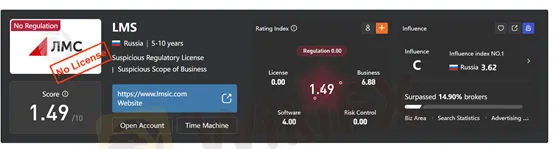

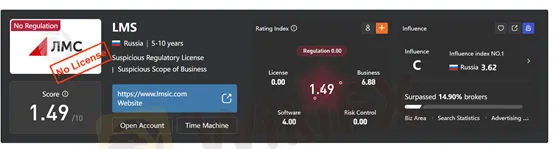

Abstract:LMS Forex Broker Review 2026 – Regulation, Risks & WikiFX Score 1.49/10.

Is LMS a safe forex broker? Read our in-depth LMS broker review covering regulation, trading conditions, risks, comparison with regulated brokers, FAQ, and why WikiFX gives LMS a low score of 1.49/10.

LMS Forex Broker Review 2026 – Regulation, Risks & WikiFX Score 1.49/10.

Is LMS a safe forex broker? Read our in-depth LMS broker review covering regulation, trading conditions, risks, comparison with regulated brokers, FAQ, and why WikiFX gives LMS a low score of 1.49/10.

LMS Broker Overview

LMS is a forex and CFD broker that claims to provide online trading services across multiple asset classes, including forex, commodities, indices, and cryptocurrencies. However, based on available public information and third-party risk assessments, LMS raises serious safety and credibility concerns.

According to WikiFX, LMS has received a very low score of 1.49/10, indicating extremely high trading risk and weak operational transparency.

WikiFX Risk Assessment

- WikiFX Score: ⭐ 1.49 / 10

- Risk Level: Very High

- Regulatory Status: No valid regulation detected

- Investor Protection: None

A WikiFX score below 2.0 usually suggests:

- Missing or invalid regulatory licenses

- Poor transparency of company background

- High potential risk to client funds

Regulation & Safety – Major Red Flags

Regulation is one of the most critical factors when evaluating a forex broker. Unfortunately, LMS does not appear to hold any valid license from reputable financial regulators such as:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- NFA / CFTC (USA)

Why this matters:

- No fund segregation requirements

- No investor compensation scheme

- No legal dispute protection

- No oversight of trading practices

Trading with an unregulated broker like LMS significantly increases the risk of fund loss, withdrawal issues, and unfair trading conditions.

LMS Broker Key Information

Trading Platform & Conditions

LMS appears to offer a proprietary or web-based trading platform rather than widely recognized platforms such as MT4 or MT5.

Concerns:

- Platform functionality cannot be independently verified

- No clear information on spreads, commissions, or execution model

- Lack of transparency on slippage and liquidity providers

Such opacity makes it difficult for traders to accurately assess real trading costs and execution quality.

LMS vs Regulated Brokers (Comparison Table)

Pros & Cons

Pros

- Claims to offer multiple trading instruments

- Web-based access without software installation

Cons

- Extremely low WikiFX score (1.49/10)

- No valid financial regulation

- No investor protection mechanisms

- Unclear trading conditions and fees

- High risk of withdrawal or fund security issues

Frequently Asked Questions (FAQ)

Q1: Is LMS a regulated forex broker?

No. LMS does not appear to be licensed or regulated by any recognized financial authority.

Q2: What does a WikiFX score of 1.49/10 mean?

A score this low indicates very high risk, weak transparency, and a lack of regulatory protection. Such brokers are generally not recommended.

Q3: Is LMS safe for beginners?

No. Beginners should avoid unregulated brokers like LMS and instead choose brokers regulated by authorities such as FCA, ASIC, or CySEC.

Q4: Can I trust LMS with my funds?

Due to the lack of regulation and investor safeguards, fund security cannot be guaranteed.

Q5: What should I do if I already deposited money with LMS?

- Stop depositing additional funds

- Keep all transaction records

- Attempt withdrawal immediately

- Seek advice from financial regulators or professional recovery services

Final Conclusion: Is LMS Worth the Risk?

Based on regulatory status, transparency issues, and a WikiFX score of just 1.49/10, LMS is a high-risk forex broker. Traders are strongly advised to avoid LMS and choose well-regulated alternatives that provide proper investor protection and legal oversight.