회사 소개

| Mitoyo 리뷰 요약 | |

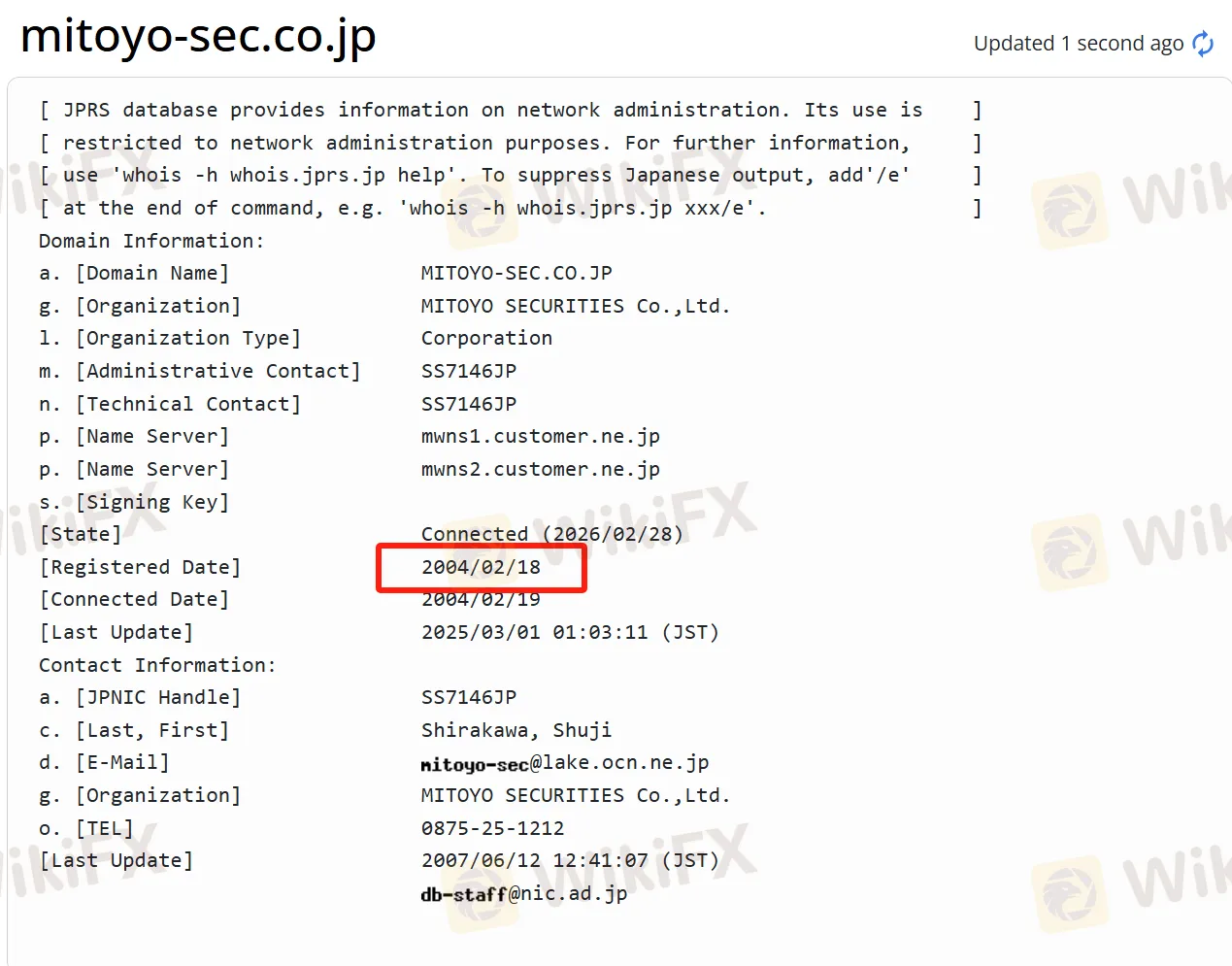

| 설립 연도 | 2004 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA (규제됨) |

| 시장 상품 | 투자신탁, 채권 및 주식 |

| 거래 플랫폼 | / |

| 고객 지원 | 전화: 0875-25-1212 |

| 팩스: 0875-25-1221 | |

Mitoyo 정보

Mitoyo 증권은 오랜 역사를 가진 일본 증권 회사입니다. 설립 이후 지역 사회에 밀접하게 뿌리내리고 Mitoyo 지역을 주력으로 사업을 진행해왔습니다. 다양한 금융 상품을 제공하며, 국내 다수 거래소에 상장된 주식, 다양한 투자신탁 및 다양한 종류의 채권을 포함합니다. 동시에 맞춤형 금융 솔루션과 다양한 거래 도구를 제공하여 다양한 투자자의 요구를 충족시킬 수 있습니다. 회사는 좋은 복지 및 혜택 제도를 갖추고 있으며 지역 발전에 큰 중요성을 두고 지역 활성화에 적극 참여하고 있습니다.

장단점

| 장점 | 단점 |

| 규제됨 | 국제 사업 한정 |

| 다양한 거래 도구 | |

| 좋은 복지 및 혜택 제도 | |

| 지역 발전에 중점 | |

| 장기 운영 시간 |

Mitoyo 합법적인가요?

Mitoyo은 합법적이고 규정을 준수하는 증권 회사입니다. 금융 서비스 규제청 (FSA)가 Mitoyo 증권을 규제하고 있으며, 라이선스 번호는 Shikoku Chief Financial Officer (Financial Merchant) No. 7입니다.

위키FX 현장 조사

위키FX 현장 조사팀이 일본의 Mitoyo 사무실을 방문하여 현장에 실제 사무실이 있는 것을 확인했습니다.

Mitoyo에서 무엇을 거래할 수 있나요?

Mitoyo은 도쿄 증권 거래소, 나고야 증권 거래소, 삿포로 증권 거래소, 후쿠오카 증권 거래소 등 다수의 거래소에 상장된 국내 주식을 제공합니다.

투자신탁은 자본 투자 신탁, 공공 채권형 투자 신탁 (MRF, 공공 채권 투자 신탁), ETF, J-REIT 등 다양한 유형이 있습니다. 투자자는 투자 신탁을 통해 다양한 투자를 실현할 수 있습니다.

투자자들은 개별 지향적 정부채(10년 변동, 5년 고정, 3년 고정 포함) 및 새 창구 판매 정부채, CB(신주 구독권이 있는 국내 전환사채 유형의 기업채), 외화채권 등과 같은 다양한 채권 상품 중에서 선택할 수 있습니다.

| 거래 가능한 상품 | 지원 |

| 투자신탁 | ✔ |

| 채권 | ✔ |

| 주식 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |