GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:LOYAL PRIMUS presents itself as a modern, accessible broker rooted in South Africa, but a growing volume of user feedback tells a different story. Our investigation uncovers a disturbing pattern where profitable trading accounts are abruptly disabled upon withdrawal requests, raising serious questions: Is LOYAL PRIMUS safe for your capital?

Hook: LOYAL PRIMUS presents itself as a modern, accessible broker rooted in South Africa, but a growing volume of user feedback tells a different story. Our investigation uncovers a disturbing pattern where profitable trading accounts are abruptly disabled upon withdrawal requests, raising serious questions: Is LOYAL PRIMUS safe for your capital?

Anonymity Disclaimer: All cases cited in this report are based on real complaint records submitted to WikiFX. To protect the privacy of the individuals involved, their identities have been anonymized.

For any trader, the ultimate test of a broker's integrity is the withdrawal process. A broker can offer the best spreads in the world, but if the exit door is locked, the trading environment is irrelevant. Our analysis of recent data regarding LOYAL PRIMUS reveals a specific, alarming behavior pattern that goes beyond simple delays: the complete deactivation of client accounts immediately following profitable trades or withdrawal attempts.

The most striking evidence comes from a trader in Brazil. In late 2024, this user deposited $600 USD and successfully generated a modest profit of $126 USD. The trouble began the moment they decided to withdraw their capital to move to another provider. According to the report, within hours of the withdrawal request, the account was not just frozen—it was deactivated entirely, blocking access to the dashboard. The user reported that three separate trading accounts associated with their profile were simultaneously shut down, trapping the original $600 principal along with the profits.

This was not an isolated incident. A nearly identical scenario played out for an Indonesian trader. After depositing $307, this trader engaged in high-volume scalping on the XAU/USD (Gold) pair, successfully turning the deposit into a balance of over $1,180 through a series of winning trades. However, the joy of success was short-lived. Upon requesting a withdrawal of the total amount, the trader found their account disabled without clarity or valid explanation. This suggests a potential systemic issue where the broker's risk management protocols may aggressively target winning accounts rather than addressing legitimate compliance concerns.

Further corroboration comes from Malaysia, where another user bluntly reported that their account was frozen specifically because of profits. The recurring theme here is distinct: it is not just that withdrawals are slow—which is a common administrative issue—but that the request to withdraw triggers a punitive account shutdown.

Even when accounts remain active, support channels appear to offer little relief. An Indonesian user reported persistent withdrawal failures, noting that helpdesk responses were “standard answers” lacking any genuine intent to resolve the financial bottleneck.

Beyond the withdrawal hurdles, WikiFX has received reports concerning the technical execution environment provided by LOYAL PRIMUS. Technical stability is paramount, especially during high-impact economic news events.

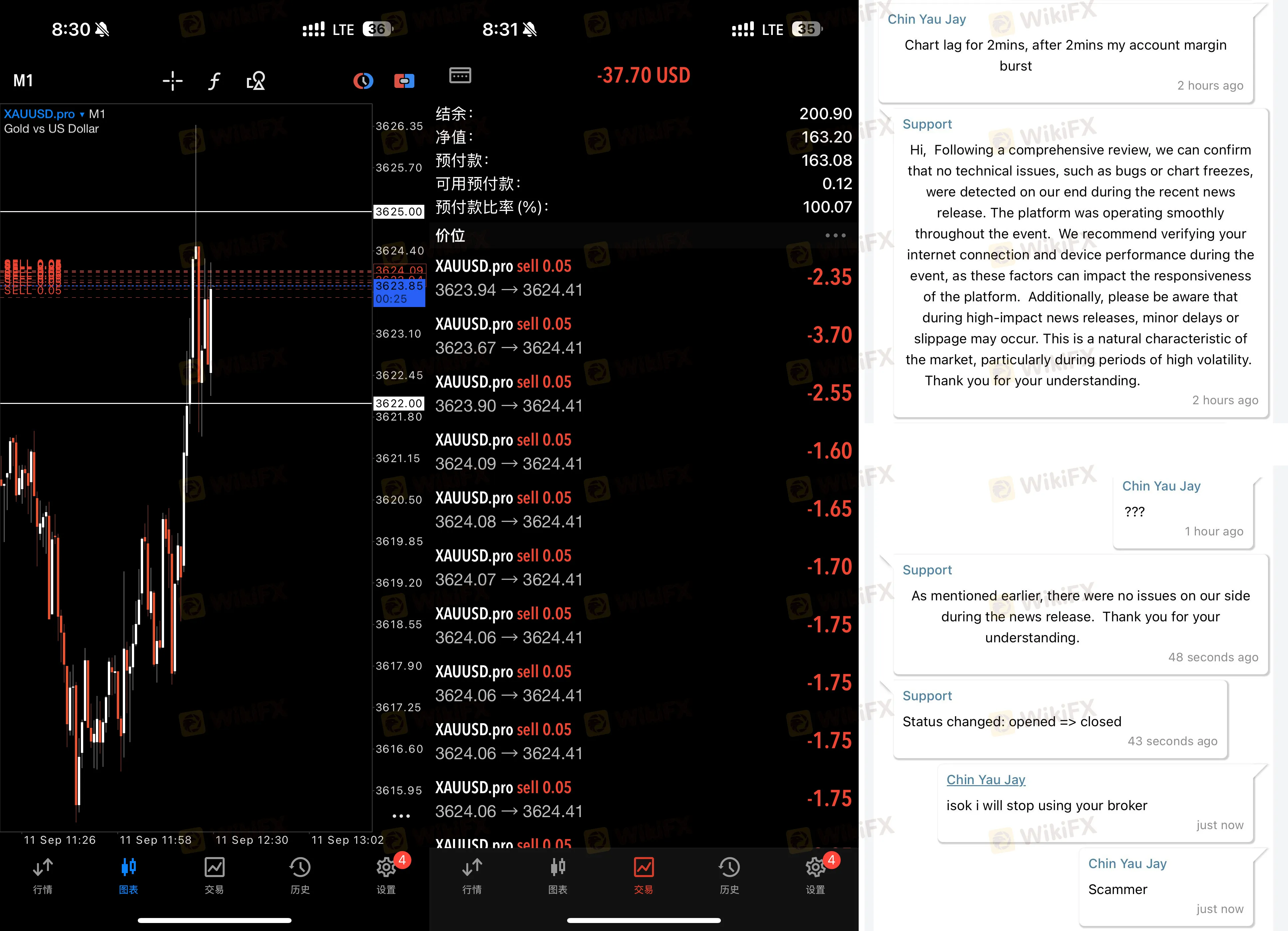

A trader based in Singapore provided a detailed account of a significant loss incurred during the US CPI (Consumer Price Index) data release. The trader entered a position one minute before the news, at 8:29 PM. However, exactly as the news hit at 8:30 PM, the broker's chart reportedly lagged for two full minutes. By the time the connection stabilized, the account had blown, resulting in a loss of $200. While volatility often causes slippage, a total chart freeze is a severe infrastructure failure. The trader noted that the broker denied any technical issues on their end and refused a refund, attributing the loss to market conditions despite the client's claim of a smooth data connection elsewhere.

Furthermore, accusations of market manipulation have surfaced from the UK. A trader warned others to avoid the platform, citing massive spreads—up to 19 points—that they believe are designed to drain client funds. This user described LOYAL PRIMUS as a “market maker” that profits directly from client losses, a conflict of interest that becomes dangerous when spreads are artificially widened.

Understanding the regulatory status of LOYAL PRIMUS is crucial for assessing these risks. The broker claims establishment in 2021 and lists headquarters in South Africa. Our database confirms that they hold license numbers with top-tier regulators like the FSCA (South Africa) and ASIC (Australia). However, holding a number and being fully compliant for retail trading are two different things.

WikiFX's regulatory system currently flags both of these licenses as “Exceeded.” In the context of financial regulation, this typically means the entity may be holding a license that does not cover the specific forex or retail services they are offering to international clients, or they are operating a business entity that goes beyond the authorized scope of that license number.

Essentially, while the broker can point to a registration number to appear legitimate, the protections afforded by that regulator may not actually apply to you, specifically if you are an international client. This creates a “regulatory mirage” where the broker looks safe on paper, but acts with the impunity of an offshore entity. The lack of effective recourse is evident in the complaints: when accounts are disabled, traders have no ombudsman to turn to because the regulatory umbrella does not truly cover these operations.

Below is the detailed regulatory status available in our records:

| Regulator Name | License Type | Current Status |

|---|---|---|

| South Africa FSCA | Financial Service Corporate | Exceeded |

| Australia ASIC | Appointed Representative | Exceeded |

Our investigation into LOYAL PRIMUS paints a picture of a broker that scores a passing grade on surface-level metrics but fails significantly in real-world user experience. The correlation between profit withdrawal attempts and account deactivations is the most critical risk factor identified. Coupled with technical complaints regarding chart freezes during volatility and a regulatory status that is “exceeded” rather than fully valid for retail protection, the risk profile significantly outweighs the benefits of their modern interface or account types.

Traders asking “is LOYAL PRIMUS safe” should weigh these “kill switch” reports heavily. When a broker controls the off-switch to your dashboard, you are not trading; you are merely gambling on their permission to let you leave.

Forex and leveraged trading carry a high level of risk and may not be suitable for all investors. The data provided in this article is derived from official regulatory databases and user-submitted complaints. Regulatory status can change, and past performance is not indicative of future results. We strongly advise users to verify all information independently before depositing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

Long Asia Group, a Saint Vincent and the Grenadines-based forex broker, has come under increasing scrutiny as a growing number of traders report troubling experiences with the broker’s operations. User feedback highlights recurring issues such as delayed or blocked withdrawals, sudden communication breakdowns, and a lack of clear accountability once funds are deposited. Several traders claim that while small withdrawals may initially go through, larger payout requests often face unexplained obstacles. More concerning are allegations suggesting that the broker may no longer be operating transparently, with users reporting prolonged silence, unresolved complaints and suspected fund mishandling. These patterns have raised serious questions about Long Asia Group’s reliability and overall legitimacy, prompting traders to exercise extreme caution before engaging with the broker. For more details, keep reading this LONG ASIA review article, where we have elaborated on the traders’ pain wit

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

Selangor police arrested 20 suspects after dismantling three online scam syndicates operating fake job and investment scams across Kajang, Seri Kembangan and Puchong, with multiple devices seized and investigations ongoing.