1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles. MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging pr

For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles.

MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging primary data from WikiFX and cross-referencing public information to provide a clear, unbiased picture.

Before entrusting a broker with capital, understanding its corporate structure and regulatory environment is non-negotiable. MH Markets operates through several entities, a common practice for global brokers, but this creates a complex regulatory landscape that traders must navigate carefully.

Regulatory Framework:

• ASIC (Australia): MH Markets is regulated by the Australian Securities and Investments Commission (ASIC), a top-tier financial authority. This regulation mandates strict operational standards, including the segregation of client funds. This means client capital must be held in separate trust accounts, ensuring it is not used for the broker's operational expenses. This provides a significant layer of security for traders under the Australian entity.

• Offshore Regulation: The broker is registered in Mauritius and, according to public information, also holds a license from the Vanuatu Financial Services Commission (VFSC) for its international operations. Offshore regulation typically allows for more flexible trading conditions, such as higher leverage, but generally offers a lower level of investor protection compared to Tier-1 jurisdictions like Australia.

• A Critical WikiFX Risk Alert: A significant point of concern highlighted by WikiFX is the broker's status with the United Arab Emirates SCA. WikiFX issues a clear risk alert stating: “This broker exceeds the business scope regulated by the United Arab Emirates SCA (license number: 20200000159) Investment Advisory Licence Non-Forex License. Please be aware of the risk!” This is a major red flag. It implies the broker may be offering forex and CFD trading services in or from the region under a license that does not permit such activities. For experienced traders, operating outside a regulator's prescribed scope is a serious breach of trust.

The dual onshore/offshore model means a trader's experience and security level will depend heavily on which entity they are registered with. For the most up-to-date information on MH Markets' licenses and any active alerts, traders should always consult the broker's detailed profile on WikiFX before opening an account.

A smooth deposit process is the first step in a trader's journey with a broker. MH Markets facilitates this through a variety of modern and traditional payment channels, aiming for accessibility across different regions.

Based on information from the broker's public-facing materials, MH Markets supports a range of funding options. However, it is crucial to note that the availability of these methods is region-specific, and traders should verify the options available to them within their client portal.

The primary deposit methods include:

• Bank/Wire Transfers: The traditional method for larger deposits. While secure, this is typically the slowest option.

• Credit/Debit Cards: A popular choice for instant funding, allowing traders to start trading almost immediately.

• Local Banking & QR Payments: Catering to specific regions, these methods offer convenience and can streamline the funding process for clients in supported countries.

• E-Wallets: Publicly available information suggests support for e-wallets such as Skrill and Neteller, which are favored by many traders for their speed and ease of use.

One of the positive aspects of MH Markets' funding policy is its fee structure for deposits. The broker explicitly states it does not charge any fees for depositing funds. This transparency is welcome, but traders must remain aware of potential third-party costs. Banks, credit card issuers, or e-wallet providers may impose their own transaction or currency conversion fees, which are outside the broker's control.

The minimum deposit is tied to the account type, offering a low barrier to entry for new traders while requiring more significant capital for premium accounts.

• Standard Account: USD 50

• Prime Account: USD 100

• ECN Account: USD 1,000

This tiered structure, confirmed by both WikiFX user feedback and the broker's website, allows traders to select an entry point that aligns with their capital and trading strategy. The claim of “instant deposits” for electronic methods is an industry standard and essential for traders looking to capitalize on market opportunities without delay.

The withdrawal process is the ultimate litmus test of a broker's integrity. Delays, opaque fees, or unexpected obstacles at this stage can destroy a trader's confidence. Here, we analyze the MH Markets withdrawal experience based on stated policies and user feedback.

MH Markets provides a reasonably detailed timeline for its withdrawal process, which can be broken down into two stages: internal processing and fund transmission.

1. Internal Processing: The broker states it “strives to process withdrawal requests promptly, typically within one business day.” A key detail is the daily cut-off time of 16:00 (GMT+2). Requests submitted before this time are scheduled for same-day processing, while those submitted after are handled on the next business day. This is a fair and transparent policy.

2. Fund Receipt Time: The time it takes for funds to appear in a trader's account after internal processing depends entirely on the chosen method:

– International Bank Wire Transfers: These are the slowest, typically taking 3–5 working days to clear.

– Other Payment Methods (E-Wallets, etc.): These are significantly faster, with funds generally received within one working day after processing.

This distinction is critical. A “one-day processing” promise does not mean funds will be in your bank account in 24 hours. For traders requiring quick access to capital, using e-wallets appears to be the far superior option over traditional bank wires.

While deposits are free, withdrawals are not always cost-free. This is another area where the chosen method matters.

• Withdrawal Fees: According to third-party reviews and industry standards, bank wire transfers are likely to incur a fee, estimated to be around $20. This fee is often levied by intermediary banks and is a common cost for this method. In contrast, withdrawals to e-wallets are often free, at least for the first transaction within a given period (e.g., per month).

• Inactivity Fee: Traders should also be aware of the inactivity fee. MH Markets may charge a fee of approximately $10 per month on accounts that have been dormant (no trading activity) for an extended period, typically cited as 90 days. This is a standard industry practice, but it can erode the balance of an unused account over time.

The WikiFX platform provides a direct channel for user experiences, offering valuable insights that go beyond official marketing claims. While the provided data does not contain specific complaints about withdrawals being blocked or delayed, it does highlight a related risk.

One user from Australia filed an “Exposure” on WikiFX, complaining that a stop-loss on their order was not triggered at the set price, resulting in the position being closed at a much worse price. They wrote, “I had a stop-loss set when I placed this order, so why wasn't it triggered at the stop-loss point? Instead, it was executed at the highest price as the stop-loss point.”

This type of complaint, while related to trade execution rather than payment processing, directly impacts the final capital available for withdrawal. Slippage, poor execution, or platform glitches can unexpectedly reduce a trader's balance, creating a negative financial experience. While other users on WikiFX praise the broker's “lightning-fast execution” and stable MT5 environment, this negative report serves as a reminder that execution quality can be inconsistent and represents a tangible risk to a trader's funds.

A trader's final withdrawable amount is the net result of their trading P&L minus all associated costs. MH Markets' fee structure varies significantly across its account types, directly influencing profitability.

• Standard Account: With spreads from 1.2 pips on EUR/USD and zero commission, this account is simple but carries higher trading costs embedded in the spread.

• Prime Account: A middle ground with tighter spreads from 0.6 pips and no commission, suitable for more active traders.

• ECN Account: Designed for professionals, scalpers, and algorithmic traders. It offers raw spreads from 0.1 pips (or even 0.0 pips at times) but charges a commission of $7 per round-turn lot.

For a high-volume trader, the ECN account's lower spread costs could significantly increase the net profit available for withdrawal, even after accounting for the commission. Conversely, a casual trader might find the simplicity of the commission-free Standard account preferable. Understanding this trade-off is essential for managing a trading account's profitability and, ultimately, the funds you can withdraw.

Based on a comprehensive analysis, the MH Markets deposits and withdrawals overview reveals a system that is largely in line with industry standards but is overshadowed by significant regulatory concerns.

The Strengths:

• Structured Processes: The broker offers a clear, time-bound policy for withdrawal processing, including a daily cut-off time.

• Multiple Funding Options: A good variety of deposit and withdrawal methods caters to a global audience.

• Transparent Fee Policy (for Deposits): The commitment to zero deposit fees is a positive attribute.

• Tier-1 Regulation (in Australia): The ASIC license provides a strong layer of security and fund segregation for clients under that entity.

The Weaknesses and Risks:

• Major Regulatory Red Flag: The WikiFX alert regarding the exceeded scope of the SCA (UAE) license is a serious issue. It suggests a potential compliance gap that could expose traders to unnecessary risks.

• Withdrawal Fees: Fees on certain methods, like bank wires, can diminish returns, especially for smaller withdrawals.

• Execution Risk: The user complaint about stop-loss failure on WikiFX, while an isolated report in the data provided, points to potential execution risks that can negatively impact account equity.

• Jurisdictional Ambiguity: Traders must be acutely aware of which regulatory entity they are signing up with, as the protections, leverage, and recourse options differ dramatically between the ASIC-regulated and offshore entities.

For the experienced trader, MH Markets presents a complex choice. The mechanics of its deposit and withdrawal system appear functional and reasonably transparent. However, the operational integrity of a broker is paramount, and the regulatory warning from WikiFX cannot be ignored. The decision to trade with MH Markets should hinge on which entity a trader is onboarded with. The Australian, ASIC-regulated arm offers a much higher degree of confidence.

Ultimately, due diligence is the trader's best defense. Before committing any capital, it is crucial to consult WikiFX to review the latest user feedback, check for any new regulatory actions, and obtain a comprehensive, unbiased assessment of the broker's performance. This will empower you to make a final decision based on a full spectrum of data, not just the broker's marketing promises.

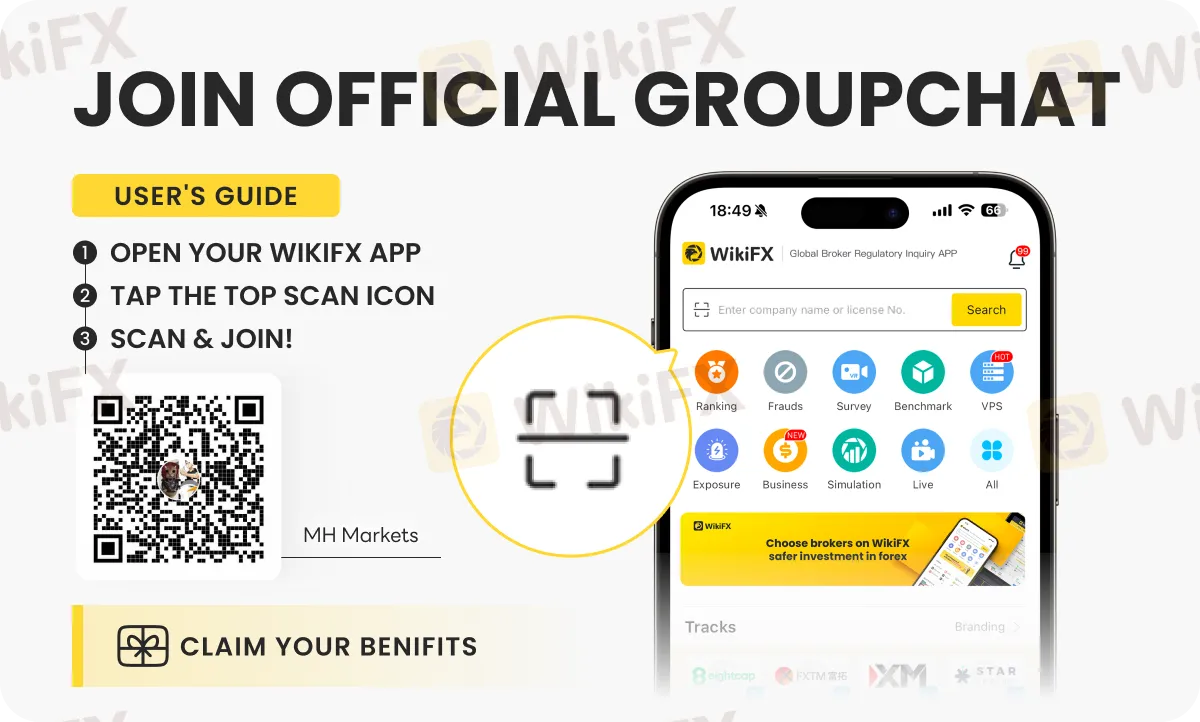

For the latest forex news about MH Markets, join this special chat group OIFSYYXKC3 by following the instructions shown below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.