Abstract:DeltaFX Broker: No Regulation Exposed risks, scams & blocked withdrawals with zero oversight. High fraud exposure—read full review now!

DeltaFX presents itself as a long‑standing Forex and CFD broker with global reach, but a closer look at its regulatory status and user experience reveals serious red flags that expose traders to severe risk. This DeltaFX review explains why the brokers lack of regulatory oversight, history of withdrawal issues, and misleading regulatory claims make it a high‑risk choice for anyone considering Forex trading with DeltaFX.

Brief Overview of the DeltaFX Broker

DeltaFX claims to have been established in the early 2000s and markets itself as an experienced UK‑based broker offering Forex, indices, metals, energies, cryptocurrencies, and other CFDs. The broker offers multiple account types, including Standard, ECN, Fixed Spread, and Nano, with minimum deposits starting at 10 USD and leverage up to 1:1000.

Trading is available through the MT4 and MT5 platforms, along with copy‑trading features for both beginners and seasoned traders. On the surface, these conditions might look attractive, but they need to be evaluated alongside the DeltaFX regulatory issues and numerous reports of blocked withdrawals and fraud allegations.

DeltaFX Regulation: Unregulated Status Exposed

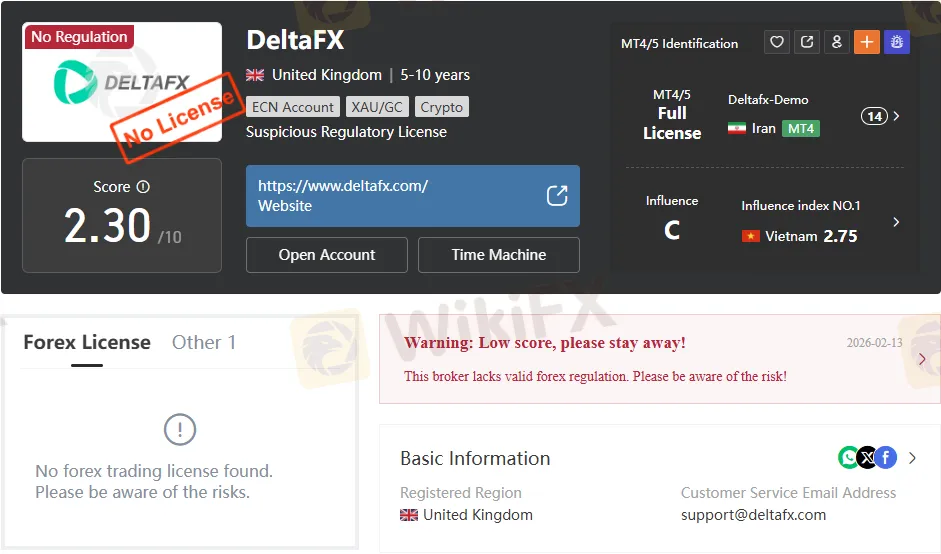

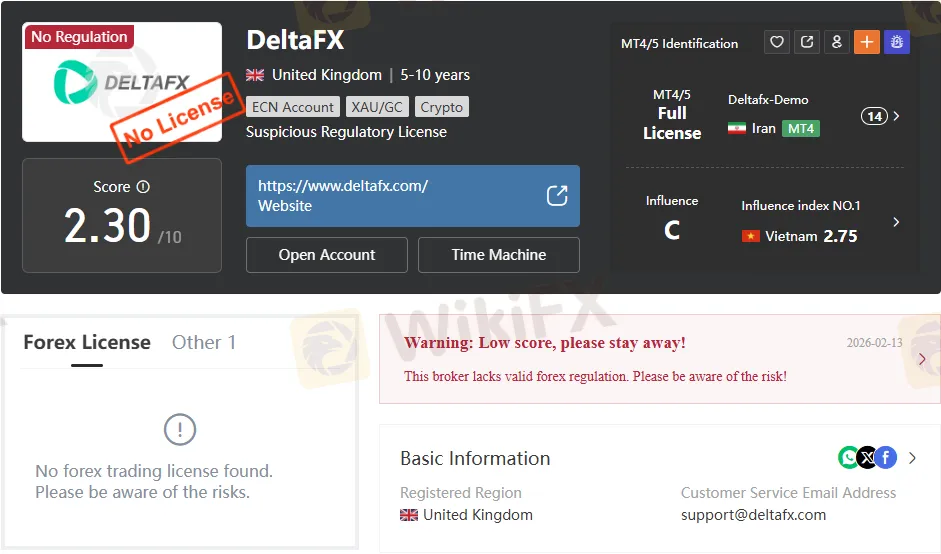

Despite marketing claims of “valid regulation” and a long market history, DeltaFX is currently classified as an unregulated broker with no effective license from any reputable financial authority. WikiFXs detailed broker profile for DeltaFX clearly lists its regulatory status as “Unregulated,” with no recognized supervisory body overseeing its activities or safeguarding client funds.

Investigations also show that DeltaFX has referenced questionable or unverifiable regulatory ties, including claims linked to different jurisdictions that do not translate into real investor protection. The UK entity associated with DeltaFX has even been deregistered, which further undermines any suggestion that the firm currently holds a credible license or operates under strict compliance standards.

High Risk, Scams, and Withdrawal Issues

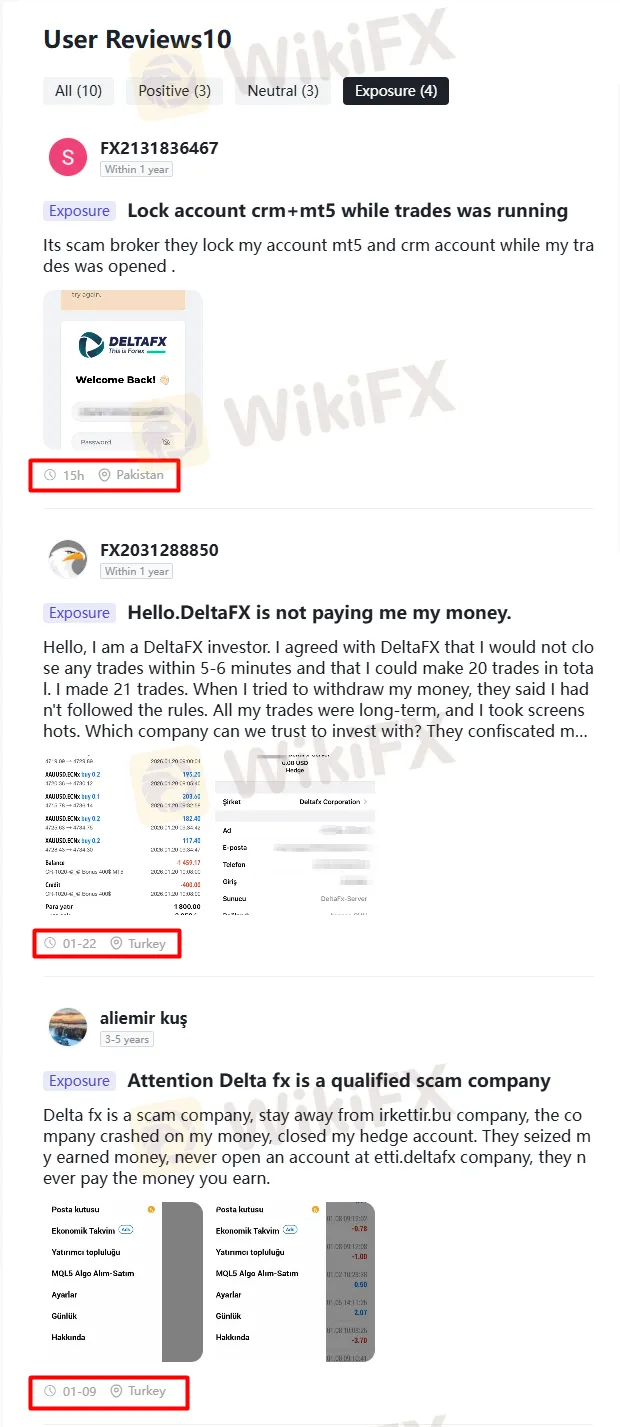

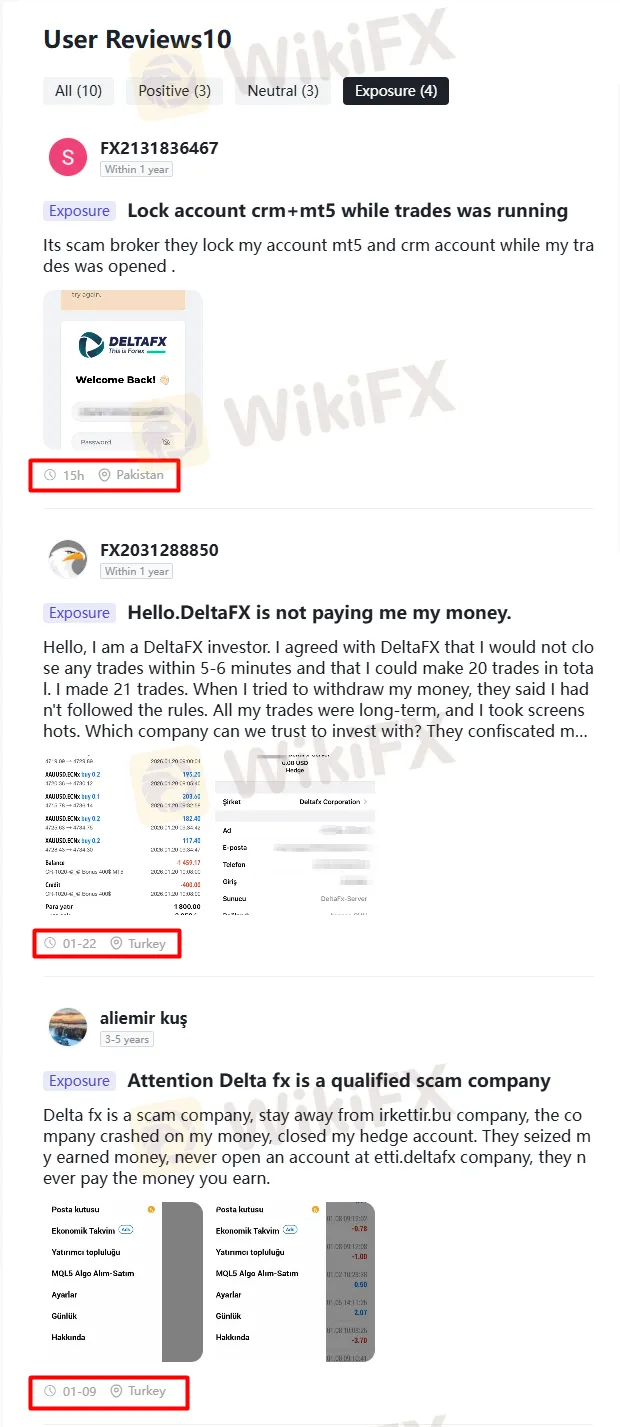

A major focus of this exposure article is the growing body of complaints about withdrawal problems with DeltaFX. WikiFX reports outline repeated cases in which clients have had accounts blocked, profits confiscated, or withdrawal requests unfulfilled, leaving traders without access to their own capital.

Because there is no real regulator standing behind the broker, affected users have almost no formal channel to enforce payouts or challenge unfair terms. This situation greatly increases the likelihood that unexplained slippage, sudden rule changes, and rejected withdrawals may go unresolved, turning the Forex DeltaFX environment into a potential trap rather than a transparent trading venue.

Trading Conditions vs. Real Safety

On paper, DeltaFX offers very flexible conditions: high leverage up to 1:1000, several account types, and access to popular MT4/MT5 terminals with support for expert advisors and copy trading. Spreads, however, can be relatively wide on key pairs, with WikiFX data showing the EUR/USD spread floating around 6.4 pips on a standard account, which is much higher than many regulated competitors.

The combination of high leverage, offshore‑style operations, and wide spreads is particularly dangerous when supervision is absent. Traders may be enticed by low entry deposits and marketing about “professional trading conditions,” but without regulation, DeltaFX has substantial freedom to manipulate prices, adjust margin rules, or suspend trading in ways that favor the house rather than the client.

Why the WikiFX App Flags DeltaFX as High‑risk

The WikiFX App specializes in assessing broker credibility by aggregating licenses, enforcement records, and user feedback into a single risk score. In the case of DeltaFX, WikiFX assigns an extremely low overall rating—around 2 or below out of 10—and explicitly warns that the broker is unregulated and linked to multiple fraud and withdrawal‑related complaints.

By checking the DeltaFX broker page on the WikiFX App, traders can quickly verify that there is no valid forex license supporting the company‘s operations, despite its claims of long experience and international offices. The app also consolidates exposure reports documenting blocked withdrawals and suspicious regulatory statements, helping users see beyond the polished marketing on the broker’s site.

Using the WikiFX App before depositing funds allows traders to compare DeltaFX with genuinely regulated brokers and understand how a poor score, unregulated status, and serious complaints can pose a real danger to their capital. For anyone researching “review DeltaFX” or “regulation DeltaFX,” the app functions as an early‑warning system that highlights exactly why this broker is considered high‑risk.

Final Verdict on the DeltaFX Broker

Putting all the evidence together, DeltaFX operates as an unregulated forex and CFD broker that has accumulated serious allegations of blocked withdrawals and fraudulent conduct. Its attractive trading offers—high leverage, multiple accounts, and MT4/MT5 access—cannot compensate for the absence of credible regulation or a trustworthy corporate structure.

For traders evaluating DeltaFX's regulation and overall reliability, the safest conclusion is that this broker has a very high fraud risk and should be avoided. Instead, investors should rely on tools like the WikiFX App to identify brokers with verifiable licenses, transparent operations, and a proven history of honoring withdrawals, thereby protecting their funds from the type of risks highlighted in this DeltaFX exposure.