Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

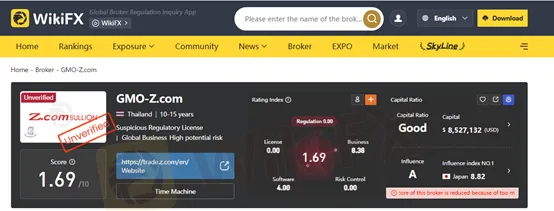

Abstract:Is GMO-Z.com a legit forex broker or a potential scam? Is it easy to log in to GMO-Z.com? This article reviews GMO-Z.com’s regulations, trading conditions, complaints, and safety in 2025.

Is GMO-Z.com a legit forex broker or a potential scam? Is it easy to log in to GMO-Z.com? This article reviews GMO-Z.coms regulations, trading conditions, complaints, and safety in 2025.

GMO-Z.com refers to several related entities under the GMO brand offering online trading services, including forex, commodities, and CFDs. The groups roots go back to GMO CLICK, widely known in Japan for internet finance and FX trading services. Over time, several international subsidiaries were established to serve markets in the UK, Hong Kong, and beyond. Previously, WikiFX has released a relevant article about this broker. click this link to see more information.

Regulatory Status

Bottom Line: Regulatory coverage exists in parts, but changes in licensing (revocations) and unclear current statuses mean you should verify the current regulatory status directly with the authorities before trading.

Traders can access popular trading software like MetaTrader 4 (MT4), alongside some proprietary platforms, depending on the region and entity. MT4 remains one of the industrys standard platforms for forex and CFD trading.

Reported spreads can be competitive on major instruments.

Flexible leverage is often available (e.g., up to 1:200 or higher for certain markets).

However, information on fees (commissions, withdrawal costs, etc.) is reported to be unclear or poorly documented on some versions of the platform — a red flag in broker transparency.

Across multiple user-generated reviews and commentary platforms:

Common Issues Reported

Customer service responsiveness: Reports describe slow or unhelpful customer support, especially around complaints and financial requests.

GMO-branded brokers generally claim to segregate client funds from company operating capital, which is a standard practice in well-regulated markets. However:

Pros

Cons

| Feature | GMO-Z.com | Typical Tier-1 Regulated Broker (FCA / ASIC / CFTC) |

| Regulatory Status | Mixed; some entities regulated in Asia, FCA license reportedly revoked. | Fully regulated by top-tier authorities (FCA, ASIC, CFTC, NFA) |

| Investor Protection | Limited or unclear, depending on the entity | Strong investor protection schemes (e.g., FSCS in the UK) |

| Fund Segregation | Claimed, but transparency varies | Mandatory and strictly audited |

| Negative Balance Protection | Not clearly disclosed | Usually mandatory for retail clients |

| Trading Platforms | MT4 and proprietary platforms | MT4, MT5, cTrader, proprietary platforms |

| Product Transparency | Trading conditions are not always clearly published | Full disclosure of spreads, commissions, and risks |

| Leverage Limits | Can be higher (region-dependent) | Strict caps (e.g., 1:30 for retail traders) |

| Withdrawal Process | User complaints reported | Generally smooth and rule-based |

| Customer Support | Mixed reviews, slow response reported | Regulated response timelines and complaint handling |

| Regulatory Audits | Not clearly disclosed | Frequent and mandatory audits |

| Suitability Checks | Limited or unclear | Mandatory client suitability and risk assessments |

Before opening an account, always verify the brokers license directly with the regulator and avoid sending funds to unverified platforms. We suggest that traders who think of this broker make themselves comfortable before making a decision.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.