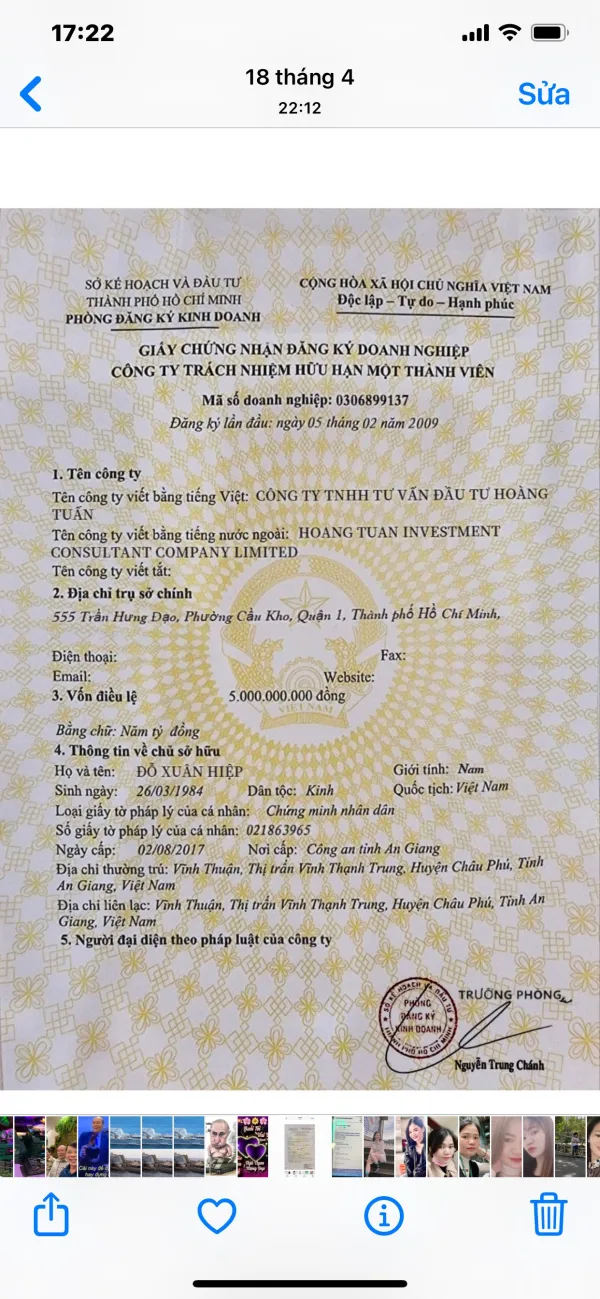

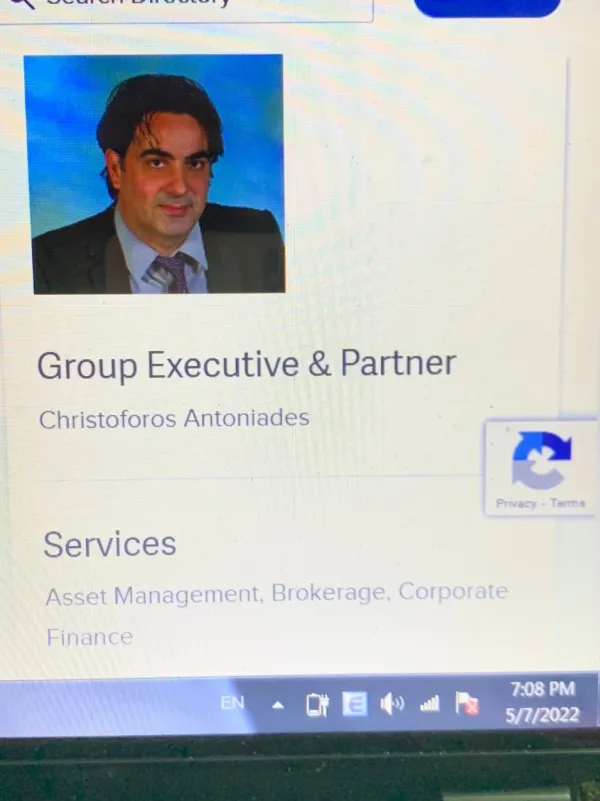

Profil perusahaan

| ARGUS Ringkasan Ulasan | |

| Didirikan | 2000 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | Diatur oleh CYSEC |

| Layanan | Manajemen Aset, Brokerage Global, Saran Investasi, Keuangan Korporat & Konsultasi |

| Platform Perdagangan | ARGUS Trader, Argus Global |

| Dukungan Pelanggan | Tel: +357 22 717000 |

| Fax: +357 22 717070 | |

| Email: argus@argus.com.cy | |

| Alamat: 25 Demosthenis Severis Ave., Lantai 1 & 2, 1080 Nicosia, Siprus; P.O. Box 24863, 1304 Nicosia, Siprus. | |

Informasi ARGUS

Didirikan pada tahun 2000, ARGUS menawarkan layanan keuangan termasuk manajemen aset, brokerage global, saran investasi, keuangan korporat, dan konsultasi.

Hal baiknya adalah perusahaan ini diatur dengan baik oleh CYSEC, yang berarti aktivitas keuangannya secara ketat dipantau oleh otoritas, sampai batas tertentu menjamin tingkat perlindungan pelanggan tertentu.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Banyak pengalaman bertahun-tahun dalam industri | / |

| Diatur oleh CYSEC | |

| Berbagai layanan keuangan ditawarkan | |

| Beragam saluran kontak |

Apakah ARGUS Legal?

ARGUS saat ini diatur dengan baik oleh CYSEC (Cyprus Securities and Exchange Commission) dengan nomor lisensi 010/03. Regulasi ini diotorisasi di 17 negara lain, yang meningkatkan keyakinan Anda untuk bertransaksi dengan perusahaan ini.

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| CYSEC | Diatur | Argus Stockbrokers Ltd | Pemrosesan Langsung (STP) | 010/03 |

Layanan ARGUS

Argus menawarkan berbagai layanan keuangan yang komprehensif, termasuk manajemen aset independen, pialang perdagangan global melalui Platform Pedagang Global ARGUS, pialang berlisensi di Bursa Saham Siprus dan Athena, solusi keuangan korporat untuk IPO dan M&A, manajemen dana diskresioner, dan penasihat investasi yang disesuaikan di berbagai kelas aset seperti ekuitas, obligasi, dan alternatif.

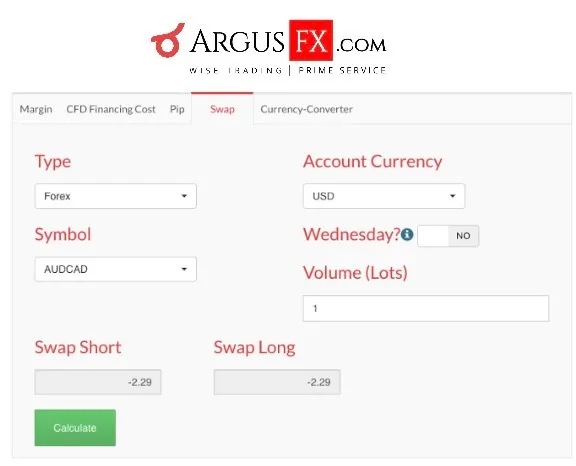

Platform Perdagangan

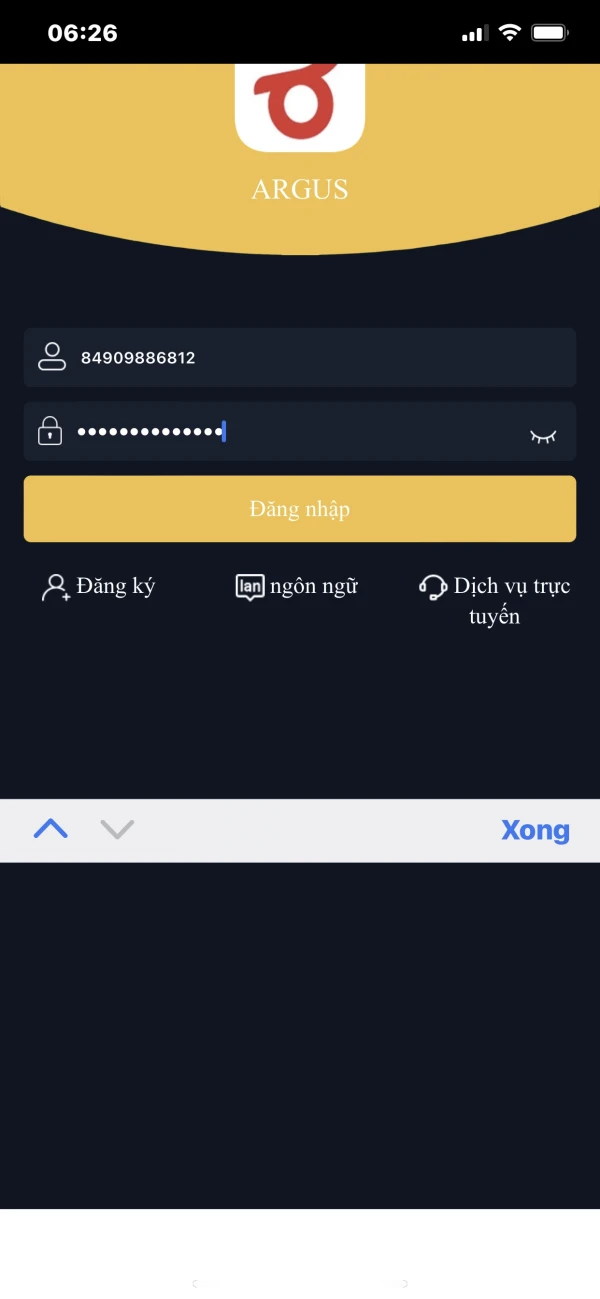

Argus Stockbrokers Ltd menawarkan dua platform perdagangan:

- Pedagang ARGUS: Untuk perdagangan di Bursa Saham Siprus dan Athena (CSE & ASE) dengan eksekusi pesanan elektronik penuh. Investor dapat bertransaksi secara online atau dengan menelepon +357 22 717000.

- Pedagang Global Argus: Didukung oleh Saxo, platform ini memberikan akses ke pasar global, termasuk forex, saham, dan komoditas. Tersedia secara online dan via desktop, dengan opsi akun percobaan.

FX2392855517

Vietnam

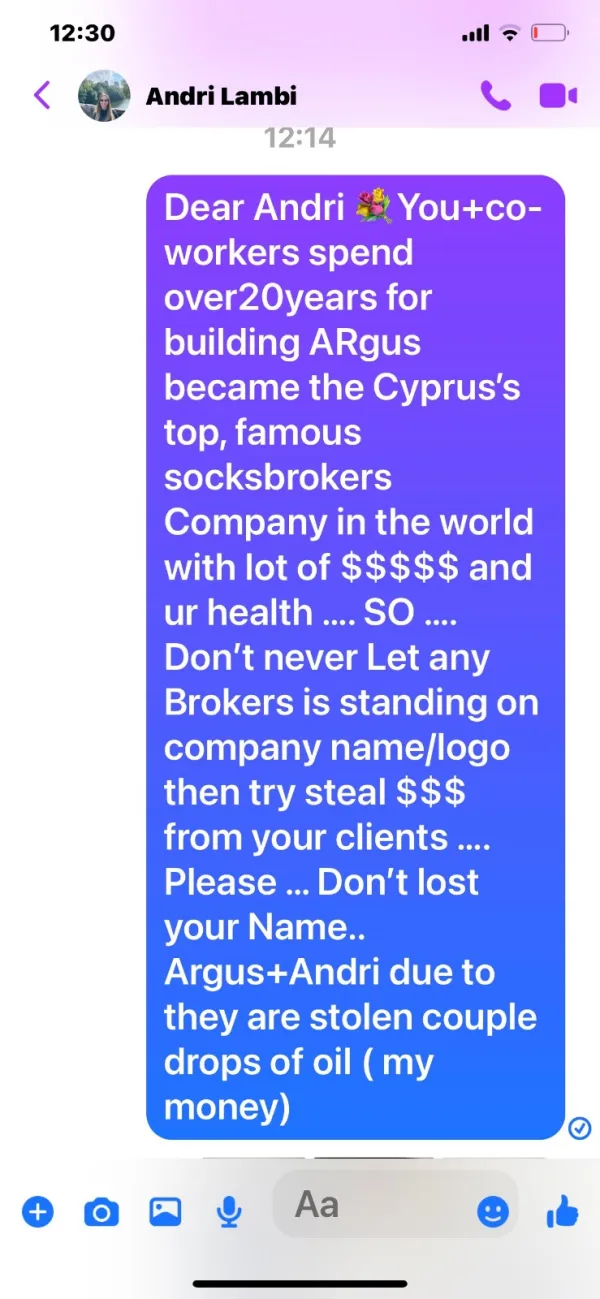

Hari ini tanggal 27 Mei 2022 ... Direksi tidak Buta juga orang Tuli ... [Dua minggu lagi 19 Mei **** Satu Bulan lagi] untuk menunggu uang saya kembali , SAD... 5 MAY, 2022Perang pergi terburuk. Saya tidak mendorong Anda ..Perusahaan ARGUS yang terhormat ..Hari ini adalah 4 April 2022.. Perang mungkin membuat ANDA benar-benar sibuk ..Tapi saya harus mengingatkan ANDA MENCOBA untuk Mengembalikan semua uang saya secepat Anda PUSH saya deposit Terima kasih .. .... …HARAPAN TERBAIK UNTUK ARGUS STOCKSBROKERS ( Andri Tringidou & CHRISTOS AKKELDES ) dan HAPPY BD My Love DẠ THẢO PHƯƠNG .. Bangga dengan orang-orang Siprus .. LEBIH KUAT ..APRIL20.2022 HARI INI 21 April-2022 .... ( MANA Christoforos ANTONIADES -Pelaksana )???? SIAPA YANG AKAN MENJAWAB SEMUA PERTANYAAN SAYA INI ... yang saya keluhkan sejak hari perusahaan memblokir dan tidak membayar kembali semua uang saya yang saya miliki di AKUN ARGUS StocksBrokers LTD ... TOLONG JANGAN BIARKAN PERTANYAAN SAYA HILANG DENGAN ANGIN ATAU DIBUAT MEREKA TUNGGAL SAMPAH ...TUNGGU JAWABAN DIREKSI ARGUS ...ARGUS masih tidak ada jawaban setelah scamming ... Jadi saya pikir mereka mencoba merampok / mencuri semua uang saya

Paparan

FX3071480497

Amerika Serikat

Saya termasuk di antara korban skema ini, dibimbing untuk berinvestasi di argus oleh seorang wanita taiwan yang secara romantis menipu saya dan mengajari saya melalui proses perdagangan dan investasi. Dalam periode ini saya menemukan fintrack .org dan mengajukan keluhan karena Argus tidak mengizinkan penarikan, mereka memulihkan akses penarikan saya dalam beberapa minggu

Paparan

Misshomeland22

Vietnam

ARGUS JANGAN BAWAH /JAWAB SEMUA LAPORAN DAN KLAIM SAYA PADA SITUS WEB ARGUS STOCKS BROKERS LTD

Paparan

FX1465373339

Vietnam

Minta perusahaan untuk mengembalikan uang

Paparan

FX2392855517

Vietnam

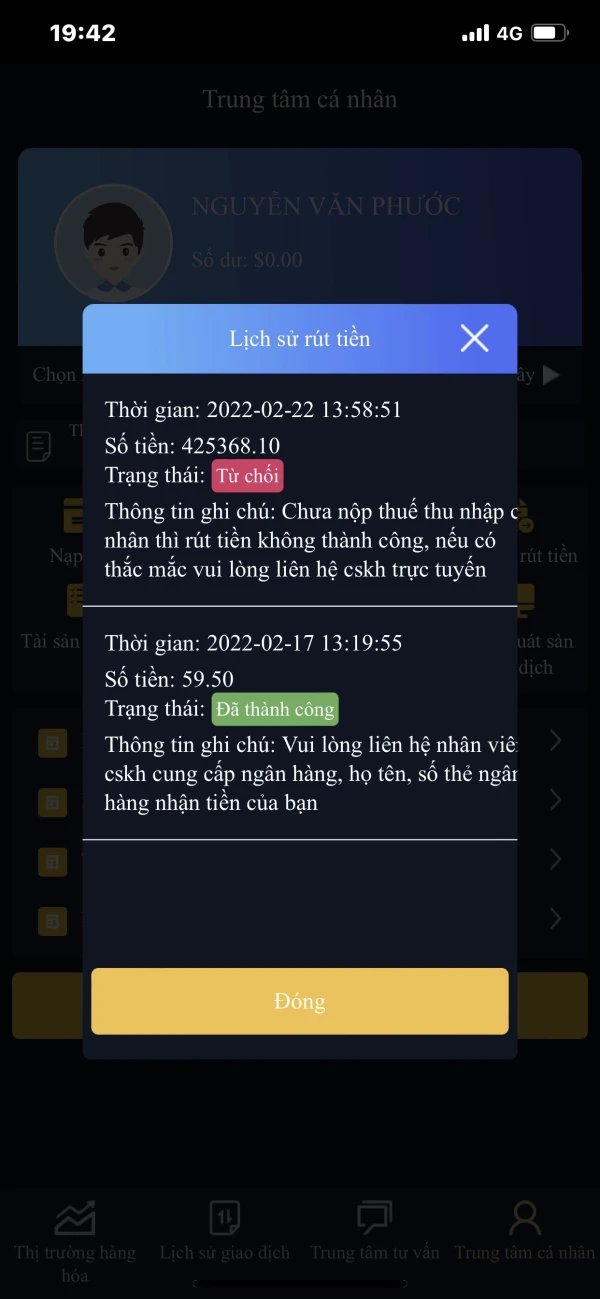

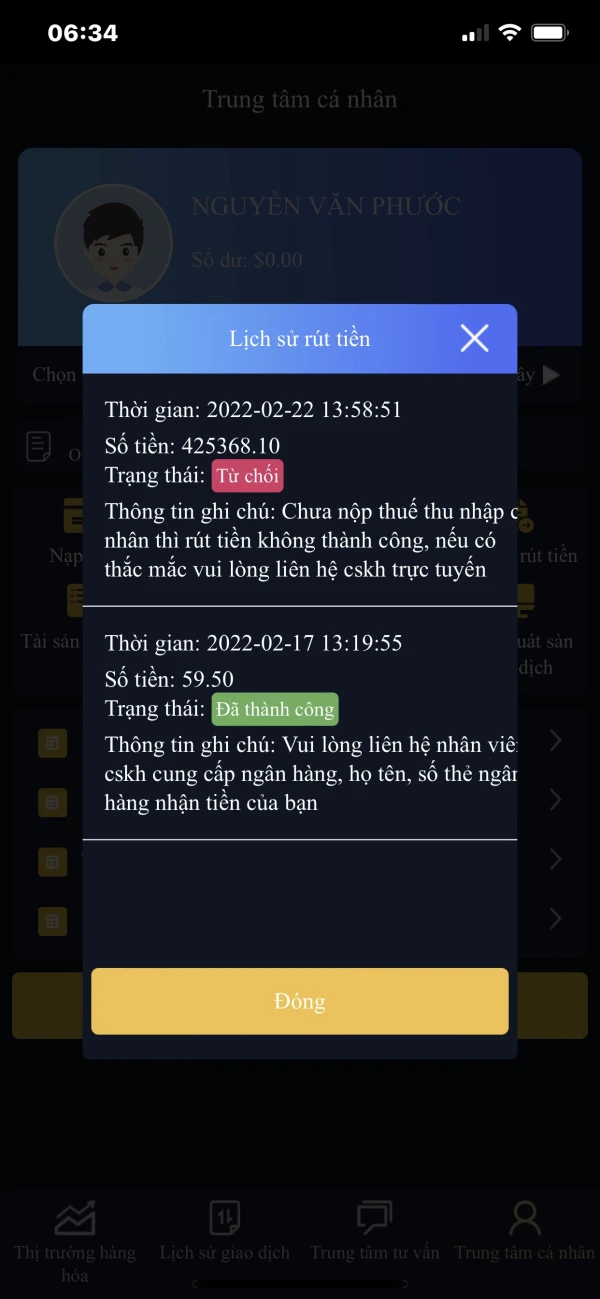

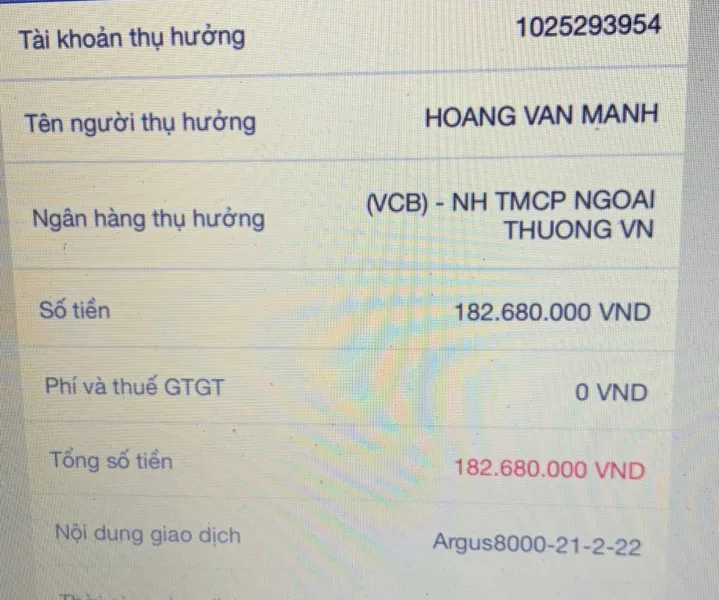

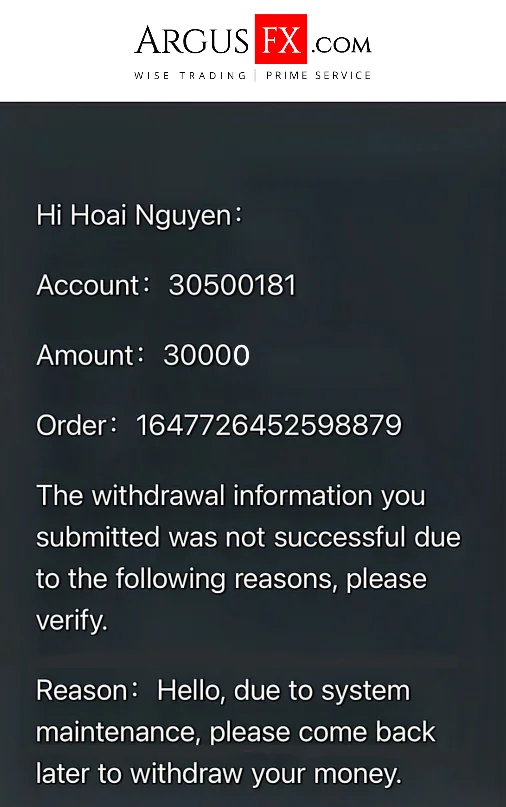

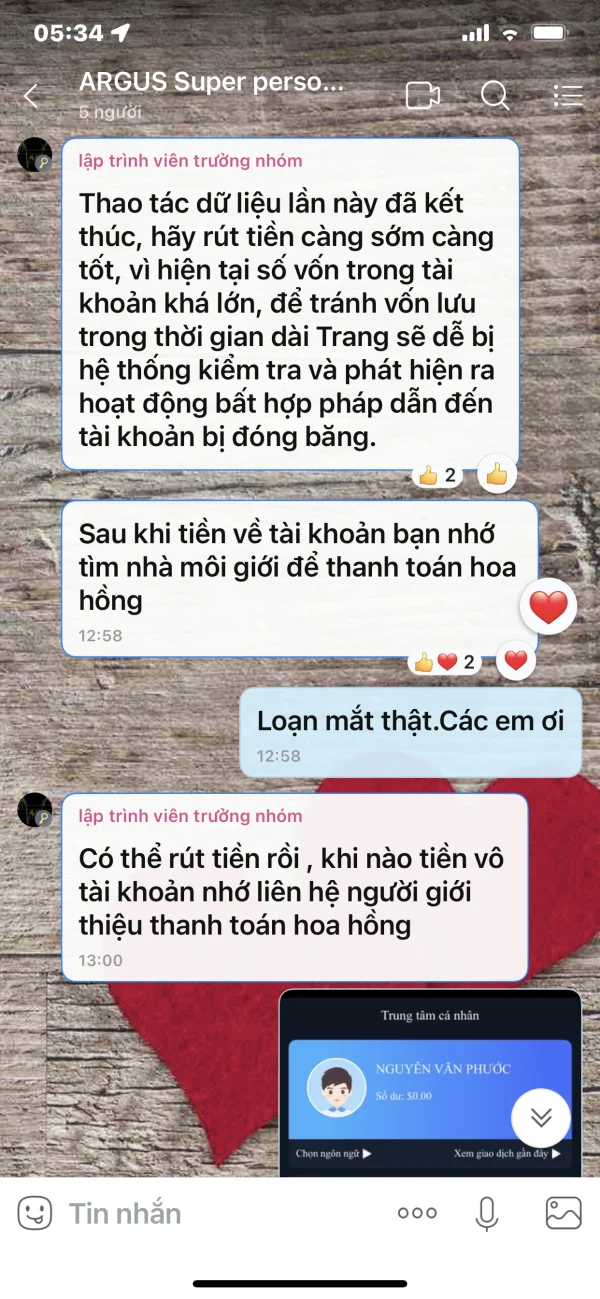

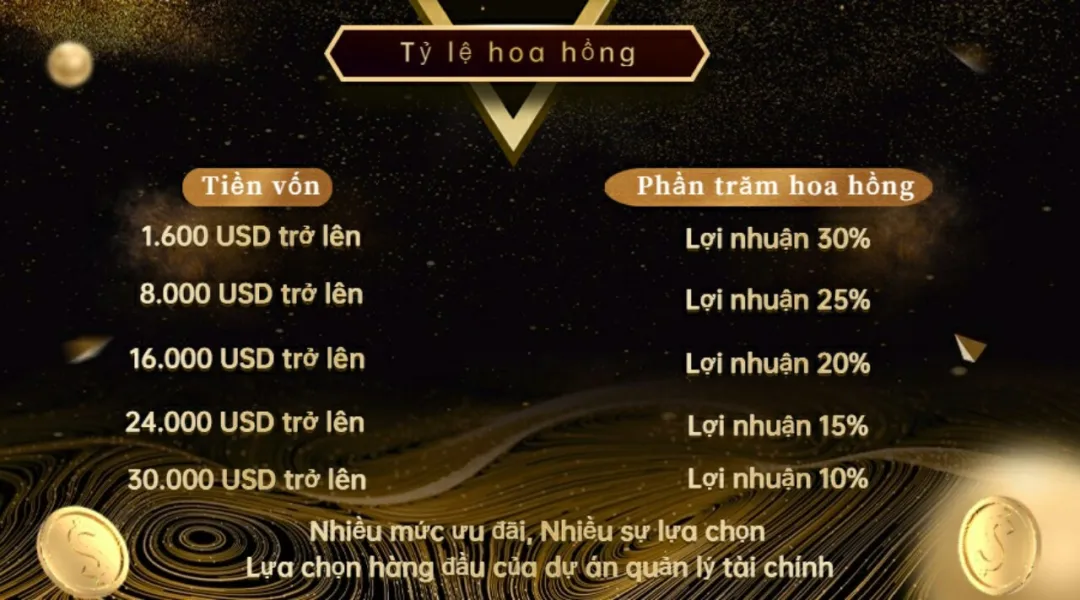

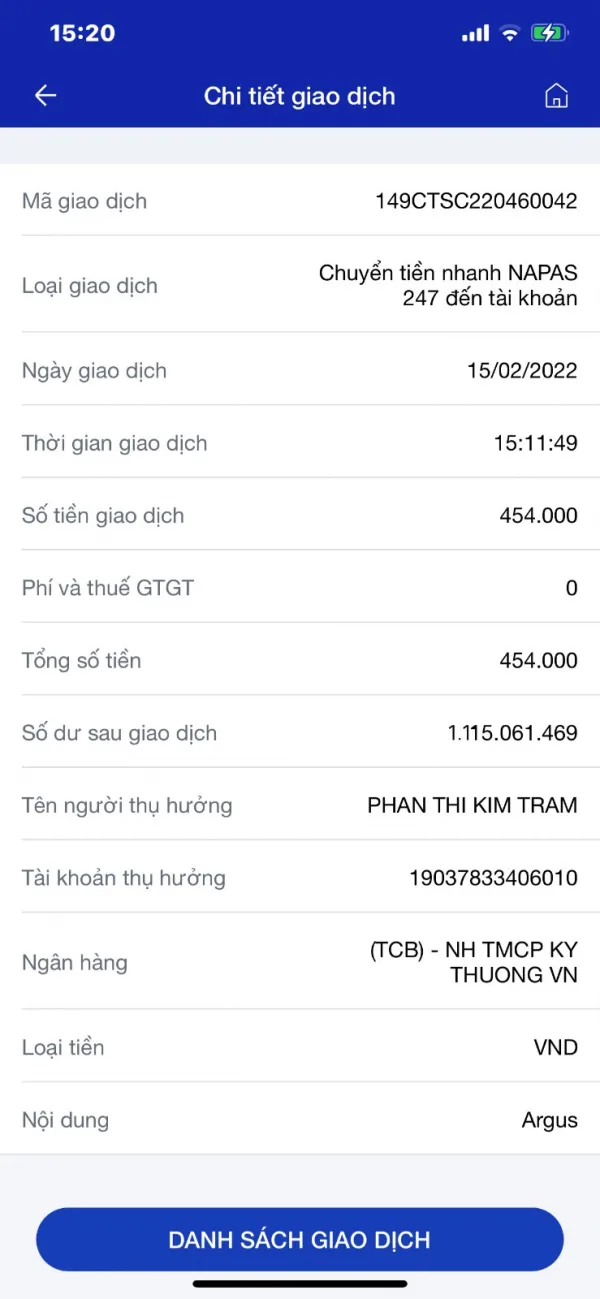

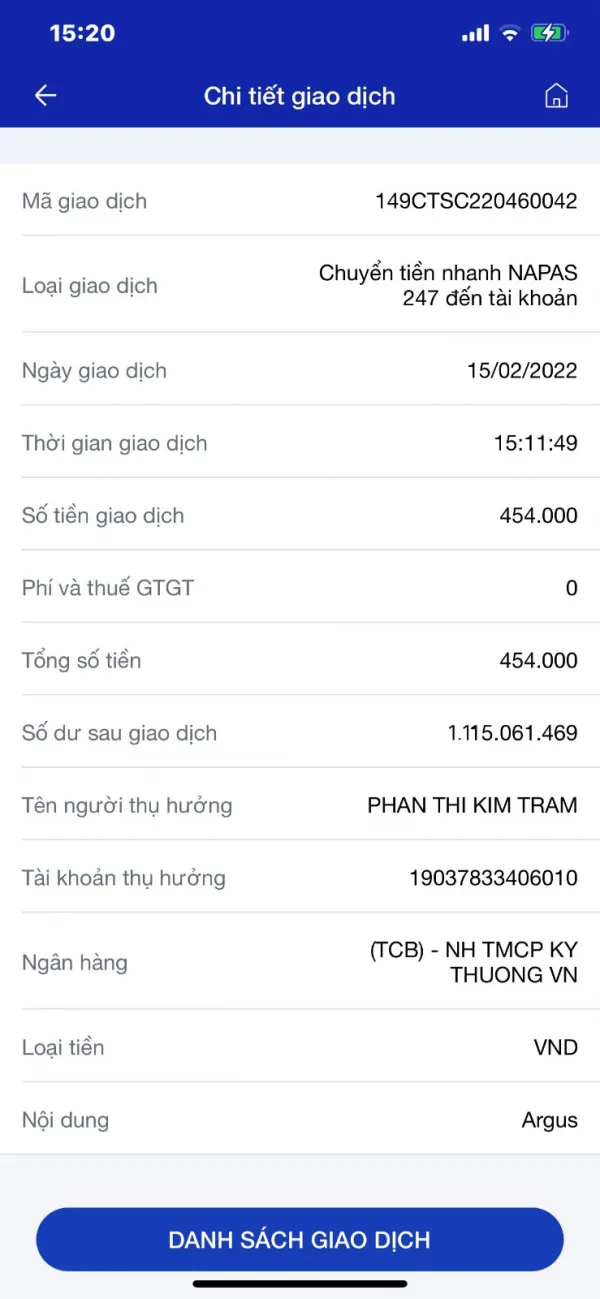

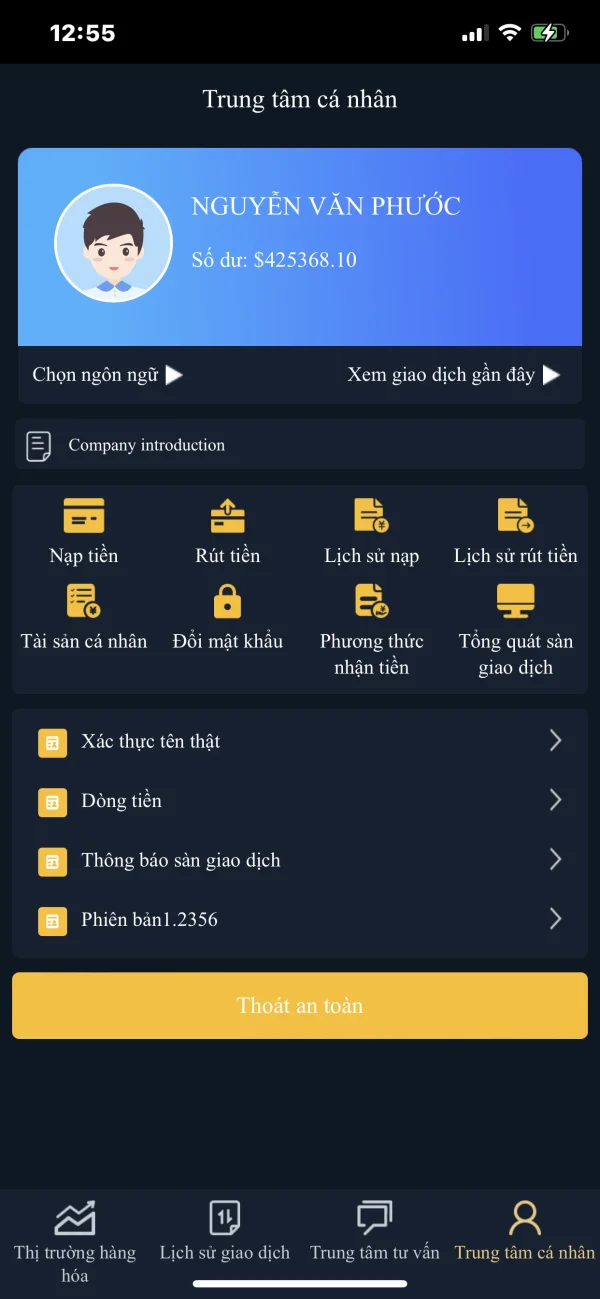

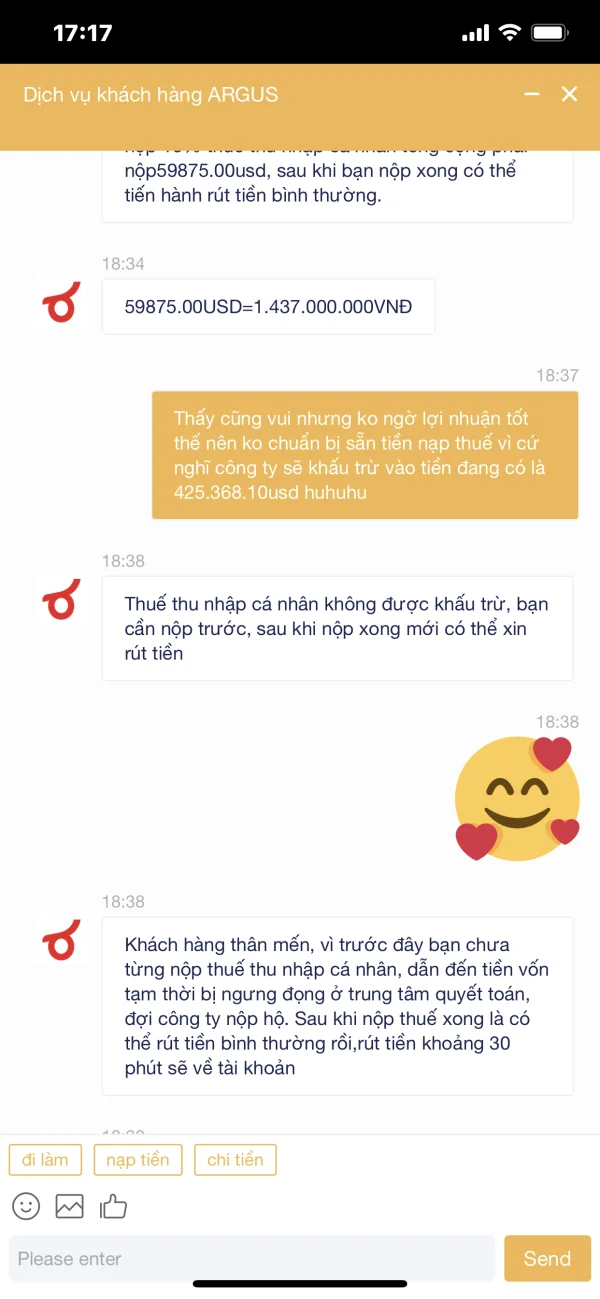

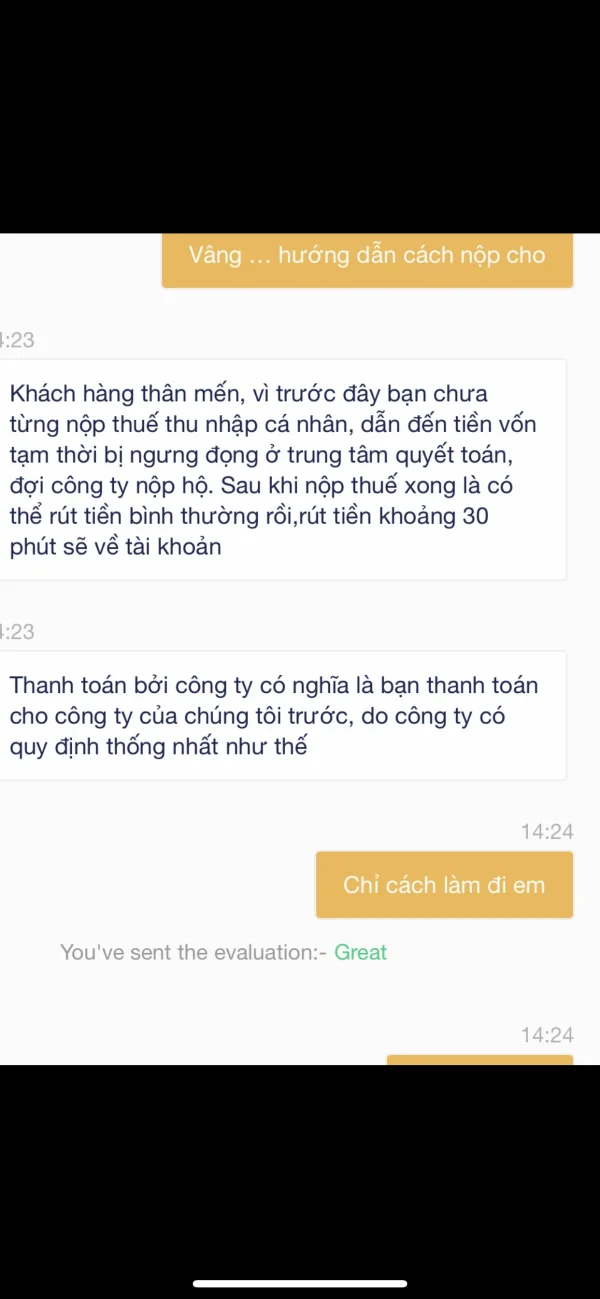

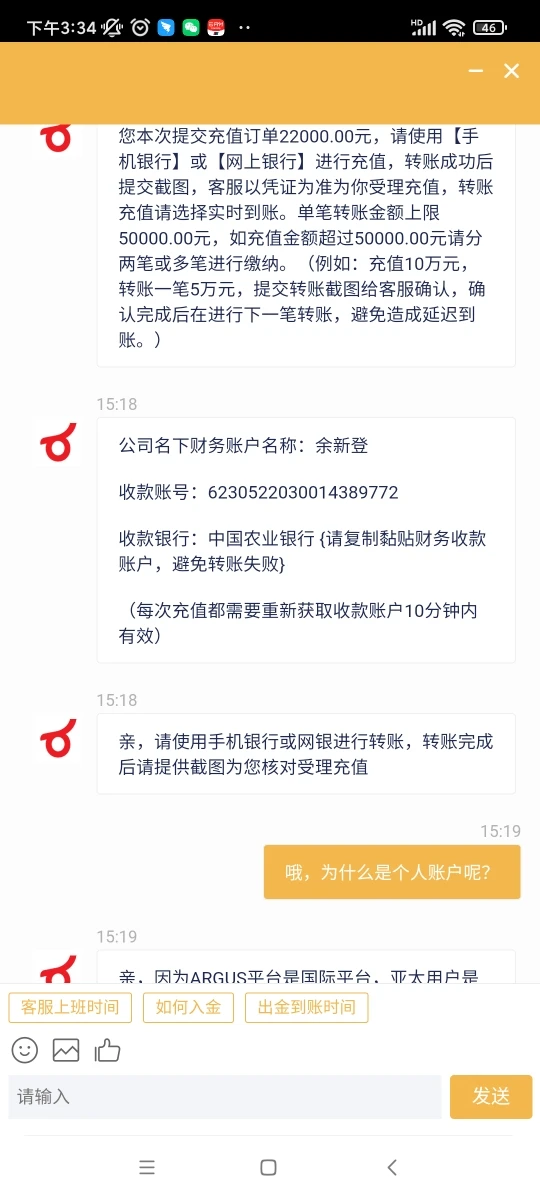

sesuai undangan dari broker ARGUS perusahaan, saya meminjam $32000 untuk diinvestasikan ARGUS .. untungnya saya untung $399168.10 plus modal $425368.10 ,,, ini adalah akun saat ini di akun saya. setelah transaksi pialang, nt menyuruh saya untuk segera menarik, atau tidak lama, sistem akan melaporkan kesalahan dan akan mengunci akun (??) setelah mengikuti instruksi penarikan, htt dilaporkan selesai karena belum. deposit 15% pajak penghasilan pribadi (????) sistem broker nt deposit 15% pajak $usd 59.875.00 sama dengan 1 miliar 437.000.000 ke rekening pribadi atau rekening perusahaan terpisah dari broker sebelum eksotik sebagai gantinya... ARGUS perusahaan saham terkenal tidak melakukan itu ... sekarang saya menelepon .. bertanya ARGUS kepentingan perusahaan atau langsung mengembalikan jumlah penuh yang saya miliki di akun

Paparan

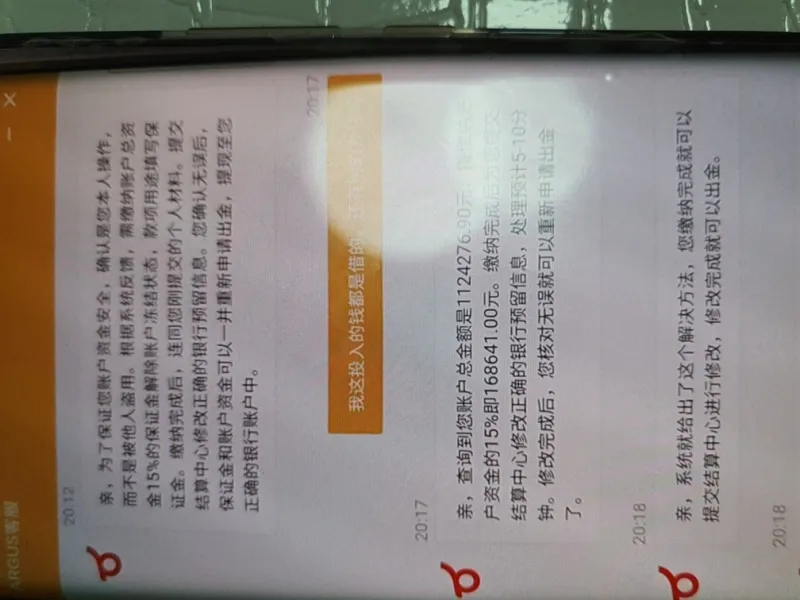

上善若水86692

Hong Kong

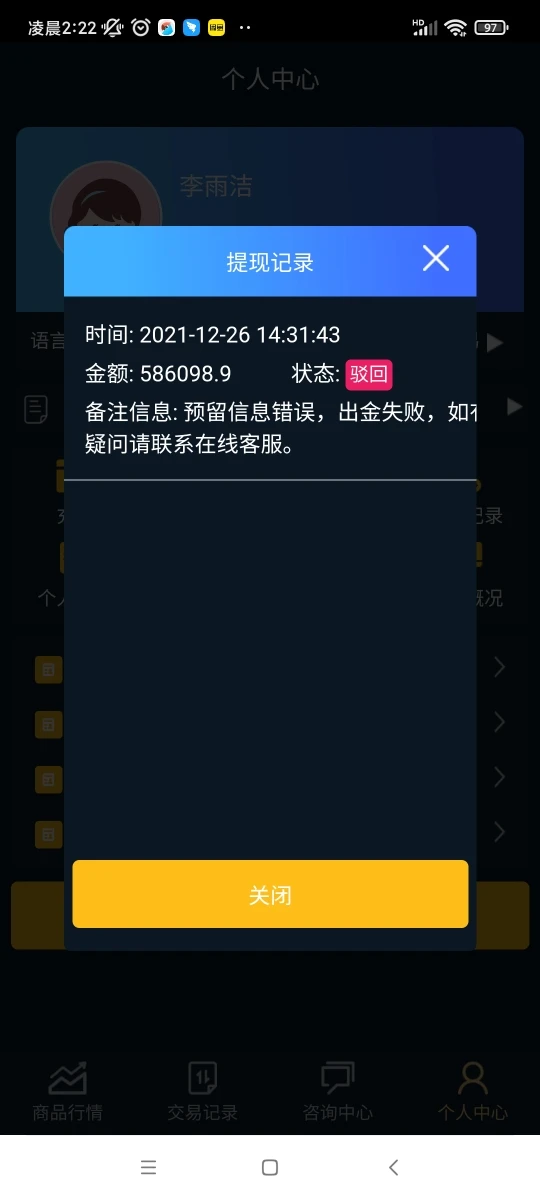

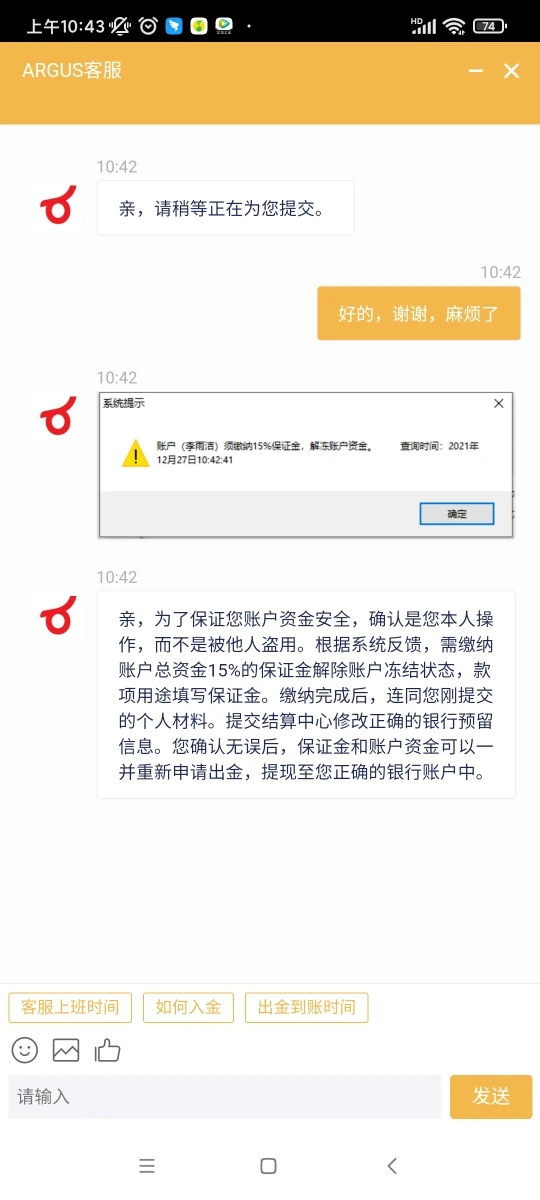

Platform penipuan, penipuan romantis, ubah informasi pelanggan dan nomor kartu untuk penarikan. Saya memeriksa nomor kartu tiga kali untuk memastikan bahwa itu benar, tetapi berubah saat penarikan. Kemudian, mereka meminta Anda untuk membayar margin dan membekukan dana agar tidak membiarkan Anda menarik. Perangkap!

Paparan

FX2268019297

Hong Kong

Menuntut margin 15% karena salah nomor kartu. Jika tidak, mereka tidak akan menarik dan mengunci akun.

Paparan

FX2268019297

Hong Kong

Mereka tidak menarik karena nomor kartu bank yang salah dan meminta margin 15%

Paparan