Company Summary

| YAMAGATAReview Summary | |

| Founded | 2006 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, ETF (Exchange-Traded Fund), REIT (Real Estate Investment Trust), Bonds, Futures, Options |

| Demo Account | ✅ |

| Commission | Depending on the products, from 2,750 yen to 588,500 yen |

| Customer Support | Tel: 023-631-7720 |

| Email: soumu@yamagatashoken.co.jp | |

| Company address: 990-0042 yamagata city nanika-machi 2-1-41 (〒990-0042 山形市七日町2-1-41) | |

Founded in 2006, YAMAGATA is an FSA-regulated securities broker registered in Japan, offering trading services in U.S Stock (U.S. Equity Brokerage), Stocks (Spot Trading of Domestic Stocks, Foreign Stocks. etc), Bonds, Futures (JGB Futures), Investment Trusts, and Life Insurance.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Japanese reading threshold |

| Variety of trading products | |

| Demo accounts | |

| Clear fee structure |

Is YAMAGATA Legit?

Yes. YAMAGATA is currently regulated by Financial Services Agency (FSA).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | 山形證券株式会社 | Retail Forex License | 東北財務局長(金商)第3号 |

What Can I Trade on YAMAGATA?

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETF (Exchange-Traded Fund) | ✔ |

| REIT (Real Estate Investment Trust) | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

YAMAGATA Fees

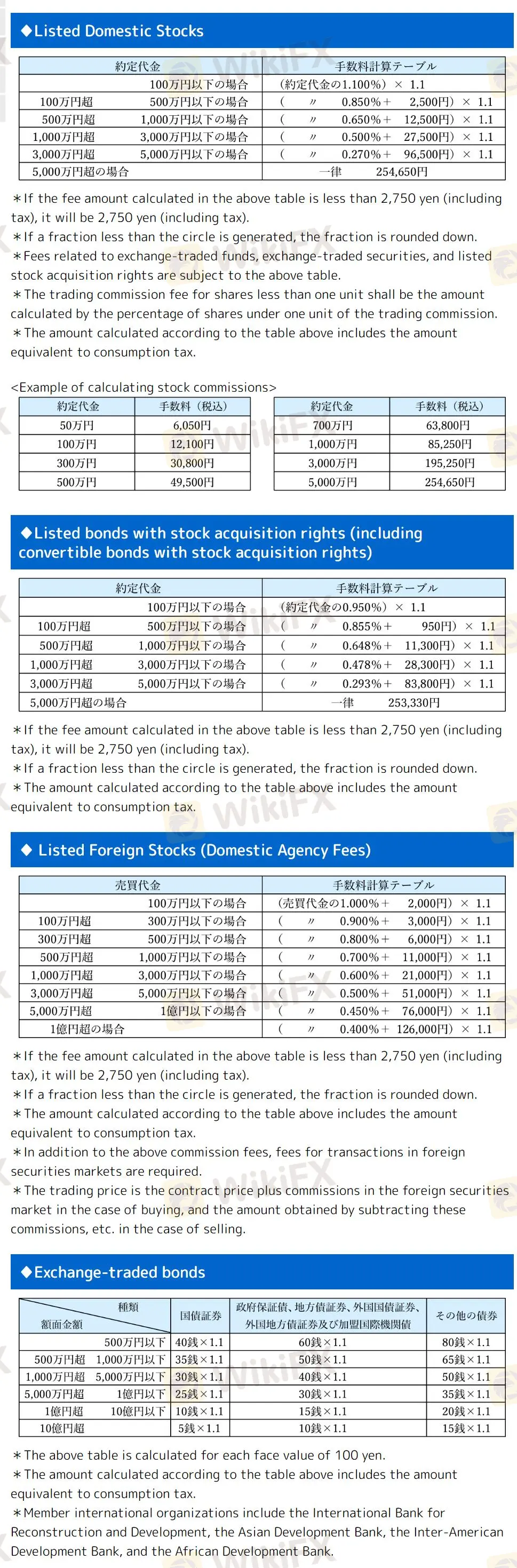

Fees for Stocks:

- Domestic Stocks & Bonds: The Minimum fee of 2,750 yen (including tax) applies if the calculated fee is less than this amount. Fractions of a yen are rounded down.

- Foreign Stocks: Same minimum fee as domestic stocks, plus additional fees for foreign market transactions.

- ETFs & Securities with Stock Acquisition Rights: Follow the same fee structure as domestic stocks.

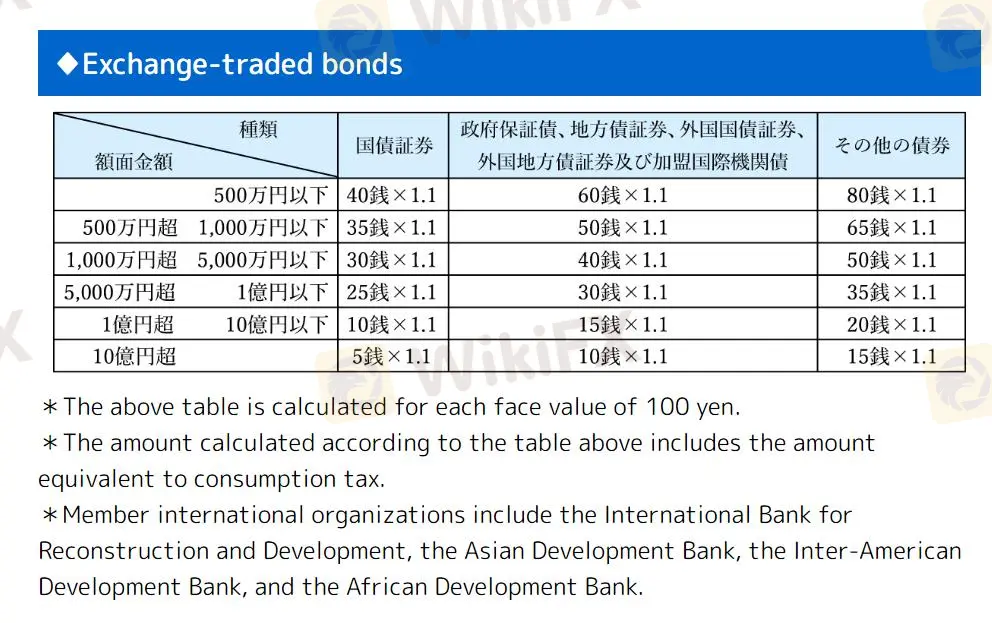

Fees for Bonds:

- Exchange-Traded Bonds: Fees calculated per 100 yen face value, including consumption tax.

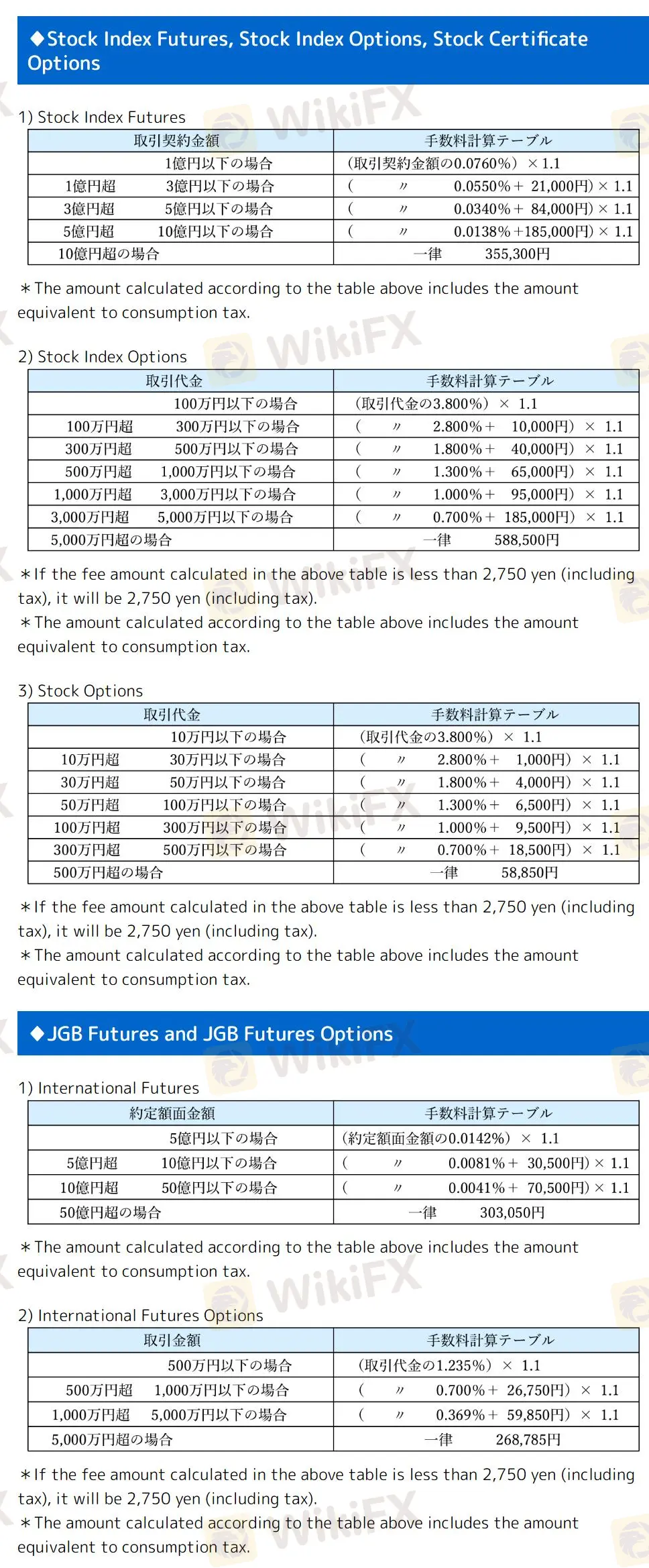

Fees for Futures and Options:

- Stock Index Futures: Fees include consumption tax.

- Stock Index Options & Stock Options: Minimum fee of 2,750 yen (including tax) if the calculated fee is less than this amount.

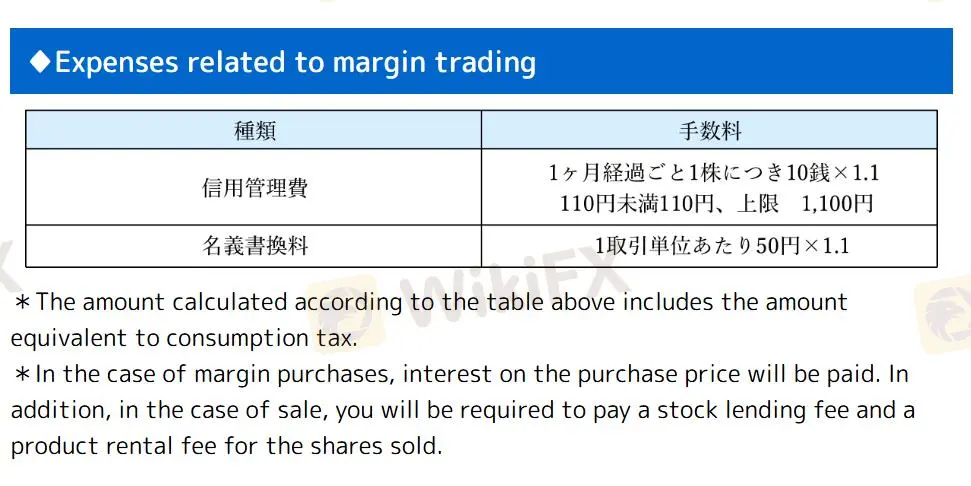

Margin Trading Expenses:

- Include interest on purchase prices for purchases and stock lending fees for sales, plus consumption tax.

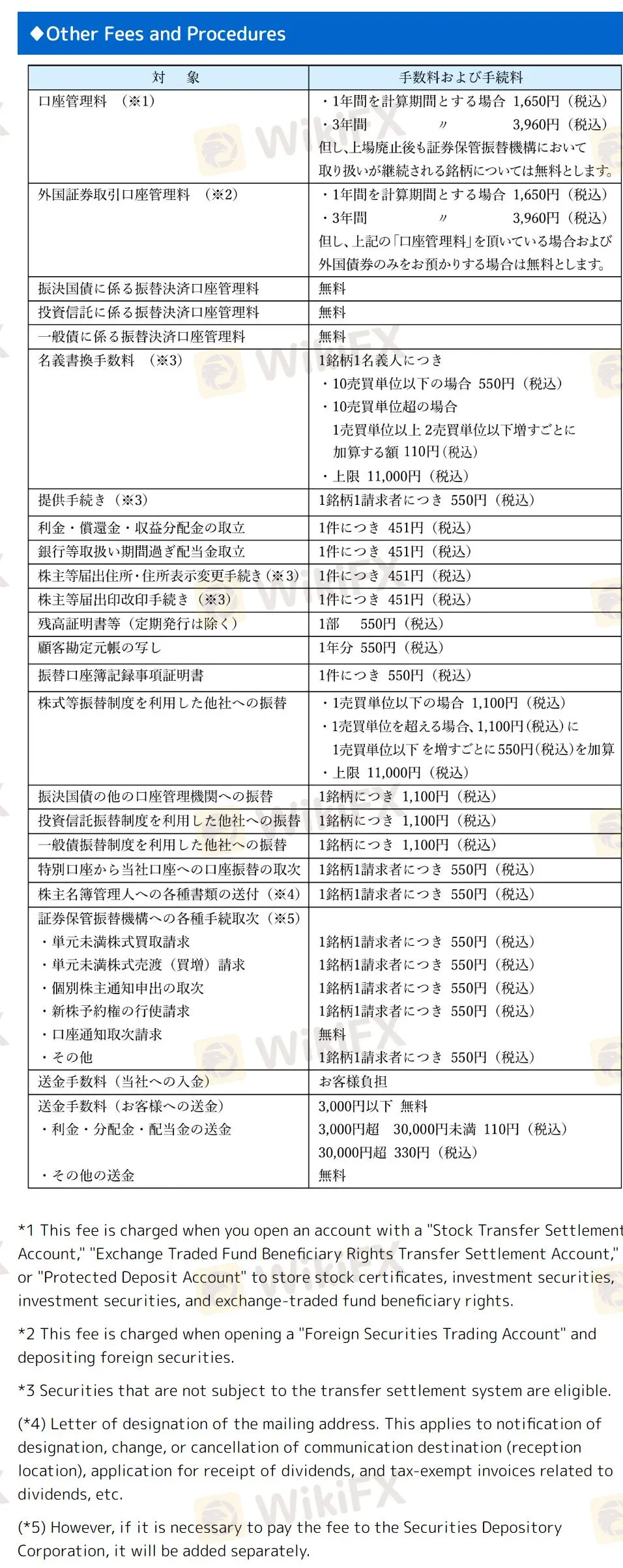

Additional Fees:

- Apply for opening specific accounts like stock transfer or foreign securities accounts.

- Apply to non-transferable securities.

- Include fees for mailing address designation and dividend-related documents.

- May include additional fees for services provided by the Securities Depository Corporation.