Profil perusahaan

| YAMAGATARingkasan Ulasan | |

| Didirikan | 2006 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Produk Perdagangan | Saham, ETF (Exchange-Traded Fund), REIT (Real Estate Investment Trust), Obligasi, Futures, Opsi |

| Akun Demo | ✅ |

| Denda | Bergantung pada produk, mulai dari 2.750 yen hingga 588.500 yen |

| Dukungan Pelanggan | Tel: 023-631-7720 |

| Email: soumu@yamagatashoken.co.jp | |

| Alamat perusahaan: 990-0042 kota yamagata nanika-machi 2-1-41 (〒990-0042 山形市七日町2-1-41) | |

Didirikan pada tahun 2006, YAMAGATA adalah pialang efek yang diatur oleh FSA yang terdaftar di Jepang, menawarkan layanan perdagangan di Saham AS (Brokerage Ekuitas AS), Saham (Spot Trading Saham Domestik, Saham Asing, dll), Obligasi, Futures (JGB Futures), Investasi Amanah, dan Asuransi Jiwa.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA | Ambang batas membaca bahasa Jepang |

| Berbagai produk perdagangan | |

| Akun demo | |

| Struktur biaya yang jelas |

Apakah YAMAGATA Legal?

Ya. YAMAGATA saat ini diatur oleh Otoritas Jasa Keuangan (FSA).

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| Otoritas Jasa Keuangan (FSA) | Diatur | YAMAGATA株式会社 | Lisensi Forex Retail | 東北財務局長(金商)第3号 |

Apa yang Bisa Saya Perdagangkan di YAMAGATA?

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| ETF (Exchange-Traded Fund) | ✔ |

| REIT (Real Estate Investment Trust) | ✔ |

| Obligasi | ✔ |

| Futures | ✔ |

| Opsi | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptocurrency | ❌ |

YAMAGATA Biaya

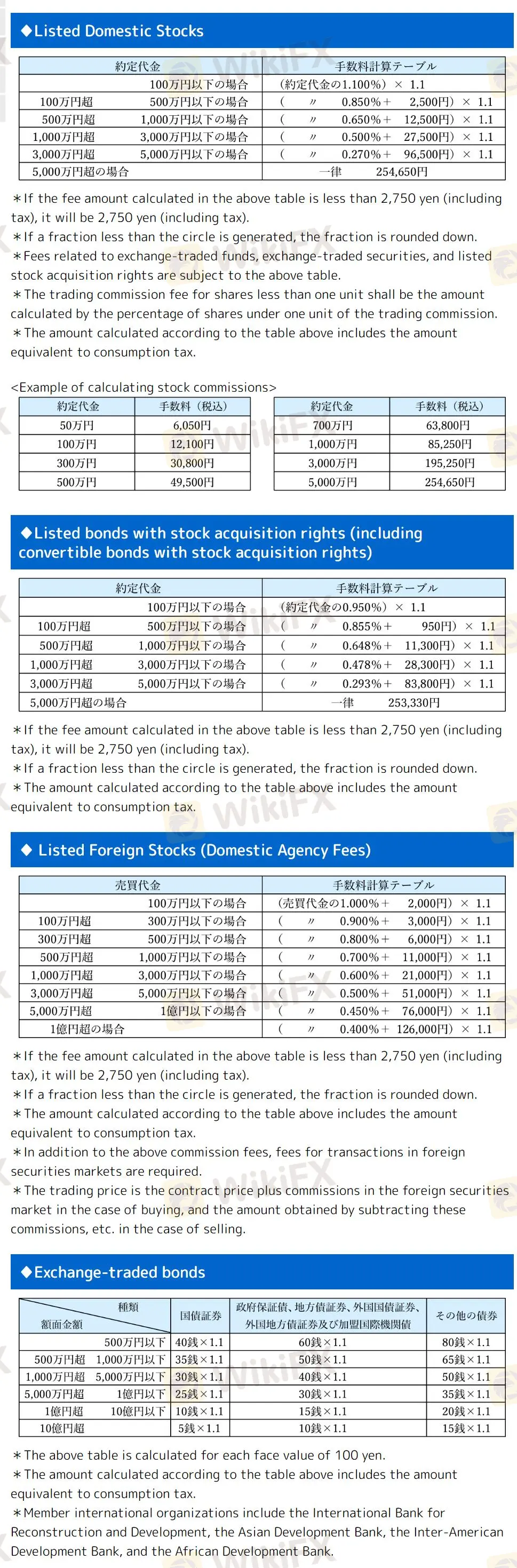

Biaya untuk Saham:

- Saham Domestik & Obligasi: Biaya minimum sebesar 2.750 yen (termasuk pajak) berlaku jika biaya yang dihitung kurang dari jumlah ini. Pecahan yen dibulatkan ke bawah.

- Saham Asing: Biaya minimum yang sama dengan saham domestik, ditambah biaya tambahan untuk transaksi pasar asing.

- ETF & Efek dengan Hak Perolehan Saham: Mengikuti struktur biaya yang sama dengan saham domestik.

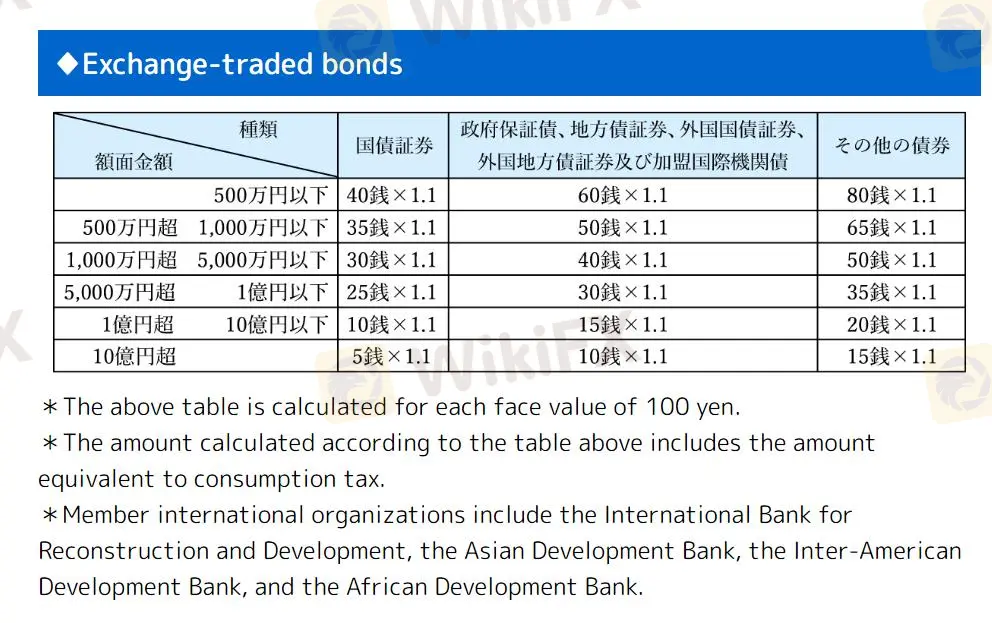

Biaya untuk Obligasi:

- Obligasi yang Diperdagangkan di Bursa: Biaya dihitung per nilai nominal 100 yen, termasuk pajak konsumsi.

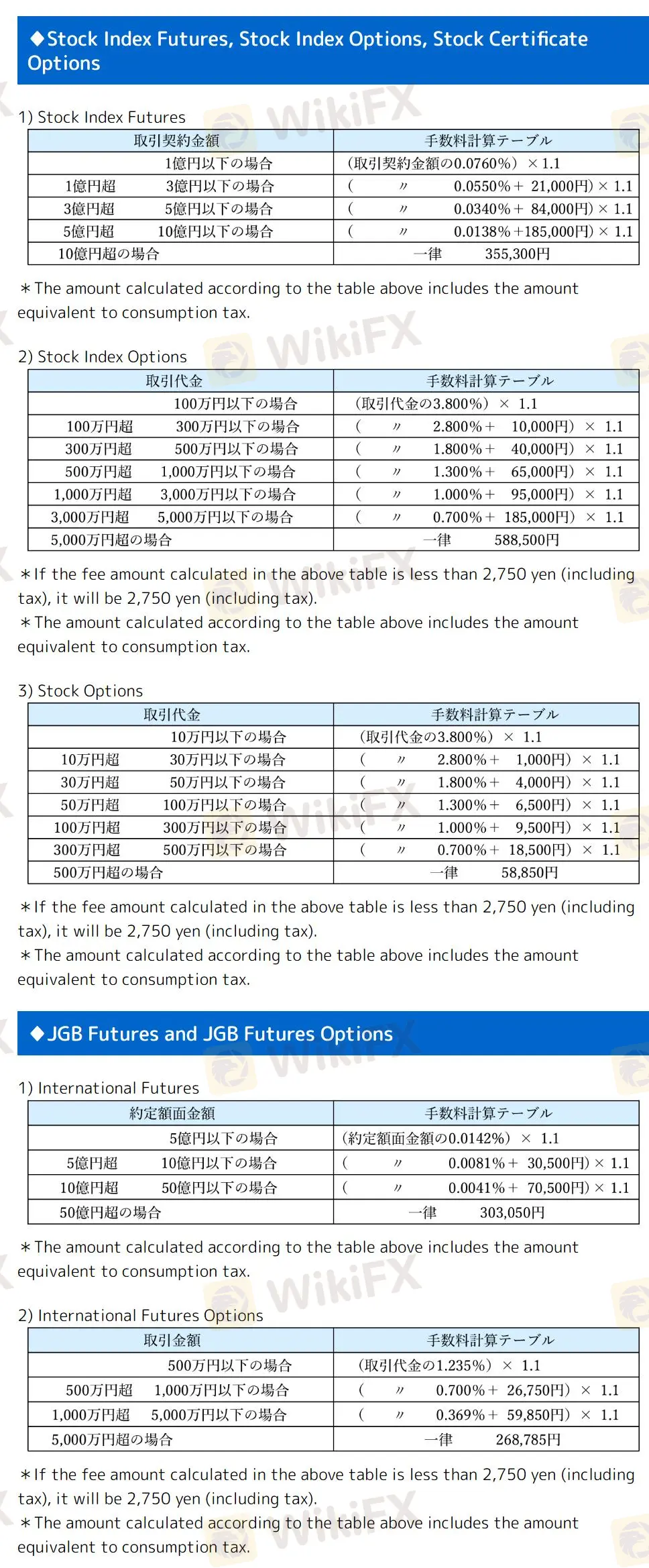

Biaya untuk Futures dan Opsi:

- Futures Indeks Saham: Biaya termasuk pajak konsumsi.

- Opsi Indeks Saham & Opsi Saham: Biaya minimum sebesar 2.750 yen (termasuk pajak) jika biaya yang dihitung kurang dari jumlah ini.

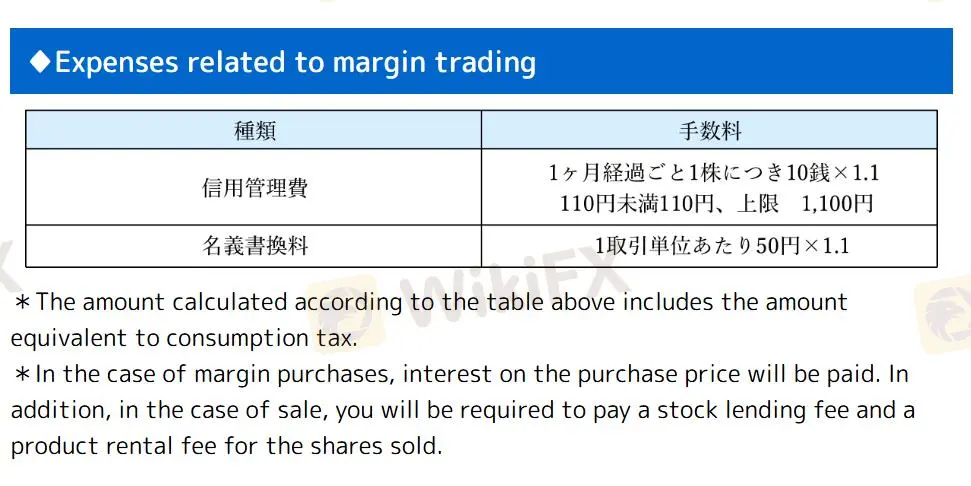

Biaya Margin Trading:

- Termasuk bunga pada harga pembelian untuk pembelian dan biaya pinjaman saham untuk penjualan, ditambah pajak konsumsi.

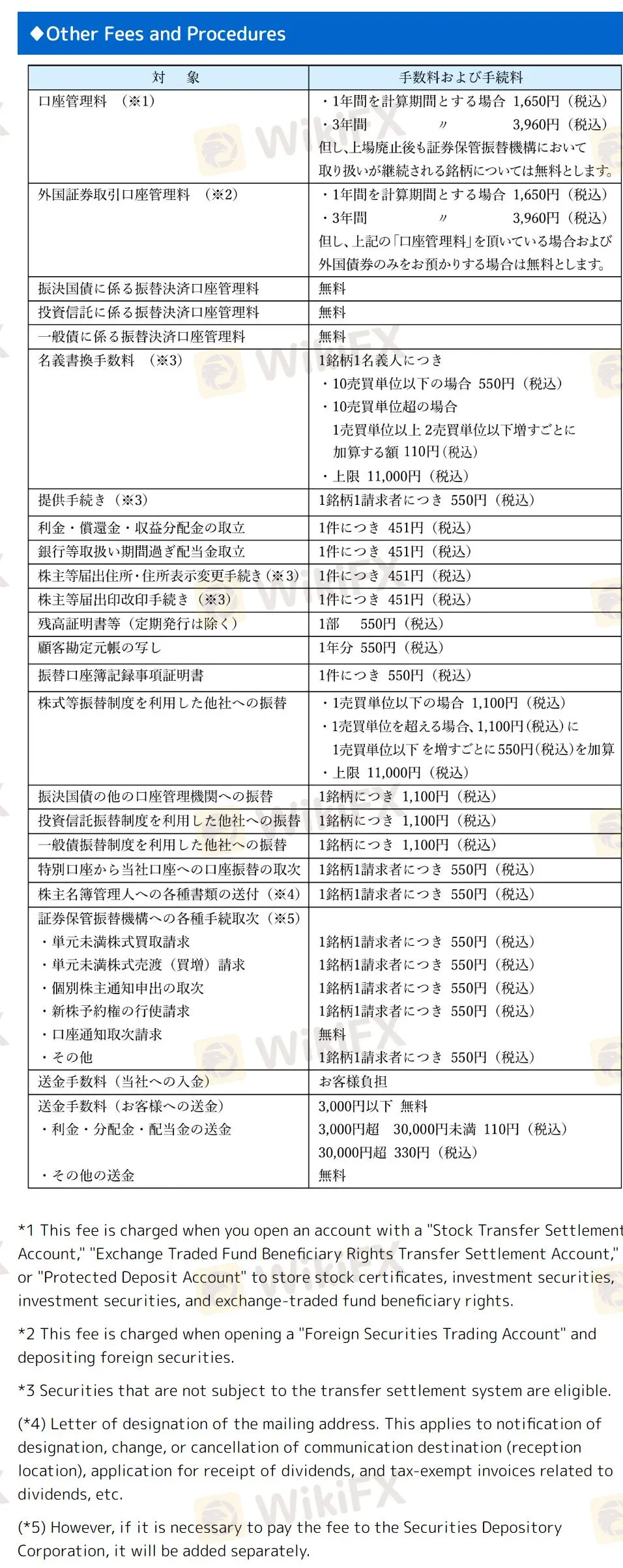

Biaya Tambahan:

- Berlaku untuk membuka rekening khusus seperti transfer saham atau rekening efek asing.

- Berlaku untuk surat berharga yang tidak dapat dipindahkan.

- Termasuk biaya untuk penunjukan alamat pengiriman surat dan dokumen terkait dividen.

- Mungkin termasuk biaya tambahan untuk layanan yang disediakan oleh Perusahaan Penyimpanan Efek.