Company Summary

| Central Tanshi Review Summary | |

| Founded | 2002 |

| Registered Country/Region | Japan |

| Regulation | Regulated by FSA (Japan) |

| Market Instruments | Forex |

| Demo Account | ❌ |

| Leverage | 1:25 for individual customer |

| EUR/USD Spread | From 0.1 pips |

| Trading Platform | Mobile app, PC and Web platforms |

| Min Deposit | 0 |

| Customer Support | Contact form |

| YouTube: https://www.youtube.com/channel/UCGDu9m4guwZcPAIPXyyx7KQ | |

| Twitter: https://twitter.com/CTFX | |

Central Tanshi is a legally regulated forex pairs provider that was registered in Japan in 2002. It offers a variety of forex pairs through versatile trading platforms, with no minimum deposit required. In addition, it provides a leverage of 1:25 for individual customers and spreads starting from 0.1 pips.

However, it does not accept inquiries by phone number. Instead, you can only submit a contact form with your questions, and they will respond to your inquiries.

Pros and Cons

| Pros | Cons |

| Long history of operation | Limited leverage |

| Regulated by Japan's FSA | No MT4/5 |

| Various forex pairs choices | Limited customer support channels |

| Commission-free | |

| Multiple trading platforms available | |

| No minimum deposit requirement |

Is Central Tanshi Legit?

Yes, Central Tanshi is a legitimate provider of forex pairs. It holds a retail forex license issued by the Japan Financial Services Agency (FSA), bearing the license number Kanto Finance Director (Financial Business) No. 278.

In addition, it is a member of the Securities and Exchange Surveillance Commission of Japan.

In conclusion, Central Tanshi is reliable, and you can consider trading forex on its platforms.

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| Regulated | Japan Financial Services Agency (FCA) | セントラル FX Co., Ltd. | Retail Forex License | Kanto Finance Director (Financial Business) No. 278 |

What Can I Trade on Central Tanshi?

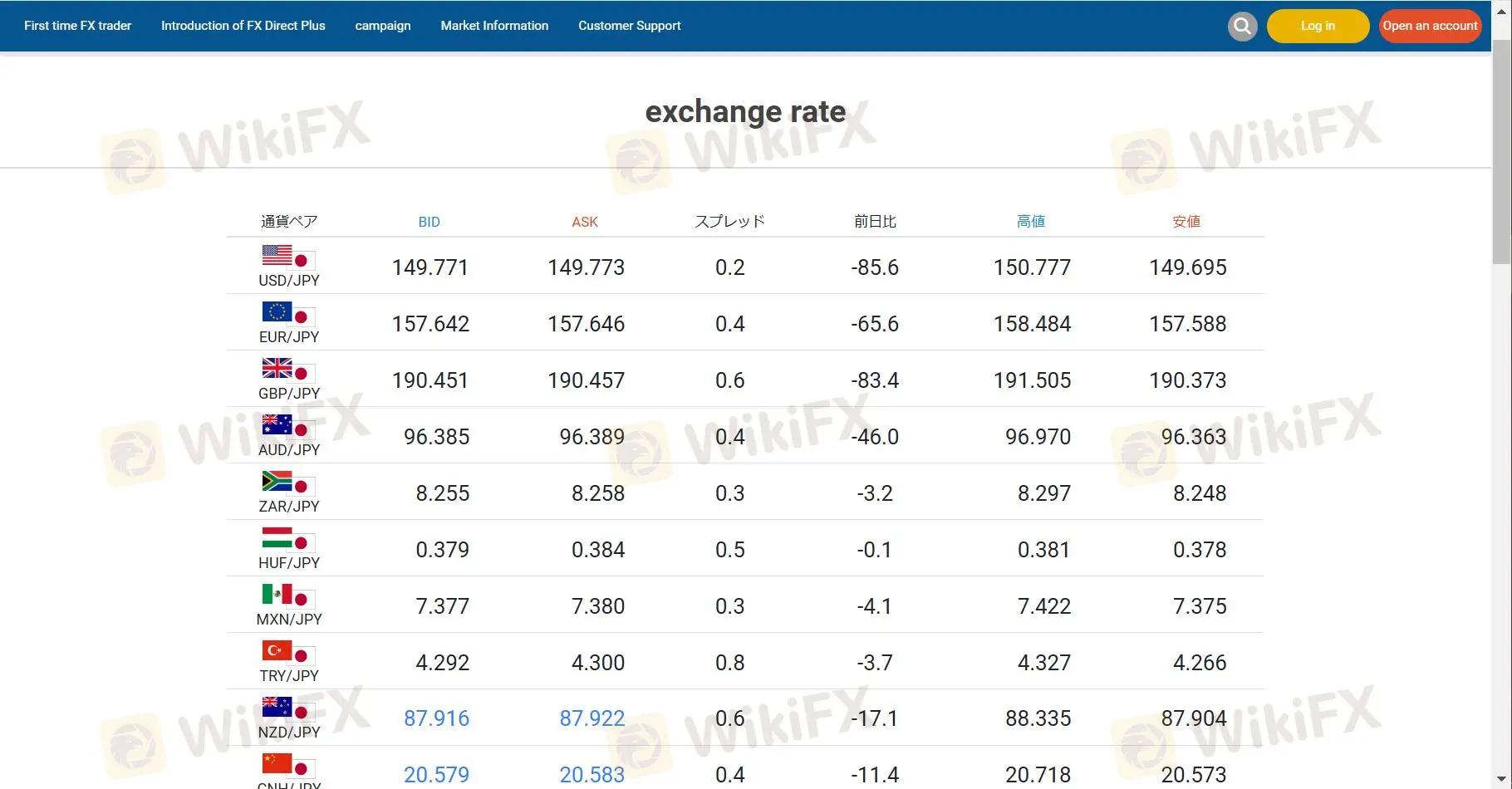

Central Tanshi focuses on forex pairs trading. It offers many common forex pairs, and you can also find exotic forex pairs on its platform. The forex pairs it provides include USD/JPY, EUR/JPY, GBP/JPY, AUD/JPY, ZAR/JPY, GBP/USD, AUD/USD...

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

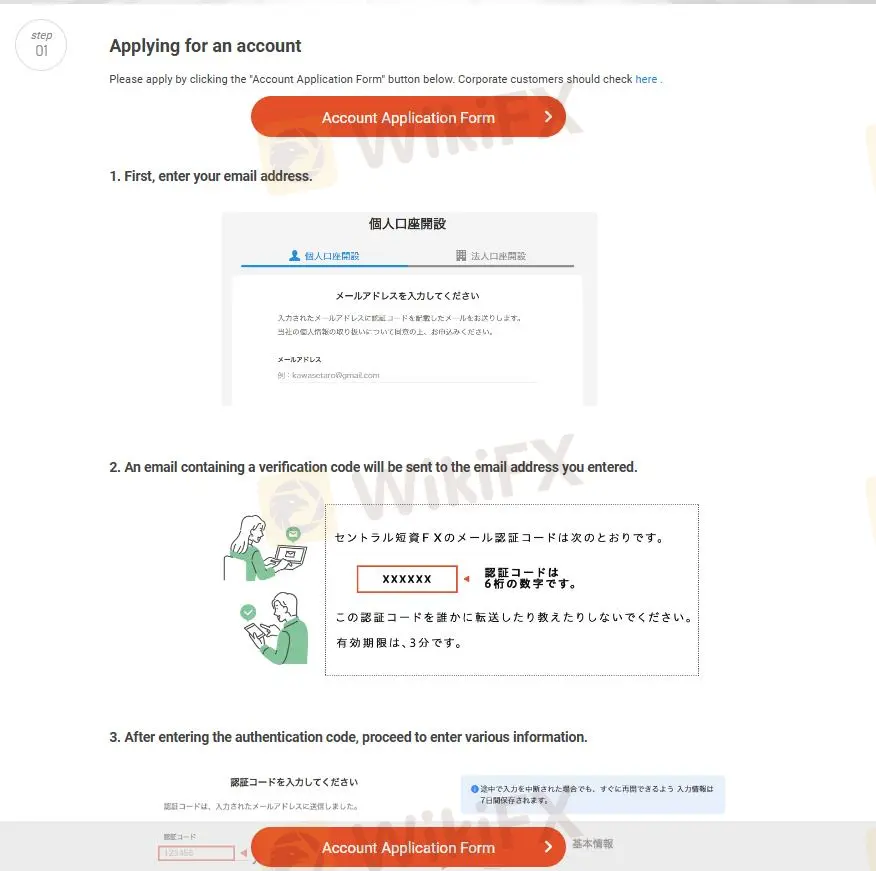

How to Open an Account?

You need to follow eight steps to register an account with Central Tanshi. All of these steps are quite easy, and detailed explanations for each are provided in its website.

- Step 1: Enter your email address.

- Step 2: Enter the verification code sent to the email address you provided.

- Step 3: Fill in your personal information.

- Step 4: Verify your identity using your smartphone. First, take a photo of your ID. Second, take aphoto of your face.

- Step 5: Once the review is complete, a notification of account opening completion, along with your user ID and password, will be sent to your registered email address.

- Step 6: Log in to your My Page and change your password for security reasons.

- Step 7: Register your My Number on your My Page.

- Step 8: Register your withdrawal bank account details on your My Page.

Leverage

The leverage offered by Central Tanshi differs between individual and corporate customers.

For individual customers, it is set at a fixed ratio of 1:25, which is considered conservative and safe, enabling you to trade securely based on your requirements.

On the other hand, for corporate customers, the leverage varies weekly based on market fluctuations, and it also differs for each type of currency pair.

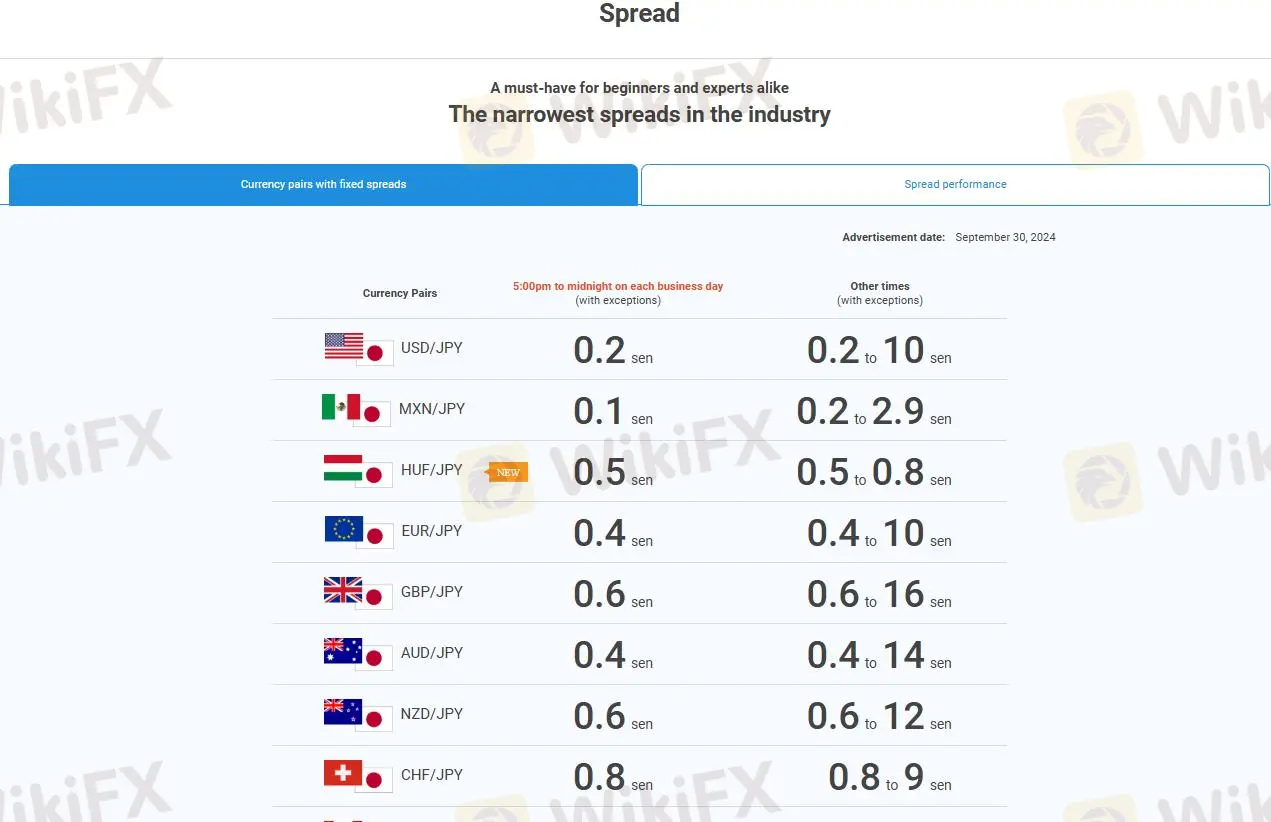

Spread

The spreads offered by Central Tanshi also vary depending on the type of currency pair.

During certain trading hours, the spread for MXN/JPY can be as low as 0.1 pips, while during other periods, the spread for GBP/JPY can reach as high as 16.0 pips.

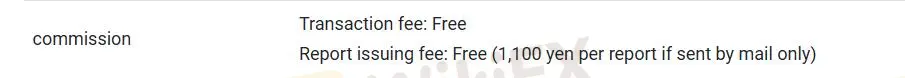

Other Fees

Central Tanshi does not charge any account maintenance fees or transaction fees.

However, if you need to send an issuing report by mail, there is a charge of 1,100 yen per report.

Additionally, for delivery services, there is a fee of 500 yen for every 10,000 units.

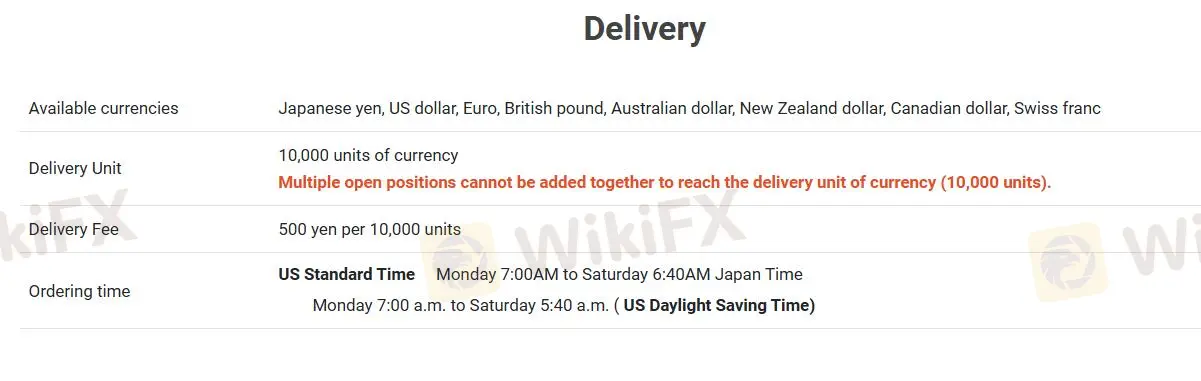

Trading Platform

Central Tanshi offers a proprietary platform available on mobile (smartphone and iPad), PC and Web.

The PC version comes with three additional options, including fast chart, Trade Plus, and a network trading system.

| Trading Platform | Supported | Available Devices | Suitable for |

| Proprietary platform | ✔ | Web, PC and Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Payment Methods

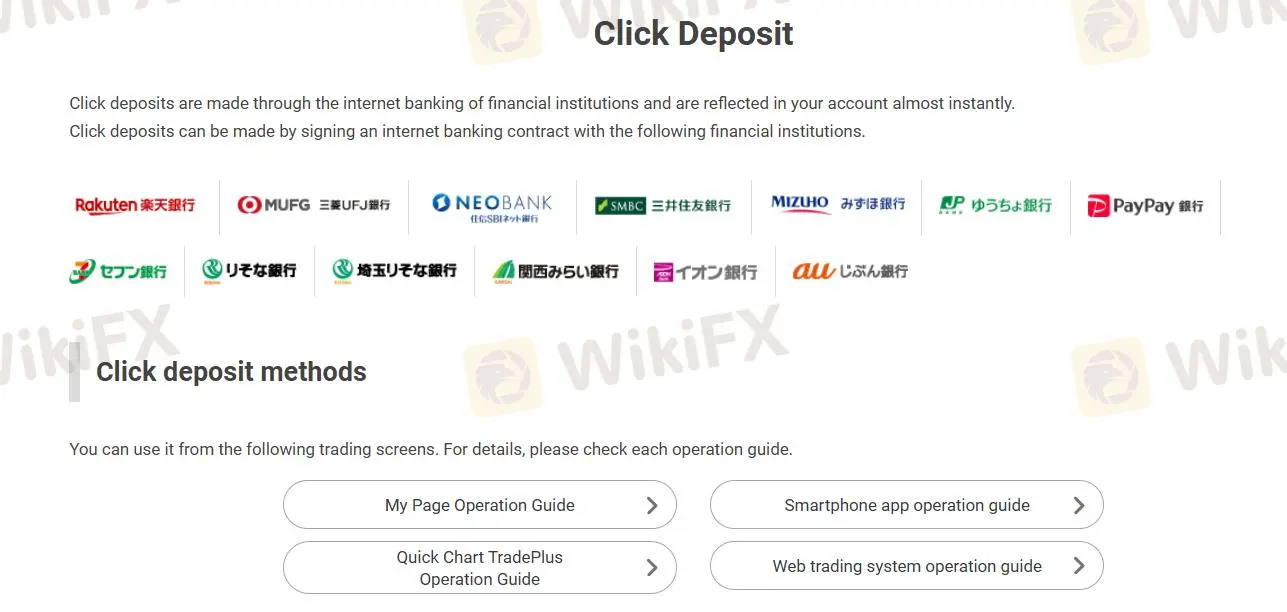

Central Tanshi offers two types of deposit methods: click deposit and bank transfer deposit.

Click deposit utilizes your financial institution's online banking service for near-instant deposits. You must have an online banking agreement with one of the following financial institutions to use this method.

Bank transfer deposit allows you to fund your account through various methods such as bank counters, ATMs, and online banking. The transfer fees will be borne by you. Supported banks include Sumitomo Mitsui Banking Corporation (Nihonbashi Branch), Mizuho Bank (Kofunecho Branch), and Mitsubishi UFJ Bank.

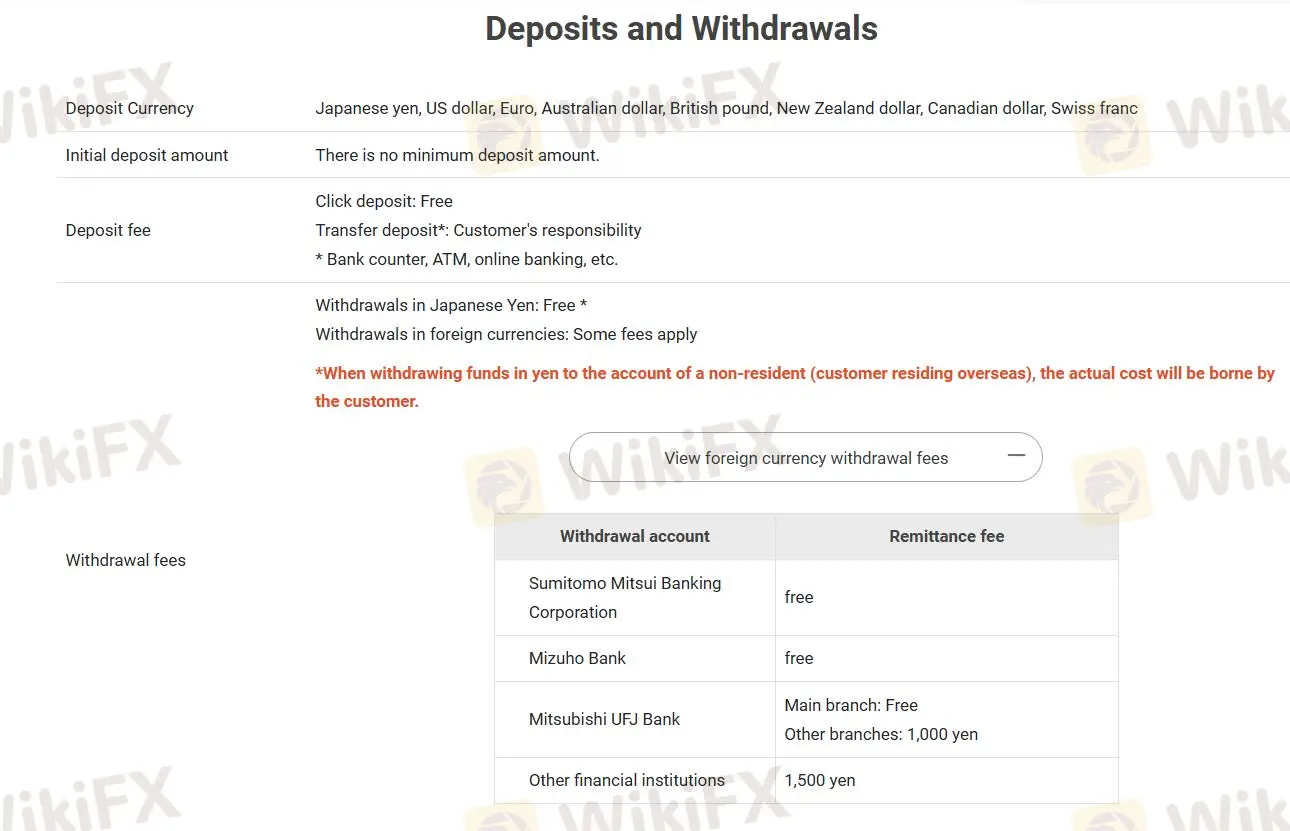

Fees

Deposit: For click deposits, it is free. For transfer deposits, certain fees may be charged.

Withdrawal: Withdrawal in Japanese Yen is free, whereas withdrawals in other foreign currencies will incur some fees.

Additionally, withdrawal fees differ based on the banking institution.

Specifically, withdrawals through Sumitomo Mitsui Banking Corporation, Mizuho Bank, and the Main Branch of Mitsubishi UFJ Bank are free.

For other branches of Mitsubishi UFJ Bank, a fee of 1,000 yen will be charged, and for other financial institutions, a fee of 1,500 yen will be imposed.