회사 소개

| Tapbit 리뷰 요약 | |

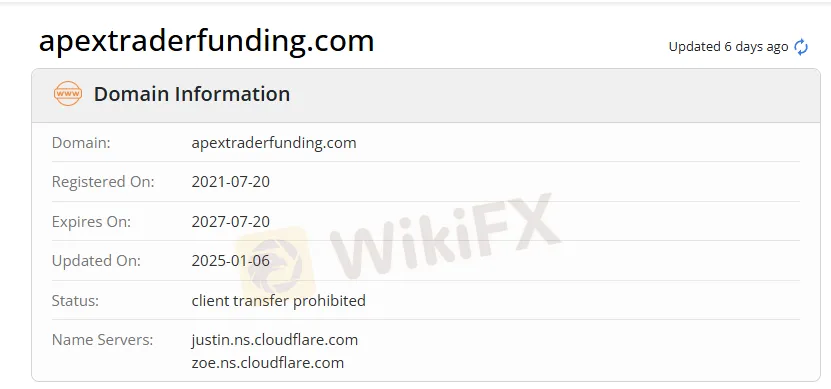

| 설립 연도 | 2021 |

| 등록 국가/지역 | 중국 |

| 규제 | 규제 없음 |

| 시장 상품 | 파생상품, 암호화폐 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | 모바일 앱 |

| 최소 입금액 | / |

| 고객 지원 | 24/7 고객 지원 |

| 실시간 채팅 | |

| 텔레그램, 인스타그램, X, 미디엄, 페이스북, 유튜브, 링크드인, 레딧 | |

| 이메일: support@tapbit.com | |

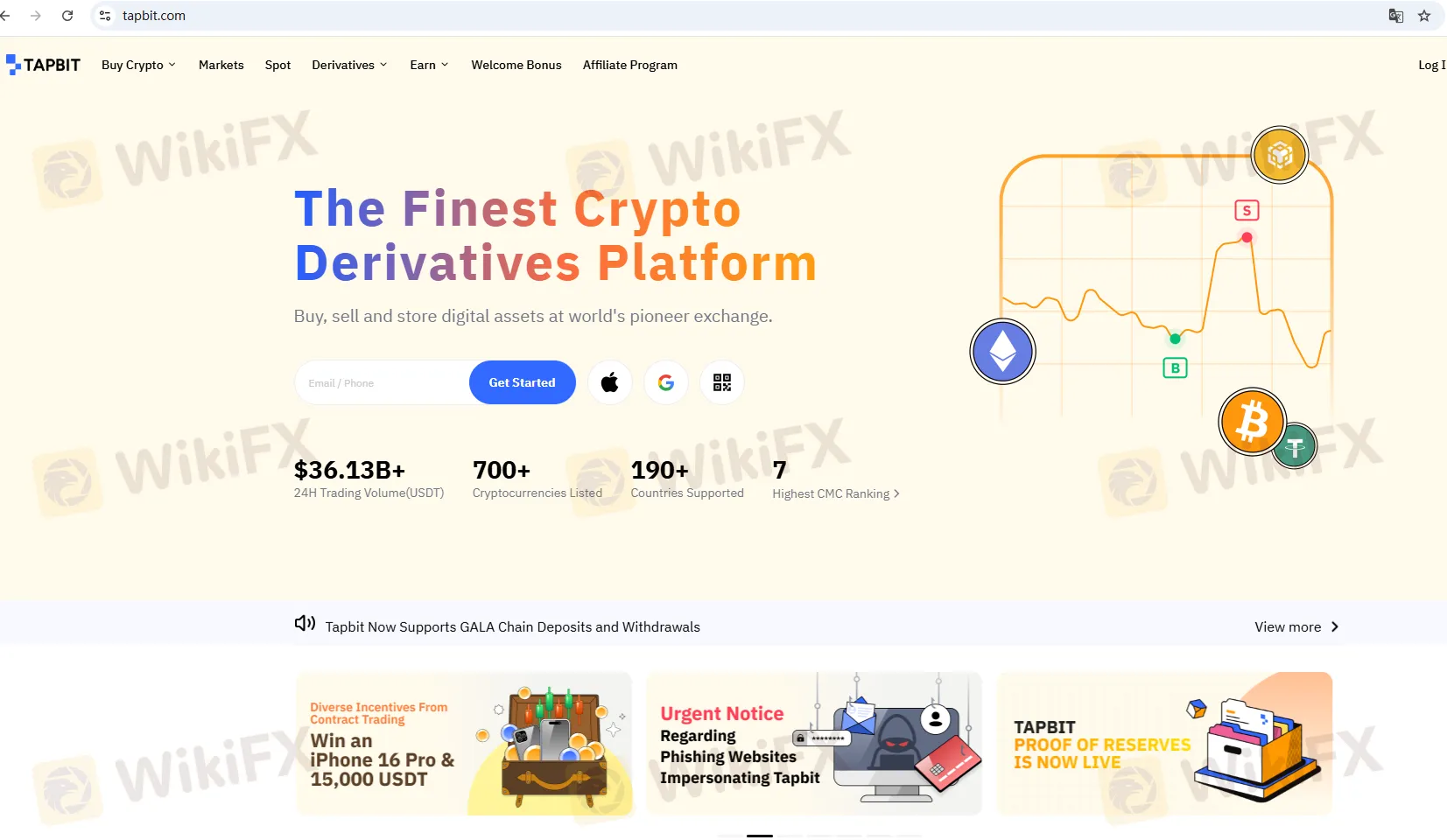

Tapbit 정보

Tapbit은 2021년에 설립되었으며 중국에 등록되어 현재 규제가 없으며 파생상품 및 암호화폐 거래를 제공합니다.

장단점

| 장점 | 단점 |

| 모바일 앱 지원 | 규제 없음 |

| 상품 부족 | |

| 데모 계정 미제공 | |

| MT4/MT5 미제공 | |

| 스프레드 정보 부족 |

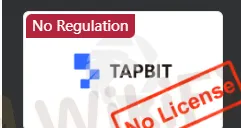

Tapbit 합법적인가요?

아니요. Tapbit은 규제가 없습니다. 리스크를 인식해주시기 바랍니다!

Tapbit에서 무엇을 거래할 수 있나요?

Tapbit은 파생상품과 암호화폐를 제공합니다.

| 거래 가능한 상품 | 지원 여부 |

| 암호화폐 | ✔ |

| 파생상품 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

거래 플랫폼

| 거래 플랫폼 | 지원 여부 | 사용 가능한 장치 | 적합 대상 |

| 모바일 앱 | ✔ | / | 간편함과 빠른 속도를 원하는 초보자 및 캐주얼 트레이더 |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |

입출금

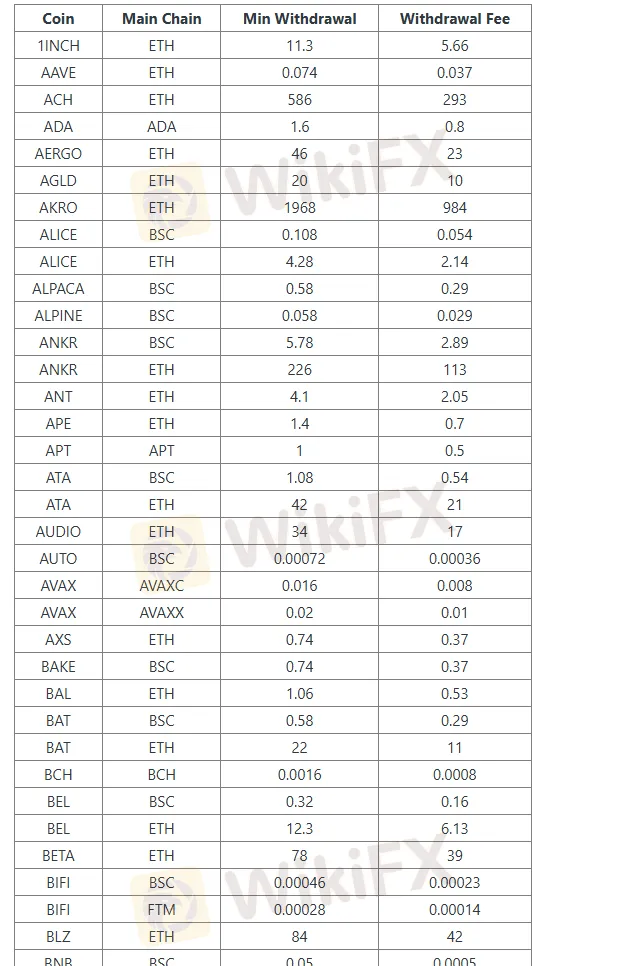

Tapbit에서는 입금이 무료이며 각 코인의 구체적인 수수료율을 확인하려면 아래 표를 참조하십시오:

암호화폐 인출 세부 정보를 정리한 표입니다:

| 코인 | 메인 체인 | 최소 인출 | 인출 수수료 |

| 1INCH | ETH | 11.3 | 5.66 |

| AAVE | ETH | 0.074 | 0.037 |

| ACH | ETH | 586 | 293 |

| ADA | ADA | 1.6 | 0.8 |

| AERGO | ETH | 46 | 23 |

| AGLD | ETH | 20 | 10 |

| AKRO | ETH | 1968 | 984 |

| ALICE | BSC | 0.108 | 0.054 |

| ALICE | ETH | 4.28 | 2.14 |

| ALPACA | BSC | 0.58 | 0.29 |

| ALPINE | BSC | 0.058 | 0.029 |

| ANKR | BSC | 5.78 | 2.89 |

| ANKR | ETH | 226 | 113 |

| ANT | ETH | 4.1 | 2.05 |

| APE | ETH | 1.4 | 0.7 |

| APT | APT | 1 | 0.5 |

| ATA | BSC | 1.08 | 0.54 |

| ATA | ETH | 42 | 21 |

| AUDIO | ETH | 34 | 17 |

| AUTO | BSC | 0.00072 | 0.00036 |

| AVAX | AVAXC | 0.016 | 0.008 |

| AVAX | AVAXX | 0.02 | 0.01 |

| AXS | ETH | 0.74 | 0.37 |

| BAKE | BSC | 0.74 | 0.37 |