Buod ng kumpanya

| TF SECURITIES Buod ng Pagsusuri | |

| Itinatag | 2003-11-19 |

| Rehistradong Bansa/Rehiyon | China |

| Regulasyon | Hindi Regulado |

| Mga Serbisyo at Produkto | Mga Serbisyong Pananaliksik, Investment Banking, Pangangasiwa ng Kayamanan, Pangangasiwa ng Asset, Negosyo sa Labas ng Bansa, Sariling Pagkalakal, Pribadong Equity at Venture Capital, Alternatibong Investment, at Futures |

| Suporta sa Customer | 95391; 400-800-5000 |

| Online Chat | |

TF SECURITIES Impormasyon

Itinatag ang TF SECURITIES noong 2000, na may punong tanggapan nito na matatagpuan sa Wuhan, Hubei Province. Bilang isang komprehensibong institusyon sa pananalapi, nag-aalok ito ng mayaman, iba't ibang, at natatanging sistema ng serbisyo.

Nagbibigay ito ng iba't ibang mga negosyo ng pondo sa pamamagitan ng equity financing, mga merger at acquisition, restructuring, bond financing, at iba't ibang mga serbisyong pang-finansyal na pangpayo. Ang saklaw ng negosyo nito ay hindi lamang kasama ang tradisyonal na mga proyekto tulad ng mga initial public offering ng mga stocks, pribadong mga placement, mga korporasyong bond, mga enterprise bond, at mga malalaking pagbili ng asset, kundi kasama rin ang mga inobatibong negosyo tulad ng mga pribadong bond para sa mga maliliit at gitnang negosyo, asset securitization, at preferred stocks.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Malawak na Saklaw ng Negosyo | Hindi Regulado |

| Kaugnayan sa Pamahalaan | Intense na Kompetisyon sa Merkado |

Tunay ba ang TF SECURITIES?

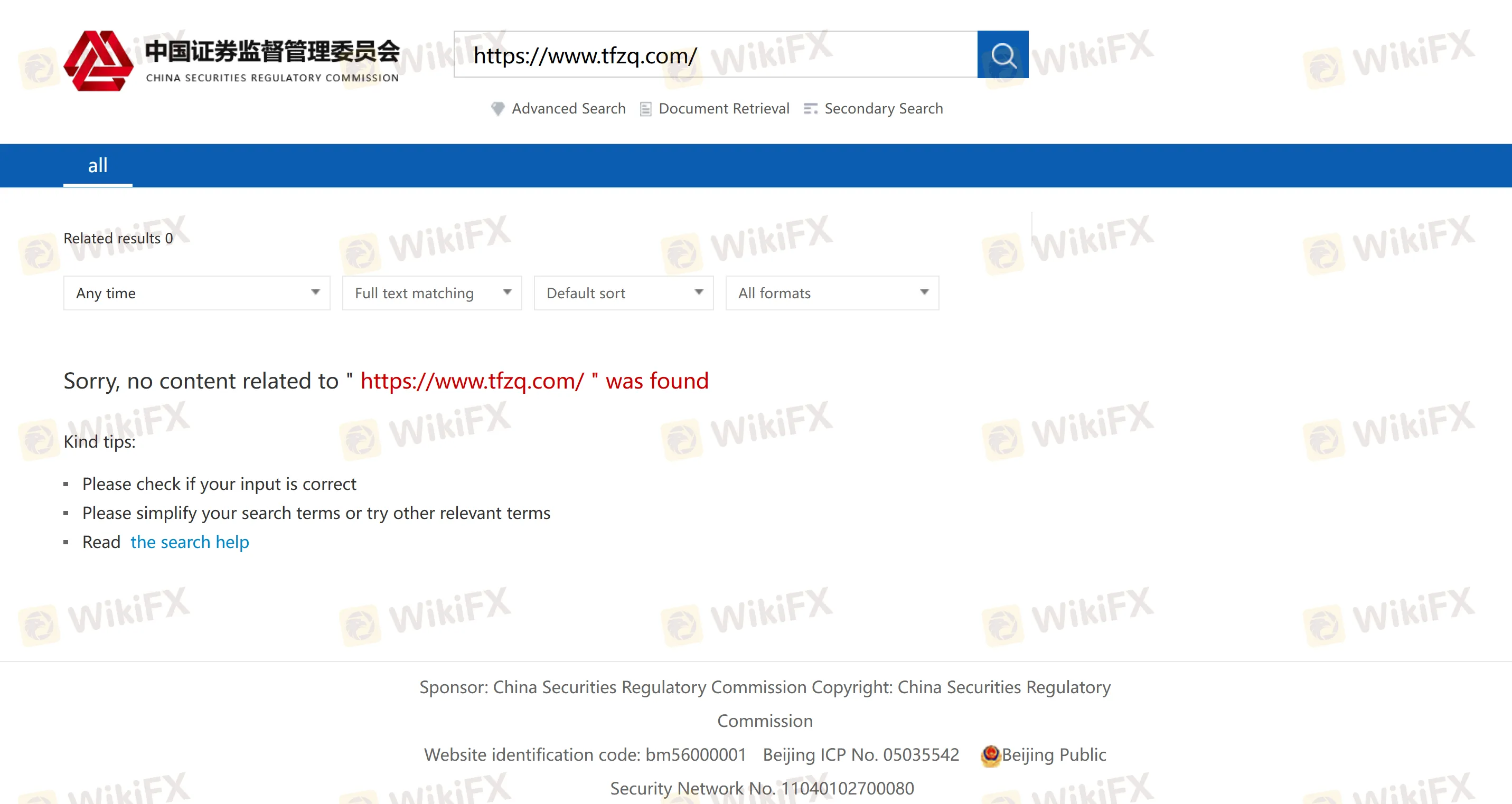

May mga pag-aalinlangan tungkol sa pagiging tunay ng TF SECURITIES. Ang kumpanya ay nakalista sa Shanghai Stock Exchange. Bagaman sinasabing natutugunan ng kumpanyang pangseguridad ang mahigpit na mga kinakailangan sa paglilista at sinusubaybayan ng China Securities Regulatory Commission (CSRC) at iba pang mga awtoridad sa regulasyon, walang kaugnayang impormasyon na matatagpuan sa opisyal na website ng CSRC.

Ano ang mga Serbisyo na ibinibigay ng TF SECURITIES?

Nagbibigay ang TF SECURITIES ng iba't ibang mga serbisyo, kasama ang mga serbisyong pananaliksik, investment banking, pangangasiwa ng kayamanan, pangangasiwa ng asset, negosyo sa labas ng bansa, sariling pagkalakal, pribadong equity at venture capital, alternatibong investment, at serbisyo sa futures.

Paano Magbukas ng Account?

Pinapayagan ng TF SECURITIES ang pagbubukas ng account sa pamamagitan ng mobile phone. Maaari kang kumuha ng mga litrato ng iyong ID card gamit ang iyong mobile phone o dumaan sa video verification. Ang mga litrato ng ID card ay awtomatikong mababasa, at maaaring gawin ito sa ilalim ng isang Wi-Fi o 4G network.