회사 소개

| TF SECURITIES 리뷰 요약 | |

| 설립일 | 2003-11-19 |

| 등록 국가/지역 | 중국 |

| 규제 | 규제되지 않음 |

| 서비스 및 제품 | 리서치 서비스, 투자은행, 자산관리, 해외사업, 자체거래, 사모투자, 대체투자, 선물 |

| 고객 지원 | 95391; 400-800-5000 |

| 온라인 채팅 | |

TF SECURITIES 정보

TF SECURITIES은 2000년에 설립되었으며 본사는 후베이성 우한에 위치해 있습니다. 종합 금융 기관으로 다양하고 독특한 서비스 시스템을 제공합니다.

주식의 초기 공개, 사모 투자, 기업 채권, 기업 채권, 주요 자산 인수와 같은 전통적인 프로젝트뿐만 아니라 중소기업을 위한 사모 채권, 자산 유동화, 우선주와 같은 혁신적인 사업을 포함한 다양한 기업에 자본 조달, 합병 및 인수, 리스처럼 다양한 금융 자문 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 다양한 사업 범위 | 규제되지 않음 |

| 정부 관련 배경 | 강한 시장 경쟁 |

TF SECURITIES의 신뢰성

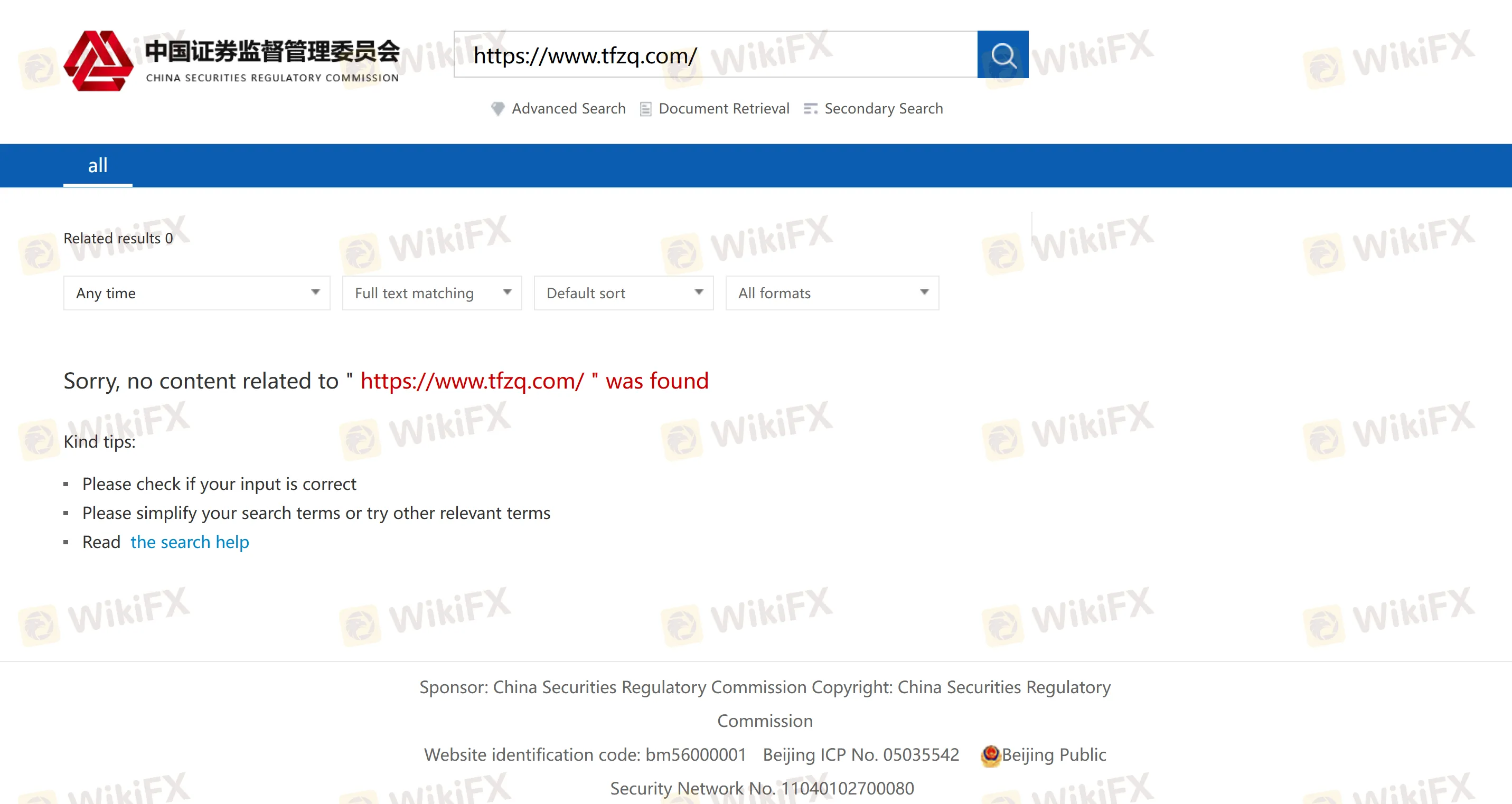

TF SECURITIES의 신뢰성에 대한 의문이 제기되고 있습니다. 이 회사는 상하이증권거래소에 상장되어 있습니다. 증권 회사는 엄격한 상장 요건을 충족하고 중국증권감독위원회(CSRC) 및 기타 규제 기관의 감독을 받는다고 주장하지만, CSRC의 공식 웹사이트에서 관련 정보를 찾을 수 없습니다.

TF SECURITIES이 어떤 서비스를 제공하나요?

TF SECURITIES은 리서치 서비스, 투자은행, 자산관리, 해외사업, 자체거래, 사모투자, 대체투자, 선물 사업 등 다양한 서비스를 제공합니다.

TF SECURITIES 계좌 개설 방법

TF SECURITIES은 휴대폰 계좌 개설을 허용합니다. 휴대폰으로 신분증 사진을 찍거나 영상 인증을 거칠 수 있습니다. 신분증 사진은 자동으로 읽히며, Wi-Fi 또는 4G 네트워크에서 진행할 수 있습니다.