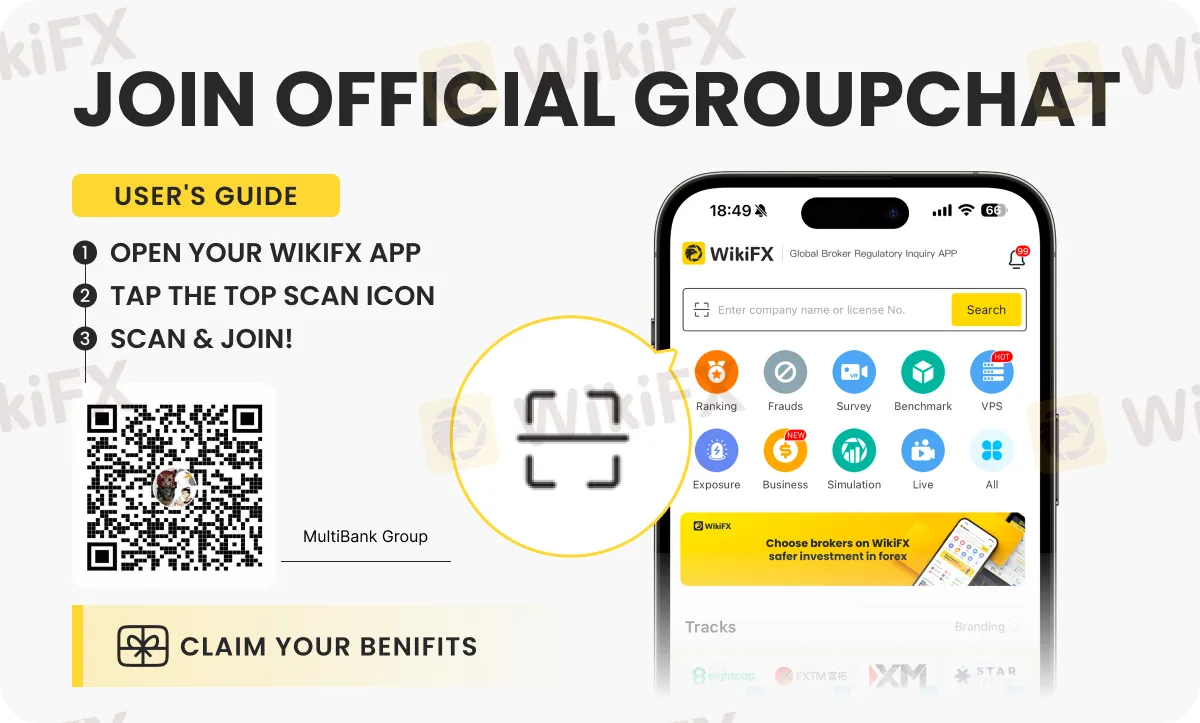

We have created an official MultibankGroup Broker community! Join it Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Currency Calculator