公司简介

| 辉立证券集团 评论摘要 | |

| 成立时间 | 1975 |

| 注册国家/地区 | 新加坡 |

| 监管 | SFC |

| 市场工具 | 证券、期货、外汇、债券、ETF、保险 |

| 模拟账户 | ❌ |

| 交易平台 | Hulit City Online、Hulit City Mobile、Stock Easy (SATS)、Options Easy (OATS)、Futures Trading (FATS) |

| 最低存款 | / |

| 客户支持 | 电话:(852) 2277 6555 |

| 传真:(852) 2277 6008 | |

| 电子邮件:cs@phillip.com.hk | |

辉立证券集团 信息

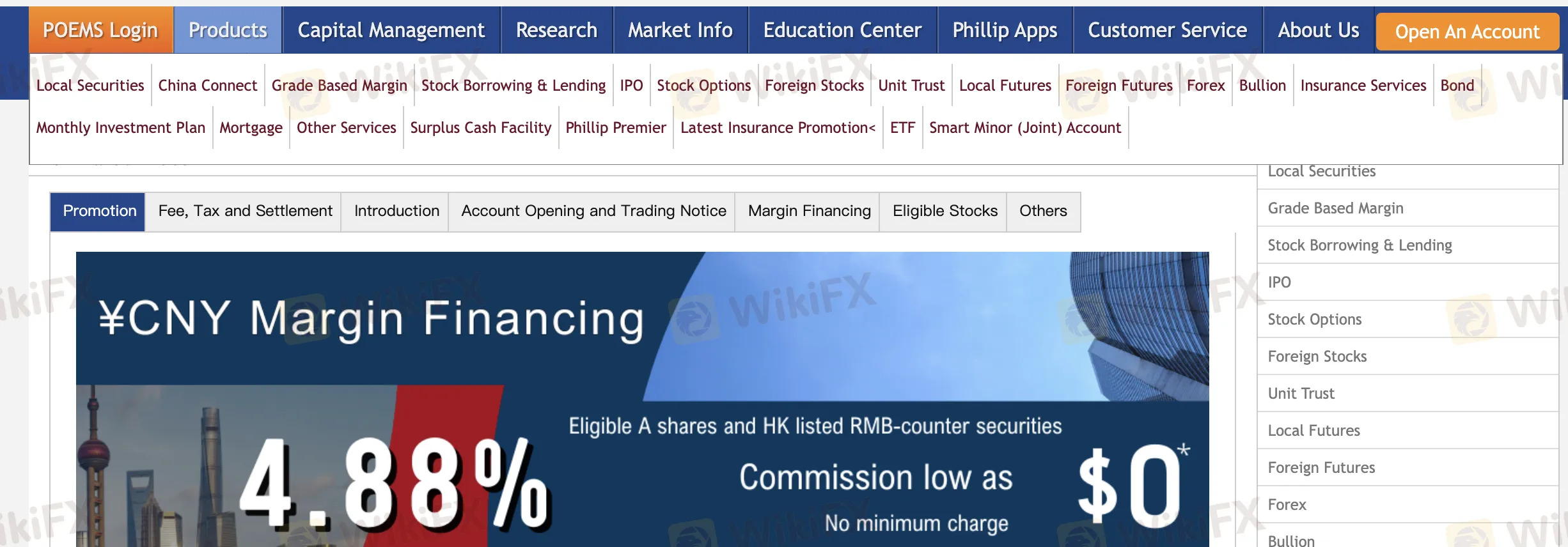

成立于1975年,总部位于新加坡,辉立证券集团 是一家多资产金融服务公司,受香港SFC监管。其自有交易系统提供了包括期货、外汇、股票、债券和基金产品在内的完整投资选择范围。尽管平台功能和账户多样性良好,但目前缺乏模拟账户或伊斯兰账户。

优点和缺点

| 优点 | 缺点 |

| 香港SFC许可 | 没有模拟账户或伊斯兰账户账户 |

| 覆盖本地和海外市场的广泛产品范围 | 部分海外交易收取较高最低佣金 |

| 多个定制交易平台,满足不同需求 | 最低存款未明确说明 |

辉立证券集团 是否合法?

根据AAZ038号许可,辉立证券集团 受香港证券及期货委员会(SFC)监管,自2003年12月9日起被允许进行期货合约和杠杆外汇交易。

我可以在 辉立证券集团 上交易什么?

包括证券、期货、货币、债券、保险和资本管理解决方案,包括管理基金和交易所交易基金(ETF),Phillip Securities提供全面的投资和财富管理服务。

| 交易工具 | 支持 |

| 证券 | ✔ |

| 期货 | ✔ |

| 外汇 | ✔ |

| 债券 | ✔ |

| 交易所交易基金(ETF) | ✔ |

| 保险 | ✔ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 期权 | ❌ |

账户类型

Phillip Securities(HK)有限公司提供两种主要的实时交易账户:保证金账户和托管账户。该公司不提供模拟或伊斯兰账户。

辉立证券集团 费用

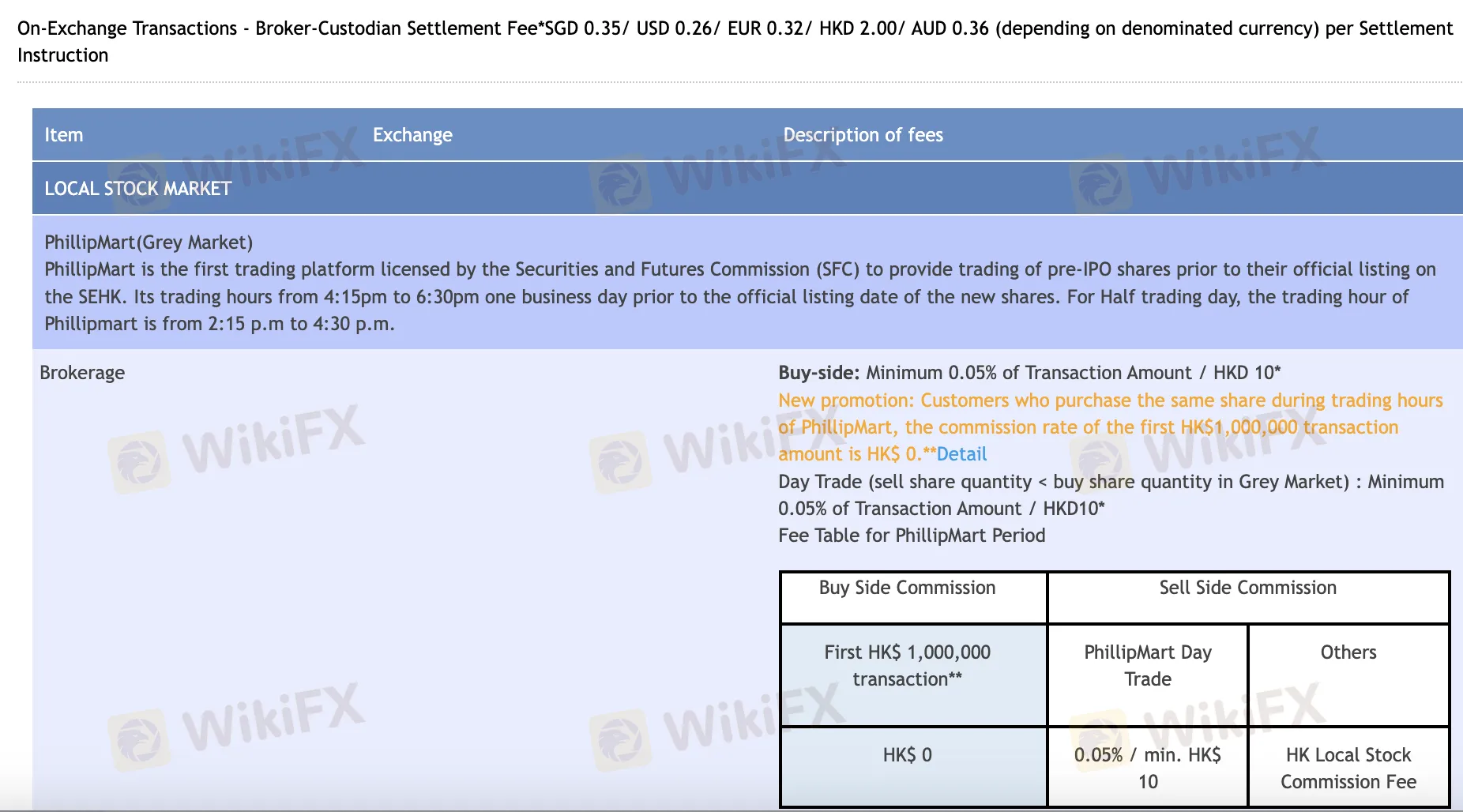

特别是对于在线和日内交易,辉立证券集团的费用通常是公平的,并与行业标准一致。它为大多数消费者免除了托管费用,并在选择的项目上提供零佣金交易。另一方面,某些外国市场交易,特别是电话交易或低交易量,可能有更高的最低费用。

| 市场/产品 | 佣金 | 印花税 | 交易征费 | 手续费 | CCASS/其他费用 | 托管费 |

| 香港股票(在线) | 0.08%(买入≤港币30K:$0,日内交易:0.05%) | 0.10% | 0.00% | 0.01% | 0.01%(最低港币3,最高港币300) | 免除(<5000手) |

| 认股权证和牛熊证 | 0.03% 日内交易 / 港币50K后0.05% | 无 | 0.00% | 0.01% | 0.01%(最低港币3,最高港币300) | 免除(<5000手) |

| 人民币双计价股票 | 在线:0.08%(最低人民币60);电话:0.25%(最低人民币100) | 0.10% | 0.00% | 0.01% | 0.01%(最低人民币3,最高人民币300) | 免除(<5000手) |

| 美国股票(在线) | 每股USD 0.0099(最低USD 1);电话:0.25%(最低USD 20) | 无 | SEC + FINRA + DTC 手续费 适用 | 包含在上述费用中 | SEC/FINRA/DTC结算 手续费 | ❌ |

| 中国A股(北向) | 买入≤ ¥30K:¥0;买入>¥30K或卖出:0.03%(在线) | 0.05%(仅卖出) | 手续费0.00341%,管理费0.002% | ChinaClear 0.001% | 通过CCASS的0.002% | 每日投资组合价值 × 0.008%/365 |

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 互利城在线 | ✔ | 桌面/网络 | 需要完整功能的股票和期货交易者 |

| 互利城移动 | ✔ | 移动设备(iOS/Android) | 在外出时进行股票交易 |

| 股票易(SATS) | ✔ | 桌面 | 初学者股票交易者 |

| 期权易(OATS) | ✔ | 桌面 | 期权交易者 |

| 期货交易(FATS) | ✔ | 桌面 | 期货交易者 |