简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CMC MARKETS Detailed Analysis

Abstract:This report is structured to provide maximum utility for decision-making. Readers will gain insights into CMC MARKETS' operational strengths and weaknesses as identified through client feedback patterns, understand the specific areas where users report satisfaction or frustration, and access quantified metrics that contextualize subjective experiences. The analysis breaks down performance across critical dimensions including trading platform functionality, spreads and fees, withdrawal processes, customer support quality, and regulatory compliance perception.

In an increasingly complex forex and CFD trading landscape, selecting the right broker requires more than reviewing marketing materials—it demands rigorous, data-driven analysis of actual user experiences. This comprehensive report examines CMC MARKETS through systematic evaluation of 228 verified user reviews collected from multiple independent review platforms, providing traders and investors with an objective assessment based on real client feedback rather than promotional content.

Our analytical methodology aggregates user testimonials from diverse sources, designated as Platform A, Platform B, and Platform C to maintain analytical independence. By examining feedback across multiple channels, we minimize platform-specific bias and capture a representative cross-section of client experiences spanning different trading styles, account types, and geographical regions. Each review has been processed through our proprietary evaluation framework, which assesses key performance indicators including platform reliability, execution quality, customer service responsiveness, fee transparency, and overall user satisfaction.

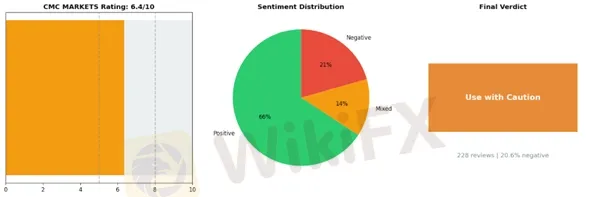

CMC MARKETS has received an overall rating of 6.36 out of 10 in our analysis, with a negative review rate of 20.61%, leading to our “Use with Caution” designation. This classification indicates that while the broker demonstrates certain strengths, potential clients should conduct thorough due diligence and carefully weigh both positive and negative aspects before committing capital.

This report is structured to provide maximum utility for decision-making. Readers will gain insights into CMC MARKETS' operational strengths and weaknesses as identified through client feedback patterns, understand the specific areas where users report satisfaction or frustration, and access quantified metrics that contextualize subjective experiences. The analysis breaks down performance across critical dimensions including trading platform functionality, spreads and fees, withdrawal processes, customer support quality, and regulatory compliance perception.

Whether you are considering CMC MARKETS as your primary broker or evaluating it against competitors, this report delivers the empirical foundation necessary for informed decision-making. By examining authentic user experiences rather than relying solely on broker-provided information, we aim to present an unvarnished view of what traders can realistically expect when choosing CMC MARKETS as their trading partner.

Key Caution Areas for CMC MARKETS Traders

Analysis of recent client feedback reveals several recurring concerns with CMC MARKETS that warrant careful consideration before opening or maintaining an account. While the broker is established and regulated, patterns in customer experiences suggest potential operational challenges that could significantly impact trading outcomes and capital access.

Withdrawal Processing and Fund Access Concerns

The most pressing issue centers on withdrawal difficulties, with 17 documented cases highlighting delays and rejections. Multiple traders report experiencing substantial obstacles when attempting to access their funds, particularly with larger amounts. The verification requirements appear inconsistently applied, with some clients facing repeated document requests despite having previously verified their accounts. One Australian trader described a frustrating experience:

“💬 Graham: ”They will do anything and everything to delay withdrawals of large cash amounts... Refused to register an external account because it was a joint account of which the trading account was one name. Note the other party to the joint account already had this same account linked to his account.“”

This asymmetry between deposit ease and withdrawal complexity represents a significant red flag. The pattern suggests potential liquidity management issues or overly bureaucratic compliance procedures that disproportionately affect clients attempting to exit positions or withdraw profits. For active traders and those managing substantial accounts, this creates genuine counterparty risk.

Trade Execution and Platform Reliability Issues

Twelve reported cases of execution problems and slippage indicate technical challenges that directly impact profitability. Traders describe inability to close positions at desired prices, “off quotes” errors on MT4, and suspiciously timed spread widening. These execution failures can transform winning trades into losses and prevent effective risk management. A Canadian trader's recent experience illustrates the support gap:

“💬 Tony: ”I've been unable to close out certain positions when I want to, which has forced me to delay transactions — sometimes resulting in missed opportunities or losses. Despite reaching out to support and providing screenshots of the errors... I've received no compensation or meaningful resolution.“”

Reports of spread manipulation are particularly concerning, with one trader documenting a $10 spread on the AUS 200 index persisting for four consecutive days—well above normal market conditions. Such anomalies raise questions about pricing transparency and whether the broker's interests align with client success.

Customer Support Deficiencies

With 17 complaints categorized under inadequate support, CMC MARKETS appears to struggle with timely problem resolution. The combination of technical issues and unresponsive support creates a compounding risk—traders face platform problems without effective recourse. This is especially problematic during volatile markets when rapid response is critical.

Hidden Fee Structures

Eight cases highlight unexpected charges, including inactivity fees that catch clients off-guard. One New Zealand trader expressed frustration after being charged monthly fees:

“💬 huri5421: ”I decided to not trade on cmc and they hit me with a 15 NZD inactive fees per month. Meanwhile many other brokers would happily provide interest if I left my money in their accounts.“”

Risk Assessment by Trader Type

High-volume traders face the greatest exposure due to withdrawal difficulties with large amounts and execution quality concerns. Position traders risk unexpected fees during inactive periods. Scalpers and day traders may encounter execution slippage that erodes edge. New traders should be particularly cautious given the support responsiveness issues that could leave them vulnerable during learning phases. These patterns suggest proceeding with significant caution, starting with minimal deposits, and maintaining alternative broker relationships for capital diversification.

Positive Aspects of CMC MARKETS: Strengths Worth Noting (With Caution)

CMC MARKETS has garnered notable praise from its user base across several key areas, particularly regarding platform usability, customer service quality, and institutional credibility. While these positive aspects deserve recognition, prospective traders should approach any broker selection with comprehensive due diligence.

Platform Design and Accessibility

The Next Generation trading platform receives consistent commendation for its intuitive interface, with 95 user mentions highlighting ease of use. Traders appreciate the straightforward setup process and visualization tools for managing stop-loss orders and monitoring positions. The platform appears well-suited for both newcomers seeking simplicity and experienced traders requiring advanced charting capabilities.

“💬 Max T: ”I really really enjoy CMC market for trading futures and stocks. It is very easy to setup visualise your stoploss and targets, and review your positions.“”

However, users have identified room for improvement, including requests for downloadable platform versions and enhanced keyboard shortcuts for managing multiple positions simultaneously. These suggestions indicate that while the platform excels in core functionality, power users may encounter workflow limitations.

Customer Service Responsiveness

With 40 positive mentions, CMC MARKETS' customer support team demonstrates commendable responsiveness and inter-departmental coordination. Users report feeling valued rather than treated as mere account numbers—a distinction that matters significantly when navigating complex trading situations or technical issues.

“💬 Alex Owen: ”Personal customer service goes a very long way... I spoke to numerous staff that all seemed to understand the situation and worked together with staff in another department to give me a solution, in good time.“”

This collaborative approach to problem-solving suggests a customer-centric culture, though individual experiences may vary depending on query complexity and regional support teams.

Regulatory Standing and Transparency

The broker's established presence since 1989 and stock exchange listing provide tangible credibility markers that resonate with safety-conscious traders. Users appreciate the transparent fee structure and competitive spreads, with 39 mentions specifically addressing trustworthiness and regulatory compliance.

“💬 Jerome Thompson: ”They've been around since 1989 and are listed on the stock exchange, so I feel like my money is in safe hands. Everything about costs is clear no surprise fees, spreads are tight, and they don't try to hide anything.“”

Who Might Benefit

These strengths suggest CMC MARKETS could suit traders who prioritize regulatory oversight, value responsive support channels, and prefer platforms balancing simplicity with comprehensive market access. The unlimited demo account practice mentioned by users provides a risk-free evaluation opportunity.

Nevertheless, positive reviews represent only one dimension of broker assessment. Prospective clients should independently verify regulatory status in their jurisdiction, compare fee structures across multiple brokers, test platform functionality during volatile market conditions, and ensure the available instruments align with their trading strategy before committing capital.

CMC MARKETS: 6-Month Review Trend Data

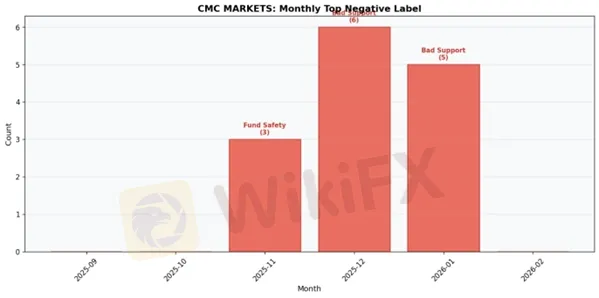

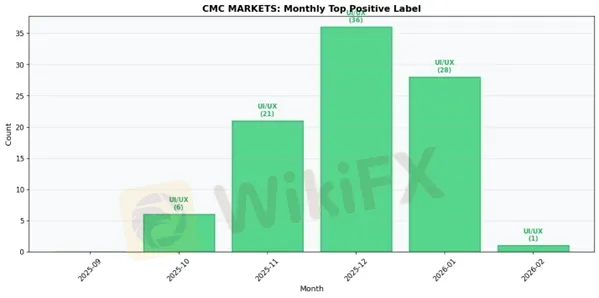

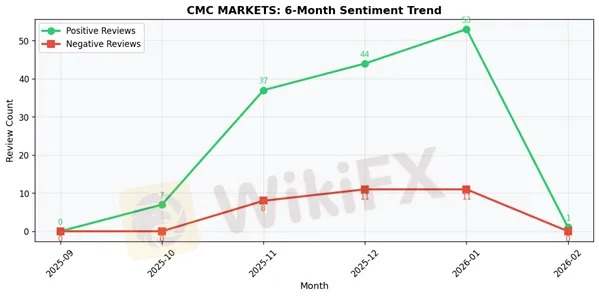

2025-09:

• Total Reviews: 1

• Positive: 0 | Negative: 0

• Top Positive Label: N/A

• Top Negative Label: N/A

2025-10:

• Total Reviews: 8

• Positive: 7 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

2025-11:

• Total Reviews: 53

• Positive: 37 | Negative: 8

• Top Positive Label: User Friendly Interface

• Top Negative Label: Fund Safety Issues

2025-12:

• Total Reviews: 63

• Positive: 44 | Negative: 11

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

2026-01:

• Total Reviews: 76

• Positive: 53 | Negative: 11

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

Key Takeaway: CMC MARKETS

CMC MARKETS presents a mixed picture for forex traders, earning a moderate overall rating of 6.4 out of 10 based on 228 reviews and a “Use with Caution” designation. The broker demonstrates notable strengths that have resonated with the majority of its client base, particularly its user-friendly interface that simplifies the trading experience, responsive customer support that addresses initial inquiries effectively, and a solid reputation for safety that provides some reassurance to traders. These positive attributes are reflected in the sentiment distribution, where 150 reviews were positive compared to just 47 negative ones, suggesting that many traders have had satisfactory experiences with the platform. However, the 20.6% negative rate cannot be ignored, as it highlights recurring concerns that potential clients should carefully consider. The most significant issues reported include support teams that, while initially responsive, sometimes fail to deliver actual solutions to problems, withdrawal delays and rejections that have frustrated traders attempting to access their funds, and broader fund safety concerns that raise questions about account security. These operational weaknesses create friction points that can significantly impact the trading experience, particularly when financial transactions are involved. For traders considering CMC MARKETS, the platform offers legitimate advantages in usability and initial support quality, but the withdrawal and fund safety issues warrant thorough due diligence before committing significant capital to this broker.

CMC MARKETS Final Conclusion

CMC MARKETS represents a moderately reliable broker with notable strengths in platform usability and reputation, though significant concerns regarding customer service effectiveness and withdrawal processes warrant careful consideration before committing substantial capital.

With a final rating of 6.36 out of 10 based on 228 reviews and a concerning negative rate of 20.61%, CMC MARKETS demonstrates a mixed performance profile that reflects both its established market presence and operational inconsistencies. The broker's user-friendly interface and generally solid reputation provide a foundation of credibility, particularly appealing to traders who prioritize platform accessibility and regulatory oversight. The responsive customer support, while listed among top strengths, appears contradicted by frequent complaints about slow support responses and lack of satisfactory problem resolution, suggesting inconsistent service quality across different departments or regions.

The most troubling findings center on withdrawal delays and rejections, alongside fund safety concerns reported by users. These issues, representing core trust factors in any broker-client relationship, elevate the risk profile significantly. While not indicating systematic fraud, the 20.61% negative rate suggests that approximately one in five clients experiences substantial dissatisfaction, primarily related to accessing their own funds or receiving adequate support when problems arise.

For beginner traders, CMC MARKETS offers advantages through its intuitive platform design, making the learning curve less steep. However, novices should start with minimal deposits and thoroughly test withdrawal processes with small amounts before scaling up their trading capital. The educational resources and platform accessibility can serve beginners well, provided they maintain conservative position sizing and keep alternative broker options available.

Experienced traders may find CMC MARKETS suitable for secondary accounts or specific trading strategies, but should avoid making it their primary broker given the withdrawal concerns. The platform's functionality supports various trading approaches, though experienced traders should maintain detailed records of all transactions and communications as a precautionary measure.

High-volume traders and scalpers should exercise particular caution, as withdrawal delays become exponentially more problematic with larger account balances and frequent transactions. The inconsistent support quality could prove especially frustrating when time-sensitive issues arise during active trading periods.

Swing traders and position traders with longer time horizons may tolerate the operational inconsistencies better than active traders, though the fundamental concerns about fund accessibility remain relevant regardless of trading style.

CMC MARKETS functions adequately for traders willing to accept moderate risk and maintain vigilant account monitoring, but falls short of the reliability standards expected from top-tier brokers. Those choosing CMC MARKETS should treat it as a “trust but verify” relationship, maintaining comprehensive documentation and never depositing more than they can afford to have temporarily inaccessible during potential dispute resolution periods.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Currency Calculator