简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Google Expands CAPEX, Reinforcing Its AI Commitment

Abstract:Based on Alphabets 2025 fourth-quarter earnings report and management guidance from the earnings call, investor confidence in the long-term AI outlook has been further strengthened. That said, despite

Based on Alphabets 2025 fourth-quarter earnings report and management guidance from the earnings call, investor confidence in the long-term AI outlook has been further strengthened. That said, despite robust Q4 results and forward guidance, the capital markets showed little immediate enthusiasm. Major U.S. equity indices remained relatively weak, with near-term market performance still driven by sentiment. The market appears to be undergoing a valuation digestion phase rather than a trend reversal.

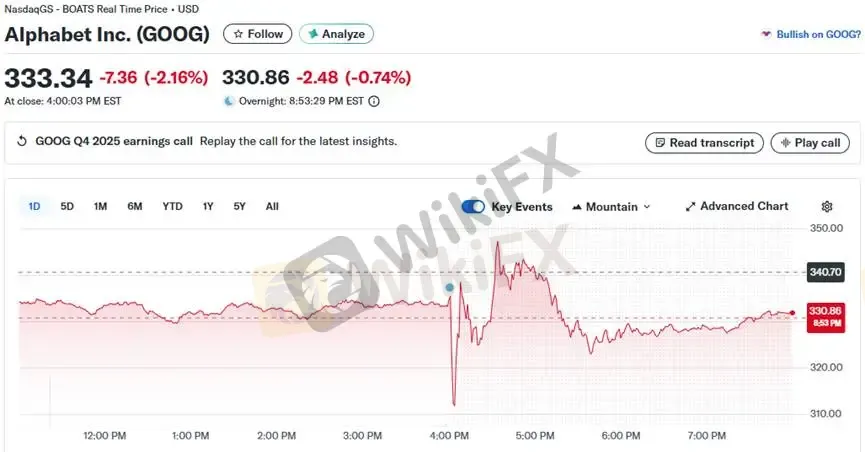

(Figure 1. Alphabet shares weakened in after-hours trading; Source: Yahoo Finance)

Key Takeaways from Alphabets Earnings Call

1. Core Guidance: Annual Revenue Surpasses USD 400 Billion for the First Time

Alphabet reported full-year 2025 revenue of USD 402.8 billion, marking a historic milestone. Fourth-quarter revenue reached USD 113.83 billion, representing an 18% year-over-year increase, while diluted EPS came in at USD 2.82. Both figures exceeded Wall Street expectations.

2. Growth Engine: Google Cloud Delivers Exceptional Performance

Revenue Acceleration: Cloud revenue climbed to USD 17.66 billion, with year-over-year growth accelerating sharply from 34% in the previous quarter to 48%.

AI Contribution: Growth was primarily driven by strong enterprise demand for Gemini AI solutions and related infrastructure, while cloud operating margins improved to approximately 30%.

3. Search Business: Resilience Enhanced by AI Integration

Search and related revenue totaled USD 63.1 billion. CEO Sundar Pichai emphasized that AI-powered search features, such as Circle to Search and AI Overviews, have not cannibalized the core business. Instead, enhanced capabilities for handling complex queries have led to higher user engagement.

4. Forward Outlook: Capital Expenditure to Double in 2026

Investment Scale: Alphabet announced that 2026 capital expenditures are expected to reach USD 175–185 billion, nearly double the 2025 level.

Use of Funds: Investment will be focused on servers and so-called “AI factory” infrastructure, reinforcing the company‘s goal of maintaining a dominant position in the AI ecosystem.

Market Sentiment and AI Agent Concerns

Despite Alphabet’s strong earnings performance, the Fear & Greed Index indicates that overall market sentiment remains firmly in “fear” territory. Investor caution has been exacerbated by recent news surrounding Anthropic.

Anthropic recently introduced a new tool that enables AI systems to operate like human users, including clicking a mouse, opening web pages, and filling out forms. This functionality is broadly referred to as AI Agents. At the current stage, OpenClaw and similar AI agent technologies remain in an early experimental or “geek” phase, rather than being mature, mass-market products.

(AI assistant OpenClaw; Source: X @OpenClaw)

From a strategic perspective, competition in AI agents is fundamentally an extension of operating system control. While model-centric companies such as Anthropic may lead in algorithmic innovation, they face significant disadvantages in real-world deployment scenarios, system-level permissions, and distribution costs. These areas are dominated by technology giants that control hardware ecosystems and operating systems. As such, we do not view Alphabets elevated capital expenditures as a structural concern. Short-term market pessimism does not imply a flawed strategic direction or erosion of competitive strength.

Macro Implications and Market Impact

Strong corporate profitability combined with increased capital investment is supportive of U.S. GDP growth. Viewed from this angle, such dynamics may also help alleviate market concerns surrounding fiat currencies. The U.S. Dollar Index has recently staged a V-shaped rebound from 95.34, suggesting limited downside risk in the near term. A firmer dollar environment is likely to further weaken bullish support for gold.

Gold: Technical Analysis

Using Bollinger Bands on the hourly chart, golds band expansion has shifted from upward to downward. Price action previously rallied toward the horizontal resistance level at 5102 before reversing lower. A subsequent rebound toward the middle band was followed by a bearish close, triggering a short-selling signal.

For investors initiating short positions, the stop-loss level should be monitored near the Bollinger mid-band. In simple terms, a breakout above 5020 would invalidate the bearish setup and require an exit.

From a momentum perspective, the MACD histogram has converged toward the zero line and shows signs of potentially expanding into negative territory. This indicator currently supports a bearish trading bias.

Risk Disclosure

The views, analyses, research, prices, and other information provided above are for general market commentary only and do not represent the official position of this platform. All readers assume full responsibility for their own risks. Please trade with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

Naira Rallies to Start February as Government targets Fiscal Consolidation

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Currency Calculator