Imranali Khatri

1-2年

Can you outline the main advantages Tapbit offers when it comes to its available trading instruments and how its fee structure is set up?

In my time evaluating different brokers, I’ve always prioritized access to a broad range of instruments and a clear, competitive fee structure. With Tapbit, I honestly find the advantages on these fronts quite limited based on my research and practical needs as a trader. Tapbit’s offering is focused solely on cryptocurrencies and derivatives, which, in my view, restricts flexibility for anyone looking to trade forex, commodities, indices, stocks, or other traditional assets. If your interest lies exclusively in crypto-related products, their platform could be of some use, but for me, the narrow scope is a notable drawback.

As for the fee structure, Tapbit’s setup for deposits is straightforward in that deposits are free, which initially seems beneficial. However, withdrawals—particularly in cryptocurrencies—do attract set fees, with each coin carrying its specific minimum withdrawal amount and fee. For example, withdrawing popular coins like ADA, AVAX, or ETH will incur explicit costs, and I always prefer brokers that publicize these details so I’m not caught off guard. On balance, while the information is transparent, the absence of traditional trading instruments, a demo account, and support for platforms like MT4 or MT5—coupled with their unregulated status—means I approach Tapbit’s limited advantages with caution. My personal strategy always leans toward platforms that offer a wider product selection and robust regulatory oversight.

Nali5689

1-2年

In what ways does Tapbit’s regulatory standing help safeguard my funds?

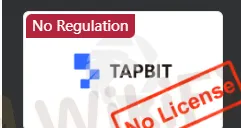

As an experienced trader, I approach any broker’s regulatory status with great caution, especially when safeguarding my capital. In the case of Tapbit, I could not find any valid or recognized regulatory licenses associated with this platform. This unregulated status is a significant concern for me. When a broker is regulated, it means they are required to comply with strict oversight regarding client fund protection, segregation of accounts, transparency, and dispute resolution. Such regulation offers traders a certain degree of recourse if things go wrong—protections that I value highly when placing hard-earned funds at risk.

With Tapbit, the lack of regulation means there are no external authorities supervising their business practices or ensuring they adhere to established financial standards. If any issues arise—such as withdrawal difficulties or operational disputes—I would have no official regulatory body to turn to for help. Furthermore, the presence of warnings about suspicious licenses and high potential risk further erodes my confidence. For me, these red flags suggest a greater risk to fund security compared to trading with a properly regulated broker. Therefore, I do not see Tapbit’s regulatory standing as providing any meaningful safeguards for my funds—in fact, it represents a substantial risk I wouldn’t take lightly.

ritzyshona

1-2年

What's the lowest amount I'm allowed to withdraw from my Tapbit account in a single transaction?

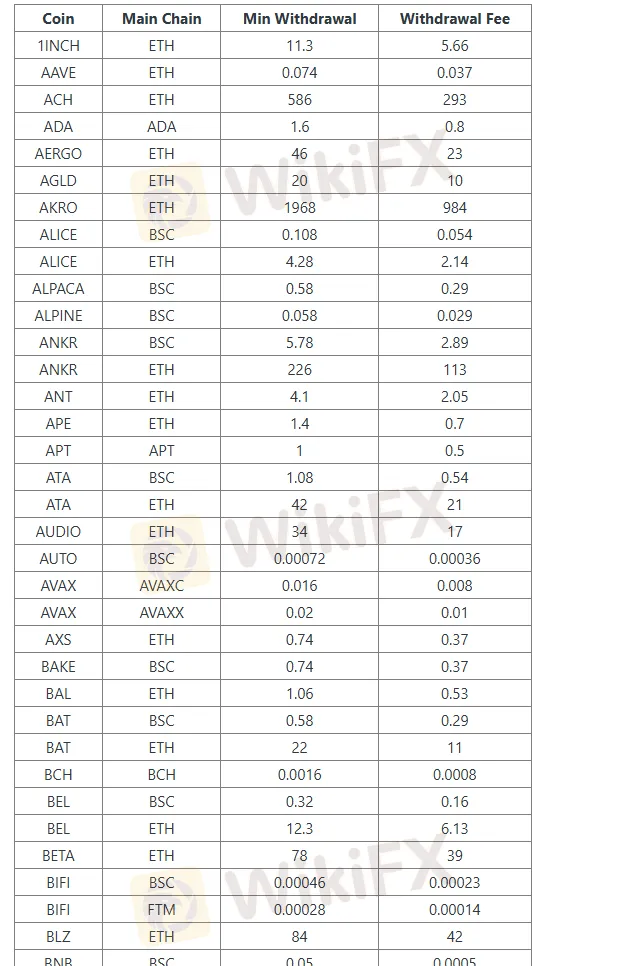

In my review of Tapbit, I found that the minimum withdrawal amount depends entirely on the specific cryptocurrency you intend to withdraw. There is no universal threshold across all coins. For example, if you’re looking to withdraw ADA, the minimum permitted per transaction is 1.6 ADA, while for AAVE it’s 0.074. Each supported crypto on the platform has its own set limit as well as a corresponding withdrawal fee. I urge anyone considering withdrawals to carefully check Tapbit’s withdrawal table for the exact coin they are using before initiating any transactions.

Given Tapbit’s lack of regulatory oversight and the high-risk rating flagged on industry monitoring platforms, I personally exercise heightened caution with any funds I hold or withdraw from this broker. In my view, the absence of standard regulatory protections leaves users with minimal recourse should unexpected issues arise during withdrawal, so understanding the platform’s detailed requirements for each digital asset is crucial for risk management. For me, staying aware of both the minimum limits and the evolving fee schedules has been an essential part of safely navigating this venue.

Broker Issues

Deposit

Withdrawal

ritzyshona

1-2年

Does Tapbit offer fixed or variable spreads, and how do their spreads typically behave during periods of heightened market volatility or major news releases?

Based on my direct experience and careful review of Tapbit, I find it concerning that the broker provides no transparent information about spreads—whether fixed or variable—on their platform. As a trader, spread structure is fundamental to understanding your potential costs and managing risk, especially during turbulent news cycles or high-volatility events. The fact that Tapbit is unregulated and does not disclose basic details about spread behavior makes it challenging, if not impossible, to anticipate trading conditions or protect yourself from sudden, unfavorable changes. Spreads often widen dramatically during periods of market volatility on even reputable platforms, and unregulated brokers can be especially risky in this regard since there is no external oversight or guarantee of fair execution. When a broker lacks both regulation and transparency on such a basic trading condition, I personally consider it an unacceptable risk. I recommend extreme caution, especially for newer traders who might underestimate their exposure to unknown transaction costs during major news announcements or market turbulence. In my view, reliable and fully disclosed spread information is non-negotiable, and without it, I cannot trade with confidence on Tapbit.

Broker Issues

Fees and Spreads