Présentation de l'entreprise

| RHB Résumé de l'examen | |

| Fondé | 1983 |

| Pays/Région enregistré(e) | Malaisie |

| Réglementation | SFC (Révoqué) |

| Produits de négociation | Indices futurs, matières premières |

| Services | Financement de marge d'actions, Financement d'actions étrangères, Financement discrétionnaire, Financement du régime d'options d'achat d'actions des employés (ESOS), Financement d'introduction en bourse (IPO) |

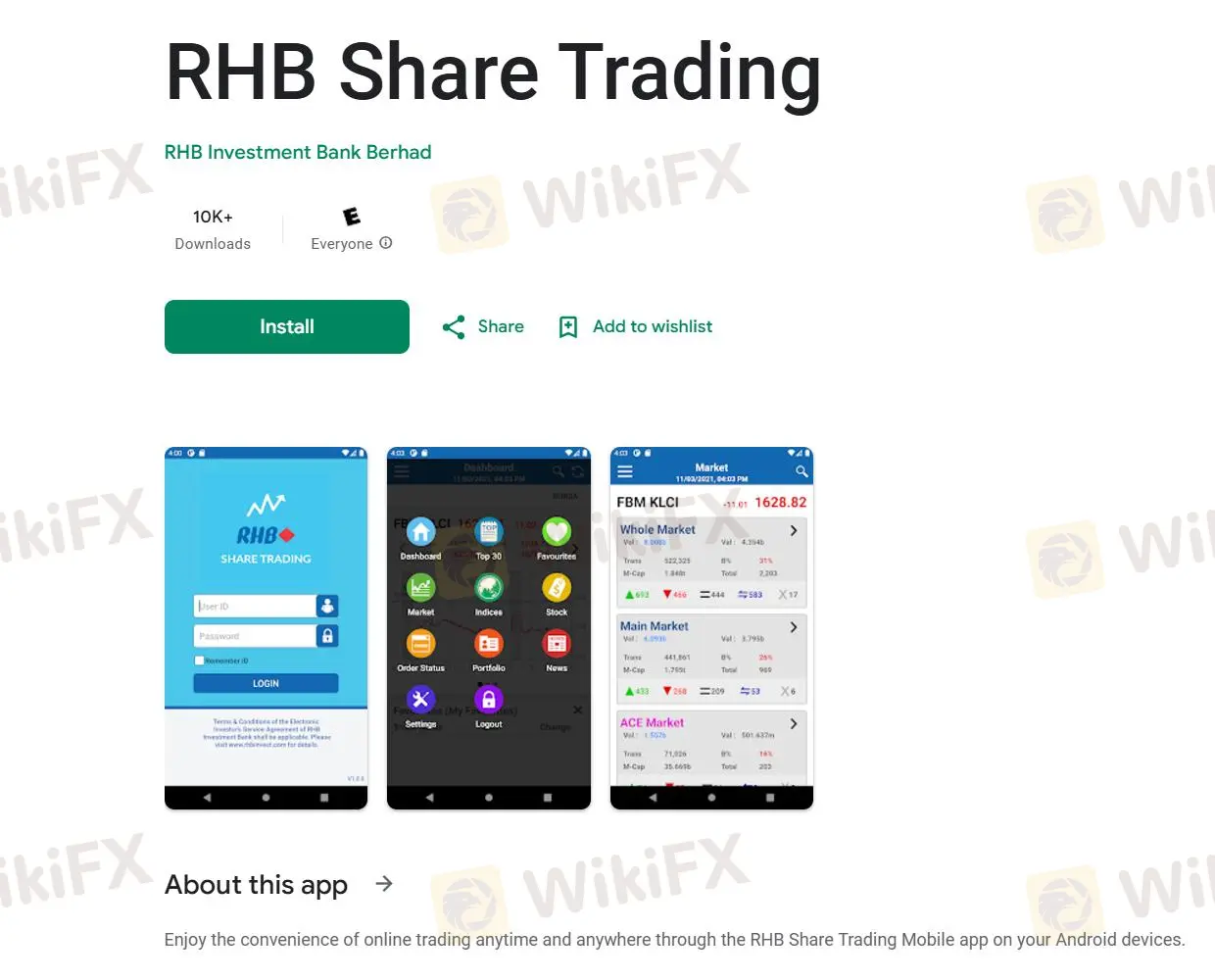

| Plateforme de négociation | RHB Trading d'actions |

| Assistance clientèle | Tél : 03-2113 8118 ; +603 – 7890 4700 |

| Fax : +603 – 7890 4670 | |

| Email : support@rhbgroup.com | |

| Adresse enregistrée : Niveau 10, Tour Un, Centre RHB, Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan, Malaisie | |

| Coordonnées des bureaux de succursales : https://www.rhbinvest.com/locate_us.html | |

Informations sur RHB

RHB Investment Bank Berhad est une entité financière basée en Malaisie qui compte plus de 50 succursales dans tout le pays. Elle propose principalement des opérations à terme sur indices et matières premières, ainsi que des services de financement à ses clients. Des services de courtage islamiques sont également disponibles pour ceux qui doivent se conformer à la charia. De plus, la société propose une galerie vidéo avec toutes sortes de sujets pour équiper les traders des connaissances nécessaires pour réussir leurs opérations.

Cependant, il convient de noter que la société opère sous le statut réglementaire de SFC révoqué, indiquant une non-conformité vis-à-vis de l'autorité.

Avantages et inconvénients

| Avantages | Inconvénients |

| De nombreuses années d'expérience dans l'industrie | Licence SFC révoquée |

| Services financiers diversifiés | |

| Assistance clientèle complète |

Est-ce que RHB est légitime ?

RHB prétend être réglementé par la SFC (Securities and Futures Commission de Hong Kong) avec des licences numérotées AMF103. Cependant, le statut de la licence est "Révoqué", ce qui indique que le courtier pourrait avoir enfreint les règles de l'institution ou n'avoir pas respecté les exigences réglementaires. Cela jette le doute sur sa crédibilité et sa légitimité.

| Pays réglementé | Régulateur | Statut actuel | Entité réglementée | Type de licence | Numéro de licence |

| SFC | Révoqué | RHB Futures Hong Kong Limited | Opérations sur contrats à terme | AMF103 |

Produits de négociation

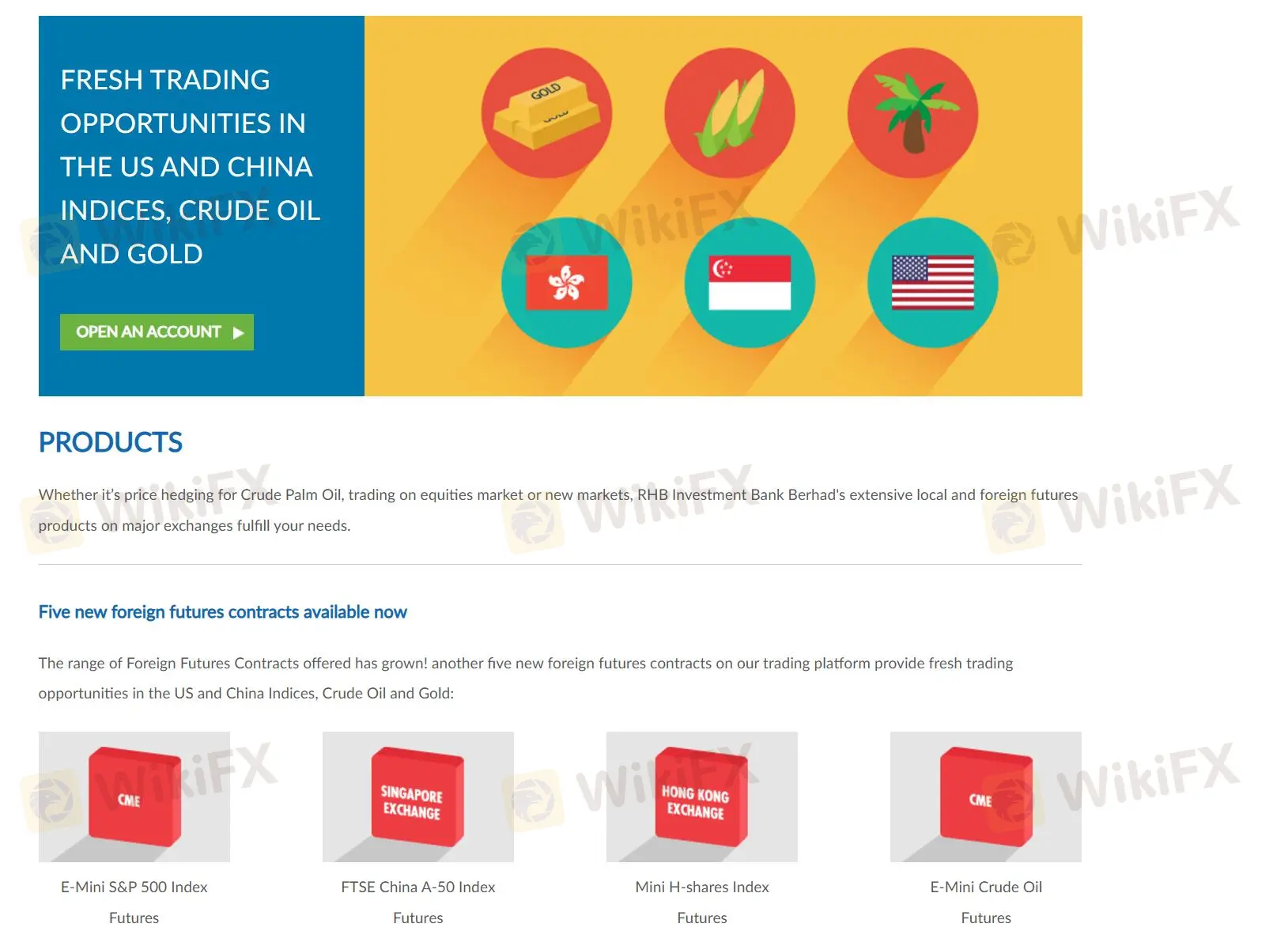

Le portefeuille de produits de RHB comprend des produits dérivés de Bursa Malaysia tels que les contrats à terme sur l'huile de palme brute et les contrats à terme sur l'or, ainsi qu'une gamme croissante de contrats à terme étrangers tels que l'E-Mini S&P 500, l'indice FTSE China A-50 et les contrats à terme sur le pétrole brut E-Mini.

Frais/Taux d'intérêt

| Service | Frais de service | Taux d'intérêt |

| Financement sur marge d'actions | ❌ | Spécifique au forfait ; pas de frais de report |

| Financement d'actions étrangères | ≥ 0,50% de la limite de financement (payable à l'avance) | SBR (3,00%) + 2,30%, min 4,55% p.a. |

| Financement discrétionnaire | Personnalisé | Personnalisé en fonction du portefeuille et des stratégies |

Plateforme de trading

RHB propose une plateforme de trading basée sur le web appelée "RHB Share Trading", avec une version d'application disponible sur les téléphones iOS et Android pour trader n'importe où, même en déplacement.