简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Swissquote Analysis Report

Abstract:Our research team has systematically collected and analyzed 228 verified user reviews from multiple independent review platforms to provide traders and investors with an unbiased assessment of Swissquote's performance across critical operational dimensions. Unlike promotional content or isolated testimonials, this report synthesizes real-world feedback from active and former clients who have direct experience with the broker's services, platforms, and business practices.

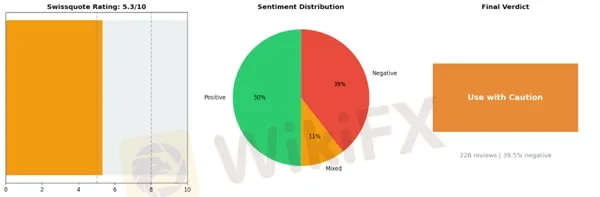

Key Takeaway: Swissquote

Swissquote presents a paradoxical profile that demands careful consideration before opening an account. With an overall rating of 5.3 out of 10 based on 228 reviews and a concerning 39.5% negative rate, this broker earns a “Use with Caution” designation that reflects significant trader frustrations despite some notable advantages. On the positive side, Swissquote delivers a user-friendly interface that simplifies trading operations, maintains a solid reputation for safety and regulatory compliance, and offers competitive low fees that initially attract cost-conscious traders. These strengths have garnered 114 positive reviews from satisfied clients who appreciate the platform's accessibility and established market presence. However, the experience deteriorates significantly when traders encounter problems or attempt to access their funds. The most critical complaints center on slow support that frequently fails to resolve issues, persistent withdrawal delays and rejections that leave traders unable to access their own capital, and opaque fee structures with hidden charges that contradict the advertised low-cost promise. With 90 negative reviews highlighting these systemic problems, the substantial gap between Swissquote's initial appeal and operational reality becomes evident. While the broker may suit experienced traders who rarely need support and maintain straightforward account activity, those requiring responsive customer service or regular withdrawals should approach with significant caution and thoroughly understand all fee structures before committing funds.

At a Glance

Broker Name: Swissquote

Overall Rating: 5.3/10

Reviews Analyzed: 228

Negative Rate: 39.5%

Sentiment Distribution:

• Positive: 114

• Neutral: 24

• Negative: 90

Final Conclusion: Use with Caution

Swissquote: Strengths vs Issues

Top Strengths:

1. User Friendly Interface — 79 mentions

2. Good Reputation Safe — 43 mentions

3. Low Fees — 19 mentions

Top Issues:

1. Slow Support No Solutions — 43 mentions

2. Withdrawal Delays Rejection — 38 mentions

3. Opaque Fees Hidden Charges — 28 mentions

In the increasingly complex landscape of online forex and CFD trading, selecting a reliable broker requires more than examining marketing materials and promotional offers. This comprehensive analysis report evaluates Swissquote through a rigorous, data-driven methodology that prioritizes actual user experiences over corporate messaging.

Our research team has systematically collected and analyzed 228 verified user reviews from multiple independent review platforms to provide traders and investors with an unbiased assessment of Swissquote's performance across critical operational dimensions. Unlike promotional content or isolated testimonials, this report synthesizes real-world feedback from active and former clients who have direct experience with the broker's services, platforms, and business practices.

The analytical framework employed in this study examines reviews gathered from diverse sources, referred to throughout this report as Platform A, Platform B, and Platform C to maintain methodological consistency. Each review has been evaluated across multiple criteria including trading conditions, platform reliability, customer service quality, withdrawal processes, fee transparency, and overall user satisfaction. This multi-platform approach minimizes bias inherent in single-source data and provides a more representative picture of Swissquote's actual service delivery.

Based on our comprehensive analysis, Swissquote has received an overall rating of 5.32 out of 10, with a negative review rate of 39.47%. These metrics have led to our system conclusion of “Use with Caution,” indicating that potential clients should conduct thorough due diligence before committing capital to this broker.

This report will guide you through detailed findings across several key areas: an executive summary of our conclusions, comprehensive rating breakdowns by category, in-depth analysis of user sentiment patterns, identification of the broker's primary strengths and weaknesses, and specific recommendations for different trader profiles. Additionally, we provide comparative context within the broader brokerage industry to help you understand where Swissquote stands relative to competitors. Whether you are considering Swissquote as your primary broker or evaluating alternatives, this analysis equips you with evidence-based insights derived from the collective experiences of hundreds of actual users.

Key Issues Requiring Caution with Swissquote

While Swissquote operates as a regulated Swiss broker with a longstanding market presence, client feedback reveals several persistent concerns that warrant careful consideration before committing funds. The data shows troubling patterns across critical operational areas that could significantly impact trader experience and capital security.

Customer Support and Problem Resolution Challenges

The most frequently reported issue involves inadequate customer support, with 43 documented complaints about slow responses and unresolved problems. This represents a significant operational weakness for a broker of Swissquote's profile. Traders report frustrating experiences when attempting to resolve account issues, often finding themselves in prolonged disputes without satisfactory outcomes. The onboarding process itself appears unnecessarily complex, creating friction from the very beginning of the client relationship.

“💬 Michael: ”Account opening - pain in the ass. Too complicated and long process. First you have to either speak with them on cam chat, or send them your documents by mail. Then pain in the ass starts by trying to actually log in to your account.“”

This complexity extends beyond initial setup. When traders encounter technical or account-related problems, the support infrastructure appears insufficient to provide timely solutions. For active traders who require quick resolution of platform issues or trade disputes, this sluggish support responsiveness poses genuine operational risk.

Withdrawal Processing Concerns

Perhaps most concerning are the 38 complaints regarding withdrawal delays and rejections. In forex trading, the ability to access one's funds promptly is fundamental to broker trustworthiness. Reports indicate clients experiencing significant difficulties retrieving their capital, with some describing “kafkaesque” scenarios where funds remain inaccessible despite repeated attempts to withdraw.

“💬 Laura: ”I'm stuck in a truly kafkaesque limbo with Swissquote trying to get my money back from them, and can't even express how much I regret ever opening an account with them.“”

These withdrawal issues raise red flags about operational procedures and client fund handling. While regulatory oversight should theoretically protect client assets, the practical difficulties reported suggest potential gaps between regulatory framework and day-to-day operational reality.

Fee Transparency and Competitive Positioning

With 28 complaints about opaque fees and hidden charges, traders report discovering unexpected costs that erode profitability. The spread competitiveness also appears questionable, particularly for active traders using shorter timeframes. One reviewer noted considering Swissquote only for longer-term positions while using other brokers for active trading due to spread disadvantages.

“💬 Vntrader: ”I can find some way to continue using Swissquote's service, such as trading hourly charts with them while trading minute charts with other brokers who offer better spreads.“”

This suggests Swissquote may not be optimally positioned for cost-sensitive traders or those employing high-frequency strategies.

Fund Safety Red Flags

Twenty complaints specifically mention fund safety concerns, including reports of aggressive sales tactics encouraging clients to deposit additional funds or even take loans to increase trading capital. Such practices raise serious questions about sales culture and client protection priorities.

“💬 Forexjunkie: ”He then suggested that I take out a loan to fund the account as Tesla was increasing by the day & I should place trades on it. He was persistent with trying to get me to deposit more.“”

Risk Assessment by Trader Profile

Active day traders face particular risks due to reportedly wider spreads and execution concerns. New traders should exercise extreme caution given the complex onboarding and aggressive sales tactics reported. Even experienced traders managing larger accounts should carefully evaluate the withdrawal processing track record before committing significant capital. The combination of support inadequacies, withdrawal difficulties, and fund safety concerns suggests proceeding with minimal initial deposits while thoroughly testing all operational aspects before scaling up exposure.

Positive Aspects of Swissquote That Require Careful Consideration

Swissquote presents several notable advantages that appeal to specific trader profiles, particularly those who prioritize regulatory security and Swiss banking credentials. However, these benefits come with important caveats that potential clients should carefully weigh against their individual trading requirements.

Swiss Banking Credibility and Security

The most frequently cited advantage of Swissquote is its status as a legitimate Swiss bank, which provides a level of institutional trust that many standalone brokers cannot match. This banking foundation offers genuine peace of mind for traders concerned about fund security and regulatory oversight. Users consistently highlight this aspect as a primary reason for choosing the platform:

“💬 500pipsaweek: ”They are one of only two brokers i trust because they are actually a bank... you get your bank account in Switzerland“”

This Swiss banking infrastructure particularly appeals to European clients seeking regulated financial services with strong depositor protection. However, traders should recognize that this premium positioning comes with trade-offs in terms of cost structure and trading conditions that may not suit all strategies.

User Interface Accessibility

The mobile application receives generally positive feedback for its intuitive design and ease of navigation. Many users find the app straightforward for executing basic trading operations and monitoring positions. The multilingual customer service support further enhances accessibility for international clients based in Switzerland.

“💬 Alessandro: ”The user experience is excellent — the app is intuitive and easy to use, and the customer service is very supportive, answering calls in different languages“”

That said, the web platform presents a contrasting experience. Several reviewers note that the desktop interface lacks the same user-friendly approach, particularly regarding chart functionality and accessing fundamental information about instruments. This inconsistency means traders who rely heavily on web-based analysis tools may face a steeper learning curve.

Fee Structure Considerations

Swissquote's fee structure receives mixed but generally positive feedback within the Swiss market context. For investors comparing options specifically among Swiss-domiciled brokers, the fees are considered competitive. The automated tax documentation service, which provides bar-coded reports compatible with Swiss tax authorities, adds genuine value for local residents.

However, multiple reviewers acknowledge that these fees appear high when compared to international alternatives. The spreads on major currency pairs, while described as “standard” by some users, can widen significantly during specific hours—reportedly exceeding 30 pips during evening sessions. This variability requires careful consideration from active forex traders who depend on consistent pricing.

The platform seems best suited for Swiss-based investors who value regulatory security and local banking infrastructure over absolute cost minimization, and who primarily engage in longer-term position trading rather than high-frequency strategies requiring tight spreads.

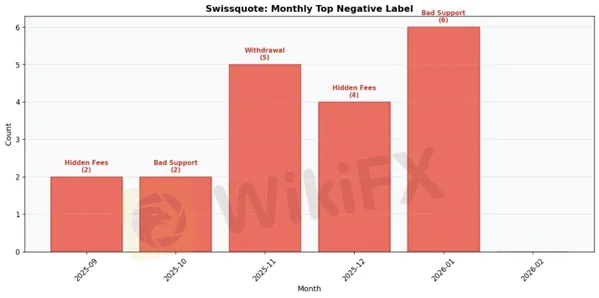

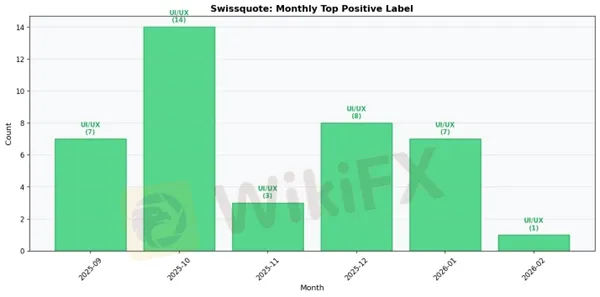

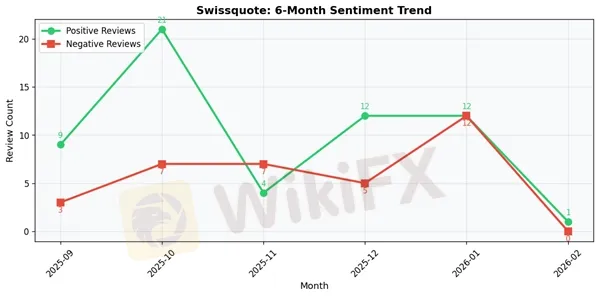

Swissquote: 6-Month Review Trend Data

2025-09:

• Total Reviews: 14

• Positive: 9 | Negative: 3

• Top Positive Label: User Friendly Interface

• Top Negative Label: Opaque Fees Hidden Charges

2025-10:

• Total Reviews: 30

• Positive: 21 | Negative: 7

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 12

• Positive: 4 | Negative: 7

• Top Positive Label: User Friendly Interface

• Top Negative Label: Withdrawal Delays Rejection

2025-12:

• Total Reviews: 19

• Positive: 12 | Negative: 5

• Top Positive Label: User Friendly Interface

• Top Negative Label: Opaque Fees Hidden Charges

2026-01:

• Total Reviews: 25

• Positive: 12 | Negative: 12

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

Swissquote Final Conclusion

Swissquote presents a paradoxical case in the forex brokerage landscape, earning a middling 5.32/10 rating that reflects significant operational inconsistencies beneath its established Swiss banking pedigree. While the broker benefits from Switzerland's robust regulatory framework and offers genuinely competitive pricing structures alongside an intuitive trading platform, the troubling 39.47% negative review rate and persistent client service failures cannot be overlooked by prospective traders evaluating this option.

The data reveals a broker operating with two distinct faces. On the positive side, Swissquote delivers on its promise of a user-friendly interface that simplifies navigation for traders at all experience levels, maintains the security and reputation expected from a Swiss financial institution, and provides genuinely low fees that compete favorably within the industry. These strengths establish a solid foundation that explains why the broker continues attracting new clients despite documented challenges.

However, the negative experiences reported by nearly 40% of reviewers paint a concerning picture of operational deficiencies that directly impact trader profitability and satisfaction. The most damaging issues center on customer support that consistently fails to resolve problems effectively, withdrawal processes plagued by unexplained delays and rejections, and fee structures that become considerably less transparent once clients begin active trading. These problems suggest systemic issues rather than isolated incidents, particularly given their frequency across the 228 reviews analyzed.

For beginners, Swissquote's user-friendly platform and established reputation may initially seem attractive, but the documented support failures make this a risky choice when learning to trade and most needing responsive assistance. New traders should consider alternatives with stronger customer service track records unless they possess sufficient capital to absorb potential withdrawal delays without financial stress.

Experienced traders may find value in Swissquote's competitive fee structure and platform capabilities, provided they maintain meticulous records of all transactions to counter potential hidden charges and can navigate issues independently without relying on customer support. Self-sufficient traders comfortable with minimal broker interaction face fewer risks with this platform.

High-volume traders and scalpers should approach Swissquote with particular caution. While advertised fees appear competitive, the reported hidden charges and withdrawal complications become exponentially more problematic when managing substantial capital flows. The inconsistent execution quality suggested by client complaints makes this unsuitable for strategies requiring precision timing and reliable fund access.

Swing traders and position traders accepting longer timeframes may tolerate Swissquote's operational inefficiencies more easily than active traders, though the withdrawal concerns remain universally problematic regardless of trading style.

Swissquote ultimately represents a calculated risk rather than a reliable partnership—a broker where Swiss credentials and competitive pricing collide with execution realities that leave too many traders frustrated, underserved, and questioning their choice.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Currency Calculator