회사 소개

| RHB Review Summary | |

| 설립 | 1983 |

| 등록 국가/지역 | 말레이시아 |

| 규제 | SFC (Revoked) |

| 거래 상품 | 미래 지수, 상품 |

| 서비스 | 주식 마진 금융, 외국 주식 금융, 임의 금융, 직원 주식 옵션 계획 (ESOS) 금융, 초기 공개 상장 (IPO) 금융 |

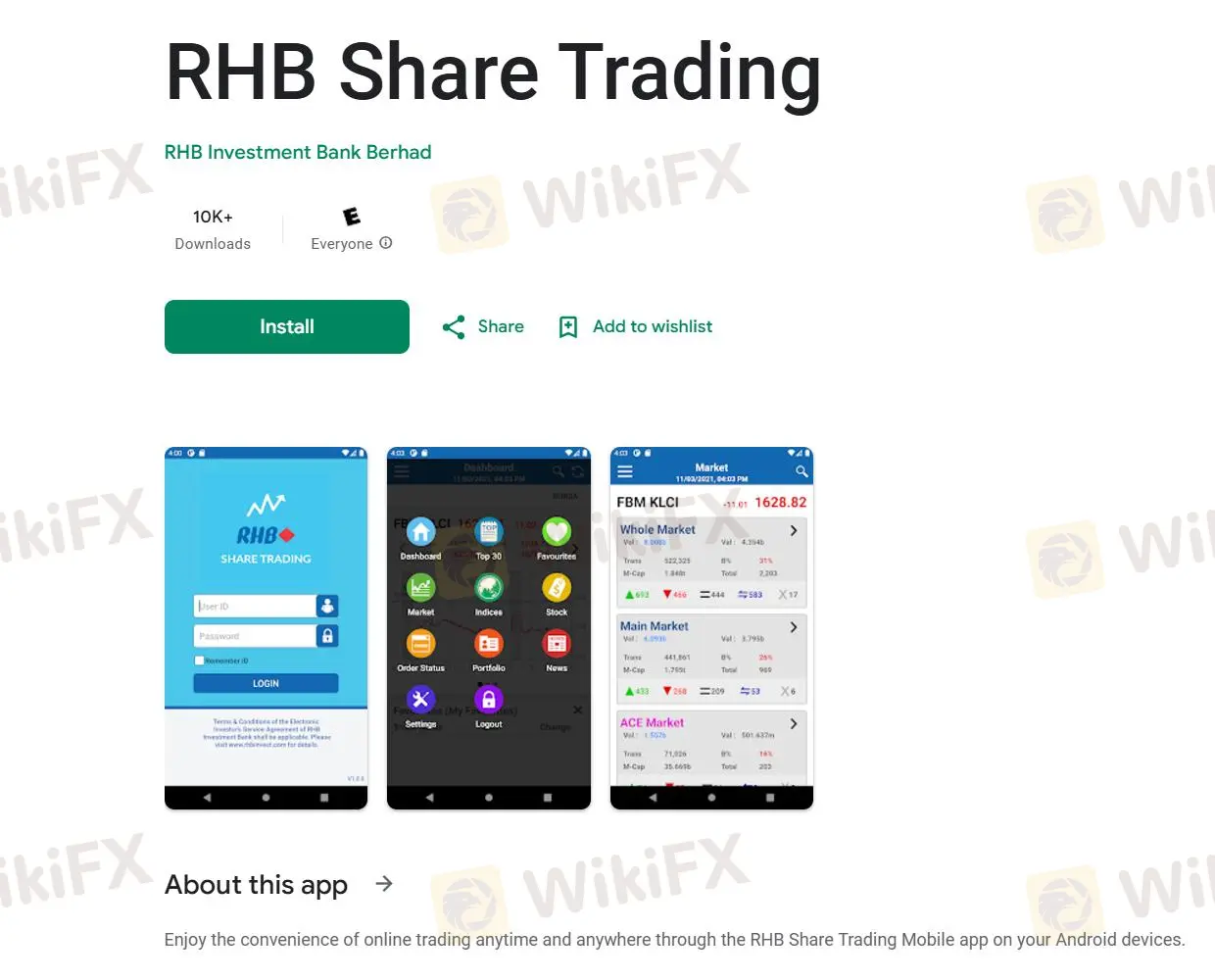

| 거래 플랫폼 | RHB 주식 거래 |

| 고객 지원 | 전화: 03-2113 8118; +603 – 7890 4700 |

| 팩스: +603 – 7890 4670 | |

| 이메일: support@rhbgroup.com | |

| 등록 주소: Level 10, Tower One, RHB Centre, Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan, Malaysia | |

| 지점 연락처: https://www.rhbinvest.com/locate_us.html | |

RHB 정보

RHB 투자은행 베라드는 말레이시아에 본사를 둔 금융 기관으로 전국에 50개 이상의 지점을 보유하고 있습니다. 지수와 상품을 중심으로 선물 거래를 제공하며, 고객에게 금융 서비스도 제공합니다. 이슬람 브로킹 서비스도 이용할 수 있어 샤리아 법규를 준수해야 하는 사람들에게도 도움이 됩니다. 또한, 회사는 트레이더들이 성공적인 거래를 위해 필요한 지식을 갖추기 위한 다양한 주제의 비디오 갤러리도 제공합니다.

그러나 주목할 점은 회사가 SFC의 규제 상태가 취소되었다는 것을 의미하는 SFC 취소 상태 하에서 운영된다는 것입니다. 이는 규제 기관의 규칙을 위반하거나 규제 요건을 충족하지 못했을 가능성을 시사합니다. 이는 회사의 신뢰성과 합법성에 의문을 제기합니다.

장단점

| 장점 | 단점 |

| 다년간의 산업 경험 | 취소된 SFC 라이선스 |

| 다양한 금융 서비스 | |

| 포괄적인 고객 지원 |

Is RHB Legit?

RHB은 홍콩 증권선물위원회 (SFC)에 AMF103 라이선스 번호로 규제 받고 있다고 주장합니다. 그러나 라이선스 상태는 "취소"이며, 이는 해당 브로커가 기관의 규칙을 위반하거나 규제 요건을 충족하지 못했을 수 있다는 것을 의미합니다. 이는 그 신뢰성과 합법성에 의문을 제기합니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| SFC | 취소 | RHB Futures Hong Kong Limited | 선물 계약 거래 | AMF103 |

거래 상품

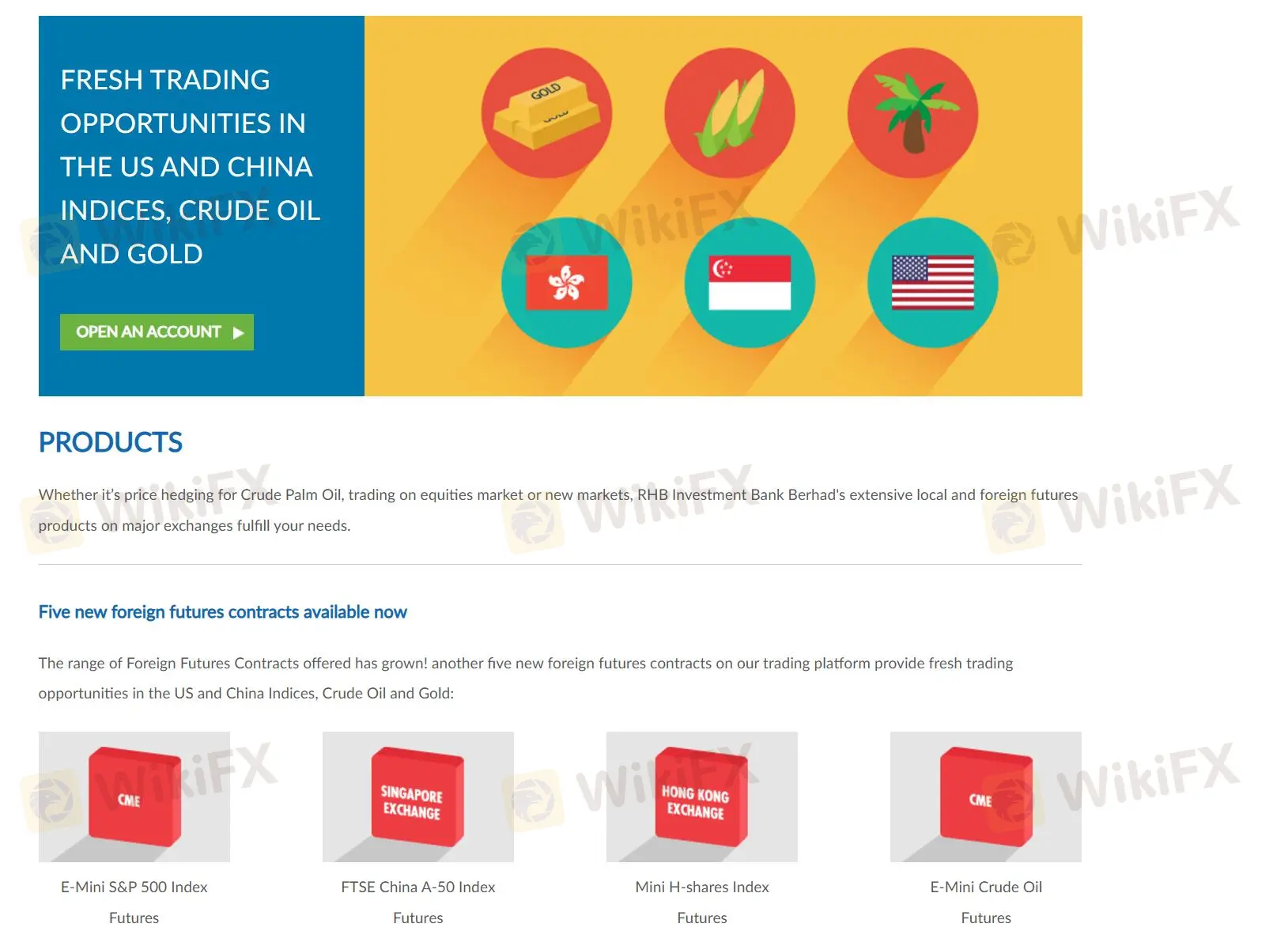

RHB의 제품 포트폴리오에는 크루드 팜 오일 선물과 골드 선물과 같은 Bursa Malaysia 파생상품뿐만 아니라 E-Mini S&P 500, FTSE China A-50 지수 및 E-Mini 원유 선물과 같은 다양한 외국 선물 계약도 포함되어 있습니다.

수수료/이자율

| 서비스 | 시설료 | 이자율 |

| 주식 마진 금융 | ❌ | 패키지별; 롤오버 수수료 없음 |

| 외국 주식 금융 | 시설 한도의 0.50% 이상 (선납) | SBR (3.00%) + 2.30%, 최소 4.55% 연간 |

| 자유 재량 금융 | 맞춤형 | 포트폴리오 및 전략에 기반한 맞춤형 |

거래 플랫폼

RHB은(는) 웹 기반 거래 플랫폼인 “RHB Share Trading”을(를) 제공하며, iOS 및 Android 폰에서도 어디서든 거래할 수 있도록 앱 버전을 제공합니다.