Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

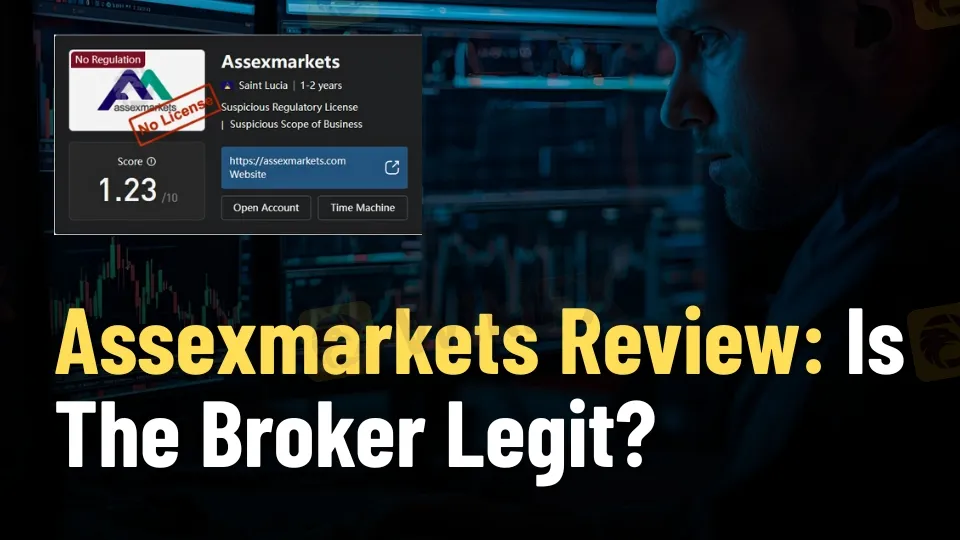

Abstract:Assexmarkets Review 2025 shows a WikiFX score of 1.23/10, flagged for no valid regulation and risky operations.

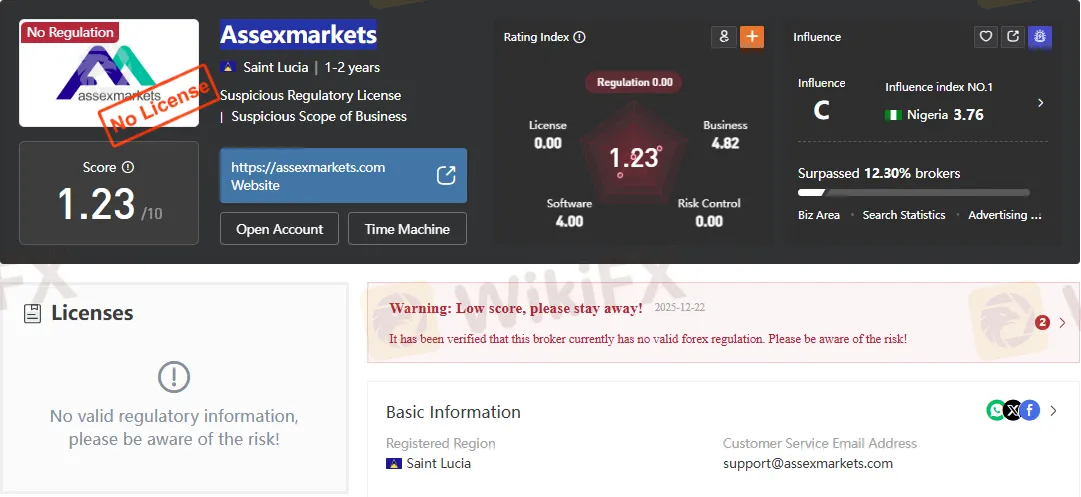

The forex and CFD trading industry has long been plagued by questions of legitimacy, particularly when it comes to offshore brokers. In this Assexmarkets Review, we examine the brokers regulatory standing, trading conditions, account structures, and user feedback. Assexmarkets operates without valid regulation, has been flagged for suspicious practices, and carries a low WikiFX score of 1.23/10.

One of the most critical aspects of any broker review is regulation. According to the extracted data, Assexmarkets Broker is registered in Saint Lucia but holds no valid forex regulation. The platform has been explicitly flagged for “suspicious regulatory license” and “suspicious scope of business.”

This lack of oversight means traders have no recourse in the event of disputes, withdrawal issues, or unethical fund deductions. Compared to regulated competitors such as IG or Pepperstone, which are licensed under tier-one authorities (FCA, ASIC), Assexmarkets falls dramatically short in credibility.

The domain registration details reveal limited transparency. No ICP registration or corporate ownership information is provided. This opacity is a red flag, especially when compared to established brokers that disclose corporate structures, audited financials, and compliance records.

Despite its regulatory shortcomings, Assexmarkets advertises a wide range of trading instruments:

The broker supports MetaTrader 5 (MT5) and claims to offer MetaTrader 4 (MT4) for beginners. MT5 is available across Windows, macOS, Linux, and mobile devices. While the platform itself is reputable, its integration with an unregulated broker raises concerns about execution reliability and fund safety.

Assexmarkets promotes seven account types, ranging from Standard to Pro Portfolio Management.

| Account Type | Minimum Deposit | Leverage | Spread | Commission |

| Standard | $1 | 1:Unlimited | From 0.2 pips | No commission |

| Standard Cent | Depends on payment system | 1:Unlimited | From 0.3 pips | No commission |

| Pro (Professional) | $3,500 | 1:Unlimited | From 0.1 pips | No commission |

| Zero | $500 | 1:Unlimited | From 0 pips | From $0.05 |

| Raw Spread | $500 | 1:Unlimited | From 0.1 pips | Up to $3.50 per lot |

| Social Pro | $500 | 1:200 | From 0.6 pips | No commission |

| Pro (Portfolio Mgmt) | N/A | 1:200 | From 0.4 pips | No commission |

The leverage offerings are extreme, with several accounts advertising 1:Unlimited leverage. This is far beyond the limits imposed by regulated jurisdictions (e.g., 1:30 in the EU, 1:50 in the US). Such high leverage magnifies risk and is often used by offshore brokers to entice inexperienced traders.

The broker claims to eliminate withdrawal fees and swap charges. However, commissions vary significantly across accounts:

While spreads appear competitive (from 0.0 pips on Zero accounts), the absence of regulation means these conditions cannot be independently verified. Traders have reported withdrawal obstructions, undermining the credibility of these advertised low-cost trading conditions.

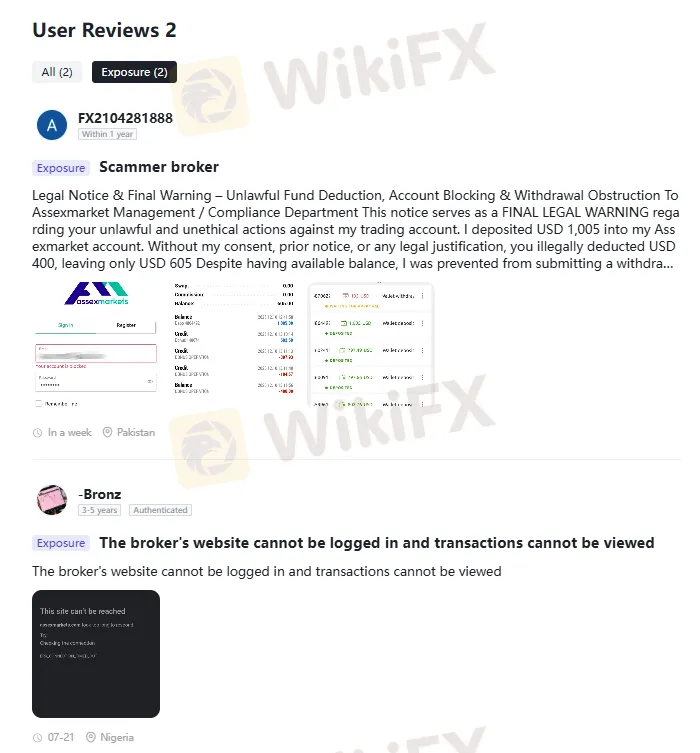

User reviews highlight serious concerns:

These complaints align with the brokers low WikiFX score and reinforce the risks of engaging with unregulated platforms.

Pros:

Cons:

When compared to regulated brokers such as IC Markets or Pepperstone, Assexmarkets falls short in every critical category:

The evidence is clear. Assexmarkets Broker operates without regulation, has been flagged for suspicious practices, and carries a WikiFX score of 1.23/10. While it advertises attractive spreads, multiple account types, and MT5 access, these features cannot compensate for the absence of oversight and the documented cases of unethical fund handling.

Final Verdict: Assexmarkets is not a legitimate broker. Traders should exercise extreme caution and consider regulated alternatives that provide transparency, investor protection, and reliable trading conditions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.