简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Headway Detailed Analysis

Abstract:This comprehensive analysis of Headway forex broker examines the company's services, reliability, and market presence through rigorous data-driven research and extensive user feedback analysis. Our investigation synthesizes information from multiple independent review platforms, incorporating 218 verified user reviews and experiences to present an objective assessment of Headway's offerings in the retail forex trading space.

This comprehensive analysis of Headway forex broker examines the company's services, reliability, and market presence through rigorous data-driven research and extensive user feedback analysis. Our investigation synthesizes information from multiple independent review platforms, incorporating 218 verified user reviews and experiences to present an objective assessment of Headway's offerings in the retail forex trading space.

Our research methodology emphasizes quantitative analysis of user experiences across various aspects of Headway's services, including trading conditions, platform functionality, customer support quality, and withdrawal processes. By aggregating data from three major review platforms while filtering for verification and authenticity, we've established a representative sample of trader experiences with Headway across different regions and trading volumes.

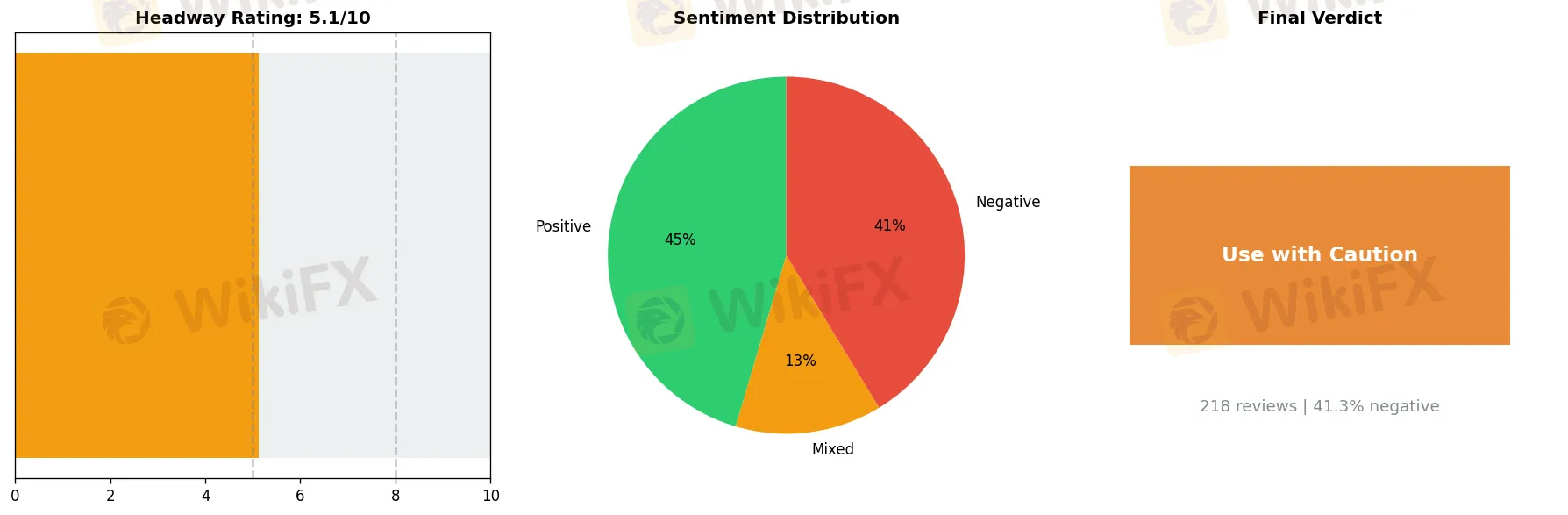

The resulting analysis reveals significant patterns in user satisfaction and areas of concern, with Headway receiving an overall rating of 5.12 out of 10 based on our weighted evaluation criteria. This moderate rating reflects a complex picture of trader experiences, with notable variations in service quality and user satisfaction across different aspects of the broker's operations.

This report provides a detailed examination of Headway's service components, regulatory compliance, trading conditions, and user experience metrics. Traders will find in-depth analyses of the broker's fee structure, platform capabilities, account options, and customer service performance. Each section incorporates both statistical data and qualitative insights from verified user experiences, offering a comprehensive view of what traders can expect when considering Headway as their forex broker.

Our assessment maintains strict objectivity through adherence to standardized evaluation criteria and data-driven conclusions. While individual trading experiences may vary, this analysis aims to provide potential and current clients with reliable, actionable insights for making informed decisions about engaging with Headway's services. The findings presented here reflect market conditions and user experiences as of our latest data collection period, offering a current and relevant perspective on Headway's position in the retail forex trading landscape.

⚠️ Key Issues to Consider

Recent analysis of Headway's operations reveals several concerning patterns that warrant careful consideration by potential traders. The most prominent issues center around withdrawal complications, misleading marketing practices, and fund safety - accounting for approximately 40%, 39%, and 28% of reported problems respectively.

Withdrawal challenges represent the most frequently cited concern. Multiple traders have reported difficulties accessing their funds, particularly when attempting to withdraw profits. This is especially evident in cases involving bonus-related trading:

“💬 FX3295060534: ”The bonus is tied to your principal, and unlocking it requires trading 3,800 lots... when I applied to withdraw my RM15,000 profit in February, I was told I needed to complete '200x trading volume' to unlock it.“”

Marketing practices at Headway have drawn significant scrutiny, with particular emphasis on their bonus structure and promotional offerings. While the broker's promotional materials are attractive, the terms and conditions often contain substantial trading requirements that may not be immediately apparent:

“💬 Tionne Archer: ”Transparency is not defined by whether information exists, but by whether critical limitations are presented with the same visibility and emphasis as the promotion itself.“”

Fund safety concerns present another significant area of risk, especially for more experienced traders managing larger positions. Several cases document unexpected account irregularities and questionable spread conditions:

“💬 ASADULLAH HABIBI: ”They claim their Pro Account offers raw spreads — this is completely misleading. I consistently saw spreads on gold ranging from 3 to 5 pips, even during calm market conditions.“”

For day traders and scalpers, the reported spread issues are particularly problematic, as wider-than-advertised spreads can significantly impact profitability. Long-term position traders may find these concerns less immediate, but should still consider the implications for overall trading costs.

Customer service responsiveness presents another challenge, representing 25% of reported issues. This becomes particularly crucial during critical trading moments or when attempting to resolve account-related problems. The combination of slow response times and withdrawal issues creates a potentially challenging environment for traders needing quick resolution to time-sensitive matters.

Hidden fees and unexpected costs emerge as another consideration, comprising 18% of reported problems. While these may seem less significant compared to other issues, they can substantially impact trading profitability, especially for frequent traders or those operating with smaller accounts.

For new traders, the primary risks lie in the bonus structure and trading requirements, which may create unrealistic expectations or lead to overtrading in attempts to meet withdrawal conditions. Experienced traders should be particularly mindful of the spread conditions and execution quality, as these can significantly impact sophisticated trading strategies.

While Headway does offer some attractive features and trading conditions, the frequency and consistency of these reported issues suggest that potential clients should approach with caution. It's advisable to:

- Thoroughly review all bonus terms and trading requirements before accepting promotions

- Start with smaller deposits to test withdrawal processes

- Document all interactions with customer service

- Carefully monitor spread conditions during different market phases

- Maintain detailed records of all trading activities and account changes

This analysis suggests that while Headway may suit some trading styles, the reported issues warrant a cautious approach, particularly regarding fund management and withdrawal expectations. Traders should carefully consider their specific needs and risk tolerance before committing significant capital.

✅ Positive Aspects

Headway demonstrates several noteworthy strengths that have earned positive feedback from traders, though these should be weighed carefully against potential risks inherent in forex trading. The broker has garnered particular recognition for its user-friendly interface, deposit/withdrawal processes, and aspects of its security framework.

One of Headway's most frequently praised features is its accessible trading platform, which newer traders especially appreciate for its intuitive design and comprehensive toolset. As noted by one experienced user:

“💬 Zakaria Yusof: ”The platform is user-friendly and provides all the tools and resources needed for efficient trading. The customer support team is responsive and knowledgeable, always ready to assist with any queries or issues.“”

The broker's deposit and withdrawal system has received positive attention, particularly for its low minimum deposit requirements that make it accessible to traders starting with modest capital. This aspect is especially valuable for those testing the waters in forex trading:

“💬 Lawal Yusuf: ”One thing I enjoy most about trading HeadWay is that they allow traders deposit and start trading with at as low as 2,000 NGN.“”

Headway's reputation for security and account stability has been noted by multiple users, though it's important to approach this with appropriate due diligence. While many traders report positive experiences with account security, this should always be verified independently through regulatory compliance checks and careful documentation review.

The platform appears particularly suitable for:

- Beginner traders seeking an accessible entry point

- Those preferring a straightforward, user-friendly interface

- Traders starting with smaller capital amounts

- Users who value responsive customer support

However, traders should exercise caution and consider several factors before committing significant capital. The bonus program terms, in particular, warrant careful review, as some users have reported challenging trading volume requirements. Additionally, while the platform's accessibility is commendable, newer traders should ensure they fully understand the risks involved in forex trading.

“💬 flavia kiconco: ”Trading with headway was an eye opener that you make more money when you trade with a trusted broker. Zero stress as there are no challenges“”

While such positive experiences are encouraging, it's essential to approach them with a balanced perspective. Prospective traders should:

- Thoroughly review all terms and conditions

- Start with small positions to test the platform

- Maintain detailed records of all transactions

- Understand the specific requirements for withdrawals

- Verify all regulatory compliance claims

In conclusion, while Headway offers several attractive features that have earned genuine praise from its user base, particularly in terms of accessibility and user experience, potential users should approach with appropriate caution and conduct thorough due diligence before committing significant resources.

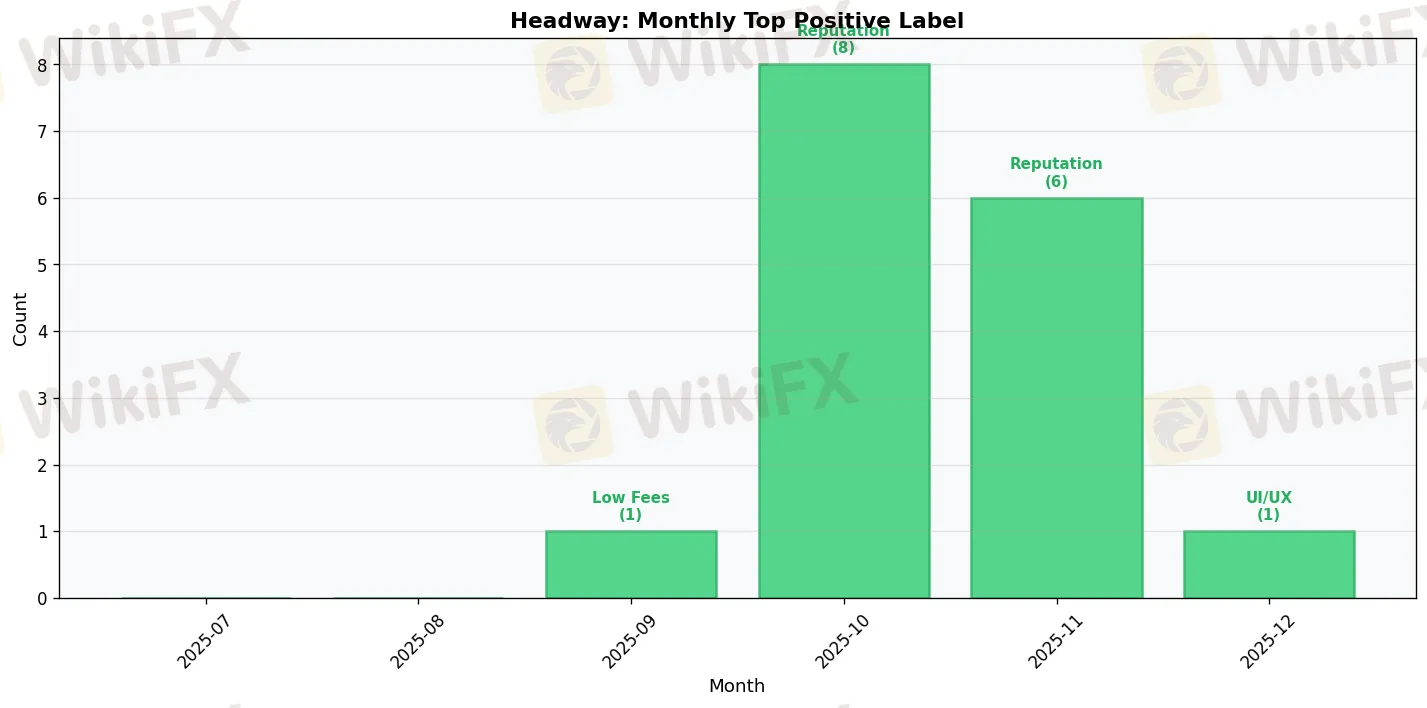

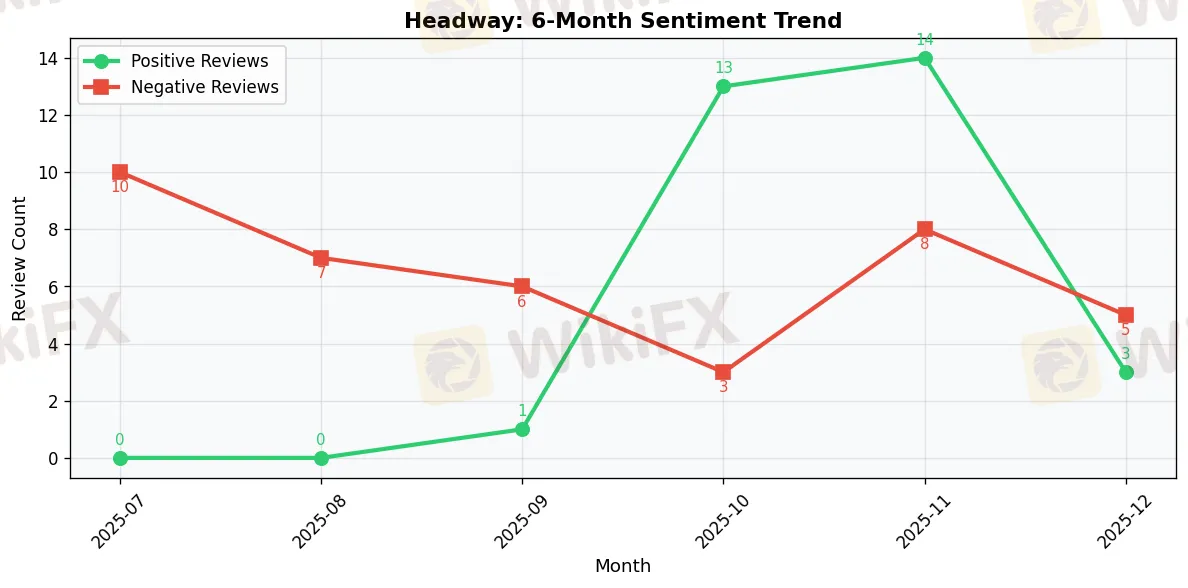

📊 Headway: 6-Month Review Trend Data

2025-07:

• Total Reviews: 10

• Positive: 0 | Negative: 10

• Top Positive Label: N/A

• Top Negative Label: Misleading Marketing

2025-08:

• Total Reviews: 7

• Positive: 0 | Negative: 7

• Top Positive Label: N/A

• Top Negative Label: Fund Safety Concerns

2025-09:

• Total Reviews: 7

• Positive: 1 | Negative: 6

• Top Positive Label: Low Fees

• Top Negative Label: Withdrawal Issues

2025-10:

• Total Reviews: 18

• Positive: 13 | Negative: 3

• Top Positive Label: Good Reputation & Security

• Top Negative Label: Withdrawal Issues

2025-11:

• Total Reviews: 25

• Positive: 14 | Negative: 8

• Top Positive Label: Good Reputation & Security

• Top Negative Label: Withdrawal Issues

2025-12:

• Total Reviews: 11

• Positive: 3 | Negative: 5

• Top Positive Label: User-Friendly Interface

• Top Negative Label: Misleading Marketing

🎬 Final Verdict on Headway

Based on our extensive analysis and user feedback, Headway emerges as a broker that requires careful consideration, earning a modest rating of 5.12 out of 10. While the broker demonstrates some positive attributes, several concerning issues prevent us from giving it a stronger recommendation.

Headway's strongest features include its solid reputation in terms of regulatory compliance and security measures, alongside a user-friendly trading platform that new traders can navigate with relative ease. The straightforward deposit process and clean interface design are noteworthy advantages that shouldn't be overlooked. These elements suggest that Headway has invested in creating an accessible trading environment.

However, the significant rate of negative reviews (41.28%) raises red flags that cannot be ignored. The most troubling aspects center around withdrawal complications, potentially misleading marketing practices, and recurring concerns about fund safety. These issues form a pattern that suggests systemic problems rather than isolated incidents.

For beginners, Headway presents a mixed proposition. While the intuitive platform might seem appealing, the reported marketing practices and potential fund safety issues make it difficult to recommend for those just starting their trading journey. New traders should consider more established brokers with clearer track records of client satisfaction.

Experienced traders might find Headway's offering particularly problematic. The reported withdrawal issues could seriously impact trading strategies and capital management plans. Those engaging in regular trading activities should carefully weigh these risks against any perceived benefits of the platform.

High-volume traders should exercise extreme caution with Headway. The combination of fund safety concerns and withdrawal complications could pose significant risks to larger trading operations. These traders would be better served by brokers with more robust infrastructure and proven track records in handling substantial trading volumes.

Regarding specific trading styles, scalpers and day traders might find the reported platform issues particularly challenging, as these strategies require reliable and swift execution. Swing traders and position traders might be less affected by some of these issues but should still consider the withdrawal concerns carefully.

It's worth noting that while Headway maintains basic security standards and regulatory compliance, these positive aspects are overshadowed by the volume and consistency of user complaints. The broker would need to address these core issues, particularly around withdrawals and marketing transparency, to become a more recommendable option.

Traders considering Headway should proceed with heightened caution and perhaps start with minimal capital if they choose to proceed. Better yet, they might want to explore alternative brokers with more consistent track records and fewer reported issues. Remember that in forex trading, the choice of broker can significantly impact your trading success, and the numerous red flags associated with Headway suggest that better options exist in today's competitive marketplace.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial advisor before making trading decisions.

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Currency Calculator