Resumo da empresa

| Pictet Resumo da Revisão | |

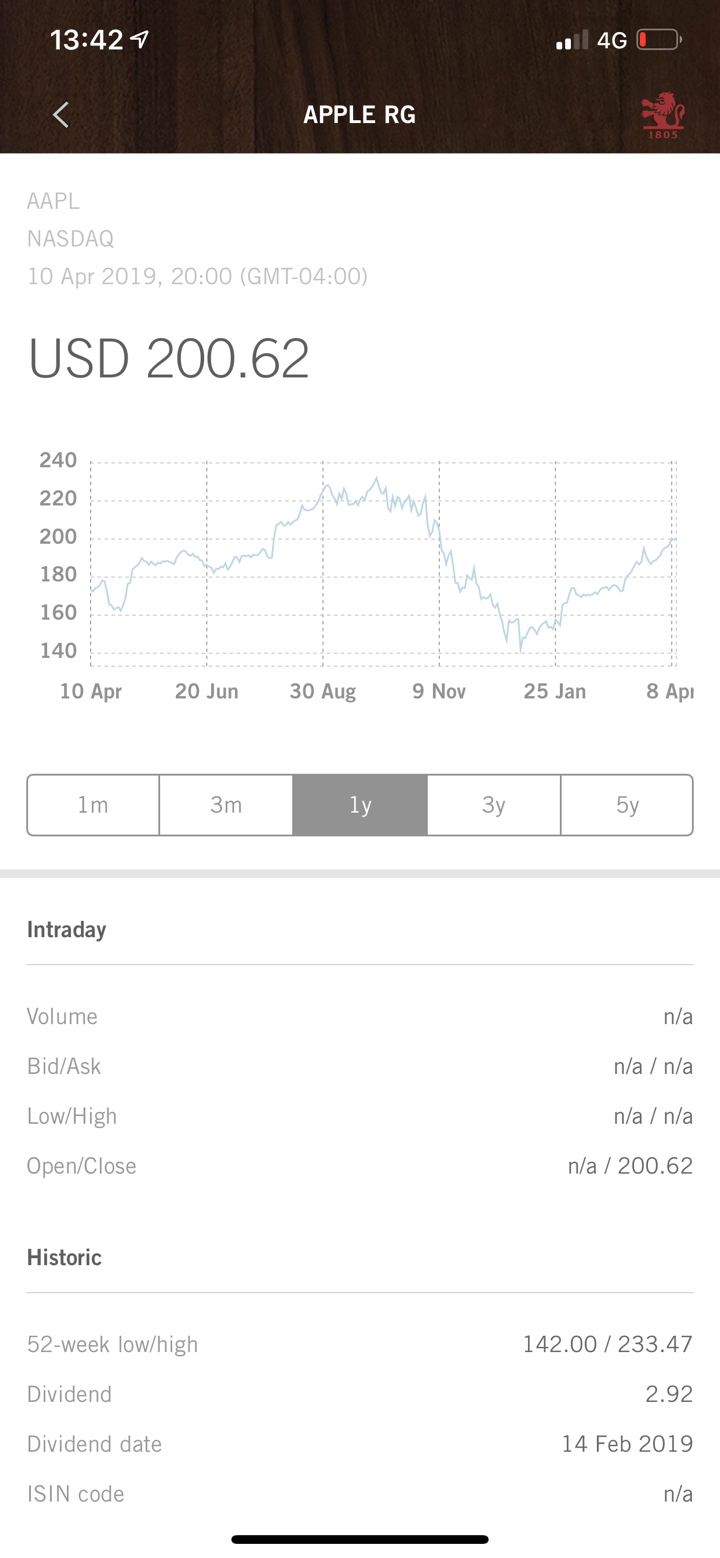

| Fundação | 1805 |

| País/Região Registrada | Suíça |

| Regulação | SFC |

| Serviços | Gestão de patrimônio, gestão de ativos, investimentos alternativos, serviços de ativos |

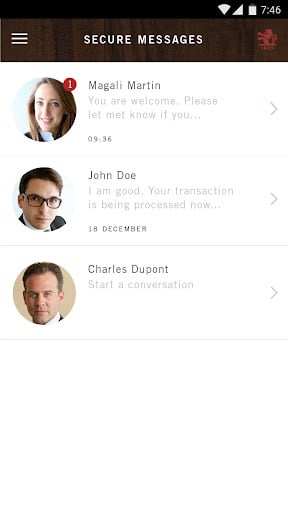

| Suporte ao Cliente | Tel: +41 58 323 23 23Tel.: +852 3191 1805 |

| Fax: +852 3191 1808 | |

Informações sobre Pictet

Pictet, fundada em 1805 e sediada na Suíça, é regulamentada pela SFC. Eles oferecem gestão de patrimônio, gestão de ativos, investimentos alternativos e serviços de ativos, com suporte ao cliente disponível por telefone e fax.

Prós e Contras

| Prós | Contras |

|

|

|

Pictet é Legítimo?

Pictet possui uma licença de "Negociação de contratos futuros" regulada pela Comissão de Valores Mobiliários e Futuros (SFC) em Hong Kong com o número de licença AAG715.

Para quem Pictet Serve?

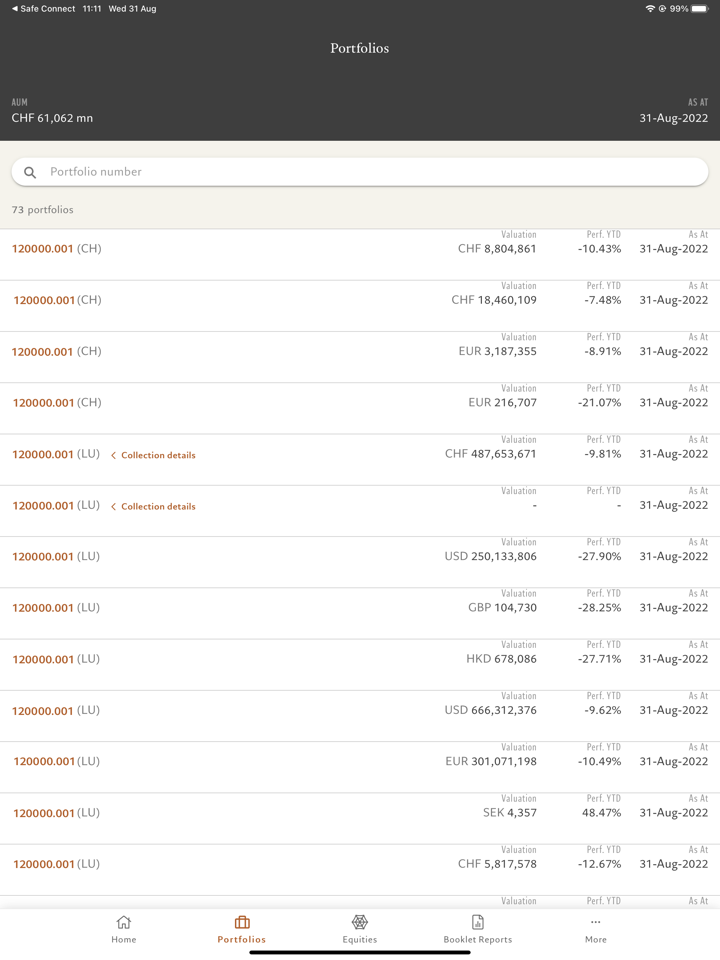

- Indivíduos e famílias: Pictet oferece fundos para ajudar instituições financeiras e intermediários a alcançar os objetivos de investimento de seus clientes, fornecendo também soluções de serviços para simplificar a administração, negociação e relatórios.

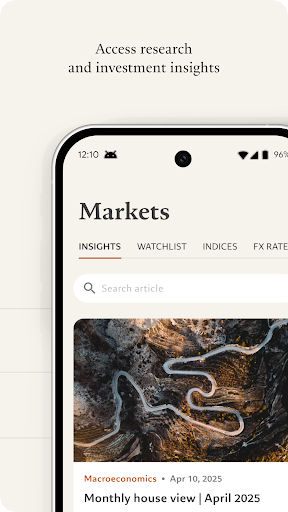

- Instituições financeiras e intermediários: Pictet oferece fundos para ajudar instituições financeiras e intermediários a alcançar os objetivos de investimento de seus clientes. Eles também fornecem soluções de serviços para simplificar os processos de administração, negociação e relatórios.

- Investidores institucionais: Pictet fornece estratégias de investimento e soluções de serviços para grandes investidores institucionais globalmente, incluindo fundos de pensão, fundos patrimoniais e fundos soberanos.

O que Pictet Faz?

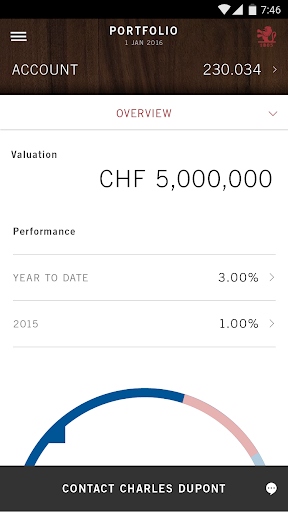

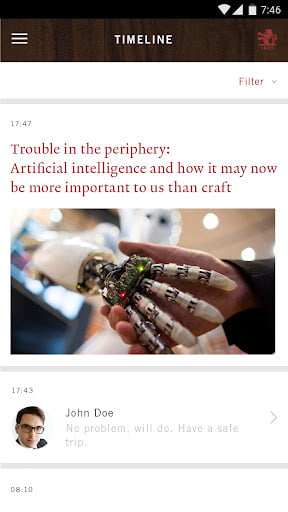

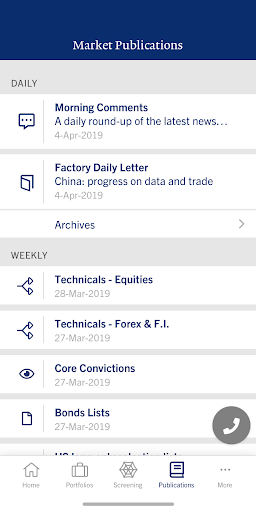

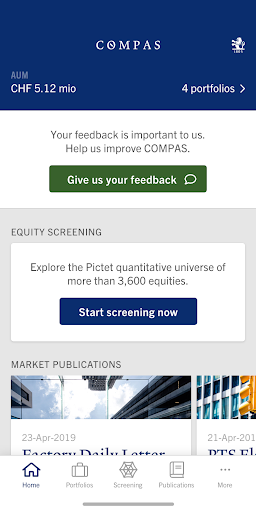

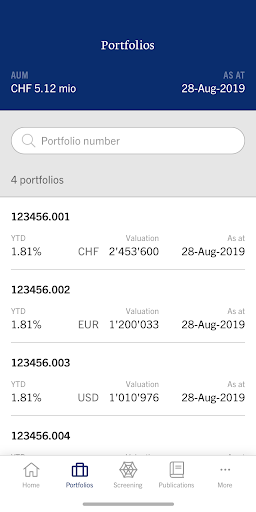

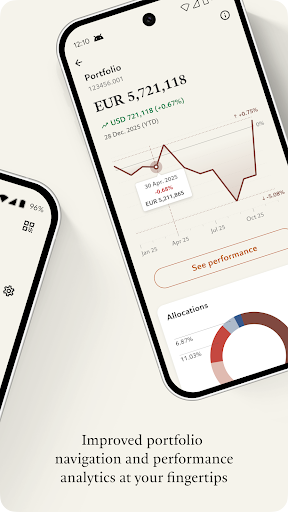

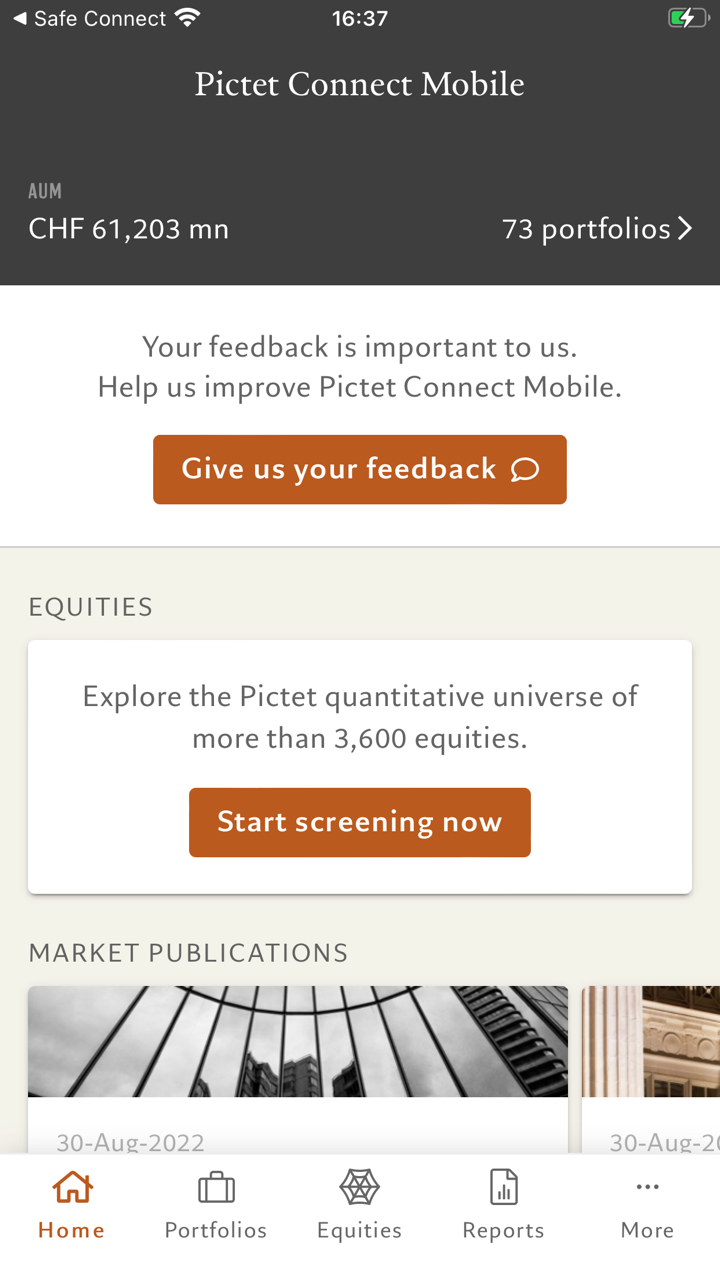

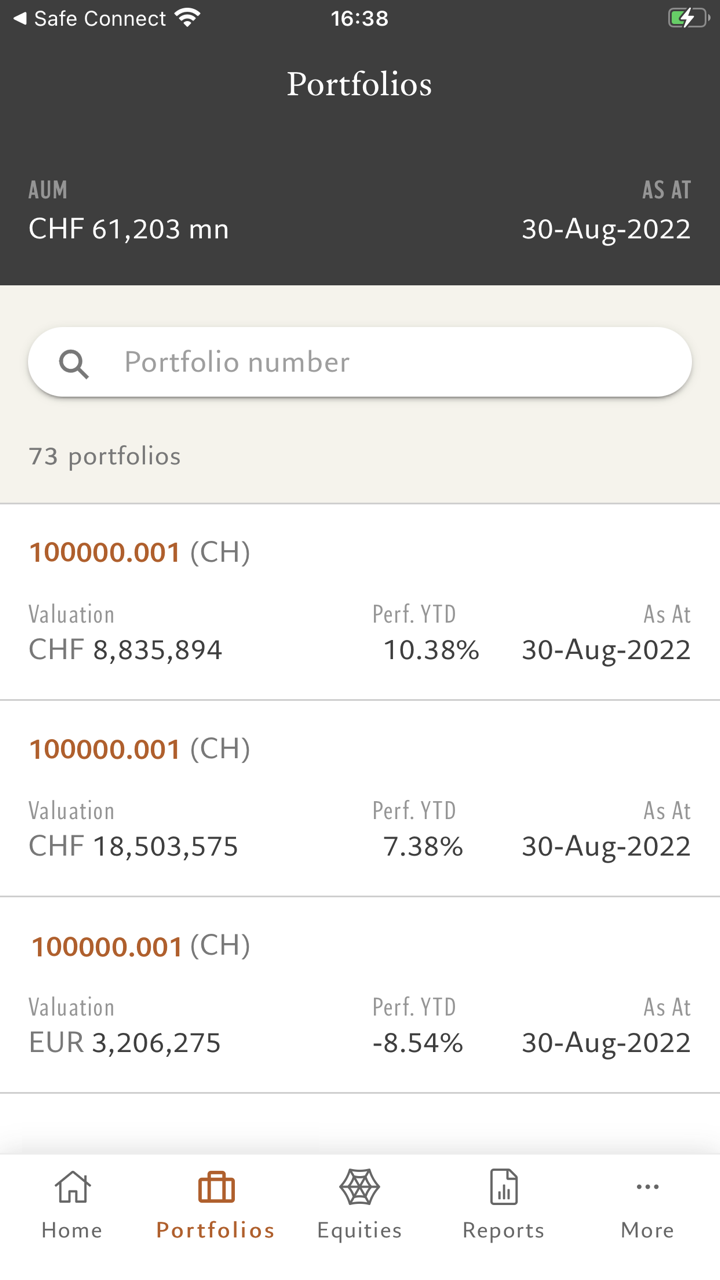

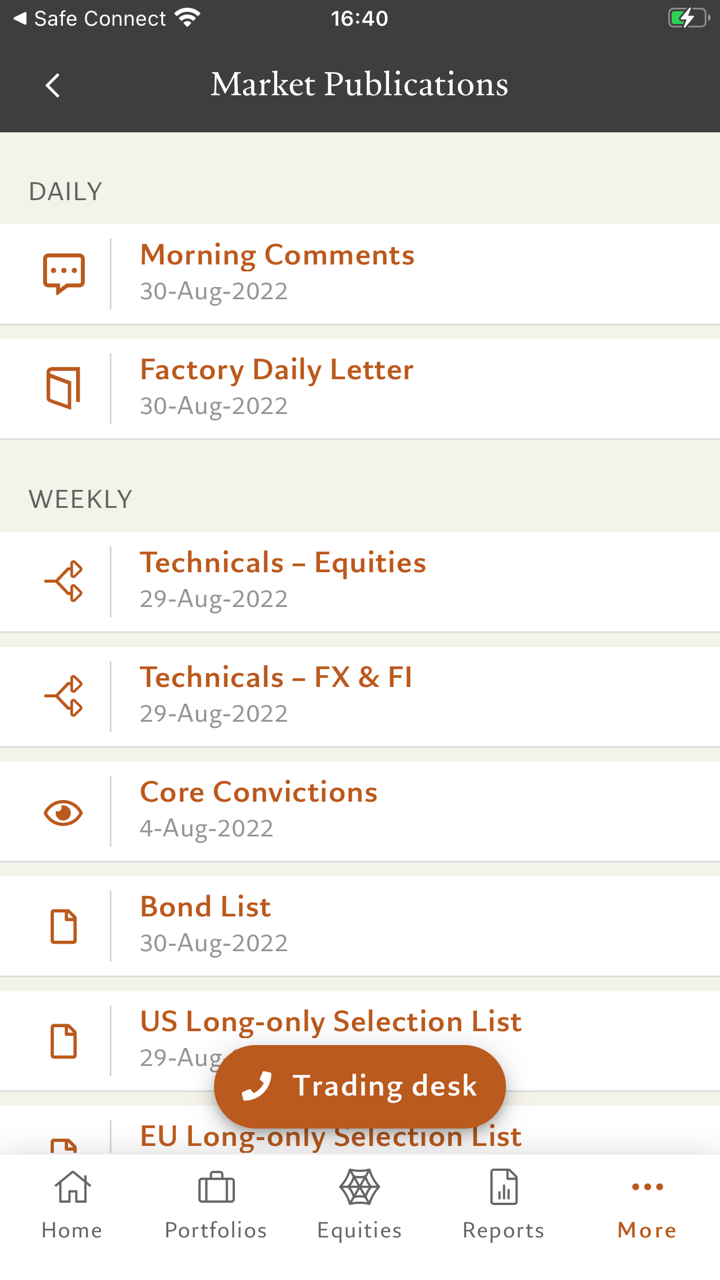

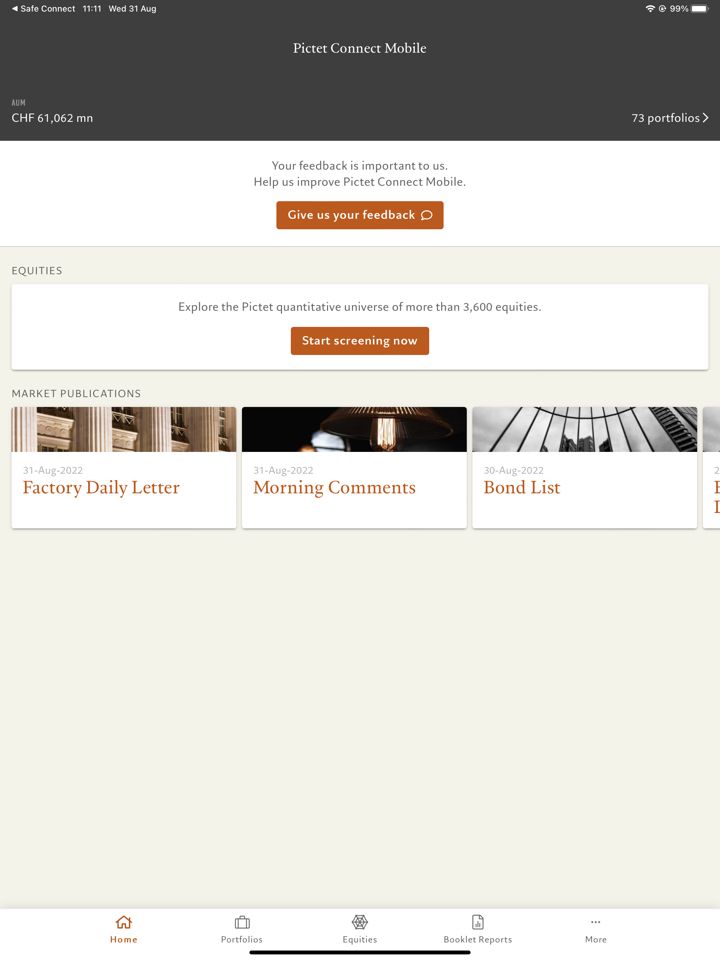

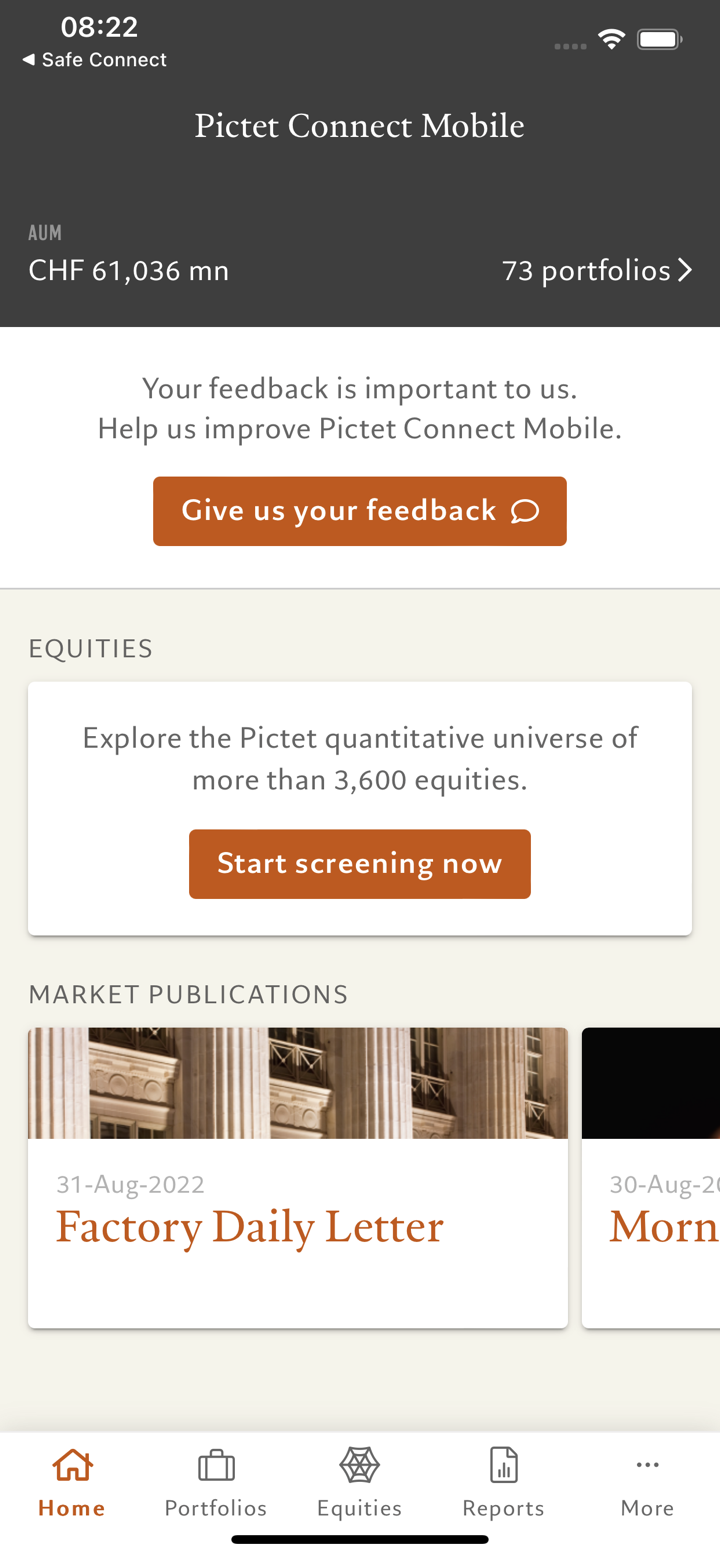

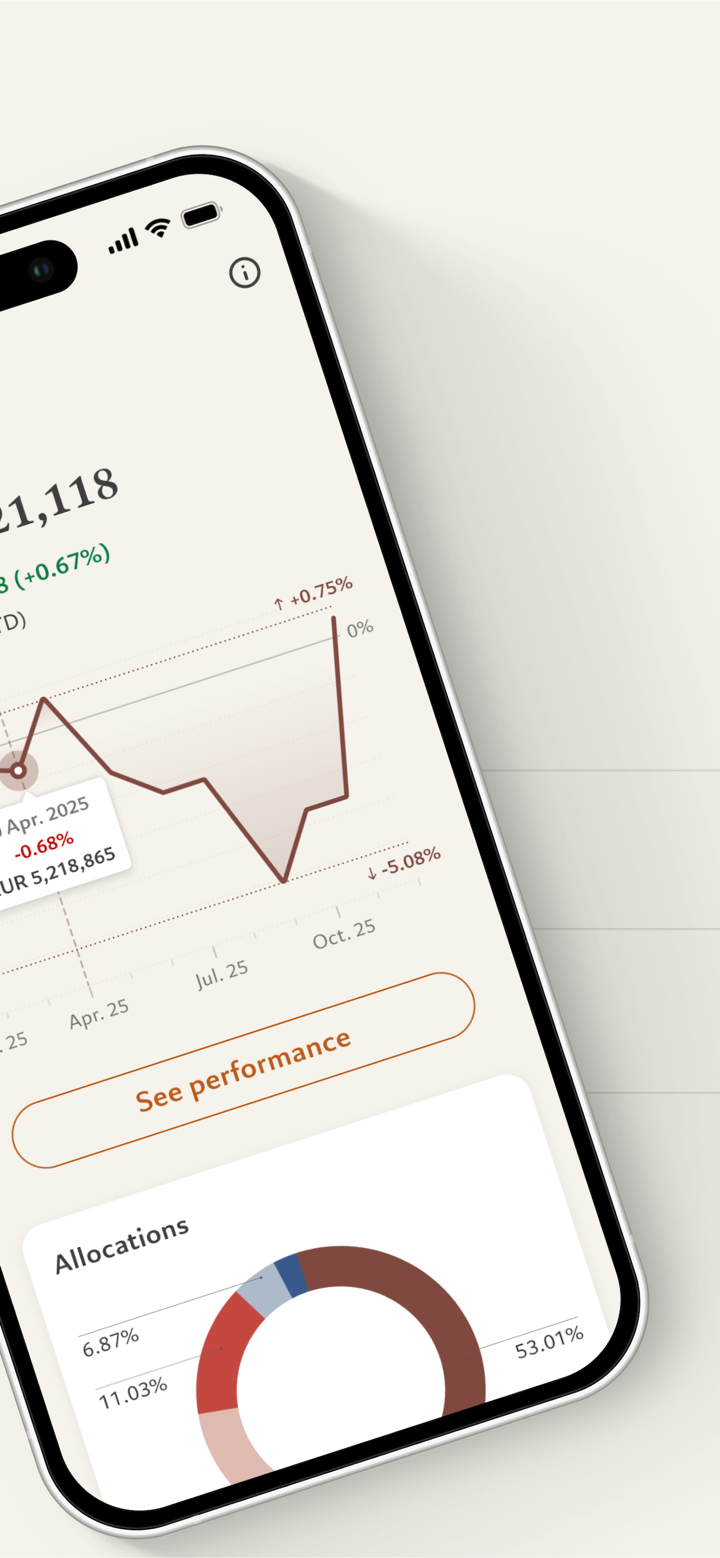

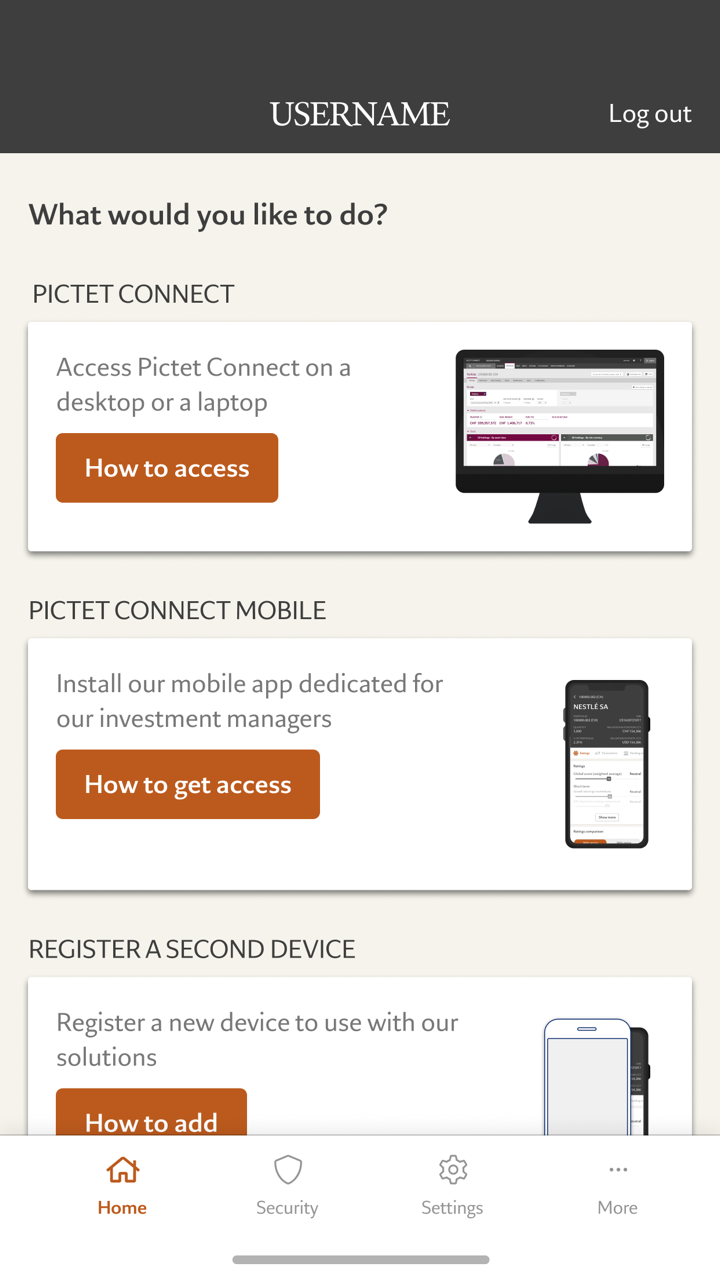

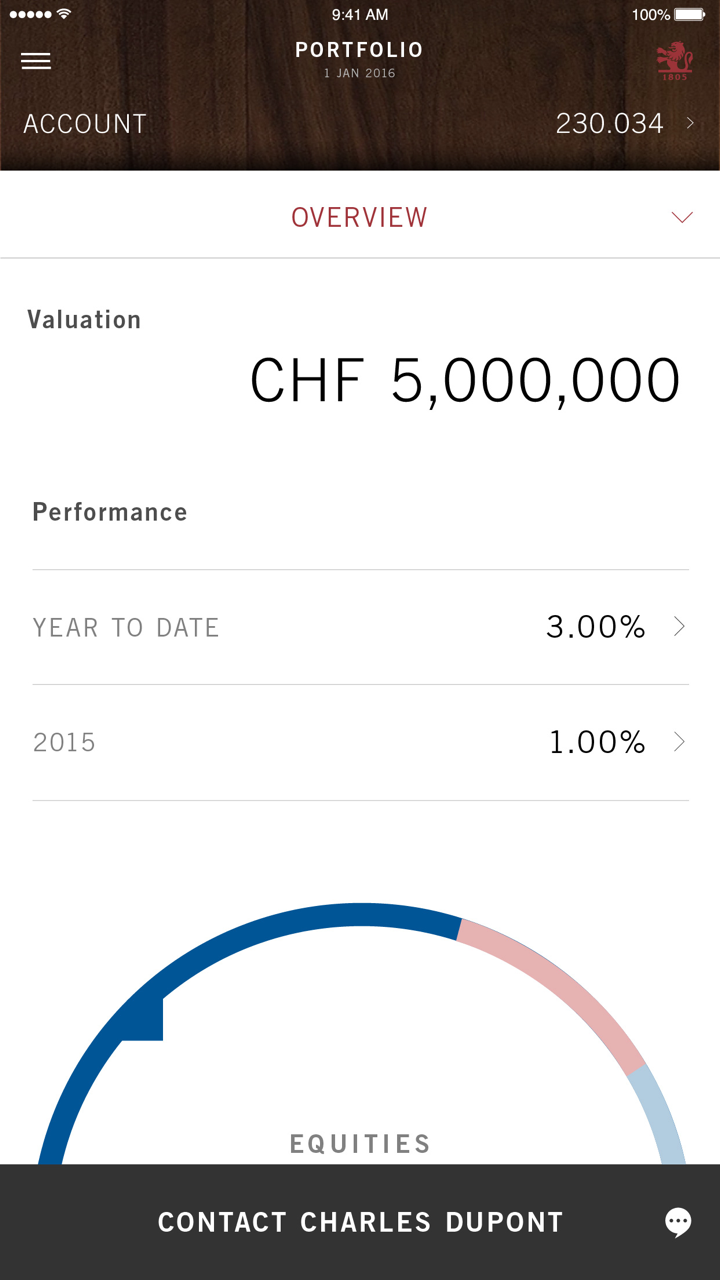

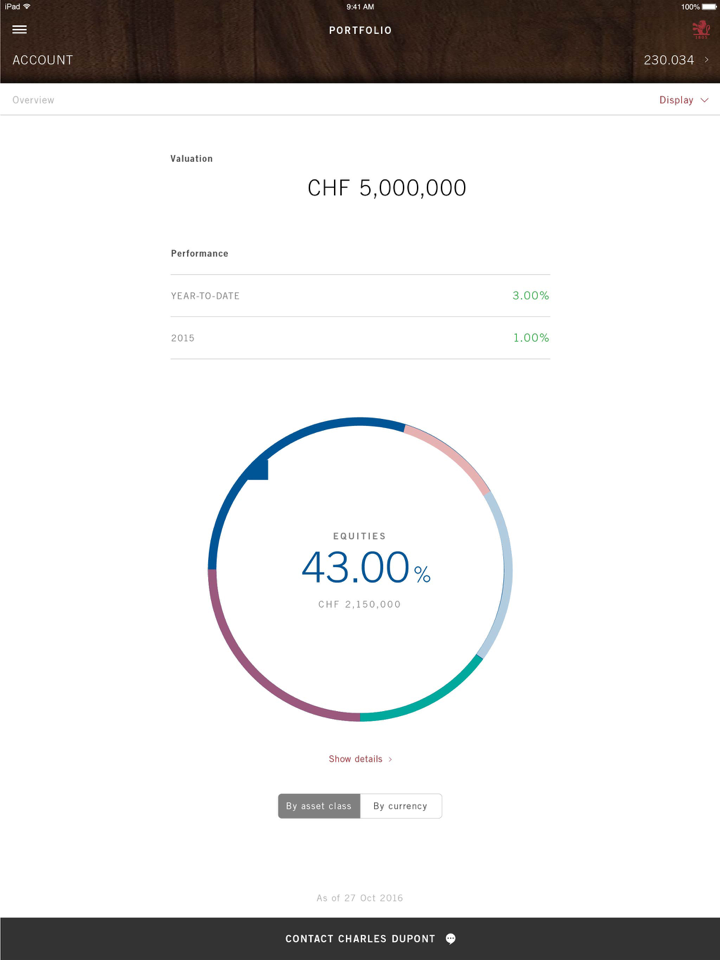

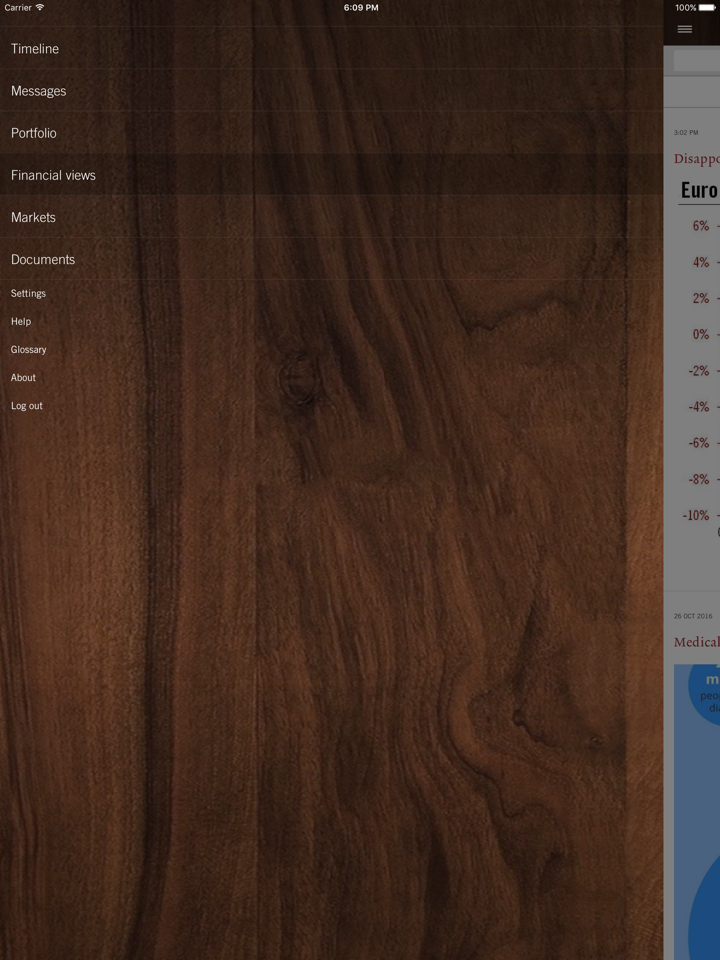

- Gestão de patrimônio: Há mais de 200 anos, a Gestão de Patrimônio Pictet tem se concentrado em ajudar clientes privados e escritórios de família a gerenciar, crescer e proteger seu patrimônio a longo prazo. Seus serviços visam ajudar os clientes a construir negócios, proteger ativos e garantir a preservação para as gerações futuras.

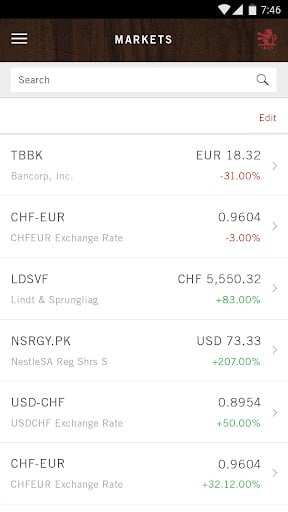

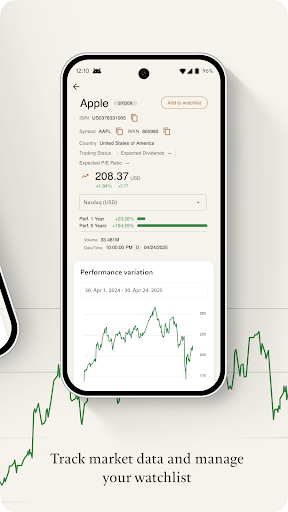

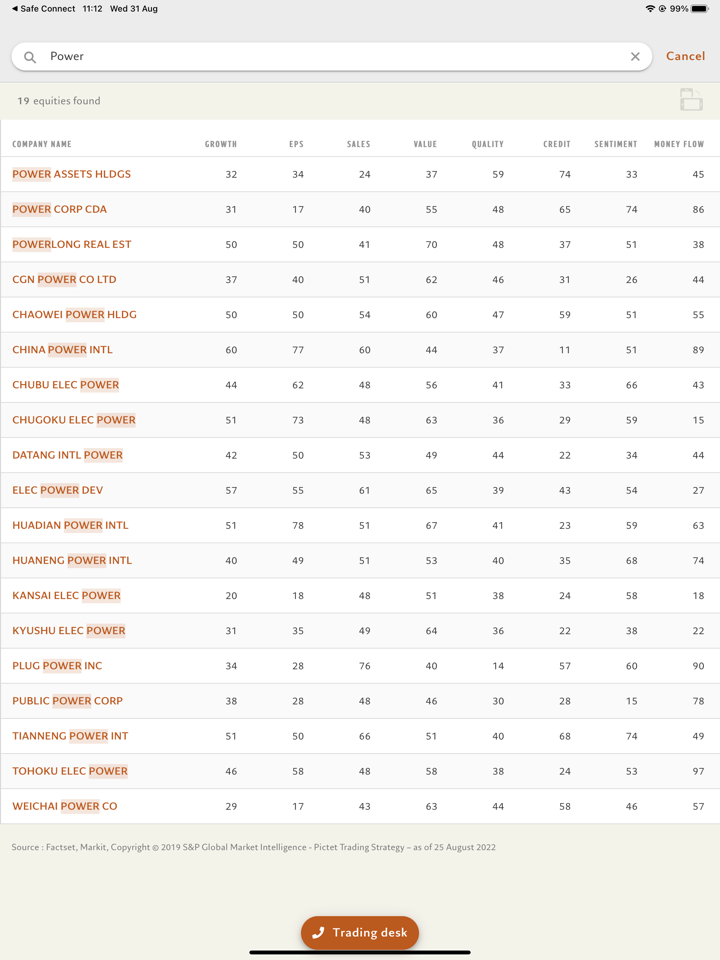

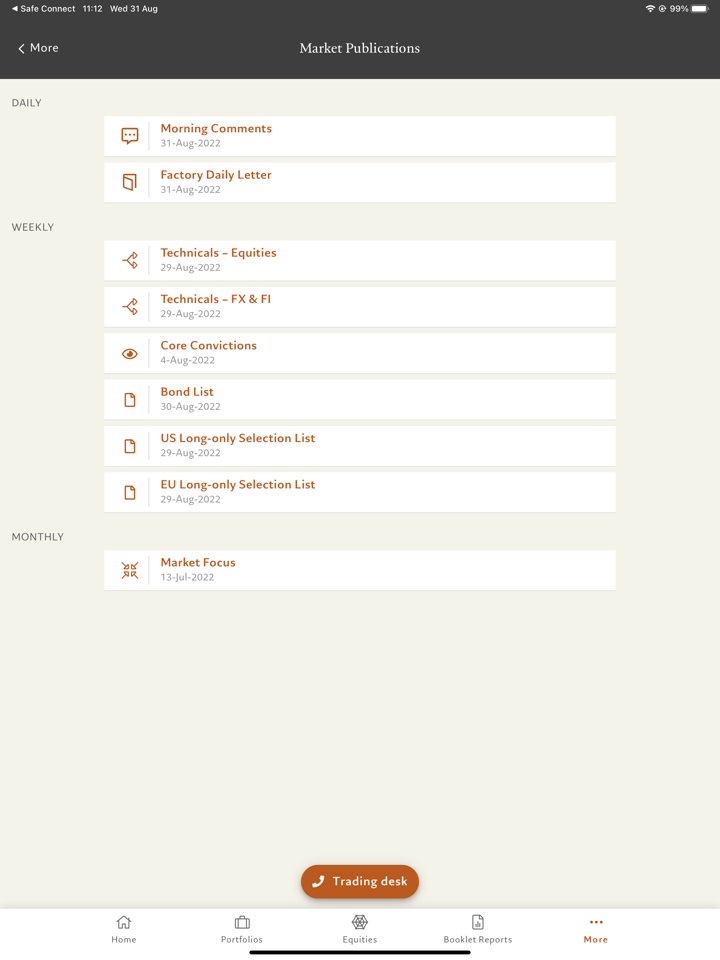

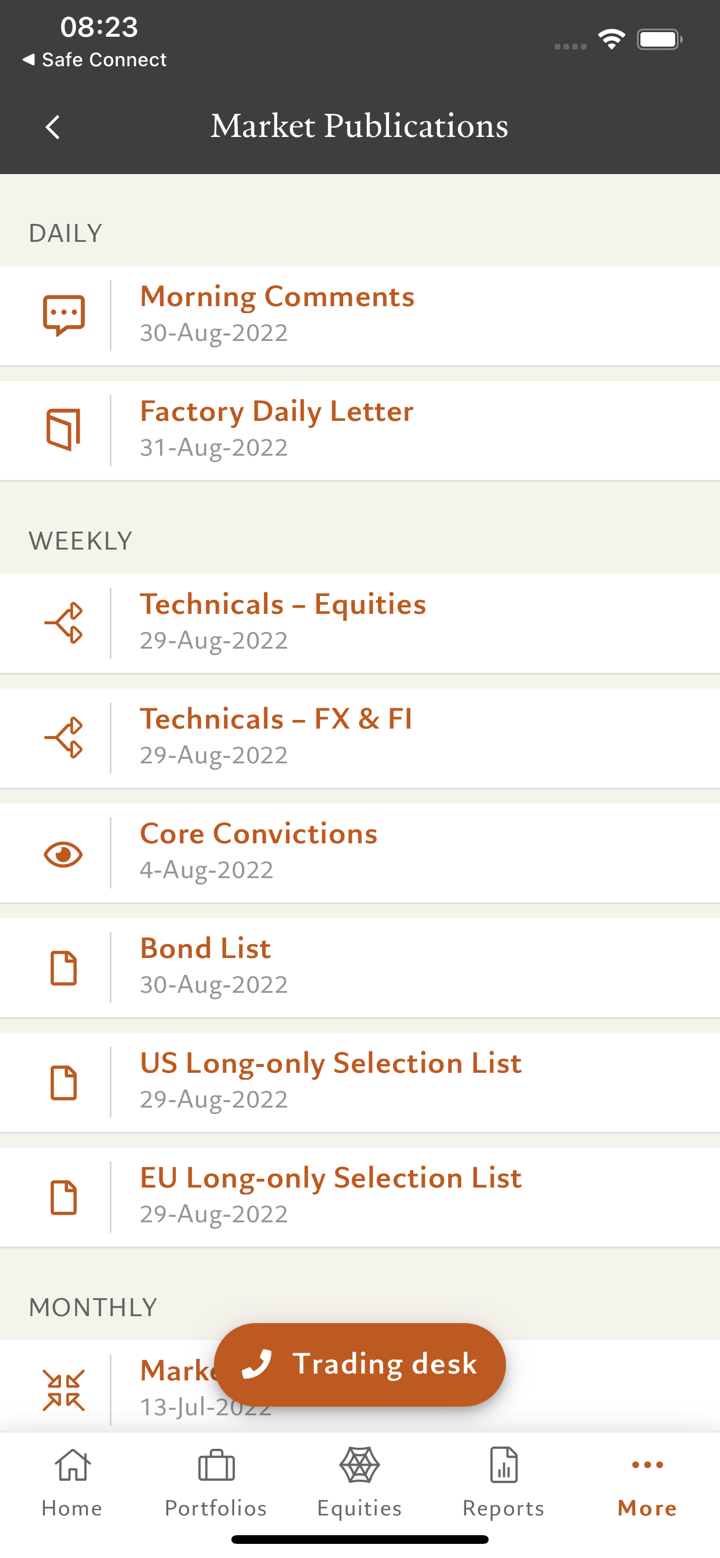

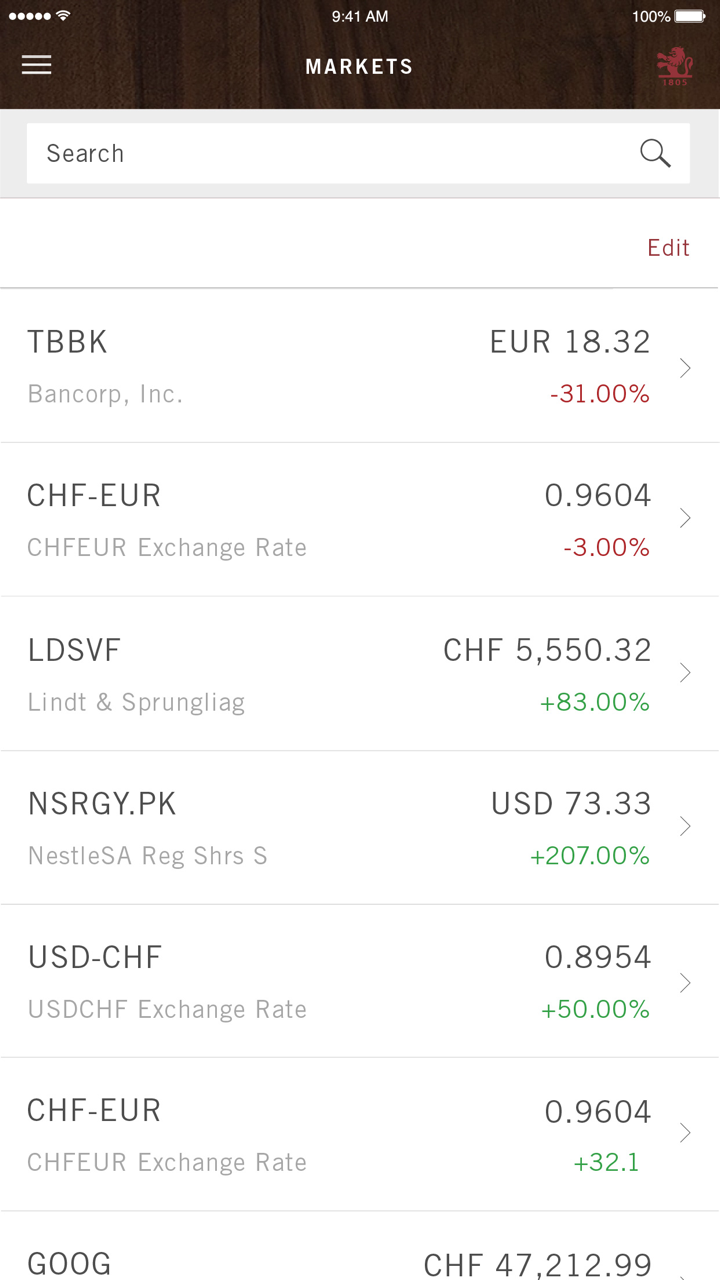

- Gestão de ativos: A Gestão de Ativos Pictet é uma empresa independente que gerencia investimentos em diversas classes de ativos, como ações, renda fixa e alternativas em nome de seus clientes.

- Investimentos alternativos: Os Investimentos Alternativos Pictet oferecem a investidores criteriosos acesso a oportunidades únicas e têm utilizado estratégias alternativas por décadas para obter resultados sólidos.

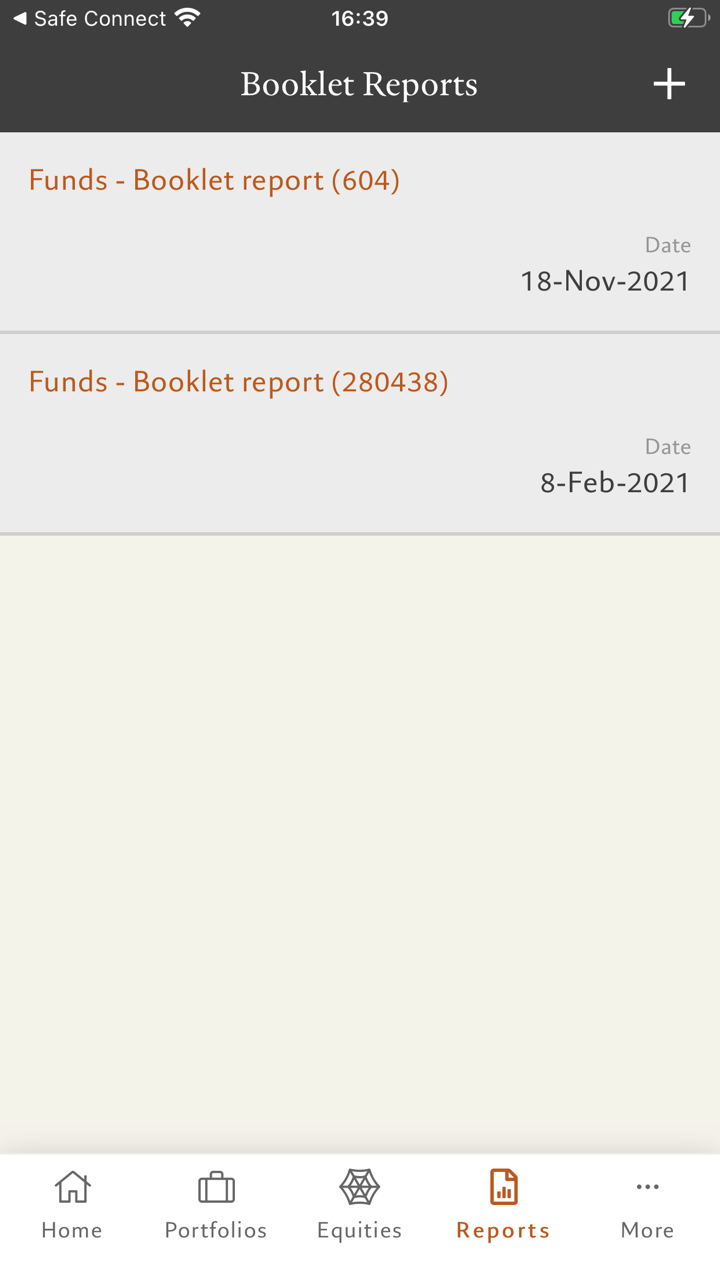

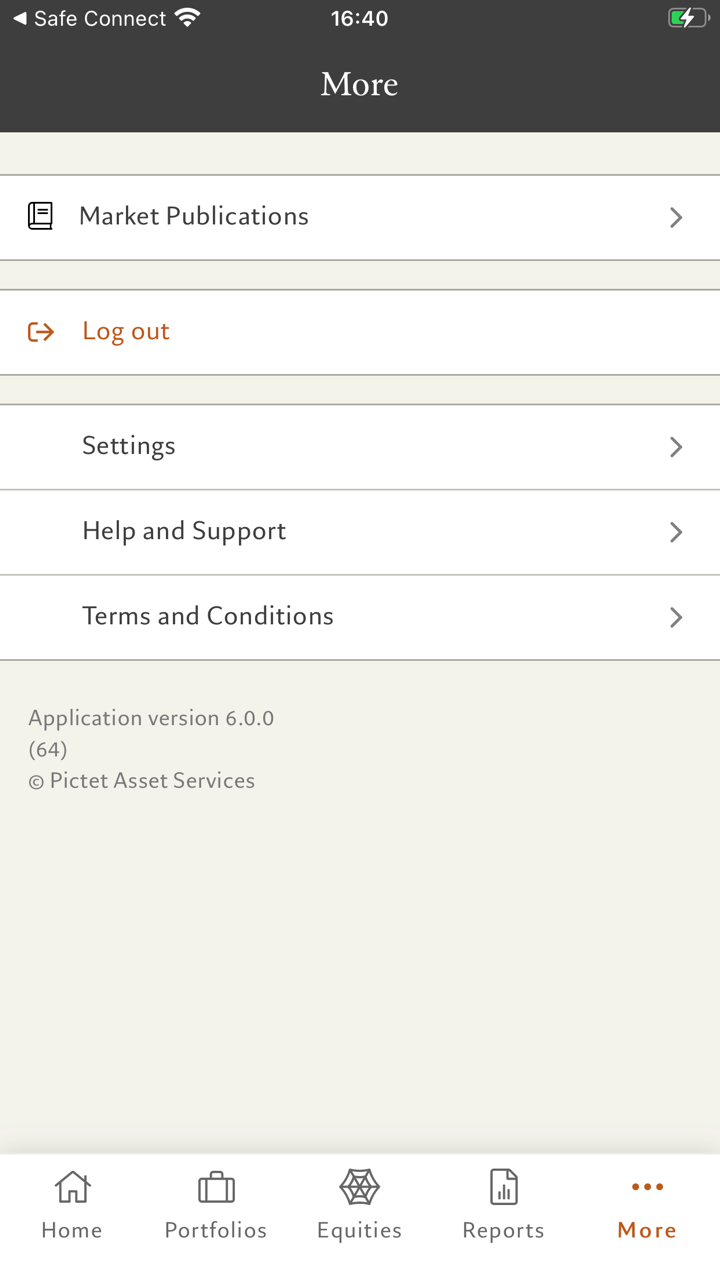

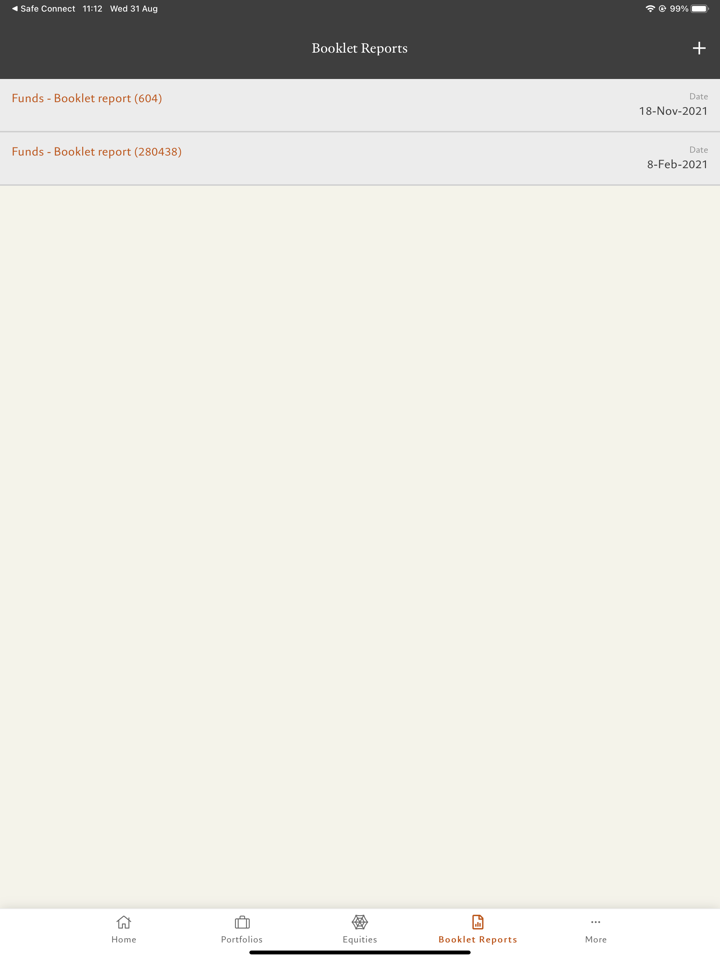

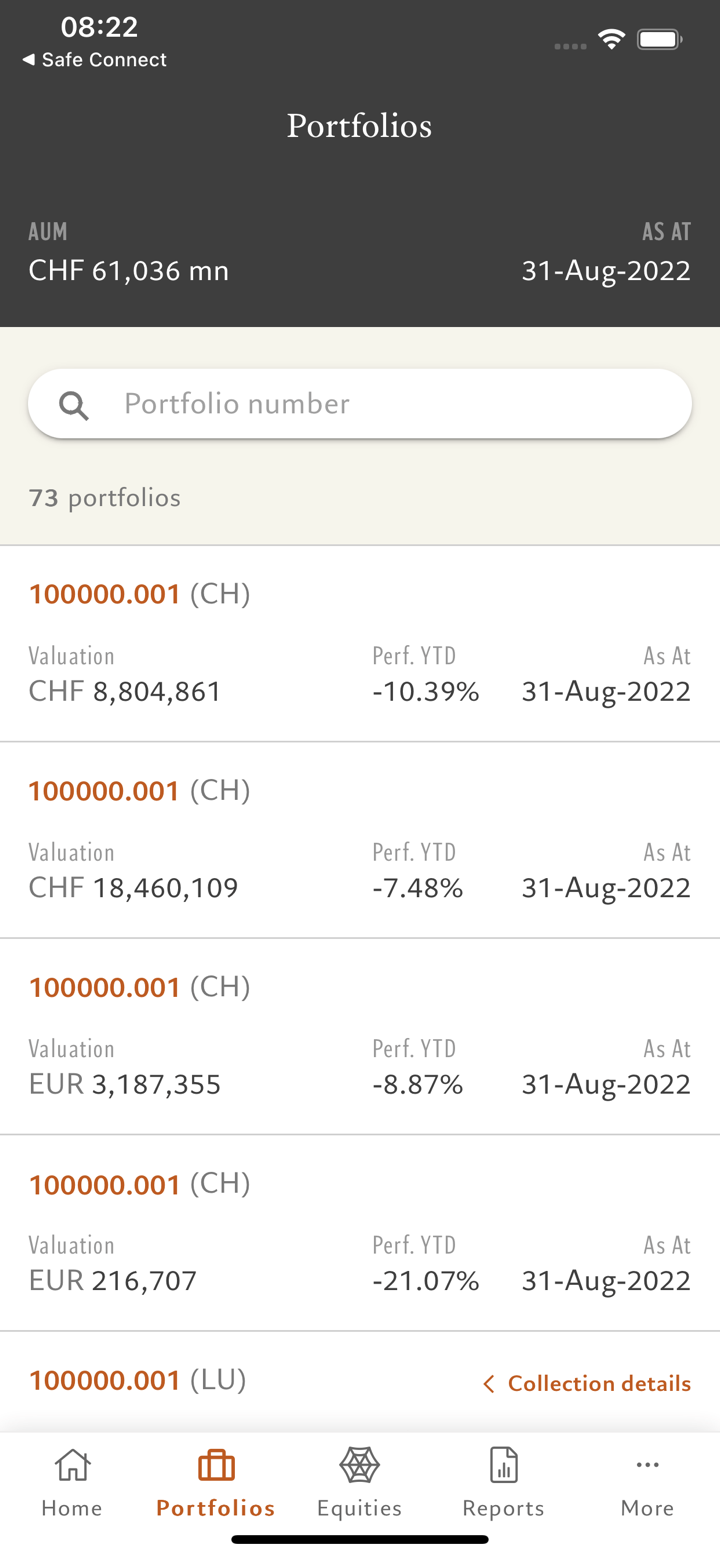

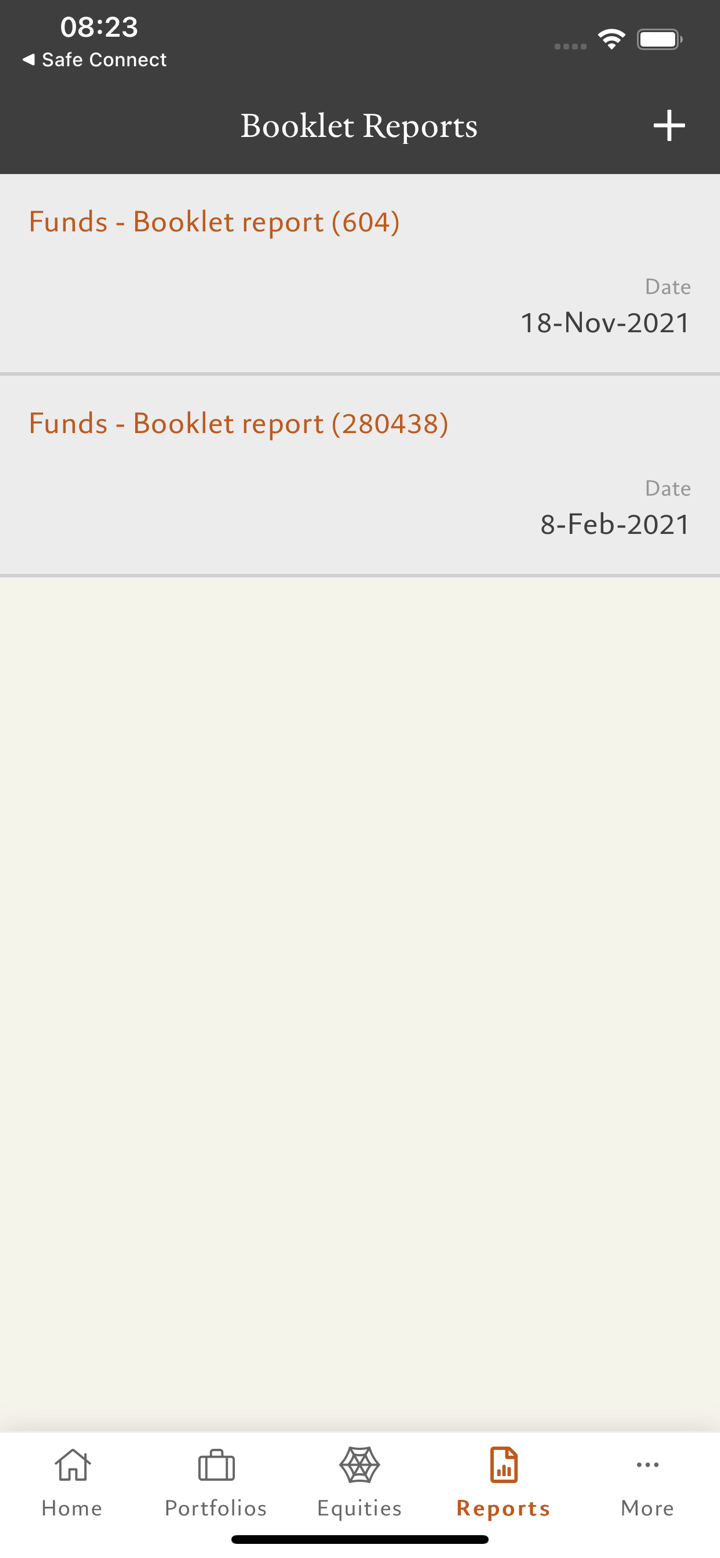

- Serviços de ativos: Os Serviços de Ativos Pictet gerenciam todos os aspectos do processo de prestação de serviços de ativos, permitindo que os clientes se concentrem na distribuição e na geração de desempenho da carteira.