Ahmed Harb

1-2年

Does TF SECURITIES charge any undisclosed fees when making deposits or withdrawals?

In my assessment of TF SECURITIES, one of the first things I look for as an experienced trader is transparency, especially when it comes to fees on deposits and withdrawals. According to the available information, I did not find any explicit disclosure or clarification regarding potential hidden fees for these transactions. This lack of clear information immediately raises some caution for me. From experience, well-regulated brokerages typically outline such details explicitly, both for legal compliance and to ensure client trust.

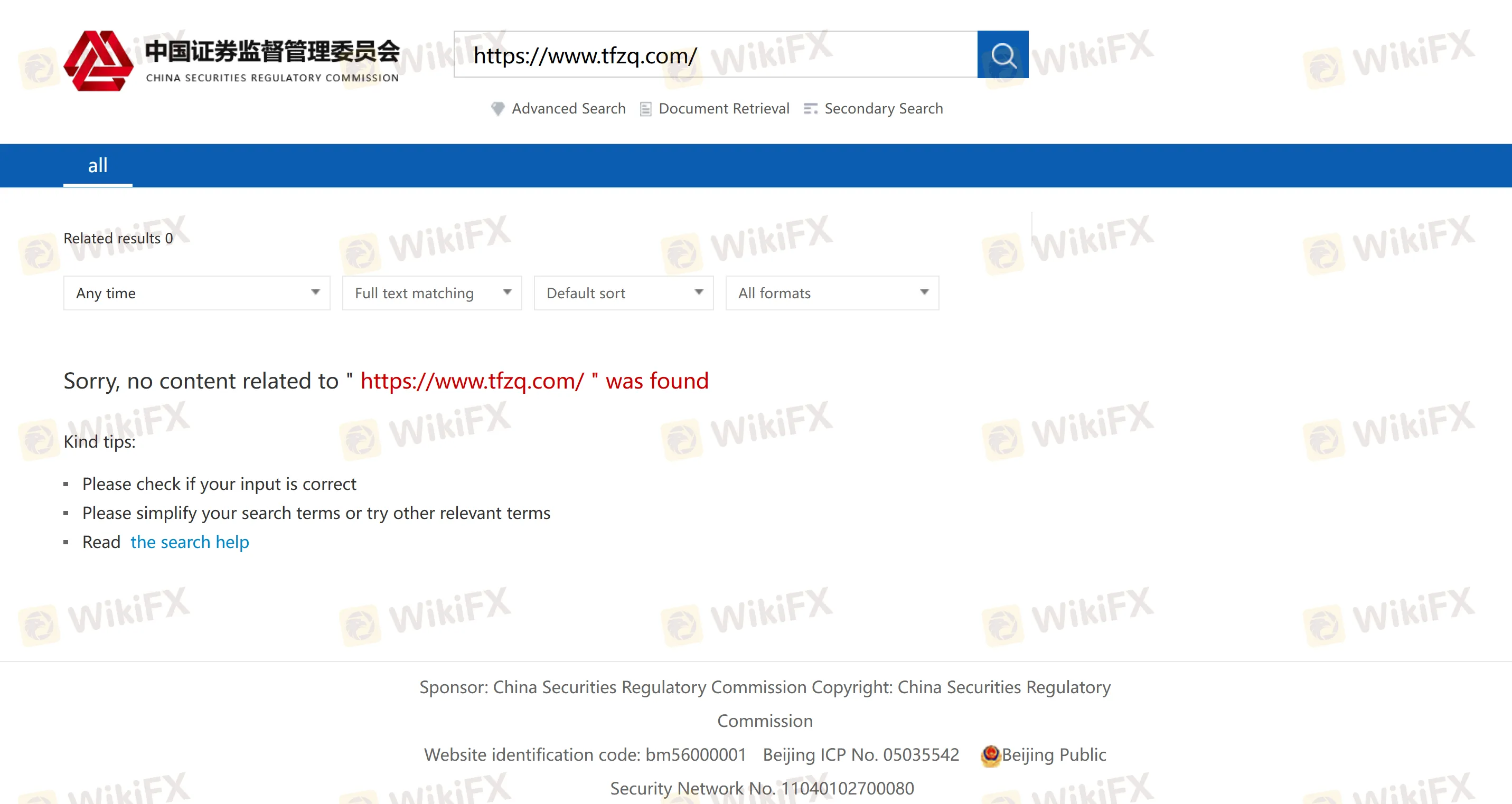

It's also important to note that TF SECURITIES currently operates without a valid regulatory license, despite being listed on the Shanghai Stock Exchange and reputedly overseen by the CSRC. This unregulated status means the usual external safeguards against sudden or unfair fee changes are not in place. Without regulation and open fee schedules, there is a higher risk that traders could encounter unexpected charges.

Personally, unless a broker provides full transparency regarding any and all fees, particularly those related to funding or withdrawals, I would remain very cautious. In my own trading, I only proceed with brokers when I’m completely confident about their fee structure, since unexpected costs can erode trading profitability and trust. Therefore, for me, the absence of clear information about deposit and withdrawal fees at TF SECURITIES is a significant concern, and something I would want resolved before considering them for any meaningful trading activity.

Broker Issues

Fees and Spreads

Elio Matacena

1-2年

Does TF SECURITIES offer fixed or variable spreads, and how are these typically affected during periods of high market volatility or major news events?

Based on my experience as an independent trader and after closely analyzing all available information about TF SECURITIES, I have to clarify that there is no accessible or transparent detail regarding whether this broker offers fixed or variable spreads on their platform. This is an important consideration for me because understanding the nature of spreads—whether they are fixed, variable, or how they might fluctuate during high volatility events—is crucial for risk management and accurate cost assessment.

Given that TF SECURITIES operates without clear international regulatory oversight and the FAQ and public materials do not specify spread structures, I would personally approach this with additional caution. In my trading career, I've learned that unregulated brokers, especially those in highly competitive markets like China, sometimes do not provide the detailed trade condition disclosures that are standard in globally regulated environments. This omission can directly impact trading outcomes, especially during major news events or periods of high volatility, when spreads can widen dramatically and affect both entry and exit prices.

For me, absent concrete information, I cannot assume the spreads remain stable, especially in volatile markets. When transparency is limited, the potential for sudden cost increases is higher. Therefore, if tradability of major economic news or minimal slippage is a core part of your strategy, I would recommend conducting live demo tests or seeking more direct answers from official customer service before making any financial commitment. I always advocate erring on the side of caution when key cost factors remain opaque.

Broker Issues

Fees and Spreads

Prash_007

1-2年

Does TF SECURITIES charge a commission per lot on their ECN or raw spread accounts?

Based on my own review and experience researching TF SECURITIES, I could not find transparent or specific information about whether they charge a commission per lot on ECN or raw spread accounts. The platform offers a diverse range of financial services, including wealth management, investment banking, and proprietary trading, but it primarily appears to operate as a domestic securities broker rather than a forex/CFD broker with the typical ECN or raw spread structures I’m used to seeing. Importantly, I noticed TF SECURITIES is listed but unregulated internationally, and there’s no clear mention of account types like ECN that are standard in the forex industry. As a trader who prioritizes clear cost structures and safety, the lack of regulatory oversight and the absence of straightforward commission details on their official resources make me extremely cautious. In my trading journey, I’ve learned the importance of knowing exactly how and what I’ll be charged before opening an account with any broker. Therefore, unless TF SECURITIES publicly provides a clear commission schedule specifically for forex ECN or raw spread accounts, I would be hesitant to proceed with them for such purposes. For me, any ambiguity on fees or lack of regulatory transparency is a significant red flag.

Broker Issues

Fees and Spreads

Jezreel2

1-2年

Could you break down the total trading costs involved when trading indices such as the US100 on TF SECURITIES?

As an experienced trader, I approach any platform with a clear focus on cost transparency and regulatory standing, as these factors significantly impact my long-term profitability and risk exposure. With TF SECURITIES, I immediately noticed several points of concern in relation to total trading costs and overall trust.

First and foremost, TF SECURITIES currently operates without valid regulatory oversight. For me, this alone introduces a heightened risk that cannot be ignored, as unregulated platforms may not be fully transparent with their fee structures or client protections. Although the company is publicly listed and offers a wide range of financial services, there is still a lack of verifiable regulatory clarity, especially concerning detailed disclosures of contract specifications or commission schedules for indices like the US100.

Typically, when trading major indices, I pay attention to several cost components: spreads, potential commissions, overnight financing (swap) fees, and any platform-specific charges that may apply (for example, account maintenance or withdrawal fees). In regulated environments, these costs are broken down transparently. Unfortunately, with TF SECURITIES, I could not find specific, explicit details regarding their charges for trading the US100 or similar index CFDs.

Without comprehensive published data, I strongly recommend proceeding with extreme caution. Before considering any substantial trading activity here, I would insist on obtaining a full written outline of all trading costs directly from the broker and verifying their legitimacy via independent means. In my experience, insufficient transparency usually signals a higher risk of unexpected or excessive fees, which is a dealbreaker for prudent trading.

Broker Issues

Fees and Spreads