Présentation de l'entreprise

| Phillip Securities Group Résumé de l'examen | |

| Fondé | 1975 |

| Pays/Région Enregistré | Singapour |

| Régulation | SFC |

| Instruments de Marché | Actions, contrats à terme, forex, obligations, ETF, assurance |

| Compte de Démo | ❌ |

| Plateforme de Trading | Hulit City Online, Hulit City Mobile, Stock Easy (SATS), Options Easy (OATS), Futures Trading (FATS) |

| Dépôt Minimum | / |

| Support Client | Tél : (852) 2277 6555 |

| Fax : (852) 2277 6008 | |

| Email : cs@phillip.com.hk | |

Informations sur Phillip Securities Group

Fondée en 1975 et basée à Singapour, Phillip Securities Group est une société de services financiers multi-actifs réglementée par la SFC de Hong Kong. Ses propres systèmes de trading offrent une gamme complète d'options d'investissement incluant des contrats à terme, du forex, des actions, des obligations et des produits de fonds. Bien que les fonctionnalités de la plateforme et la diversité des comptes soient bonnes, il manque actuellement un compte de démonstration ou un compte islamique.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Licencié par la SFC de Hong Kong | Pas de compte de démonstration ou de comptes islamiques |

| Large gamme de produits couvrant les marchés locaux et étrangers | Certains échanges à l'étranger entraînent des commissions minimales élevées |

| Plusieurs plateformes de trading personnalisées pour différents besoins | Dépôt minimum non clairement mentionné |

Phillip Securities Group est-il Légitime ?

Sous la Licence No. AAZ038, Phillip Securities Group est réglementé par la Securities and Futures Commission (SFC) de Hong Kong, autorisé à traiter des contrats à terme et du trading de change sur marge depuis le 9 décembre 2003.

Que Puis-je Trader sur Phillip Securities Group ?

Incluant des titres, des contrats à terme, des devises, des obligations, des assurances et des solutions de gestion de capitaux, y compris des fonds gérés et des ETF, Phillip Securities offre un large éventail de services de gestion de patrimoine et d'investissement.

| Instruments de trading | Pris en charge |

| Titres | ✔ |

| Contrats à terme | ✔ |

| Forex | ✔ |

| Obligations | ✔ |

| ETF | ✔ |

| Assurances | ✔ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

Type de compte

Phillip Securities (HK) Ltd. propose deux types principaux de comptes de trading en direct : Compte sur marge et Compte de garde. La société ne propose pas de comptes de démonstration ou de comptes islamiques.

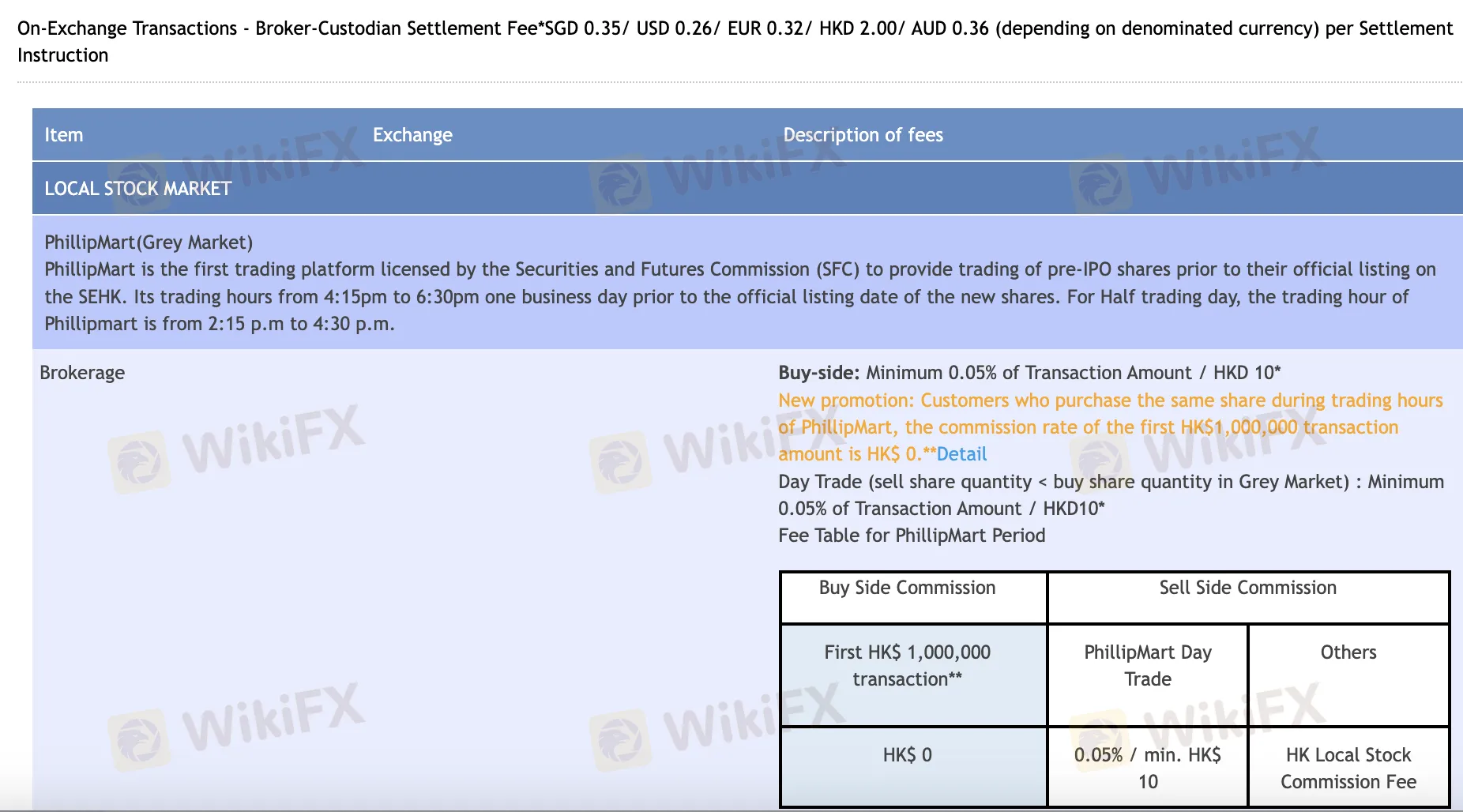

Frais Phillip Securities Group

Surtout pour le trading en ligne et le day trading, les coûts de Phillip Securities Group sont généralement équitables et conformes aux normes de l'industrie. Il renonce aux frais de garde pour la plupart des consommateurs et propose des offres sans commission sur certains articles choisis. En revanche, certaines opérations sur les marchés étrangers, notamment par téléphone ou en faible volume, peuvent entraîner des frais minimums plus élevés.

| Marché/Produit | Courtage | Droit de timbre | Prélèvement sur transaction | Frais de transaction | CCASS/Autres frais | Frais de garde |

| Actions de HK (En ligne) | 0,08% (Achat ≤ HKD 30K : 0 $, Day Trade : 0,05%) | 0,10% | 0,00% | 0,01% | 0,01% (Min HKD 3, Max HKD 300) | Exonéré (<5000 lots de titres) |

| BSA & CBBC | 0,03% Day Trade / 0,05% après HKD 50K | Aucun | 0,00% | 0,01% | 0,01% (Min HKD 3, Max HKD 300) | Exonéré (<5000 lots de titres) |

| Actions à double cotation en RMB | En ligne : 0,08% (Min CNY 60) ; Téléphone : 0,25% (Min CNY 100) | 0,10% | 0,00% | 0,01% | 0,01% (Min CNY 3, Max CNY 300) | Exonéré (<5000 lots de titres) |

| Actions américaines (En ligne) | USD 0,0099/action (Min USD 1) ; Téléphone : 0,25% (Min USD 20) | Aucun | Frais SEC + FINRA + DTC applicables | Inclus ci-dessus | Frais de compensation SEC/FINRA/DTC | ❌ |

| Actions A de Chine (Sens Nord) | Achat ≤ ¥30K : ¥0 ; Achat > ¥30K ou Vente : 0,03% (En ligne) | 0,05% (Vente uniquement) | Manutention 0,00341%, Gestion 0,002% | ChinaClear 0,001% | 0,002% via CCASS | Valeur quotidienne du portefeuille × 0,008%/365 |

Plateforme de Trading

| Plateforme de Trading | Pris en charge | Appareils Disponibles | Convient pour |

| Hulit City En Ligne | ✔ | Bureau / Web | Traders d'actions et de contrats à terme ayant besoin de toutes les fonctionnalités |

| Hulit City Mobile | ✔ | Mobile (iOS/Android) | Traders d'actions en déplacement |

| Stock Easy (SATS) | ✔ | Bureau | Débutants en trading d'actions |

| Options Easy (OATS) | ✔ | Bureau | Traders d'options |

| Futures Trading (FATS) | ✔ | Bureau | Traders de contrats à terme |