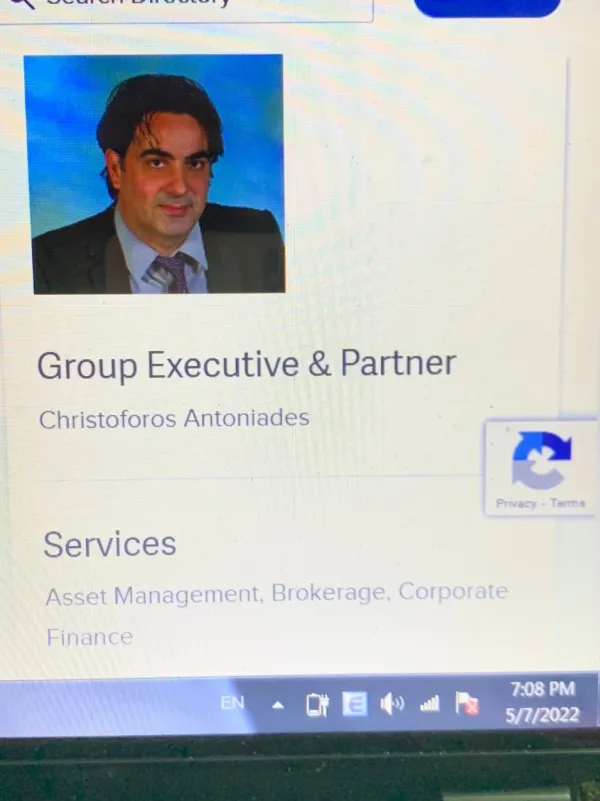

Buod ng kumpanya

| ARGUS Buod ng Pagsusuri | |

| Itinatag | 2000 |

| Nakarehistrong Bansa/Rehiyon | Cyprus |

| Regulasyon | Regulated by CYSEC |

| Mga Serbisyo | Asset Management, Global Brokerage, Investment Advice, Corporate Finance & Consulting |

| Platform ng Paggagalaw | ARGUS Trader, Argus Global |

| Suporta sa Customer | Tel: +357 22 717000 |

| Fax: +357 22 717070 | |

| Email: argus@argus.com.cy | |

| Address: 25 Demosthenis Severis Ave., 1st & 2nd Floor, 1080 Nicosia, Cyprus; P.O. Box 24863, 1304 Nicosia, Cyprus. | |

Impormasyon Tungkol sa ARGUS

Itinatag noong 2000, nag-aalok ang ARGUS ng mga serbisyong pinansyal kabilang ang asset management, global brokerage, investment advice, corporate finance at consulting.

Ang magandang bagay ay ang kumpanya ay mahusay na regulado ng CYSEC, na nangangahulugang ang mga aktibidad nito sa pinansya ay mahigpit na binabantayan ng ahensiyang ito, sa ilang aspeto ay nagbibigay ng tiyak na antas ng proteksyon sa customer.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Maraming taon ng karanasan sa industriya | / |

| CYSEC regulated | |

| Iba't ibang serbisyong pinansyal na inaalok | |

| Maraming paraan ng pakikipag-ugnayan |

Tunay ba ang ARGUS?

Ang ARGUS ay kasalukuyang mahusay na regulado ng CYSEC (Cyprus Securities and Exchange Commission) na may lisensiyang 010/03. Ang regulasyon ay awtorisado sa 17 iba pang mga bansa, na nagpapalawak ng iyong kumpiyansa sa pakikipagkalakalan sa kumpanyang ito.

| Regulated Country | Regulator | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| CYSEC | Regulated | Argus Stockbrokers Ltd | Straight Through Processing (STP) | 010/03 |

Mga Serbisyo ng ARGUS

Nag-aalok ang Argus ng isang kumpletong hanay ng mga serbisyong pinansiyal, kabilang ang independiyenteng pamamahala ng ari-arian, global trading brokerage sa pamamagitan ng ARGUS Global Trader Platform, lisensyadong brokerage sa Cyprus at Athens Stock Exchanges, corporate finance solutions para sa IPOs at M&A, discretionary fund management, at tailored investment advisory sa iba't ibang uri ng asset tulad ng equities, bonds, at alternatives.

Plataforma ng Trading

Ang Argus Stockbrokers Ltd ay nag-aalok ng dalawang platform ng trading:

- ARGUS Trader: Para sa trading sa Cyprus at Athens Stock Exchanges (CSE & ASE) na may full electronic order execution. Ang mga investors ay maaaring mag-trade online o tumawag sa +357 22 717000.

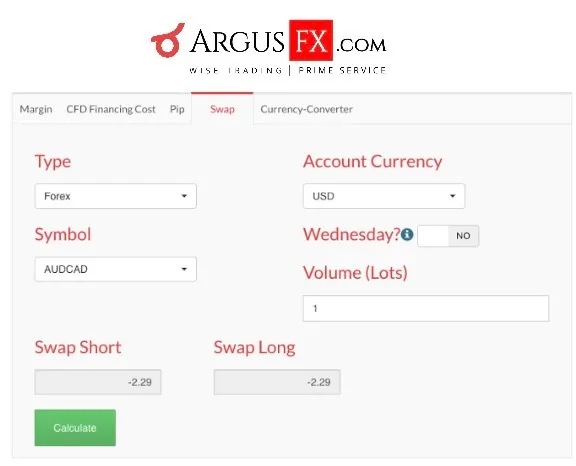

- Argus Global Trader: Pinapatakbo ng Saxo, ang platform na ito ay nagbibigay ng access sa global markets, kabilang ang forex, stocks, at commodities. Ito ay available online at via desktop, mayroong trial account option.

FX2392855517

Vietnam

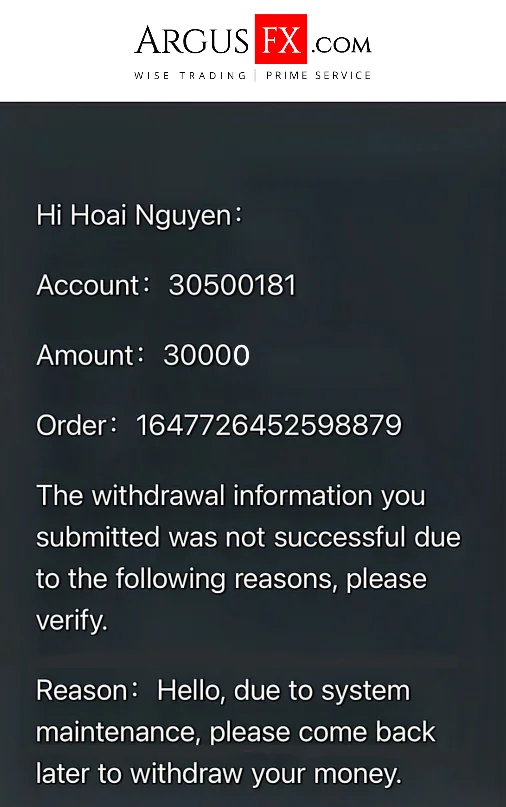

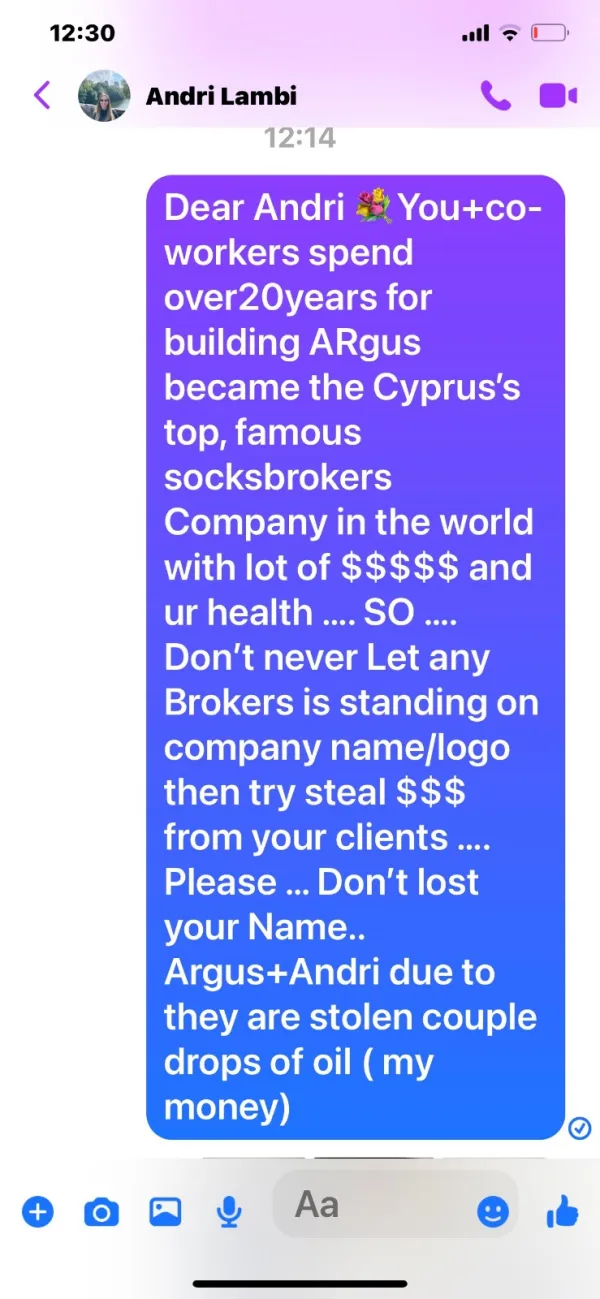

Ngayon ay Mayo, ika-27,2022 ... ang Lupon ng mga Direktor ay hindi Blinders ni mga Bingi .....[Dalawang linggo pa Mayo 19 ****Isa pang Buwan] para sa paghihintay ng aking pera pabalik , MAlungkot... MAY5th,2022Digmaan naging pinakamasama. I dont push U ..Dear ARGUS COMPANY .. Today is April4,2022.. The war may made YOU really busy .. But I have to remind YOU TRY to Payback all my money as fast as like You PUSH me deposit Salamat .. .... …BEST WISHES TO ARGUS STOCKSBROKERS ( AnDri Tringidou & CHRISTOS AKKELIDES ) at HAPPY BD My Love DẠ THẢO PHƯƠNG .. Proud of people of Cyprus .. BE STRONGER ..APRIL20.2022st-2 April 2022 ( WHERE's Christoforos ANTONIADES -Executor )???? SINO ANG SAGOT SA LAHAT NG AKING MGA TANONG NA ITO ... na inireklamo ko mula sa araw na pagharang ng kumpanya at hindi binabayaran ang lahat ng aking pera na mayroon ako sa ARGUS StocksBrokers LTD ACCOUNT ... MANGYARING HUWAG MANGYARING NAWALA ANG AKING MGA TANONG O IBIGAY SILA. UR GARBAGE CANS ...HINTAYIN ANG MGA SAGOT NG LUPON NG MGA DIRECTOR NI ARGUS …Wala pa ring sagot si ARGUS pagkatapos mang-scam... Kaya naisip kong sinubukan nilang ninakawan/nakawan lahat ng pera ko.

Paglalahad

FX3071480497

Estados Unidos

Ako ay kabilang sa mga biktima ng pamamaraang ito, na ginabayan upang mamuhunan sa argus ng isang babaeng taiwan na romantikong nilinlang ako at nagturo sa akin sa proseso ng pangangalakal at pamumuhunan. Sa loob ng panahong ito natuklasan ko ang fintrack .org at nagreklamo dahil hindi pinapayagan ni Argus ang pag-withdraw, ibinalik nila ang aking access sa pag-withdraw sa loob ng ilang linggo

Paglalahad

Misshomeland22

Vietnam

ARGUS HUWAG MAG-REPLY /SAGUTIN ANG LAHAT NG AKING MGA REPORT AT CLAIM SA WEB SITE ARGUS STOCKS BROKERS LTD

Paglalahad

FX1465373339

Vietnam

Hilingin sa kumpanya na i-refund

Paglalahad

FX2392855517

Vietnam

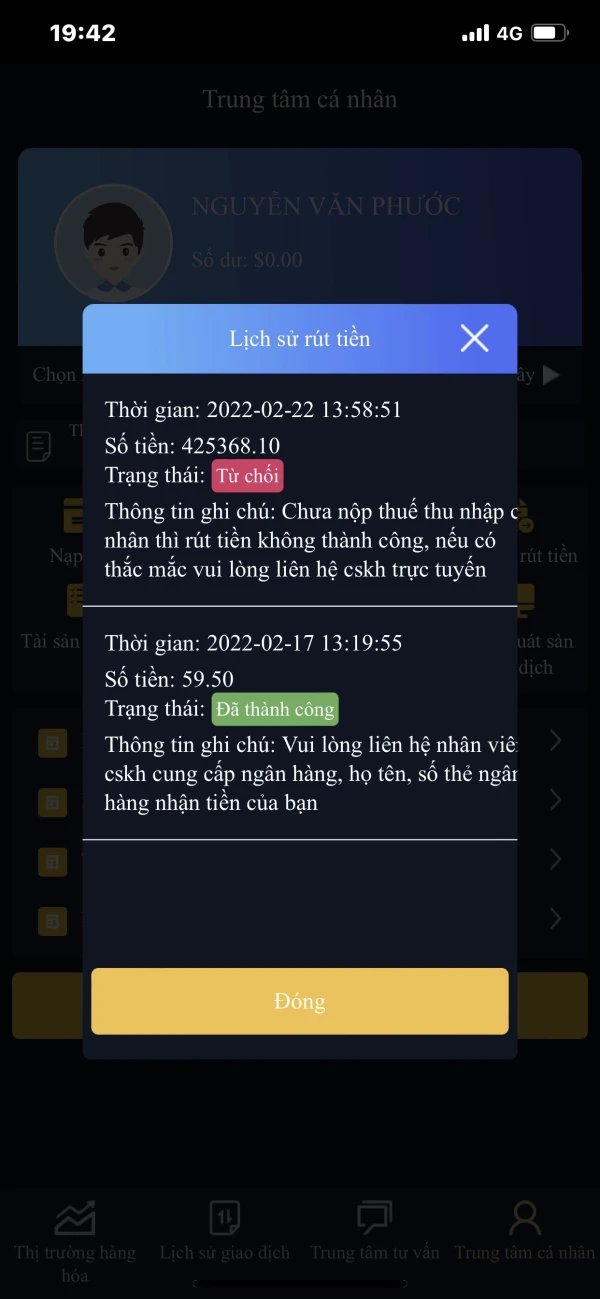

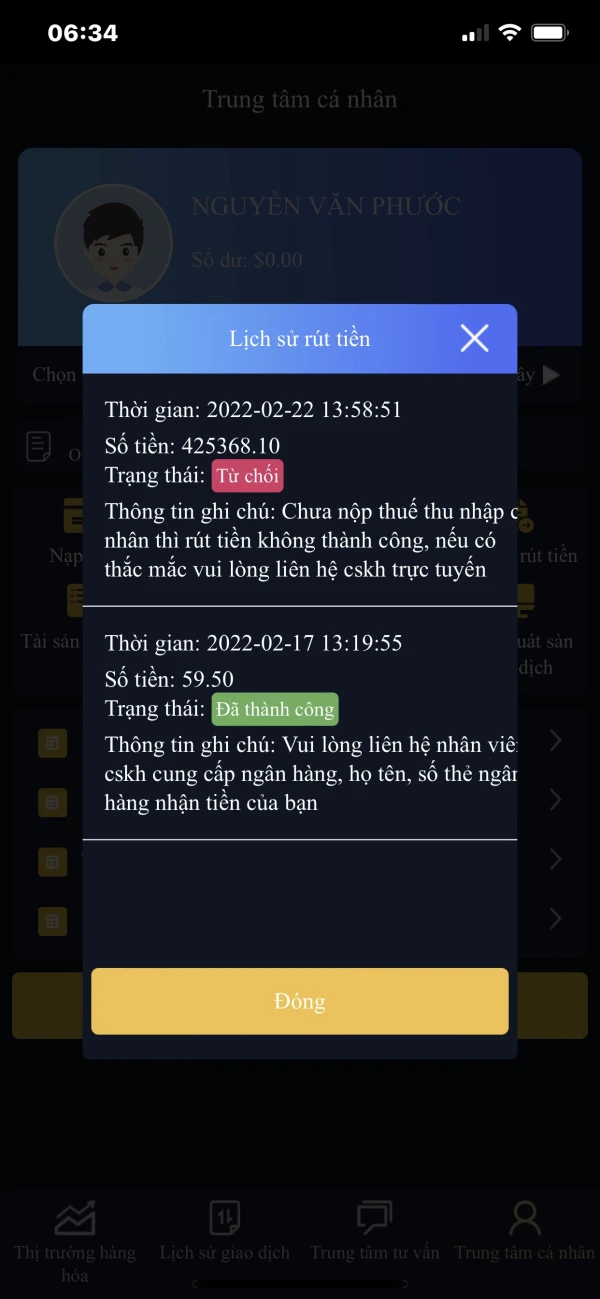

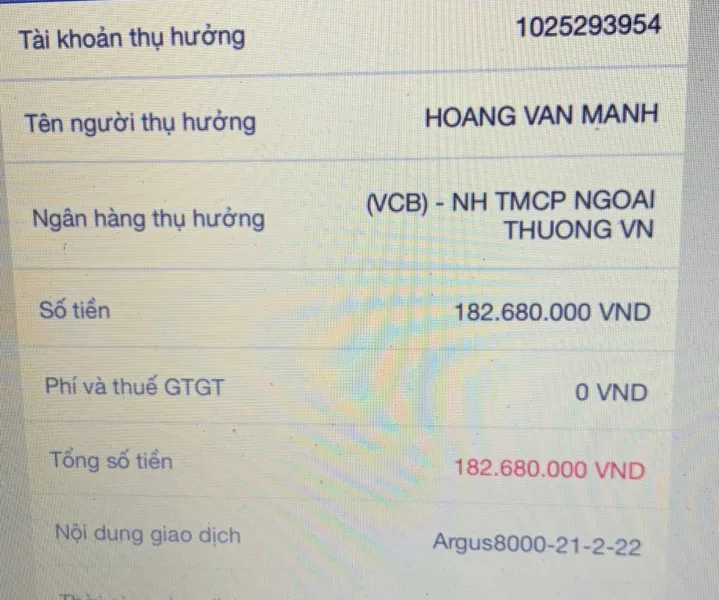

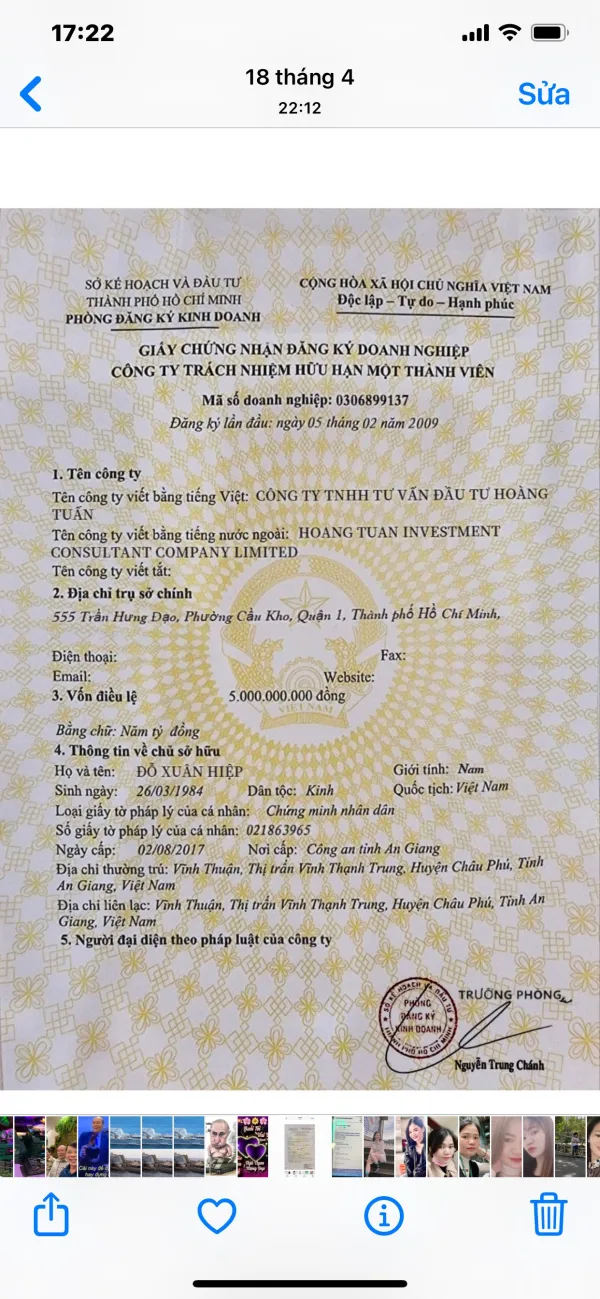

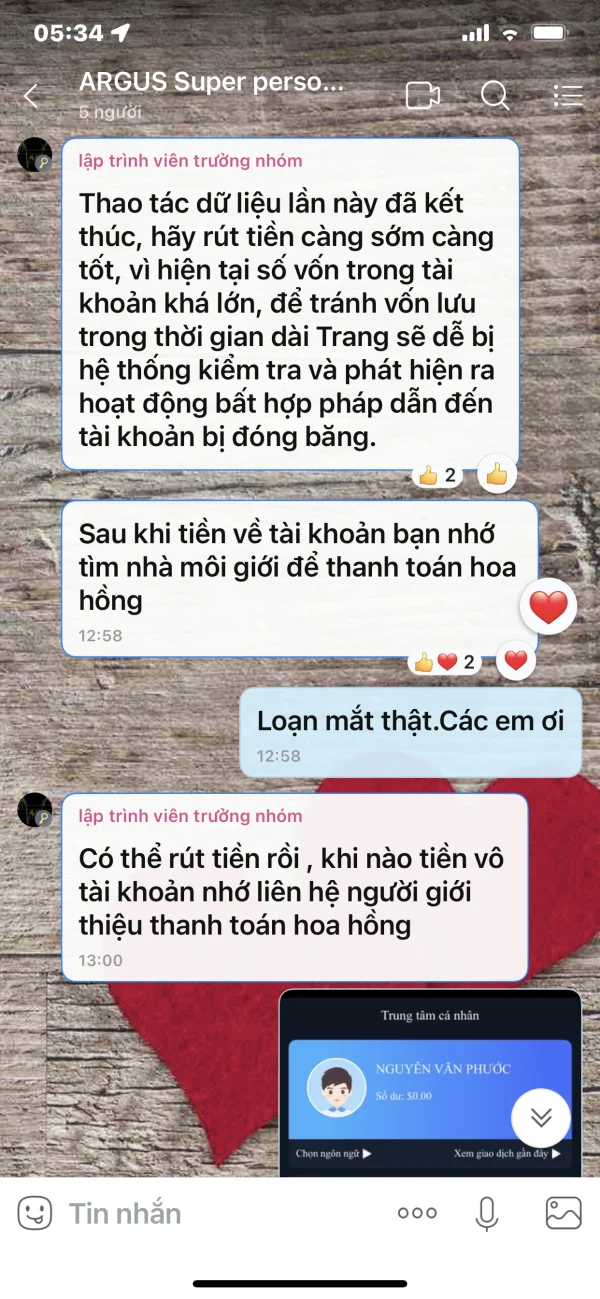

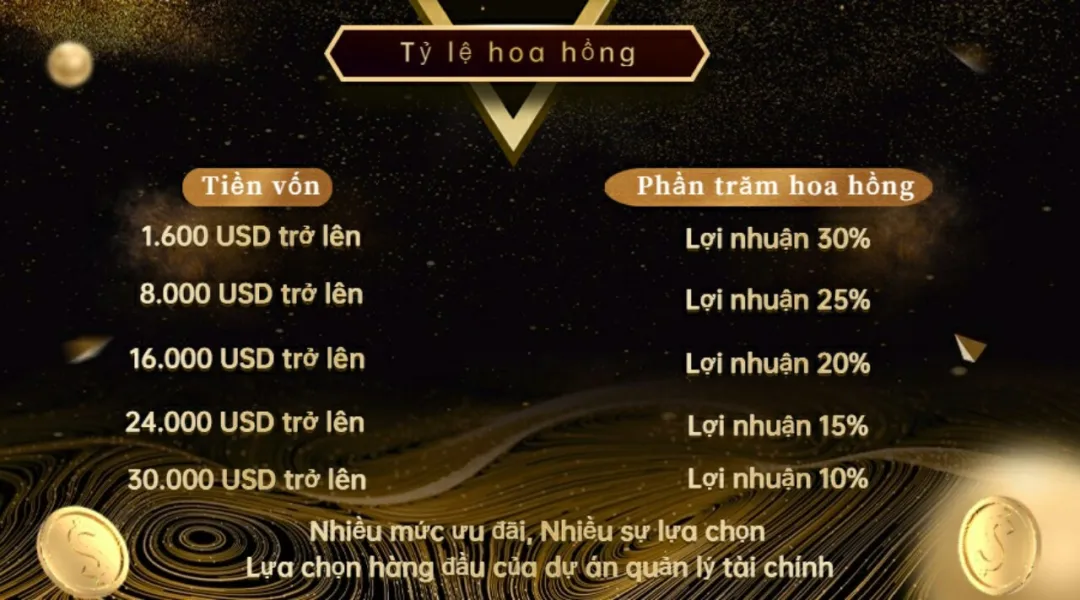

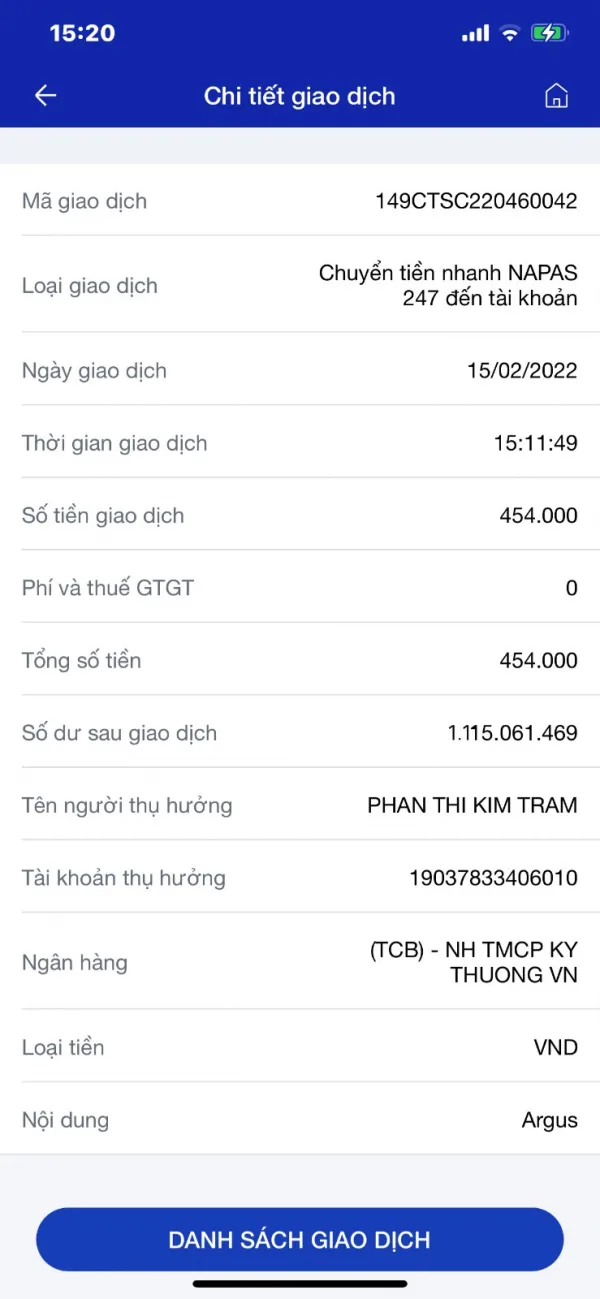

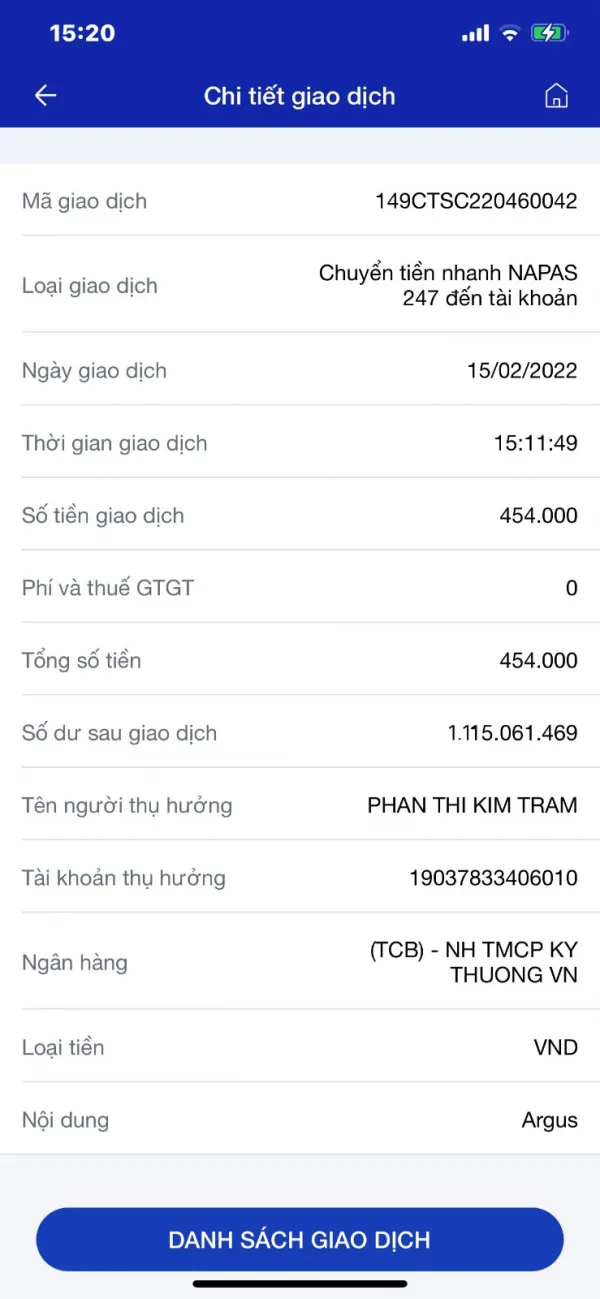

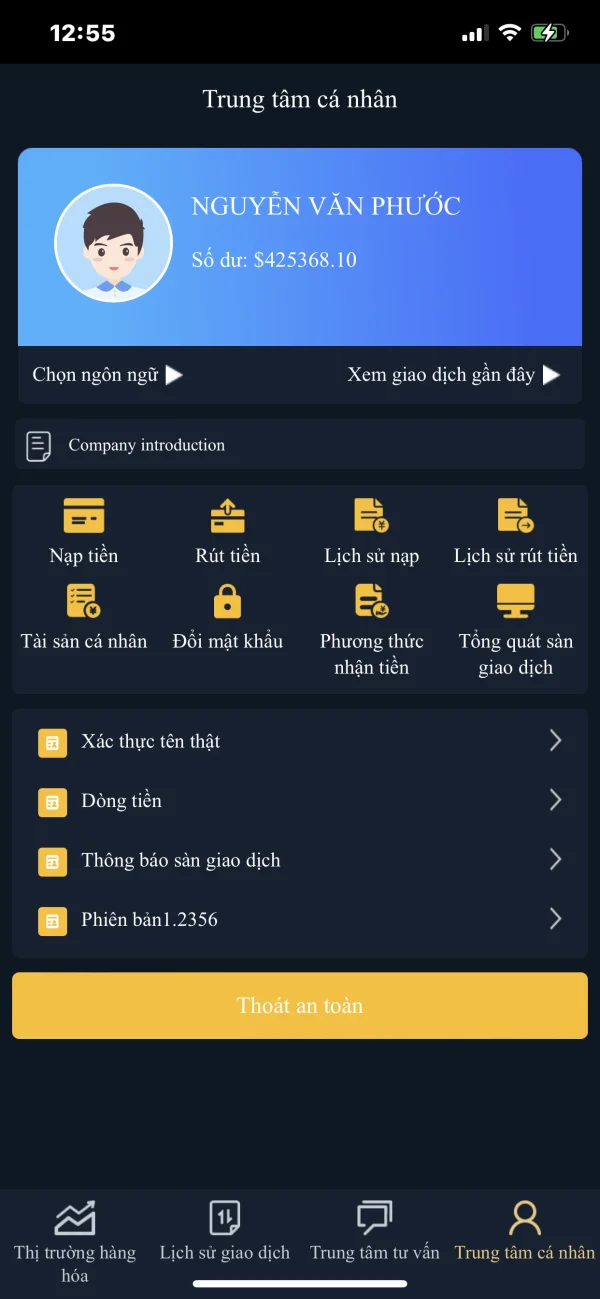

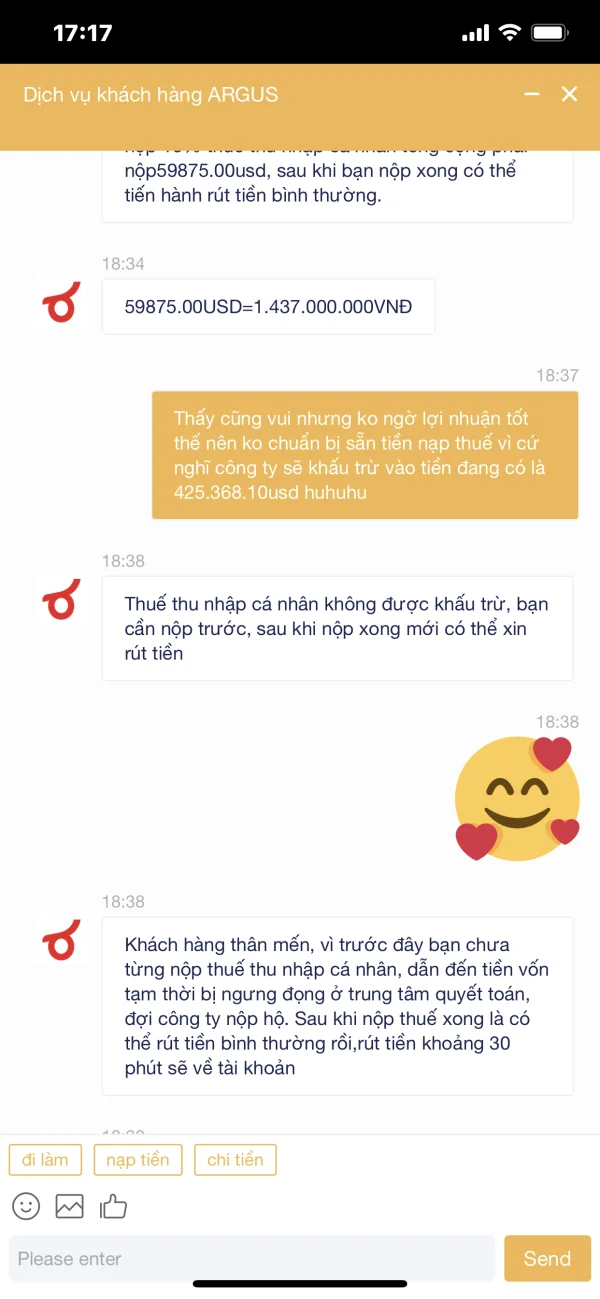

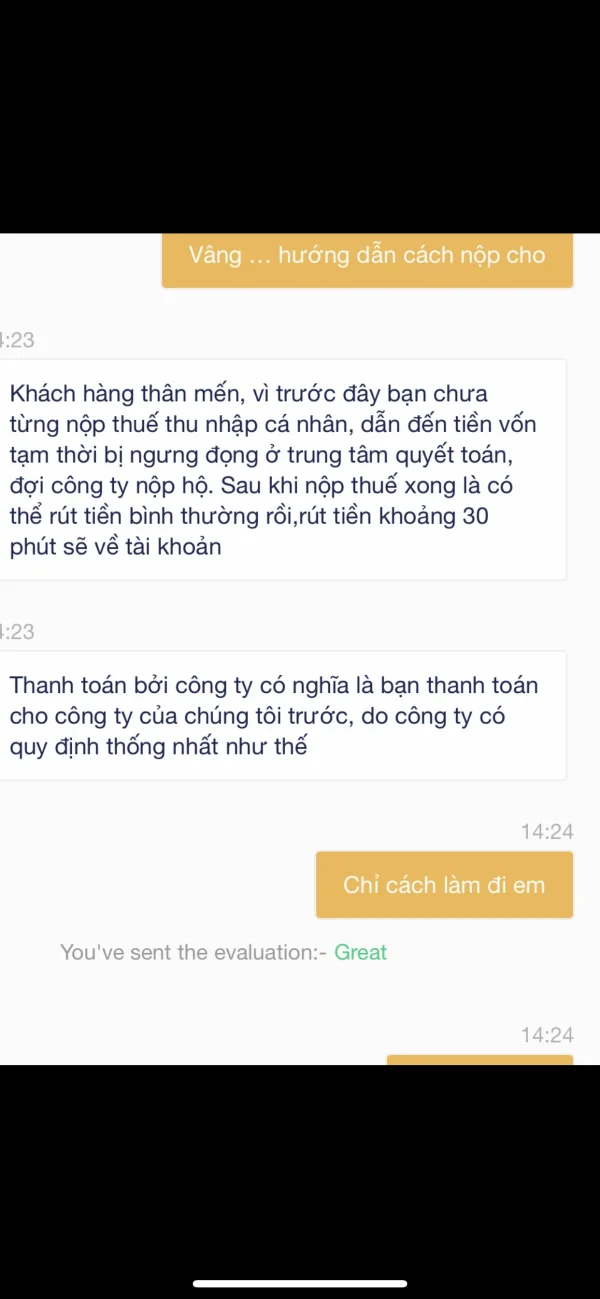

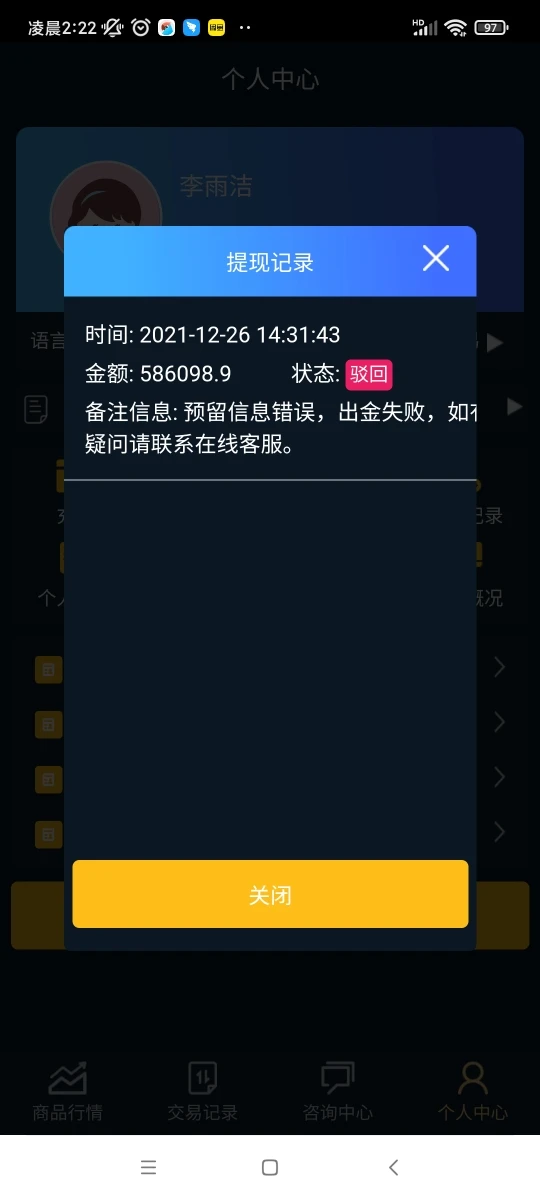

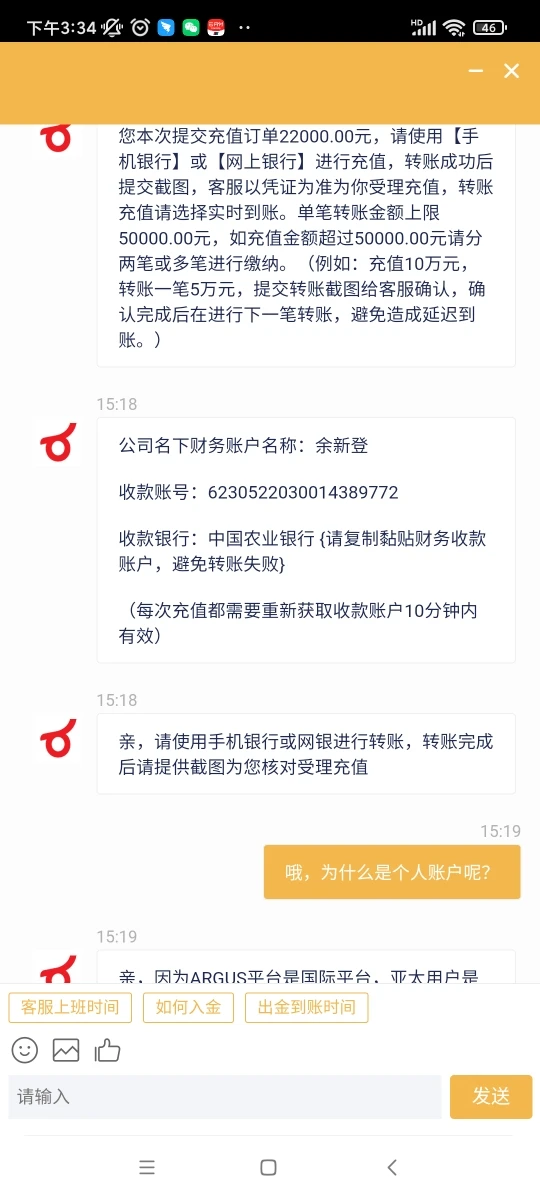

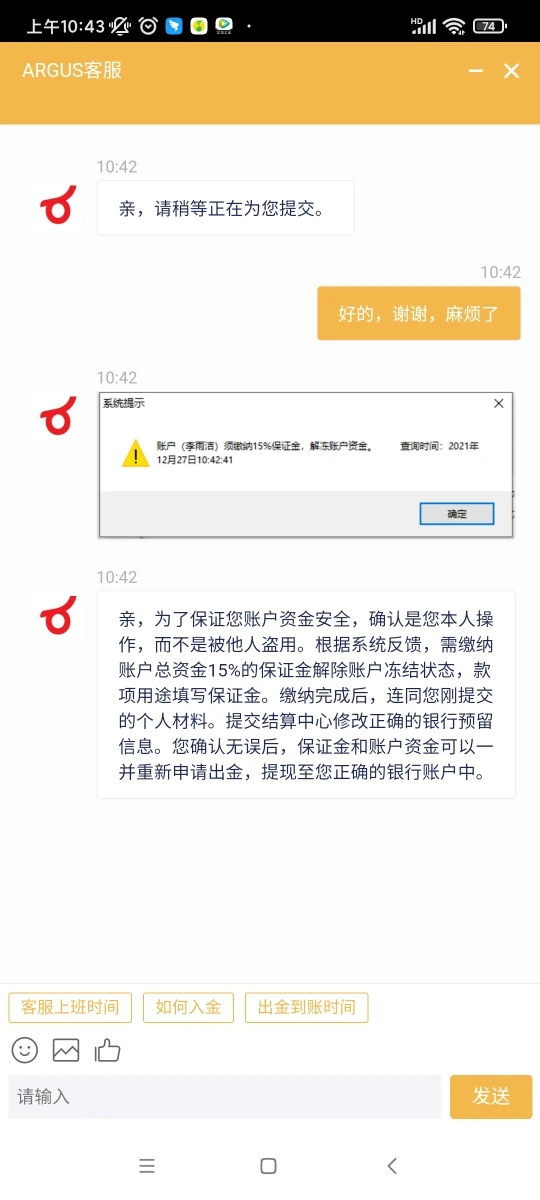

ayon sa imbitasyon ng broker ng <invalid Value> Compny, humiram ako ng $32000 para mamuhunan <invalid Value> .. buti na lang may tubo ako na $399168.10 plus capital is $425368.10 ,,, ito ang kasalukuyang account sa aking account. after the brokerage transaction, nt told me to withdraw agad, or not so long, the system will report an error and will lock the account (??) after following the withdrawal instructions, htt reported done kasi hindi pa. magdeposito ng 15% personal income tax (????) brokerage system nt deposit 15% tax $usd 59,875.00 katumbas ng 1 bilyon 437,000,000 sa personal na account o hiwalay na account ng kumpanya ng broker bago ang exotic sa halip... <invalid Value> hindi ginawa yun ng sikat na stocks company... now i'm calling .. asking <invalid Value> interes ng kumpanya o direktang i-refund ang buong halaga na mayroon ako sa isang account

Paglalahad

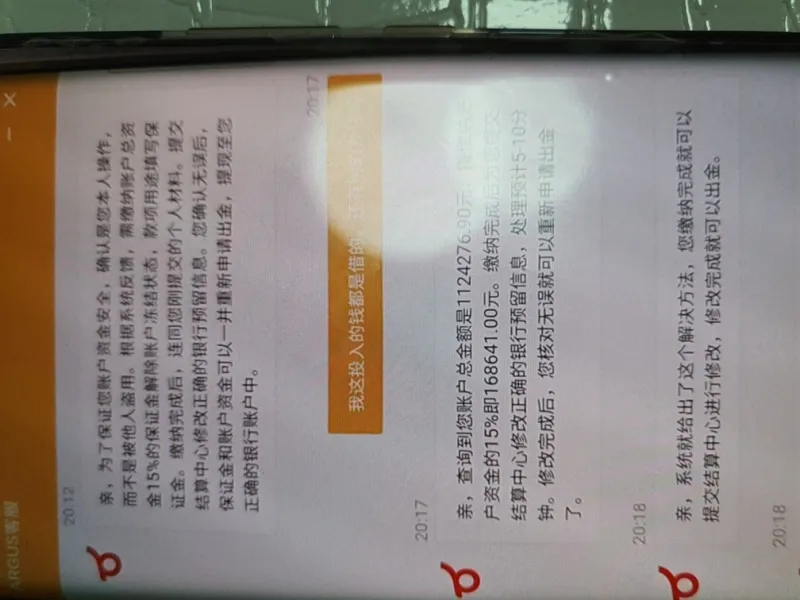

上善若水86692

Hong Kong

Platform ng pandaraya, romance scam, pagbabago ng impormasyon ng customer at numero ng card para sa withdrawal. Tinitingnan ko ang numero ng card nang tatlong beses upang matiyak na tama ito, ngunit nagbago ito habang nag-withdraw. Pagkatapos, hinihiling nila sa iyo na bayaran ang margin at i-freeze ang pondo para hindi ka makapag-withdraw. bitag!

Paglalahad

FX2268019297

Hong Kong

Nangangailangan ng 15% na margin dahil sa maling numero ng card. Kung hindi, hindi nila aalisin at i-lock ang account.

Paglalahad

FX2268019297

Hong Kong

Hindi sila nag-withdraw dahil sa maling numero ng bank card at humihingi ng 15% na margin

Paglalahad