Serious74

1-2年

According to your research and what reviewers are saying, how legitimate do you believe YAMAGATA is?

From my perspective as a long-time trader, legitimacy is often anchored in regulation and transparency. YAMAGATA stands out in this regard since it is fully regulated by Japan’s Financial Services Agency (FSA), which is a highly reputable financial authority. Having observed many brokers over the years, I’ve found that FSA-regulated firms generally adhere to strict operational and disclosure standards, which provides a degree of reassurance for me as a potential client. YAMAGATA’s regulatory status is clearly disclosed with a specific retail forex license, and their address and contact information are readily available, which I consider essential signs of operational transparency.

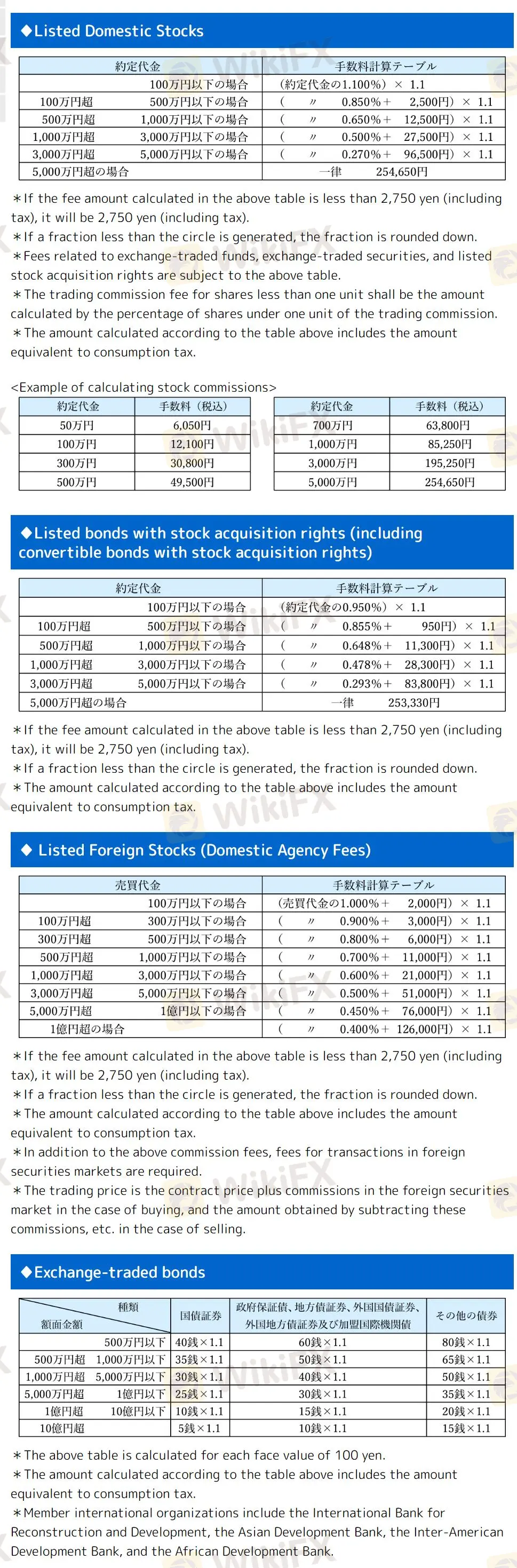

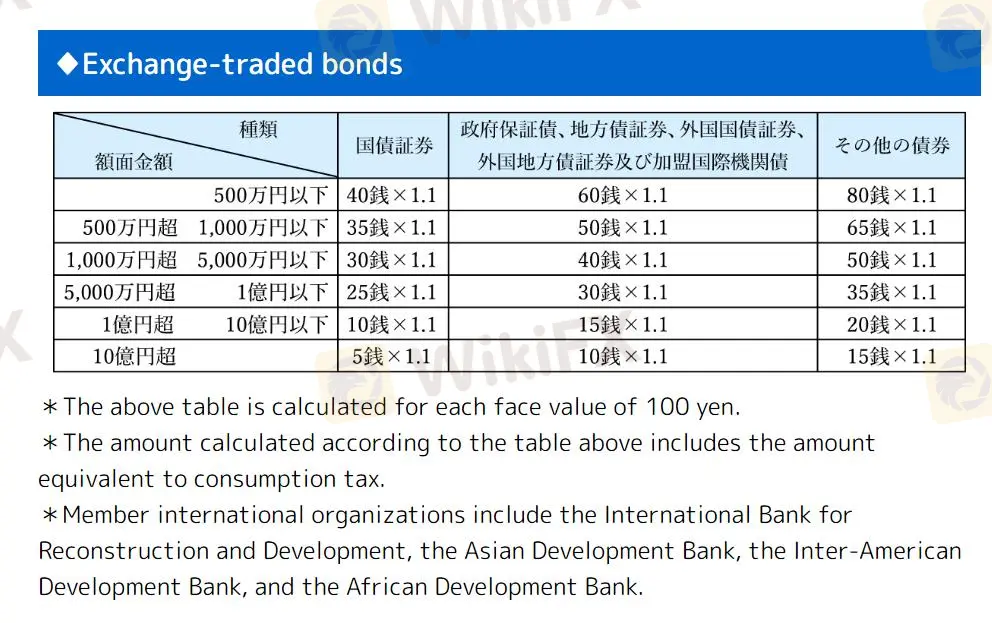

I notice, however, that YAMAGATA does not actually offer forex or cryptocurrency trading. Their core focus is on stocks, ETFs, REITs, bonds, futures, and options. For someone like me who primarily trades forex, this is a crucial distinction, as a “Retail Forex License” doesn’t equate to access to spot forex or major currency pairs via this platform. Also, there is a “medium potential risk” noted, so I would be prudent and carefully review their fee structure—minimums and special service fees may impact smaller account holders or those with infrequent trades.

Ultimately, based on my assessment of their regulation, business longevity, and operational transparency, I believe YAMAGATA is a legitimate, licensed Japanese securities broker. That said, I approach any financial relationship with measured caution and suggest a thorough read of all terms before committing funds, especially due to their product focus and nuanced fee structure.

Moshiheya

1-2年

Is it possible to trade particular assets such as Gold (XAU/USD) and Crude Oil on the YAMAGATA platform?

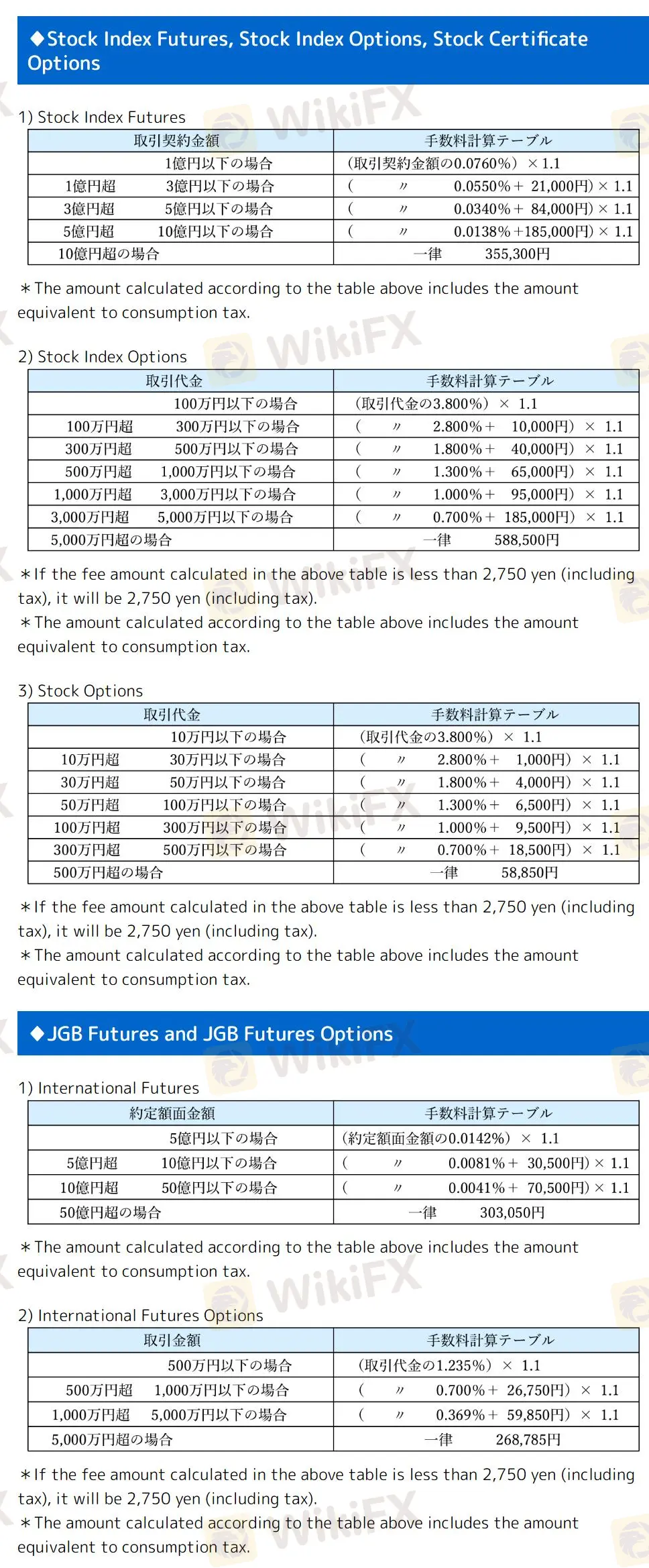

From my personal experience and after thoroughly examining YAMAGATA’s offerings, I found that trading assets such as Gold (XAU/USD) or Crude Oil is not currently possible on their platform. YAMAGATA, being an FSA-regulated brokerage established in Japan, primarily provides access to instruments like domestic and foreign stocks, ETFs, REITs, bonds, futures (specifically JGB futures), investment trusts, and options. As someone who has navigated multiple platforms over the years, the absence of commodities, including precious metals and energy products, is a notable limitation for me.

The platform’s well-defined product list means that I am unable to directly speculate on gold or crude oil price movements through spot, CFD, or futures instruments. This focus on traditional securities and Japanese regulation does provide a measure of safety and clarity around the products available. The clear fee structure and regulatory oversight are advantages, but for traders like myself seeking exposure to global commodities, including gold or oil, YAMAGATA does not meet that need. Therefore, if these assets are essential to your strategy, it’s important to look at alternative brokers who specifically offer commodity trading alongside equities and bonds.

Broker Issues

Account

Leverage

Platform

Instruments

Sergey5

1-2年

Are there any payment methods with YAMAGATA that allow for instant withdrawals?

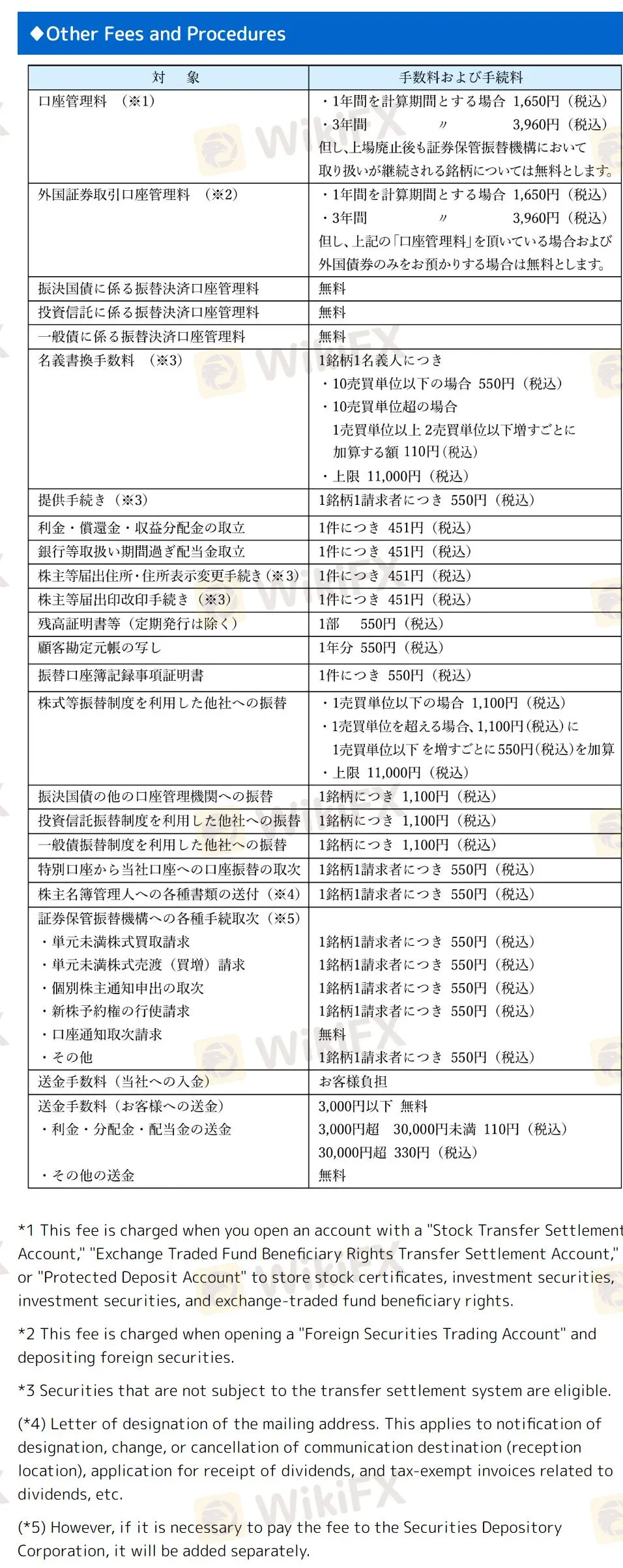

Based on my review of YAMAGATA, I did not find any details specifically listing payment methods or clarifying whether instant withdrawals are supported. For me as a trader, timely access to funds is crucial, so the absence of transparent information on withdrawal methods or speeds naturally makes me cautious. Although YAMAGATA is a long-standing, FSA-regulated Japanese broker with a 15-20 year track record and a clear fee structure for trading stocks, ETFs, and related instruments, I always look for explicit terms regarding deposits and withdrawals before committing significant capital.

My experience tells me that brokers regulated in Japan, like YAMAGATA, usually adhere to strict standards for fund security and transfer procedures, but this does not guarantee instant processing. Additional fees also apply for various account operations, which could impact withdrawal timelines or costs. Without concrete information on instant withdrawal options, I advise anyone considering this broker to directly consult their customer support via the provided telephone or email before making funding decisions. In my judgment, it’s best to confirm all operational details to avoid unwanted surprises and ensure an approach aligned with personal risk management preferences.

Broker Issues

Withdrawal

Deposit

Mansuber007

1-2年

How much maximum leverage does YAMAGATA provide for major forex pairs, and how does this leverage differ across other asset types?

After reviewing YAMAGATA’s offering in detail as an independent trader, I found that their service does not actually include forex trading for major currency pairs at all. This came as a surprise considering the “Retail Forex License” label, but upon closer inspection, my experience shows they only provide access to stocks, ETFs, REITs, bonds, futures, and options. There is no mention of forex or leverage for currency pairs, so traders seeking leveraged FX products would need to look elsewhere.

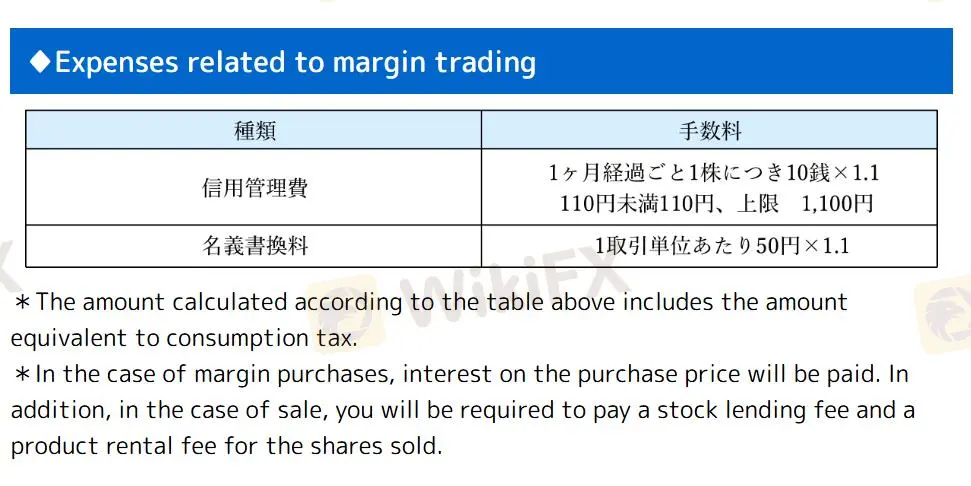

As for leverage and margin across YAMAGATA’s available assets, the broker’s fee and structure details suggest a fairly traditional, conservative approach, which is understandable given their Japanese FSA regulation. Margin trading is available for stocks, with associated expenses like interest on purchase prices and stock lending fees, but the specifics on the exact leverage ratios aren’t transparent from their public details. For me, whenever a broker isn’t explicit about leverage levels—especially for riskier instruments—I interpret it as a sign to proceed cautiously and seek direct clarification before engaging with margin products. The lack of support for forex and leveraged commodities also signals a focus on regulated, possibly lower-risk investment opportunities, which is more typical of Japanese securities firms. In my opinion, traders prioritizing higher leverage or multi-asset access, particularly in FX, would not find YAMAGATA suitable for their needs.

Broker Issues

Account

Platform

Instruments

Leverage